Unlocking the Secrets to Low-Interest Loans: What Banks Don’t Tell You

Mia Anderson

Photo: Unlocking the Secrets to Low-Interest Loans: What Banks Don’t Tell You

Securing a loan with a favorable interest rate is often a challenging task for many individuals and businesses. While banks and financial institutions offer a variety of loan options, understanding how to access low-interest loans can be a mystery to many. The process might seem like a complex puzzle, but with the right knowledge and strategies, you can navigate the financial landscape and unlock the secrets to obtaining these desirable loans. In this article, we'll delve into the world of low-interest loans, uncovering the hidden insights that banks might prefer to keep under wraps.

Understanding Interest Rates

Before we embark on the quest for low-interest loans, it's essential to grasp the basics of interest rates. Interest rates are the cost of borrowing money, expressed as a percentage of the loan amount. These rates can vary significantly, and understanding the factors that influence them is crucial. Banks often consider various elements when determining interest rates, including your creditworthiness, the type of loan, and the current market conditions.

The Role of Creditworthiness

One of the most significant factors affecting your ability to secure low-interest loans is your creditworthiness. Banks and lenders rely heavily on credit scores and credit reports to assess the risk associated with lending to you. A good credit score can be your golden ticket to lower interest rates. It signifies to lenders that you are a responsible borrower, increasing your chances of obtaining favorable loan terms.

Here's an interesting anecdote: Imagine two friends, Emma and John, both seeking loans for their dream projects. Emma, with her excellent credit history, effortlessly secures a loan with a remarkably low-interest rate, while John, who has struggled with credit card debt, faces higher rates. This scenario highlights the power of a strong credit profile.

Strategies for Improving Credit Score

If your credit score isn't where you'd like it to be, fear not! There are proven strategies to enhance your creditworthiness:

1. Review Your Credit Report Regularly

Start by obtaining a copy of your credit report from major credit bureaus. Look for any errors or discrepancies and dispute them promptly. A single mistake can impact your score significantly.

2. Pay Bills on Time

Late payments can haunt your credit report for years. Set up automatic payments or reminders to ensure you never miss a due date. This simple habit can work wonders for your credit score.

35. Reduce Credit Card Balances

High credit card balances can negatively affect your score. Aim to keep your credit utilization ratio below 30%. This means using only a small portion of your available credit limit.

4. Build a Credit History

If you're new to credit, consider starting with a secured credit card or becoming an authorized user on someone's account. Building a positive credit history takes time, but it's a worthwhile investment.

Negotiating with Banks

Once you've optimized your creditworthiness, it's time to approach banks with confidence. Remember, banks are in the business of lending, and they want your business. Here are some negotiation tactics to consider:

1. Shop Around

Don't settle for the first offer. Compare interest rates and terms from multiple lenders. Competition among banks can work in your favor, as they may be willing to match or beat a competitor's offer.

2. Highlight Your Strengths

When negotiating, emphasize your financial stability and reliability. Showcase your consistent income, stable employment history, and any assets you possess. Banks appreciate borrowers who demonstrate a low-risk profile.

3. Consider Collateral

Offering collateral, such as a home or vehicle, can significantly improve your chances of securing a low-interest loan. This reduces the risk for the lender and may result in more favorable terms.

Alternative Lending Options

In today's digital age, traditional banks are not the only game in town. Alternative lending platforms and online lenders have emerged, offering competitive loan options:

1. Peer-to-Peer Lending

Peer-to-peer lending platforms connect borrowers directly with individual investors. These platforms often provide competitive rates, especially for borrowers with strong credit profiles.

2. Online Lenders

Online lenders have streamlined the loan application process, making it quicker and more accessible. They may offer lower interest rates for well-qualified borrowers.

3. Credit Unions

Credit unions are member-owned financial cooperatives that often provide more favorable terms and rates to their members. Consider joining one if you're eligible.

Final Thoughts

Obtaining low-interest loans is not an elusive dream but a realistic goal with the right approach. By understanding the importance of creditworthiness, implementing strategies to improve your credit score, and negotiating with lenders, you can unlock the secrets to financial success. Remember, knowledge is power, and being informed about your options can lead to significant savings over the life of your loan.

So, take control of your financial destiny, and don't be afraid to explore the various lending avenues available. With persistence and a solid financial foundation, you can achieve the low-interest loans you desire and make those dream projects a reality.

Marketing

View All

January 20, 2025

5 Best Digital Marketing Tools for GrowthUncover the top 5 digital marketing tools every marketer needs. Boost efficiency, drive results, and streamline your campaigns now!

Mia Anderson

January 25, 2025

Email Marketing in the Digital AgeUnlock the power of email marketing with modern strategies tailored for the digital age. Connect with your audience like never before!

Mia Anderson

January 23, 2025

Social Media in Digital Marketing 2024Learn how social media is revolutionizing digital marketing in 2024. Boost your brand with actionable tips for viral campaigns!

Mia Anderson

Entertainment

View AllDiscover the latest viral marketing strategies that can catapult your brand to success in 2024. Learn proven tips to create buzz and engage your audience. Start now!

Mia Anderson

Discover the intriguing realm of celebrity culture and how it affects society. Learn about the possible effects of our infatuation and how celebrities turn their notoriety into brands. An must read for everybody curious about the contemporary celebrity phenomena.

