Credit Card Hacks: How to Maximize Rewards and Minimize Debt

Mia Anderson

Photo: Credit Card Hacks: How to Maximize Rewards and Minimize Debt

Are you a credit card user looking to make the most of your spending? In today's world, credit cards are more than just a convenient payment method; they can be powerful tools for financial optimization. This article aims to unlock the secrets of credit card management, offering a comprehensive guide to help you maximize rewards, minimize debt, and ultimately take control of your financial journey. By the end, you'll be equipped with practical strategies to navigate the world of credit cards like a pro.

Understanding Credit Card Rewards

Credit card rewards are a lucrative incentive for cardholders, offering a wide range of benefits that can enhance your financial well-being. From cashback to travel perks, these rewards are designed to make your spending work for you. Let's delve into the world of credit card rewards and explore how you can make them work to your advantage.

Cashback Rewards

One of the most popular types of credit card rewards is cashback. Every time you make a purchase, you earn a percentage of that amount back, essentially getting paid to spend. For instance, a cashback credit card might offer 2% cashback on all purchases, meaning you earn $2 for every $100 spent. This can add up quickly, especially for those with significant monthly expenses. Imagine receiving a substantial cashback bonus at the end of the year, providing a welcome financial boost.

Travel Rewards

For the adventurous souls, travel rewards can be a dream come true. These rewards often include airline miles or hotel points, allowing you to accumulate points for every dollar spent, which can be redeemed for flights, hotel stays, or even car rentals. Imagine planning your dream vacation and using your accumulated points to cover a significant portion of the costs. This not only makes travel more affordable but also adds an element of excitement to your credit card usage.

Retail Rewards

Retail rewards cater to the shopping enthusiasts. Many credit cards partner with specific retailers, offering exclusive discounts, bonus points, or even cash rebates on purchases made at these stores. For example, a retail rewards card might provide 5% cashback on all purchases made at a popular online marketplace, encouraging cardholders to shop and save simultaneously. These rewards can make everyday shopping more rewarding and cost-effective.

Managing Debt: A Balancing Act

While credit card rewards are enticing, it's crucial to approach credit card usage with a balanced perspective, ensuring that you don't fall into the trap of mounting debt. Here's how you can manage your credit card debt effectively:

Create a Budget and Stick to It

The foundation of responsible credit card usage is a well-planned budget. Create a monthly budget that accounts for your income, essential expenses, and discretionary spending. Allocate a specific amount for credit card payments, ensuring it aligns with your financial capabilities. By setting a budget, you gain control over your spending and can avoid the pitfalls of overspending.

Pay Off Balances Regularly

One of the most effective ways to manage credit card debt is to pay off your balances in full and on time each month. This strategy not only keeps your debt under control but also helps you avoid interest charges and late fees. If paying the full balance is challenging, aim to pay more than the minimum required amount to reduce the overall debt burden.

Consider Debt Consolidation

If you find yourself juggling multiple credit card debts, debt consolidation might be a viable option. This involves combining your debts into a single, more manageable payment. You can explore debt consolidation loans or balance transfer credit cards, which offer promotional periods with low or no interest, providing an opportunity to pay off your debt faster.

Seek Professional Guidance

Managing debt can be complex, and it's okay to seek professional help. Non-profit credit counseling agencies, like American Consumer Credit Counseling, offer valuable resources and guidance. They can assist in creating a personalized debt management plan, negotiating with creditors, and providing financial education to empower you to take control of your finances.

Financial Optimization: Going the Extra Mile

Maximizing credit card rewards and managing debt is just the beginning of your financial optimization journey. Here are some additional strategies to take your financial game to the next level:

Portfolio Optimization

Investors often use portfolio optimization techniques to maximize returns and minimize risk. This concept can be applied to your credit card usage as well. Diversify your credit card portfolio by holding cards with different reward structures. For instance, have a cashback card for daily expenses, a travel rewards card for vacations, and a retail rewards card for shopping. This diversification ensures you get the best rewards for various spending categories.

Monitor and Rebalance

Regularly review your credit card portfolio and rebalance it to align with your changing needs and goals. For example, if you're planning a big-ticket purchase, consider applying for a card with an introductory 0% APR offer, allowing you to pay off the purchase over time without incurring interest. Similarly, if you're approaching a milestone like retirement, you might shift your focus to cards with more conservative rewards, such as cash rebates.

Stay Informed and Adapt

The credit card landscape is ever-evolving, with new offers and promotions regularly introduced. Stay informed about the latest trends and opportunities by subscribing to financial newsletters or following reputable credit card blogs. This knowledge will enable you to adapt your credit card strategy, ensuring you always have the most suitable cards in your wallet.

Conclusion

Credit card management is an art that requires a delicate balance between maximizing rewards and minimizing debt. By understanding the intricacies of credit card rewards, implementing effective debt management strategies, and embracing financial optimization techniques, you can become a master of your financial destiny. Remember, the key to success is staying informed, being proactive, and adapting your approach as your financial goals evolve.

