How to Save Thousands on Mortgage Payments Over Time

Mia Anderson

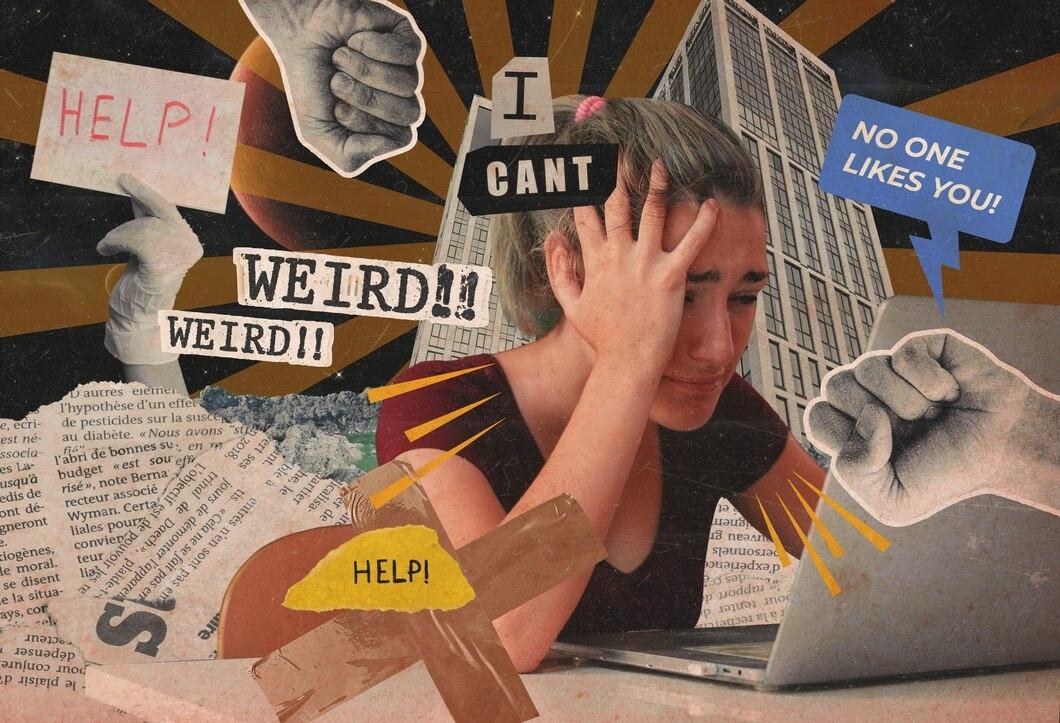

Photo: How to Save Thousands on Mortgage Payments Over Time

Owning a home is a significant financial commitment, and finding ways to reduce mortgage payments can significantly impact your long-term financial health. With the right strategies, you can save thousands of dollars over the life of your mortgage, providing financial flexibility and security. In this article, we'll explore practical and effective methods to minimize your mortgage expenses and maximize your savings.

Understanding the Basics: Mortgage Savings Strategies

Before diving into the various cost-saving techniques, it's essential to understand the fundamentals of mortgage payments. A mortgage is a long-term loan used to purchase a home, typically paid back over 15 to 30 years. The key components of a mortgage include the principal (the original loan amount), interest, taxes, and insurance. By focusing on these elements, you can develop a strategy to reduce overall costs.

1. Shop Around for the Best Mortgage Rates

The interest rate on your mortgage is a critical factor in determining your monthly payments. Even a small difference in rates can result in substantial savings over time. Here's how to secure the best rate:

- Compare Lenders: Don't settle for the first offer. Shop around and compare rates from multiple lenders, including banks, credit unions, and online mortgage providers. This competitive research can lead to finding more favorable terms.

- Negotiate Rates: Lenders may be open to negotiating rates, especially if you have a strong credit score or a substantial down payment. Don't be afraid to ask for a better rate or discuss incentives they can offer.

- Consider Adjustable-Rate Mortgages (ARMs): ARMs offer lower initial interest rates, which can be beneficial if you plan to sell or refinance your home before the rate adjusts. However, be aware of the potential for rate increases in the future.

2. Increase Your Down Payment

A larger down payment can significantly reduce your mortgage payments and overall interest costs. Here's how:

- Lower Loan Amount: A higher down payment means you borrow less, resulting in a smaller loan amount. This directly reduces the interest you pay over the life of the mortgage.

- Avoid PMI: Private Mortgage Insurance (PMI) is typically required if your down payment is less than 20% of the home's value. PMI protects the lender but adds to your monthly expenses. A substantial down payment can help you avoid this extra cost.

- Example: Let's say you're buying a $300,000 home. A 20% down payment of $60,000 saves you the PMI cost and reduces the loan amount, leading to lower monthly payments and substantial long-term savings.

Strategies to Reduce Mortgage Costs Over Time

Once you've secured your mortgage, there are ongoing strategies to minimize expenses and maximize savings:

3. Make Extra Payments

One of the most effective ways to save on mortgage interest is to make extra payments. Here's how it works:

- Pay More Than the Minimum: Whenever possible, pay more than the minimum monthly payment. Even small additional amounts can reduce the principal faster, leading to less interest accrual.

- Target High-Interest Periods: In the early years of a mortgage, a significant portion of your payment goes towards interest. By making extra payments during this period, you can reduce the principal faster and save on long-term interest.

- Example: Consider a $200,000 mortgage with a 4% interest rate. Paying an extra $100 per month can save you over $20,000 in interest and shorten the loan term by several years.

