The Secret to Building a Million-Dollar Financial Portfolio

Mia Anderson

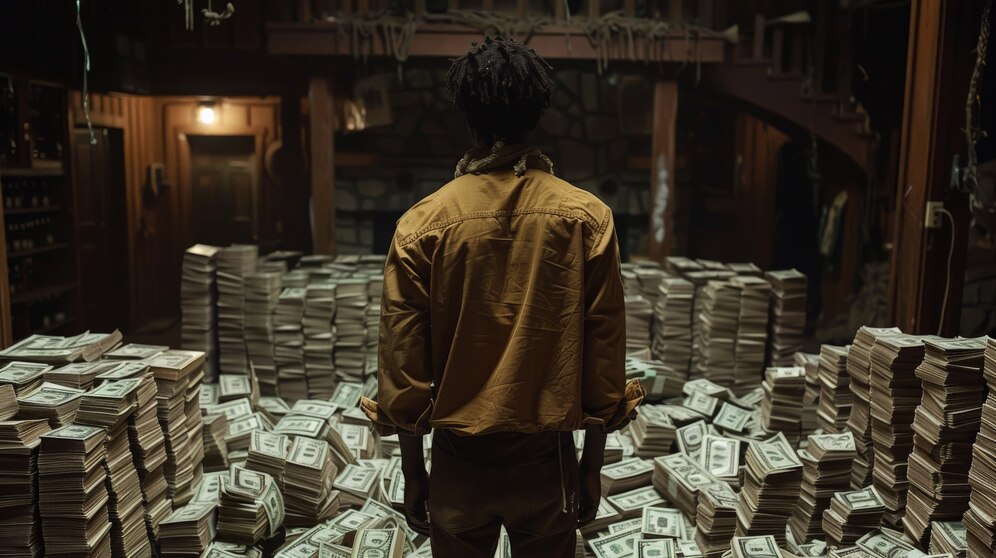

Photo: The Secret to Building a Million-Dollar Financial Portfolio

In the pursuit of financial freedom, many aspire to build a substantial wealth portfolio, but the path to success is often shrouded in mystery. This article aims to demystify the process of wealth creation and reveal the secrets behind building a million-dollar financial empire. By exploring various wealth-building strategies, we will uncover the principles that can guide anyone towards achieving their financial dreams. Let's embark on this enlightening journey together.

The Foundation of Wealth Building

Pay Yourself Like a Business

Imagine treating your personal finances as if you were running a successful enterprise. This is the essence of "paying yourself like a business," a powerful concept in wealth building. It involves allocating a portion of your income to yourself before any other expenses, a practice often referred to as "paying yourself first." By prioritizing saving and investing for your future, you lay the foundation for long-term financial growth.

For instance, consider John, a young professional who decides to implement this strategy. He sets aside 20% of his monthly income into a dedicated investment account. Over time, this disciplined approach allows him to accumulate a substantial sum, which he then invests in a diverse range of assets. This simple yet effective habit sets the stage for John's journey towards building a million-dollar portfolio.

Diversify Your Income Streams

Relying solely on a single source of income can be risky and limit your wealth-building potential. Diversifying your income streams is a crucial strategy to enhance financial stability and accelerate wealth creation. This involves exploring various avenues to generate revenue, ensuring a steady cash flow and reducing the impact of economic uncertainties.

Take the case of Sarah, a freelance designer who initially relied solely on client projects. Realizing the importance of diversification, she decided to expand her income streams. Sarah started offering online courses, selling digital products, and even investing in a small rental property. These additional sources of income provided her with a more stable financial foundation and increased her overall wealth over time.

Set SMART Financial Goals

Wealth building is a deliberate and intentional process, and setting realistic financial goals is the compass that guides your journey. These goals should be Specific, Measurable, Attainable, Relevant, and Time-bound (SMART). By defining clear objectives, you can create a roadmap to track your progress and stay focused on your financial aspirations.

Imagine a young couple, Mark and Lisa, who dream of early retirement. They set a SMART goal to save and invest enough to achieve financial independence by the age of 45. This goal becomes their driving force, influencing their spending habits and investment decisions. By regularly reviewing and adjusting their strategy, Mark and Lisa stay on track, turning their dream into a tangible reality.

Strategies for Investment Success

Embrace Long-Term Investing

Wealth building is a marathon, not a sprint. Many aspiring investors fall into the trap of chasing quick profits, only to be disappointed by scams or high-risk ventures. The secret to long-term investment success lies in playing the long game and maintaining a patient, disciplined approach.

Consider the story of Warren Buffett, one of the world's most successful investors. Buffett's investment philosophy emphasizes long-term value investing, focusing on companies with strong fundamentals and sustainable growth prospects. By ignoring short-term market fluctuations and media hype, Buffett has built an immense fortune over decades, proving that patience and a long-term perspective are key to investment success.

Explore Diverse Investment Options

Building a million-dollar portfolio requires a well-rounded investment strategy. Diversifying your investments is a powerful way to manage risk and maximize returns. This involves allocating your capital across various asset classes, such as stocks, bonds, real estate, and alternative investments.