In this journey, you'll encounter numerous credit card hacks and strategies, but it's essential to find what works best for your unique financial situation. Whether it's earning substantial cashback rewards, enjoying dream vacations with travel points, or achieving financial freedom through debt management, the power to transform your financial life is within your grasp. So, embark on this credit card mastery adventure with confidence, and watch your financial landscape flourish.

Marketing

View All

January 20, 2025

5 Best Digital Marketing Tools for GrowthUncover the top 5 digital marketing tools every marketer needs. Boost efficiency, drive results, and streamline your campaigns now!

Mia Anderson

January 27, 2025

PPC vs SEO: Digital Marketing ShowdownDiscover the differences between PPC and SEO in digital marketing. Find out which strategy is right for your goals and budget. Make an informed choice today!

Mia Anderson

January 21, 2025

Why Digital Marketing is Vital for SMBsDiscover why small businesses must adopt digital marketing in 2024. Learn tips and tactics to compete in the digital age. Take your business online today!

Mia Anderson

Entertainment

View AllDiscover the latest trends in cinematic universes for 2024. Explore how interconnected storytelling is evolving and its impact on modern media. Learn more now!

Mia Anderson

Discover the top indie movies of all time that will captivate and inspire you. Dive in to see which films made the list click to explore cinematic gems!

Mia Anderson

Discover how streaming is revolutionizing the movie industry. Explore its impact and future trends. Click to stay ahead in the entertainment world!

Mia Anderson

Unlock the secrets to creating captivating animation videos in 2024. Discover expert tips and techniques to bring your ideas to life. Start now!

Mia Anderson

Automotive

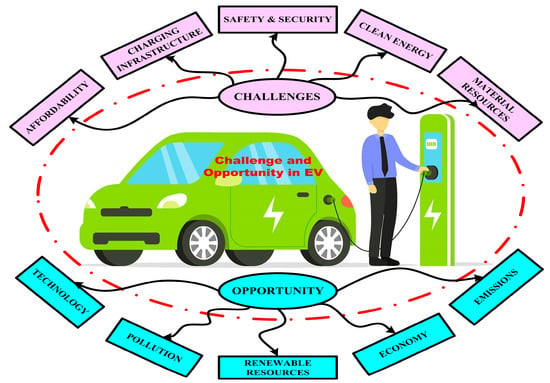

View AllExplore how the rise of electric vehicle (EV) infrastructure is driving changes in land use and urban planning worldwide.

Read MoreNeed cash fast? Discover how to sell your car for cash with quick and reliable methods!

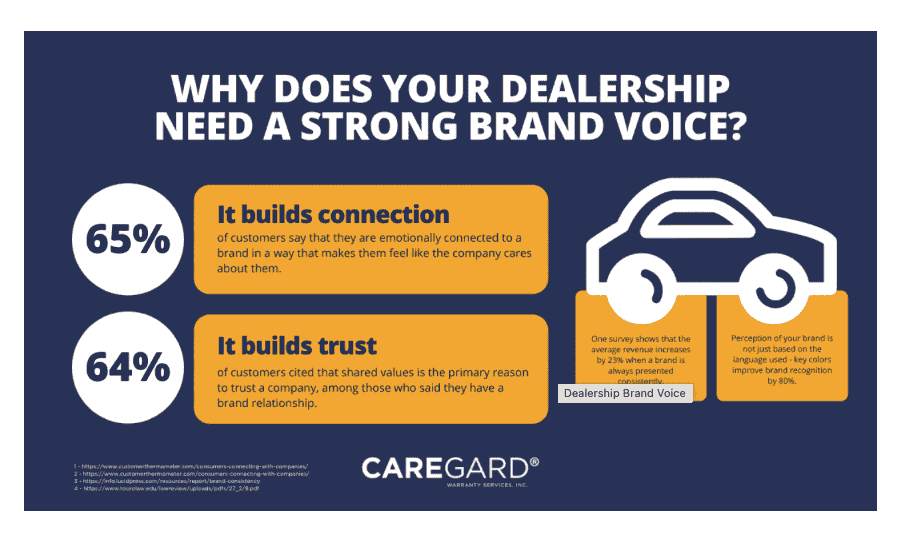

Read MoreDominate the auto market with these Dealer Daily tips. Learn strategies to increase efficiency and outshine competitors!

Read MorePolular🔥

View All

1

2

3

4

5

6

7

8

9

10

News

View AllAugust 6, 2024

2024 Election News: Breaking Updates, Polls, and Predictions - Get the Latest Insights Now!

Read MoreTechnology

View All

August 12, 2024

The Ultimate Guide to Investment Banking Services: Unlocking Wealth Secrets

Discover the secrets to building wealth with investment banking services. Our guide unlocks the exclusive world of investment banking and how it can work for you.

January 18, 2025

Data-Driven Decisions: Strategies for Success

Discover how data-driven decision-making improves business outcomes. Learn strategies and tools to make smarter, data-backed choices!

August 12, 2024

The Best Help Desk Software for Small Businesses: Top Picks

Elevate your small business with the best help desk software! Discover our top picks for simple, efficient, and cost-effective solutions to streamline your customer support and boost growth.

Tips & Trick