5 High-Yield Investments for Beginners You Can Start Today

Mia Anderson

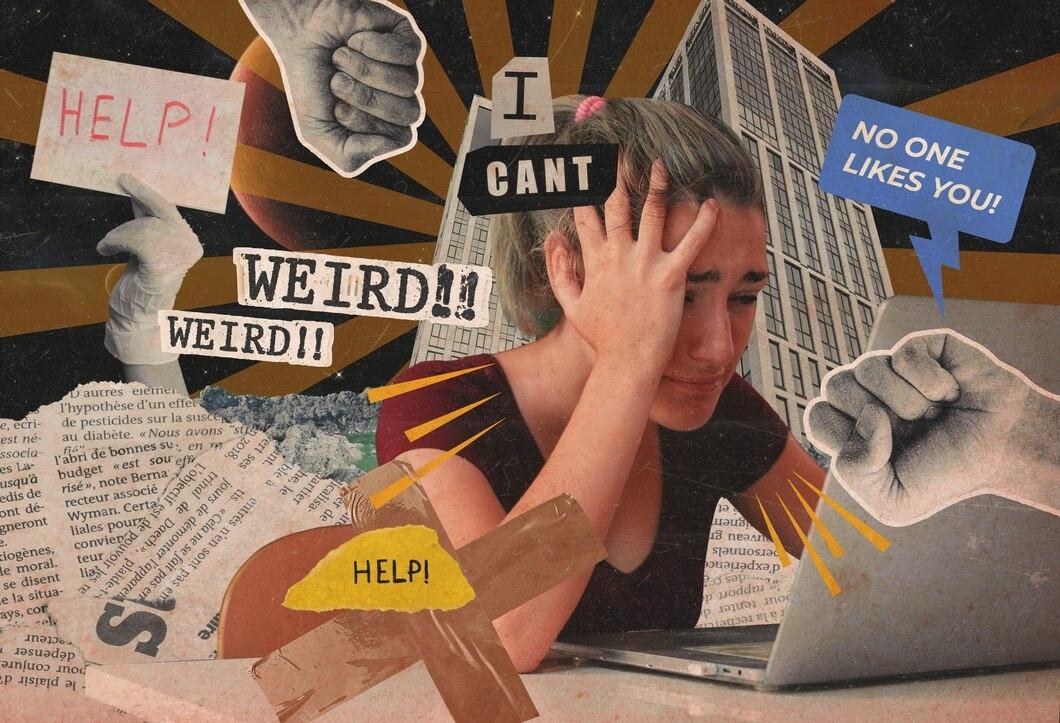

Photo: 5 High-Yield Investments for Beginners You Can Start Today

Are you a novice investor looking to make your money work harder? High-yield investments might be the answer you're seeking. These financial instruments offer the potential for impressive returns, making them an attractive strategy for those eager to grow their wealth. But where do you start, especially if you're new to the investing game? In this article, we'll explore five high-yield investment options that are not only lucrative but also accessible for beginners. Get ready to dive into a world of financial opportunities!

Understanding High-Yield Investments

Before we dive into the specifics, let's clarify what we mean by high-yield investments. In simple terms, these are investments that offer the potential for above-average returns compared to traditional savings accounts or low-risk investment options. The allure lies in the possibility of significant gains, but it's essential to understand that higher returns often come with increased risk.

5 High-Yield Investments for Beginners

1. High-Yield Savings Accounts

Let's kick things off with a relatively low-risk option: high-yield savings accounts. These are not your typical savings accounts; they offer higher interest rates, making your money grow faster. Online banks, with their lower operating costs, often provide some of the best high-yield savings accounts. This investment strategy is ideal for short-term savings goals, allowing you to earn more interest without sacrificing safety. For instance, imagine you have $5,000 set aside for an upcoming vacation. By placing it in a high-yield savings account, you could earn a few hundred dollars in interest over a year, a nice bonus for your travel fund!

2. Money Market Funds

If you're seeking a step up in terms of yield, consider money market funds. These funds invest in short-term debt instruments, such as government securities and certificates of deposit (CDs), offering higher yields than traditional savings accounts while maintaining a high level of safety and liquidity. Money market funds are a great way to diversify your portfolio and potentially earn more than with a regular savings account. Think of it as a bridge between savings and more aggressive investment options.

3. AAA Bonds

For those willing to venture slightly deeper into the world of investing, AAA bonds are an excellent choice. These investment-grade bonds, particularly short-duration ones with the highest AAA rating, offer a moderate level of risk and attractive returns. The AAA rating indicates a minimal default risk, providing a sense of security. However, it's crucial to remember that bond prices can be sensitive to interest rate changes, and the issuer's financial health can impact their riskiness. A well-diversified portfolio might include AAA bonds as a stable, income-generating component.

4. Investment Grade Corporate Bonds

Corporate bonds are another avenue for high-yield investing. Investment-grade corporate bonds are those issued by companies with strong credit ratings, typically indicating a lower risk of default. These bonds offer moderate returns and are a great way to diversify your portfolio beyond stocks and government securities. As with any investment, it's essential to research the issuing company and understand the specific bond's terms and conditions.

