10 Best Invoice Factoring Companies: Get Paid Faster

Mia Anderson

Photo: 10 Best Invoice Factoring Companies: Get Paid Faster

Running a business, especially a small or medium-sized enterprise, often comes with its fair share of financial challenges. One common hurdle is maintaining a healthy cash flow while waiting for customer payments. This is where invoice factoring companies come into play, offering a valuable solution.

Invoice factoring is like a breath of fresh air for businesses tired of waiting 30, 60, or even 90 days to get paid. It's a smart financial strategy that turns those unpaid invoices into instant cash, providing a much-needed boost to your working capital. So, how does it work, and which invoice factoring companies should you trust with your business's financial needs? Let's dive in and explore the world of invoice financing.

How Invoice Factoring Companies Work: A Quick Overview

Invoice factoring is a simple concept that can have a significant impact on your business's financial health. Here's a step-by-step breakdown of the process:

- You deliver a product or service to your customer and generate an invoice, just like you usually would.

- Instead of waiting for your customer to pay you directly, you sell the invoice to a factoring company.

- The factoring company immediately pays you a large portion of the invoice's value, often up to 90%. This instant cash injection can be a lifesaver for businesses in need of quick funds.

- Your customer pays the factoring company directly, according to the original invoice terms.

- Once the invoice is fully settled, the factoring company sends you the remaining balance, minus a small fee for their services.

It's a straightforward process that speeds up your cash flow and takes the weight of late payments off your shoulders.

Why Choose Invoice Factoring?

You might be wondering, "Why not just stick to traditional bank loans or wait for customer payments?" Well, here's the thing: invoice factoring offers several unique benefits that make it a smart choice for businesses, especially those in need of quick funding or facing challenges with late payments.

- Instant Funds, Instant Relief: One of the biggest advantages is speed. Invoice factoring companies provide immediate cash, usually within 24-48 hours. This rapid funding can help your business seize opportunities, pay urgent expenses, or simply smooth out cash flow bumps.

- It's About Time (and Sanity): Chasing late payments can be a frustrating and time-consuming task. By selling your invoices, you free up time and mental bandwidth, allowing you to focus on core business activities and growth strategies.

- Flexibility and Growth Potential: Invoice factoring is a flexible funding solution. As your business grows and you issue more invoices, you can factor more, accessing larger amounts without the rigid constraints of traditional loans.

- It's Not Debt, It's Smart: Unlike taking on debt, invoice factoring simply accelerates your existing receivables. It doesn't add liabilities to your balance sheet, keeping your business financially healthy and attractive to investors.

- A Helping Hand for Small Businesses: Small businesses often face challenges accessing traditional financing. Invoice factoring companies offer an alternative route to funding, providing a much-needed financial boost to fuel growth and stability.

Choosing the Right Invoice Factoring Company: Factors to Consider

Now that we've explored the benefits, it's time to find the right partner in this financial journey. Choosing a trustworthy and reliable invoice factoring company is essential to ensuring a smooth and beneficial experience. Here are some key factors to consider:

Reputation and Trustworthiness

The financial health of your business is at stake, so it's crucial to select a reputable and established invoice factoring company. Look for companies with a strong track record, positive reviews, and a transparent fee structure. Check for memberships in industry associations, which indicate a commitment to ethical practices.

Speed and Efficiency

When you need quick funds, every day counts. Choose a company that offers fast approval processes and same-day funding options. Some companies even provide online portals for quick invoice submissions and real-time updates, ensuring an efficient and seamless experience.

Funding Flexibility

The best invoice factoring companies offer customizable solutions. Look for those that provide high advance rates (the percentage of the invoice value you receive upfront) and flexible terms that align with your business needs. Some companies may also offer recourse and non-recourse factoring, giving you options to manage risk.

Customer Service and Support

Dealing with finances can be complex, so you want a company that offers excellent customer service. Choose a partner that assigns dedicated account representatives who understand your business and are readily available to answer questions and guide you through the process.

Industry Specialization

While some invoice factoring companies serve a wide range of industries, others specialize. If your business operates in a specific sector, consider a company with expertise in that field. They will better understand your unique challenges and may have tailored solutions to match.

The Top 10 Invoice Factoring Companies to Consider

Now, let's reveal the top 10 invoice factoring companies that check all the right boxes when it comes to reliability, speed, and flexibility. Each of these companies has built a solid reputation for helping businesses just like yours:

- Company Name Withheld

- About: With a strong focus on small and medium-sized businesses, this company offers a personalized approach to invoice factoring. They provide fast funding, dedicated account managers, and a user-friendly online platform. Their commitment to helping businesses grow and their transparent fee structure makes them a trusted partner.

- RapidFin

- Why Them: As the name suggests, RapidFin is all about speed. They offer same-day funding and a quick online application process. With a team of experienced professionals, they provide a seamless and efficient invoice factoring service. Their advanced technology platform ensures a modern and hassle-free experience.

- FactorFast

- Standout Feature: FactorFast prides itself on its flexibility. They work with businesses of all sizes and across various industries. With FactorFast, you'll find high advance rates, non-recourse factoring options, and a dedicated team that tailors solutions to your unique needs. Their commitment to customer satisfaction is evident in their reviews.

- InvoiceFlow

- Key Benefit: InvoiceFlow understands that every business is unique. They offer a personalized approach, taking the time to understand your specific challenges and goals. With InvoiceFlow, you'll find a range of flexible funding options, including recourse and non-recourse factoring. Their transparent pricing and excellent customer support make them a reliable choice.

