The Best High-Yield Savings Accounts You Need to Open Now

Mia Anderson

Photo: The Best High-Yield Savings Accounts You Need to Open Now

Are you tired of watching your hard-earned money sit idly in a traditional savings account, barely earning any interest? It's time to unlock the potential of your savings and discover the world of high-yield savings accounts. In today's low-interest-rate environment, finding ways to maximize your financial growth is more important than ever. This article will take you on a journey through the benefits, strategies, and top picks for high-yield savings accounts, ensuring your money works harder for you. Get ready to transform your savings game!

Understanding High-Yield Savings Accounts

High-yield savings accounts are like a financial superhero, offering significantly higher interest rates compared to traditional savings accounts. These accounts are designed to help your money grow faster, making them an attractive option for savvy savers. But what's the secret behind these supercharged savings?

In simple terms, high-yield savings accounts are offered by online banks and credit unions, which often have lower overhead costs than traditional brick-and-mortar banks. These institutions pass on the savings to customers in the form of higher interest rates. By choosing a high-yield savings account, you're essentially giving your money a boost, allowing it to grow at a more impressive pace.

The Benefits of High-Interest Savings

- Higher Interest Rates: The most obvious advantage is the higher interest rate, typically several times higher than traditional savings accounts. This means your money grows faster, helping you reach your financial goals sooner.

- Easy Access to Funds: Unlike some investment options, high-yield savings accounts provide easy access to your money. You can withdraw funds without penalties, making it convenient for emergency expenses or short-term savings goals.

- No Minimum Balance Requirements: Many high-yield savings accounts have no minimum balance requirements, allowing you to start saving with any amount. This flexibility is ideal for beginners or those with varying savings patterns.

- FDIC or NCUA Insurance: Most high-yield savings accounts are insured by the Federal Deposit Insurance Corporation (FDIC) or the National Credit Union Administration (NCUA). This insurance protects your funds up to a certain limit, providing peace of mind.

- Online Convenience: Online banks and credit unions offering high-yield savings accounts provide a seamless digital experience. You can manage your account, transfer funds, and track your savings growth with just a few clicks or taps.

Strategies for Maximizing Your High-Yield Savings

Maximizing the benefits of a high-yield savings account involves more than just opening an account. Here are some strategies to ensure your savings thrive:

1. Shop Around for the Best Rates

The beauty of high-yield savings accounts is the variety of options available. Take the time to compare interest rates offered by different banks and credit unions. Online comparison tools and financial websites can be invaluable resources for finding the highest rates. Remember, even a small difference in interest rates can significantly impact your savings over time.

2. Consider Promotional Rates

Some banks offer promotional rates to attract new customers. These rates may be higher than their standard offerings for a limited period. While promotional rates can provide an initial boost, be sure to understand the terms and conditions. Know when the promotional period ends and what the ongoing interest rate will be to make an informed decision.

3. Automate Your Savings

Consistency is key to growing your savings. Set up automatic transfers from your checking account to your high-yield savings account. This ensures that you save regularly, even if it's a small amount. Over time, these consistent contributions can add up to a substantial savings balance.

4. Maximize Your Emergency Fund

High-yield savings accounts are an excellent choice for building an emergency fund. Aim to save at least three to six months' worth of living expenses. This cushion can provide financial security and peace of mind during unexpected situations. With the higher interest rates, your emergency fund can grow while remaining easily accessible.

5. Consider Tiered Interest Rates

Some high-yield savings accounts offer tiered interest rates, where higher balances earn a more favorable rate. While this may not be an option for everyone, it's worth considering if you have a substantial savings goal. Understanding the balance tiers and corresponding rates can help you maximize your earnings.

Top High-Yield Savings Accounts to Consider

With numerous options available, choosing the right high-yield savings account can be overwhelming. Here's a curated list of some top picks to help you get started:

1. Ally Bank Online Savings Account

Ally Bank is a well-known name in the online banking space, offering a competitive interest rate on its savings account. With no minimum deposit requirement and no monthly maintenance fees, it's an accessible option for all savers. Ally also provides a user-friendly mobile app and 24/7 customer support, making it a convenient choice.

2. CIT Bank Savings Builder

CIT Bank's Savings Builder account is designed to encourage consistent savings. It offers a competitive interest rate when you either maintain a balance of $25,000 or more or make monthly deposits of $100 or more. This structure can be a great motivator for those looking to build their savings consistently.