5. High-Quality ETFs

Exchange-Traded Funds (ETFs) are a fantastic option for beginners, especially those seeking a low-cost, diversified investment. ETFs are baskets of securities that trade on an exchange, much like stocks. They can contain various assets, including stocks, bonds, or commodities, providing instant diversification. High-quality ETFs, often recommended by experts, offer a balanced approach, combining low-risk and higher-risk assets. This strategy ensures that you're not putting all your eggs in one basket, which is a common pitfall for inexperienced investors.

Navigating the Risk-Return Tradeoff

As you explore these high-yield investment options, it's crucial to understand the risk-return tradeoff. In the world of investing, higher returns are often accompanied by increased risk. For instance, a new tech startup might promise high returns but also carries a higher chance of failure, potentially resulting in a complete loss of investment. On the other hand, lower-risk investments, like government bonds, typically offer lower returns. It's a balancing act, and the key is to find the right mix that aligns with your financial goals, timeline, and risk tolerance.

Starting Your Investment Journey

Embarking on your investment journey can be both exciting and daunting. The key is to start small and learn as you go. Begin with a clear understanding of your investment goals. Are you saving for a house, retirement, or simply looking to grow your wealth over time? This clarity will guide your investment choices.

Once you've set your goals, consider starting with a conservative approach, as suggested by many experts. Focus on stable investments with a proven track record. This strategy will help you build confidence and gain valuable experience. As you become more comfortable, you can gradually explore riskier options, always keeping in mind the importance of diversification.

Staying Informed and Adapting

The world of investing is dynamic, and staying informed is crucial. Keep an eye on reputable financial news sites to stay abreast of market trends, industry developments, and company-specific news. Avoid sources that promise quick riches or easy tricks, as these often lead to disappointment. Instead, focus on building a solid foundation of investment knowledge.

As you gain experience, you'll develop a sense of what works best for your financial situation and risk appetite. Remember, investing is a marathon, not a sprint. It's about making consistent, informed decisions that align with your long-term goals.

Conclusion

High-yield investments offer an exciting avenue for beginners to enter the world of investing. From high-yield savings accounts to ETFs, there are numerous options to suit different risk profiles and financial objectives. The key is to start with a clear plan, educate yourself, and adapt as you gain experience. While the potential for impressive returns is enticing, it's essential to approach high-yield investing with a balanced mindset, considering both the rewards and the risks.

So, whether you're saving for a dream vacation or planning for retirement, consider these high-yield investment options as tools to help you achieve your financial goals. Happy investing!

Marketing

View All

January 19, 2025

How to Master Digital Marketing BasicsLearn the essentials of digital marketing in this beginner-friendly guide. Kickstart your journey with step-by-step strategies. Start mastering today!

Mia Anderson

January 25, 2025

Email Marketing in the Digital AgeUnlock the power of email marketing with modern strategies tailored for the digital age. Connect with your audience like never before!

Mia Anderson

January 21, 2025

Why Digital Marketing is Vital for SMBsDiscover why small businesses must adopt digital marketing in 2024. Learn tips and tactics to compete in the digital age. Take your business online today!

Mia Anderson

Entertainment

View AllDiscover proven strategies for monetizing your blog in 2024. Learn how to boost revenue effectively. Read now for actionable insights and start earning today!

Mia Anderson

Discover top tips on streaming your favorite films legally & safely with our guide - click now, don't miss out!

Mia Anderson

Unlock the secrets of modern screenwriting with our expert tips and techniques. Start crafting compelling scripts today click to learn how!

Mia Anderson

Discover the latest trends in cinematic universes for 2024. Explore how interconnected storytelling is evolving and its impact on modern media. Learn more now!

Mia Anderson

Automotive

View AllExplore cutting-edge innovations shaping EV charging infrastructure and making electric vehicles more accessible globally.

Read MoreExplore resale value trends for electric vehicles and what buyers can expect when selling their EV in the future.

Read MoreLearn how electric vehicles (EVs) help reduce greenhouse gas emissions and combat climate change. Discover the environmental benefits!

Read MorePolular🔥

View All

1

2

3

4

5

7

8

9

10

News

View AllOctober 14, 2024

2024 Vaccination Updates: What You Need to Know for Flu & COVID-19 Protection

Read MoreTechnology

View All

December 7, 2024

Top 10 Smartphones with the Best Battery Life in 2024

Say goodbye to battery anxiety! Discover the top 10 smartphones with exceptional battery life. Click to explore and stay charged all day.

December 12, 2024

The Ultimate Tech Deals You Need to Grab Before They Disappear in 2024

Don't miss out on the hottest tech deals of 2024! Click to discover limited-time offers and save big on gadgets.

December 16, 2024

How to Upgrade Your PC for Under $500 – Best Components for 2024

Upgrade your PC on a budget! Discover the best components for 2024 to enhance performance. Click to learn more and build your dream PC.

Tips & Trick