4. Refinance at a Lower Rate

Refinancing your mortgage involves replacing your current loan with a new one, ideally at a lower interest rate. This strategy is particularly effective when market rates have decreased since you initially obtained your mortgage.

- Lower Interest Rate: A lower rate means you pay less interest over the life of the loan, reducing your monthly payments.

- Shorten the Loan Term: When refinancing, consider a shorter loan term, such as switching from a 30-year to a 15-year mortgage. This can result in significant interest savings.

- Example: Refinancing a $250,000 mortgage from a 30-year term at 4.5% to a 15-year term at 3% can save you tens of thousands of dollars in interest over the life of the loan.

5. Reconsider Your Loan Term

The length of your mortgage term plays a crucial role in your overall interest payments:

- Longer Terms: A 30-year mortgage offers lower monthly payments but results in more interest paid over time.

- Shorter Terms: Opting for a 15-year mortgage means higher monthly payments but significantly less interest paid overall. This can be an excellent strategy if you can afford the increased monthly commitment.

- Example: A $200,000 loan at 4% interest over 30 years will cost approximately $143,739 in interest. The same loan over 15 years will cost around $62,673 in interest, saving you over $80,000.

Additional Tips for Long-Term Savings

Beyond these primary strategies, there are other ways to ensure you're making the most of your mortgage:

- Bi-Weekly Payments: Consider making half of your monthly payment every two weeks instead of a full payment monthly. This simple change can result in one extra payment per year, reducing your loan term and interest.

- Avoid Unnecessary Fees: Be cautious of fees associated with your mortgage, such as late payment fees or prepayment penalties. These can eat into your savings.

- Maintain a Good Credit Score: A higher credit score can lead to better refinancing options and more favorable rates in the future.

Conclusion

Saving on mortgage payments is a long-term game that requires a strategic approach. By shopping for the best rates, making extra payments, refinancing wisely, and considering loan terms, you can significantly reduce your overall costs. These strategies not only save you money but also provide financial freedom and security. Remember, small adjustments and consistent efforts can lead to substantial savings, allowing you to build wealth and achieve your financial goals.

Implementing these techniques may require discipline and planning, but the rewards are well worth it. With the right approach, you can turn your mortgage into a powerful tool for financial success.

Marketing

View All

January 19, 2025

How to Master Digital Marketing BasicsLearn the essentials of digital marketing in this beginner-friendly guide. Kickstart your journey with step-by-step strategies. Start mastering today!

Mia Anderson

January 25, 2025

Email Marketing in the Digital AgeUnlock the power of email marketing with modern strategies tailored for the digital age. Connect with your audience like never before!

Mia Anderson

January 21, 2025

Why Digital Marketing is Vital for SMBsDiscover why small businesses must adopt digital marketing in 2024. Learn tips and tactics to compete in the digital age. Take your business online today!

Mia Anderson

Entertainment

View AllDiscover proven strategies for monetizing your blog in 2024. Learn how to boost revenue effectively. Read now for actionable insights and start earning today!

Mia Anderson

Discover top tips on streaming your favorite films legally & safely with our guide - click now, don't miss out!

Mia Anderson

Unlock the secrets of modern screenwriting with our expert tips and techniques. Start crafting compelling scripts today click to learn how!

Mia Anderson

Discover the latest trends in cinematic universes for 2024. Explore how interconnected storytelling is evolving and its impact on modern media. Learn more now!

Mia Anderson

Automotive

View AllExplore cutting-edge innovations shaping EV charging infrastructure and making electric vehicles more accessible globally.

Read MoreExplore resale value trends for electric vehicles and what buyers can expect when selling their EV in the future.

Read MoreLearn how electric vehicles (EVs) help reduce greenhouse gas emissions and combat climate change. Discover the environmental benefits!

Read MorePolular🔥

View All

1

2

3

4

5

7

8

9

10

News

View AllOctober 14, 2024

2024 Vaccination Updates: What You Need to Know for Flu & COVID-19 Protection

Read MoreTechnology

View All

December 7, 2024

Top 10 Smartphones with the Best Battery Life in 2024

Say goodbye to battery anxiety! Discover the top 10 smartphones with exceptional battery life. Click to explore and stay charged all day.

December 12, 2024

The Ultimate Tech Deals You Need to Grab Before They Disappear in 2024

Don't miss out on the hottest tech deals of 2024! Click to discover limited-time offers and save big on gadgets.

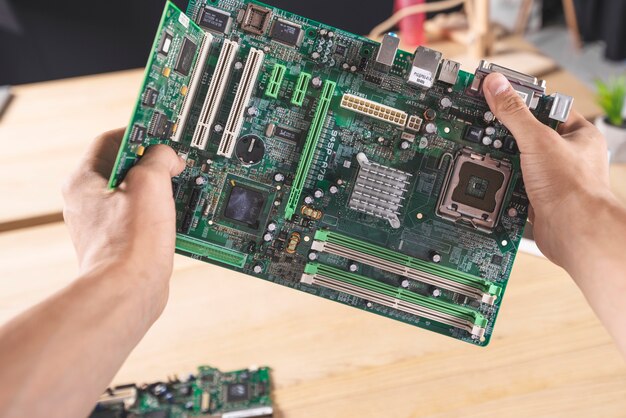

December 16, 2024

How to Upgrade Your PC for Under $500 – Best Components for 2024

Upgrade your PC on a budget! Discover the best components for 2024 to enhance performance. Click to learn more and build your dream PC.

Tips & Trick