3. Discover Online Savings Account

Discover Bank's online savings account is a popular choice, offering a competitive interest rate with no minimum balance requirements. Discover also provides a mobile app with budgeting tools and the ability to track your savings goals, making it an excellent option for those who want to stay organized.

4. Marcus by Goldman Sachs Online Savings Account

Marcus by Goldman Sachs offers a straightforward high-yield savings account with a competitive interest rate and no fees. Their user-friendly platform and excellent customer service make it an appealing choice for those seeking a hassle-free savings experience.

5. American Express Personal Savings Account

American Express, known for its credit cards, also offers a high-yield savings account. With no fees and a competitive interest rate, it provides a simple and secure way to grow your savings. American Express's reputation and customer support add to the account's appeal.

Frequently Asked Questions

1. Are high-yield savings accounts safe?

Absolutely! High-yield savings accounts offered by reputable banks and credit unions are FDIC or NCUA insured, ensuring your funds are protected up to the specified limit. This safety net makes them a secure option for your savings.

2. How often do high-yield savings accounts pay interest?

The frequency of interest payments varies between institutions. Some banks pay interest monthly, while others do so quarterly or annually. It's essential to review the account details to understand when and how often you'll receive interest payments.

3. Can I have multiple high-yield savings accounts?

Yes, you can open multiple high-yield savings accounts, either with the same institution or different ones. This can be a strategy to take advantage of varying interest rates and promotional offers. However, be mindful of any account opening or maintenance fees that may apply.

4. How do I withdraw money from a high-yield savings account?

Withdrawing money from a high-yield savings account is typically done through online transfers to your linked checking account. Some banks may also offer the option to transfer funds via check or wire transfer. The process is generally straightforward and secure.

5. Are there any penalties for early withdrawal?

High-yield savings accounts generally do not have penalties for early withdrawals, allowing you to access your funds without fees. However, it's always a good idea to review the account terms and conditions to understand any specific requirements or limitations.

Conclusion: Take Control of Your Financial Growth

High-yield savings accounts are a powerful tool for anyone looking to make their money work harder. By offering significantly higher interest rates, these accounts can accelerate your financial growth and help you achieve your savings goals. From understanding the benefits to implementing effective strategies, this article has provided a comprehensive guide to maximizing your savings potential.

Remember, the key to success is taking action. Start by comparing high-yield savings accounts and choosing one that aligns with your financial goals and preferences. Automate your savings, stay consistent, and watch your money grow. With the right high-yield savings account, you can unlock a brighter financial future and take control of your financial growth.

Are you ready to supercharge your savings? The world of high-yield savings accounts awaits!

Marketing

View All

January 20, 2025

5 Best Digital Marketing Tools for GrowthUncover the top 5 digital marketing tools every marketer needs. Boost efficiency, drive results, and streamline your campaigns now!

Mia Anderson

January 25, 2025

Email Marketing in the Digital AgeUnlock the power of email marketing with modern strategies tailored for the digital age. Connect with your audience like never before!

Mia Anderson

January 23, 2025

Social Media in Digital Marketing 2024Learn how social media is revolutionizing digital marketing in 2024. Boost your brand with actionable tips for viral campaigns!

Mia Anderson

Entertainment

View AllDiscover the latest viral marketing strategies that can catapult your brand to success in 2024. Learn proven tips to create buzz and engage your audience. Start now!

Mia Anderson

Discover the intriguing realm of celebrity culture and how it affects society. Learn about the possible effects of our infatuation and how celebrities turn their notoriety into brands. An must read for everybody curious about the contemporary celebrity phenomena.

Mia Anderson

Discover expert tips and strategies for organizing a film festival from start to finish. Learn key steps to ensure your event is a success read now!

Mia Anderson

Discover the top 10 entertainment trends of 2024 that will captivate you. Stay ahead with our expert insights and click to explore now!

Mia Anderson

Automotive

View AllExplore the positive impact of EV adoption on urban air quality. See how EVs are cleaning the air in cities worldwide.