Mia Anderson

Discover expert tips and strategies for organizing a film festival from start to finish. Learn key steps to ensure your event is a success read now!

Mia Anderson

Discover the top 10 entertainment trends of 2024 that will captivate you. Stay ahead with our expert insights and click to explore now!

Mia Anderson

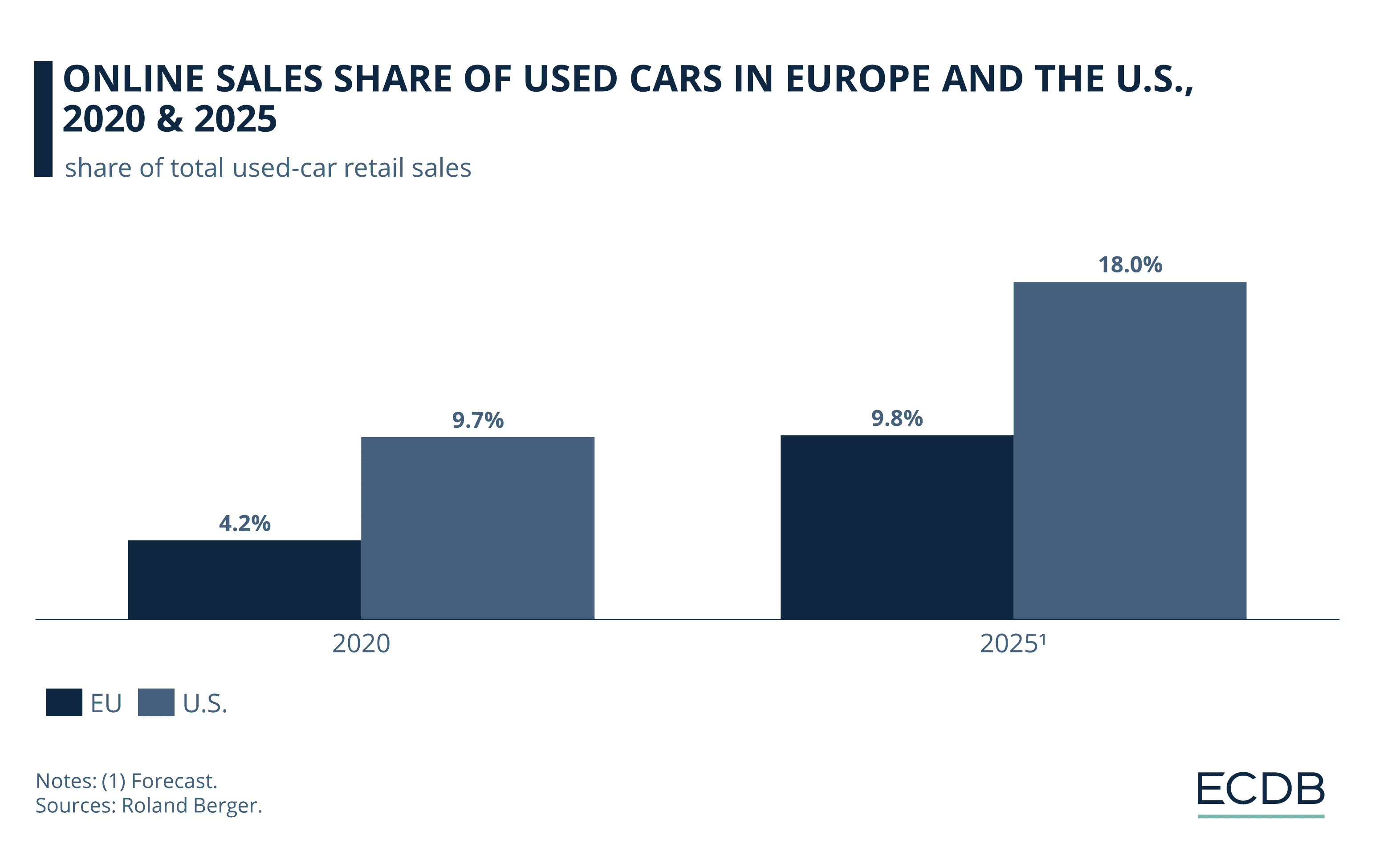

Automotive

View AllExplore the positive impact of EV adoption on urban air quality. See how EVs are cleaning the air in cities worldwide.

Read MoreExplore the pros and cons of selling your car online vs. locally. Find out which suits you best!

Read MoreExplore what drives consumer interest in EVs. Discover key insights into attitudes, barriers, and 2024’s hottest EV trends.

Read MorePolular🔥

View All

1

2

3

4

5

6

7

8

9

10

News

View AllAugust 13, 2024

The Ultimate Guide to Google Advertising: Secrets to Skyrocket Your Success

Read MoreTechnology

View All

December 8, 2024

Don’t Buy Another Laptop Until You Read This 2024 Comparison

Make an informed laptop purchase! Our 2024 comparison guide helps you find the perfect fit. Click to learn more and choose wisely.

August 30, 2024

Top Cloud Storage Solutions to Keep Your Data Safe

Discover the best cloud storage solutions to safeguard your data and boost efficiency. Explore top picks and make an informed choice today!

November 3, 2024

10 Tech Gadgets You Didn't Know You Needed in 2024

Discover the top 10 tech gadgets that will change your life in 2024. Uncover hidden must-haves read now!

Tips & Trick