Smart Budgeting Strategies Every Family Needs to Know

Mia Anderson

Photo: Smart Budgeting Strategies Every Family Needs to Know

Smart Budgeting Strategies Every Family Needs

Managing a household budget can often seem like a daunting task. However, with the right strategies and tools, families can navigate their finances with ease and efficiency. In this article, we'll explore essential budgeting tips for families, uncovering effective household budgeting strategies and financial planning methods that can lead to more financial stability and savings.

Understanding the Basics of Family Budgeting

Budgeting is more than just tracking expenses—it's about planning and prioritizing to ensure financial stability. For families, this involves evaluating income, setting financial goals, and managing spending in a way that aligns with those goals. Effective budgeting can help families save money, reduce debt, and improve overall financial well-being.

Setting Realistic Financial Goals

One of the first steps in smart budgeting is setting clear and achievable financial goals. Whether it's saving for a family vacation, building an emergency fund, or planning for education expenses, defining these goals provides direction and motivation. For instance, setting a goal to save $500 a month for a year can make the process more manageable and measurable.

Creating a Comprehensive Budget

To create a comprehensive budget, start by listing all sources of income, including salaries, allowances, and any additional earnings. Next, outline all monthly expenses, such as utilities, groceries, transportation, and entertainment. It’s important to differentiate between fixed and variable expenses. Fixed expenses, like mortgage or rent, remain constant, while variable expenses can fluctuate.

Utilizing Budgeting Tools and Apps

In the digital age, numerous budgeting tools and apps can simplify the process. Applications like Mint, YNAB (You Need a Budget), and PocketGuard offer features to track spending, categorize expenses, and provide insights into your financial habits. These tools can be particularly useful for families looking to manage their finances efficiently and identify areas for improvement.

Implementing Smart Spending Strategies

Smart spending is crucial for maintaining a balanced budget. This involves being mindful of where your money goes and making adjustments as needed. For example, meal planning and preparing meals at home can significantly cut down on dining-out expenses. Similarly, shopping with a list and avoiding impulse purchases can help keep spending in check.

Exploring Budget-Friendly Family Living

Living within a budget doesn't mean sacrificing comfort or enjoyment. Instead, it’s about making informed choices that align with your financial situation. Opting for budget-friendly alternatives, such as DIY home projects or local family outings, can provide fun and enrichment without breaking the bank. For instance, organizing a family picnic at a local park can be as enjoyable as an expensive outing and creates memorable experiences.

Managing Household Expenses

Effective management of household expenses is key to successful budgeting. This involves regularly reviewing and adjusting your budget to accommodate any changes in income or expenses. Additionally, finding ways to reduce recurring costs, such as switching to more cost-effective service providers or negotiating bills, can contribute to savings.

Building an Emergency Fund

An emergency fund is an essential component of financial planning for families. It acts as a financial cushion in case of unexpected expenses, such as medical emergencies or car repairs. Aim to save at least three to six months’ worth of living expenses in an easily accessible account. Building this fund gradually can provide peace of mind and financial security.

Seeking Professional Advice

Sometimes, seeking professional advice can offer valuable insights into managing family finances. Financial advisors can provide personalized recommendations based on your family’s unique situation, helping you create a tailored budgeting plan. They can also offer guidance on investments, retirement planning, and tax strategies.

Tracking and Adjusting Your Budget

Budgeting is an ongoing process that requires regular monitoring and adjustments. Track your spending and compare it to your budget to ensure you’re staying on track. If you notice any discrepancies or if your financial situation changes, make the necessary adjustments to your budget to keep it aligned with your goals.

Conclusion

Implementing smart budgeting strategies is essential for achieving financial stability and ensuring a secure future for your family. By setting realistic goals, utilizing budgeting tools, managing expenses effectively, and building an emergency fund, families can take control of their finances and make informed decisions. Remember, budgeting is a dynamic process that requires regular review and adjustment. With commitment and the right strategies, families can enjoy greater financial well-being and peace of mind.

Marketing

View All

January 23, 2025

10 Content Strategies for Digital SuccessCreate winning content with these 10 proven digital marketing strategies. Enhance engagement and conversions starting today!

Mia Anderson

January 20, 2025

5 Best Digital Marketing Tools for GrowthUncover the top 5 digital marketing tools every marketer needs. Boost efficiency, drive results, and streamline your campaigns now!

Mia Anderson

January 19, 2025

How to Master Digital Marketing BasicsLearn the essentials of digital marketing in this beginner-friendly guide. Kickstart your journey with step-by-step strategies. Start mastering today!

Mia Anderson

Entertainment

View AllDiscover the fascinating history of superhero movies, from early adaptations to modern blockbusters. Uncover surprising facts and insights click to explore!

Mia Anderson

Discover how the Metaverse is revolutionizing entertainment in 2024. Read about the latest trends and innovations shaping the future of digital experiences.

Mia Anderson

Find out which movie streaming platforms are the best in 2024. Get insights, compare options, and choose your ideal service. Click to learn more!

Mia Anderson

Discover the amazing history of animated films and how they came to rule the world. Discover how animation has captured the attention of viewers all across the world, from the first attempts to the greatest works of today!

Mia Anderson

Automotive

View AllDominate the auto market with these Dealer Daily tips. Learn strategies to increase efficiency and outshine competitors!

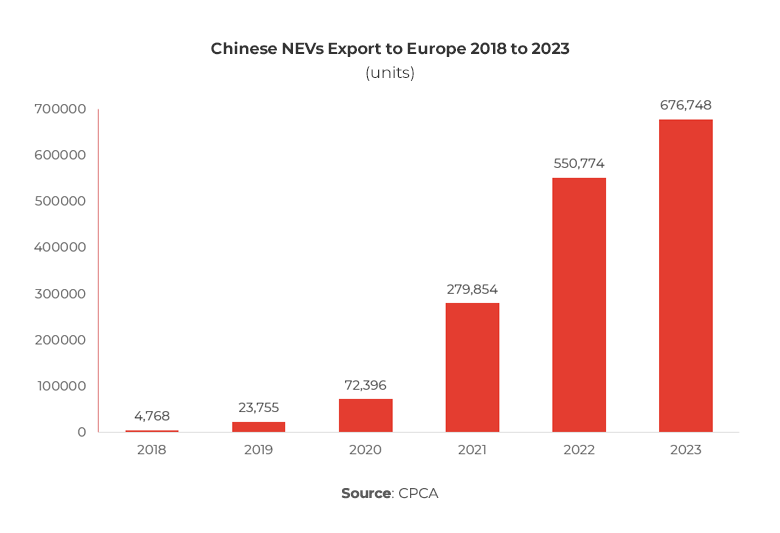

Read MoreLearn how import and export tariffs affect EV prices globally and what that means for buyers and manufacturers.

Read MoreExplore resale value trends for electric vehicles and what buyers can expect when selling their EV in the future.

Read MorePolular🔥

View All

1

2

4

6

7

8

9

10

Technology

View All

August 9, 2024

The Best Video Game Graphics in 2024

Find out which video games from 2024 provide the most amazing graphics and captivating gameplay. These games will wow you with their beautiful settings and minute features!

August 27, 2024

How Expert IT Consulting Services Can Transform Your Business

Discover top IT consulting services to drive business growth. Explore expert solutions tailored to your needs and boost your tech efficiency. Click to learn more!

December 13, 2024

Should You Upgrade to a Smart Home? 6 Reasons to Start Today

Upgrade your home with smart tech! Learn 6 compelling reasons to embrace the future. Click to explore and transform your living space.

Tips & Trick