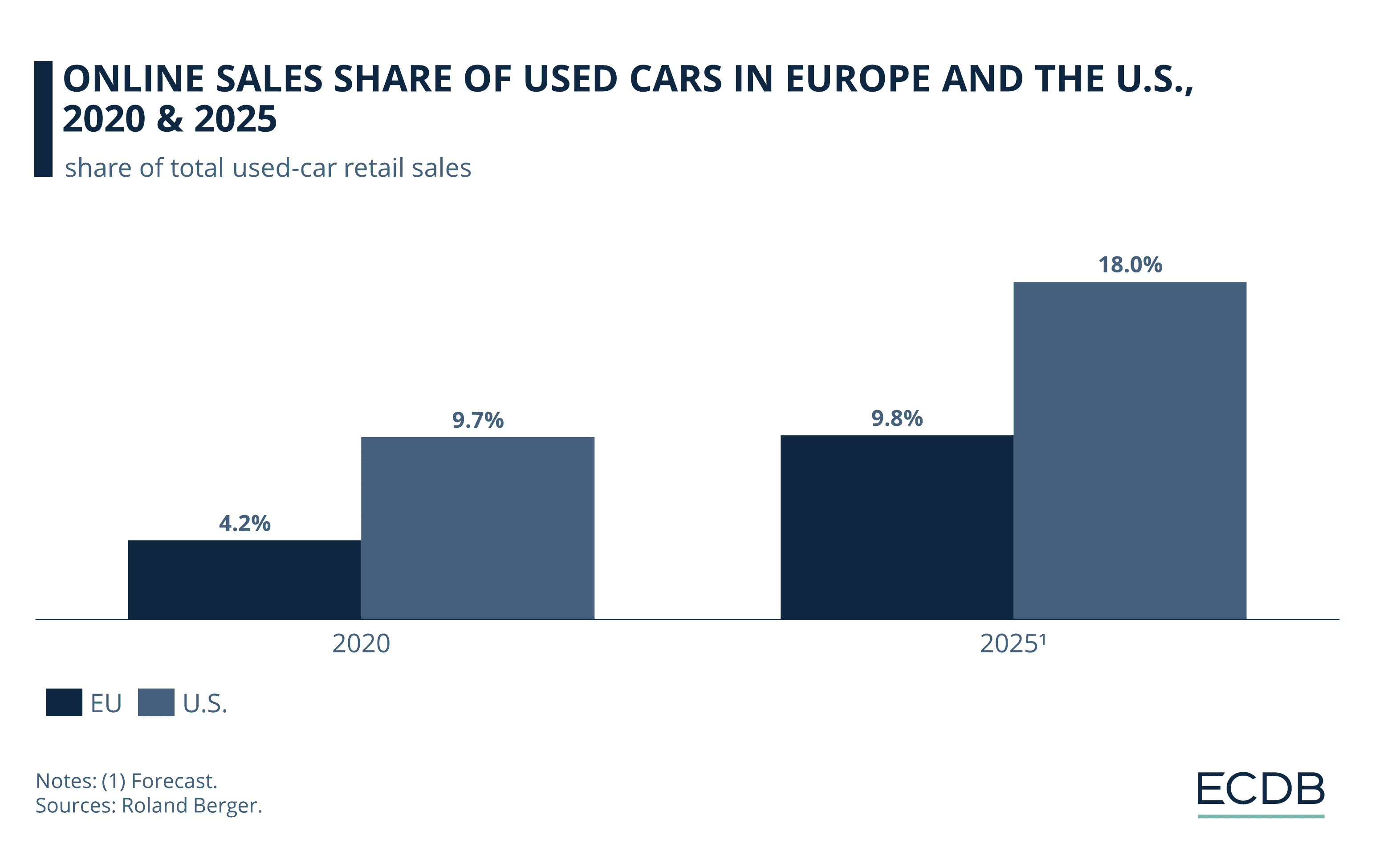

Read MoreExplore the pros and cons of selling your car online vs. locally. Find out which suits you best!

Read MoreExplore what drives consumer interest in EVs. Discover key insights into attitudes, barriers, and 2024’s hottest EV trends.

Read MorePolular🔥

View All

1

2

3

4

5

6

7

8

9

10

News

View AllAugust 13, 2024

The Ultimate Guide to Google Advertising: Secrets to Skyrocket Your Success

Read MoreTechnology

View All

December 8, 2024

Don’t Buy Another Laptop Until You Read This 2024 Comparison

Make an informed laptop purchase! Our 2024 comparison guide helps you find the perfect fit. Click to learn more and choose wisely.

August 30, 2024

Top Cloud Storage Solutions to Keep Your Data Safe

Discover the best cloud storage solutions to safeguard your data and boost efficiency. Explore top picks and make an informed choice today!

November 3, 2024

10 Tech Gadgets You Didn't Know You Needed in 2024

Discover the top 10 tech gadgets that will change your life in 2024. Uncover hidden must-haves read now!

Tips & Trick