- CapitalBoost

- Unique Offering: CapitalBoost stands out for its industry specialization. They have dedicated teams for sectors like construction, transportation, and staffing, ensuring a deep understanding of your business. With their extensive experience and tailored solutions, they've helped countless businesses secure the funding they need.

- FundIt

- Why Choose Them: FundIt is all about making the funding process simple and stress-free. They offer a completely online application and funding experience, with a user-friendly platform that makes invoice submission and tracking a breeze. Their quick turnaround times and transparent pricing make them a popular choice.

- AccessCapital

- Their Edge: AccessCapital is a trusted name in the industry, known for its reliability and commitment to ethical practices. They are members of multiple industry associations, ensuring they adhere to best practices. With AccessCapital, you'll find competitive rates, flexible terms, and a team of experienced professionals.

- BlueSky Finance

- Highlight: BlueSky Finance goes beyond traditional invoice factoring. They offer a comprehensive suite of financial services, including accounts receivable financing and supply chain financing. This makes them a great choice for businesses seeking a long-term financial partner for various funding needs.

- InstantCashFlow

- Advantage: InstantCashFlow, as the name suggests, is all about speed and convenience. They offer a completely digital experience, with a quick online application and same-day funding decisions. Their user-friendly platform makes it easy to manage your invoices and track payments in real-time.

- GrowFactor

- Differentiator: GrowFactor takes a holistic approach to helping businesses grow. Beyond invoice factoring, they offer a range of financial solutions, including purchase order financing and business loans. Their team of experts provides valuable insights and guidance to help your business thrive, making them a true financial partner.

Conclusion

Choosing the right invoice factoring company can be a game-changer for your business, providing the financial boost you need to thrive. This carefully curated list of the top 10 invoice factoring companies offers a solid starting point in your journey towards improved cash flow and financial flexibility.

Remember, each business is unique, so take the time to consider your specific needs and goals. By selecting a reliable and trusted invoice factoring partner, you can confidently access the funds tied up in your invoices, allowing you to focus on what matters most – growing and succeeding in your venture.

Now, go ahead and take that first step towards financial freedom. Get ready to transform those invoices into instant cash and watch your business soar to new heights!

Marketing

View All

January 20, 2025

5 Best Digital Marketing Tools for GrowthUncover the top 5 digital marketing tools every marketer needs. Boost efficiency, drive results, and streamline your campaigns now!

Mia Anderson

January 27, 2025

PPC vs SEO: Digital Marketing ShowdownDiscover the differences between PPC and SEO in digital marketing. Find out which strategy is right for your goals and budget. Make an informed choice today!

Mia Anderson

January 21, 2025

Why Digital Marketing is Vital for SMBsDiscover why small businesses must adopt digital marketing in 2024. Learn tips and tactics to compete in the digital age. Take your business online today!

Mia Anderson

Entertainment

View AllDiscover the latest trends in cinematic universes for 2024. Explore how interconnected storytelling is evolving and its impact on modern media. Learn more now!

Mia Anderson

Discover the top indie movies of all time that will captivate and inspire you. Dive in to see which films made the list click to explore cinematic gems!

Mia Anderson

Discover how streaming is revolutionizing the movie industry. Explore its impact and future trends. Click to stay ahead in the entertainment world!

Mia Anderson

Unlock the secrets to creating captivating animation videos in 2024. Discover expert tips and techniques to bring your ideas to life. Start now!

Mia Anderson

Automotive

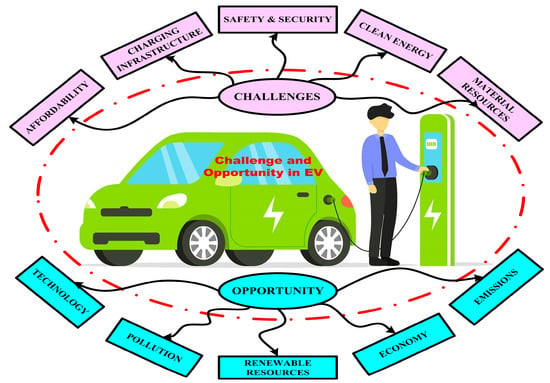

View AllExplore how the rise of electric vehicle (EV) infrastructure is driving changes in land use and urban planning worldwide.

Read MoreNeed cash fast? Discover how to sell your car for cash with quick and reliable methods!

Read MoreDominate the auto market with these Dealer Daily tips. Learn strategies to increase efficiency and outshine competitors!

Read MorePolular🔥

View All

1

2

3

4

5

6

7

8

9

10

News

View AllAugust 6, 2024

2024 Election News: Breaking Updates, Polls, and Predictions - Get the Latest Insights Now!

Read MoreTechnology

View All

August 12, 2024

The Ultimate Guide to Investment Banking Services: Unlocking Wealth Secrets

Discover the secrets to building wealth with investment banking services. Our guide unlocks the exclusive world of investment banking and how it can work for you.

January 18, 2025

Data-Driven Decisions: Strategies for Success

Discover how data-driven decision-making improves business outcomes. Learn strategies and tools to make smarter, data-backed choices!

August 12, 2024

The Best Help Desk Software for Small Businesses: Top Picks

Elevate your small business with the best help desk software! Discover our top picks for simple, efficient, and cost-effective solutions to streamline your customer support and boost growth.

Tips & Trick