Stocks and bonds are traditional investment choices, offering the potential for capital appreciation and income generation. For those with access to employer-sponsored plans like 401(k)s, these can be excellent vehicles for long-term wealth accumulation. However, exploring alternative investments, such as rental properties, peer-to-peer lending, and crowdfunding, can provide additional income streams and further diversify your portfolio.

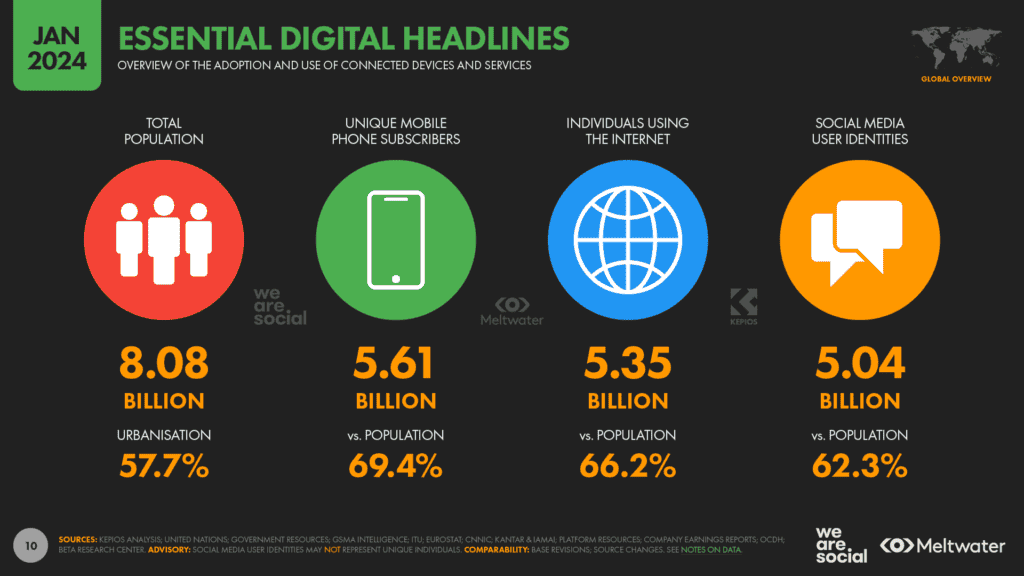

Stay Informed and Adapt

The financial world is ever-evolving, and staying informed is crucial for investment success. Keeping up with market trends, economic indicators, and industry developments can help you make informed decisions and adapt your investment strategy accordingly.

For example, the rise of technology and digital assets has opened up new investment opportunities. Cryptocurrencies and blockchain-based projects have gained significant traction, attracting both institutional and retail investors. By staying abreast of these trends and understanding the underlying technology, investors can explore these emerging markets and potentially tap into high-growth investment opportunities.

Overcoming Challenges and Staying Motivated

Manage Risk and Emotions

Wealth building is not without its challenges and pitfalls. One of the most significant obstacles is managing risk and emotions. The financial markets can be volatile, and emotional decision-making can lead to costly mistakes. It is essential to develop a disciplined approach, sticking to your investment plan and avoiding impulsive reactions to market fluctuations.

A practical way to manage risk is to diversify your portfolio and set clear risk tolerance levels. This involves understanding your financial goals, time horizon, and comfort with market volatility. By allocating your investments based on your risk profile, you can minimize potential losses and ensure a more stable wealth-building journey.

Stay Motivated and Adapt to Change

Building a million-dollar portfolio is a long-term endeavor, and maintaining motivation can be challenging. It is crucial to stay focused on your financial goals and keep yourself inspired throughout the journey.

One effective strategy is to celebrate small wins along the way. Whether it's reaching a savings milestone or achieving a specific investment target, acknowledging these achievements can provide a sense of progress and motivation. Additionally, surrounding yourself with like-minded individuals or joining investment communities can offer support, valuable insights, and a sense of accountability.

Conclusion: The Power of Wealth Building

Wealth building is an empowering process that can transform lives and secure financial freedom. By adopting the strategies outlined in this article, anyone can embark on a journey towards building a million-dollar financial portfolio. From paying yourself first to diversifying income streams and investments, these principles provide a solid foundation for success.

Remember, wealth creation is a marathon, and the path may be filled with challenges and uncertainties. However, by staying informed, adapting to market dynamics, and maintaining a disciplined approach, you can navigate these obstacles and achieve your financial aspirations. The secret to building a million-dollar portfolio lies in consistent effort, patience, and a commitment to lifelong learning.

So, take the first step, set your financial goals, and start building the wealth you deserve. The journey may be long, but the rewards are well worth the effort. Happy investing!

Marketing

View All

January 20, 2025

5 Best Digital Marketing Tools for GrowthUncover the top 5 digital marketing tools every marketer needs. Boost efficiency, drive results, and streamline your campaigns now!

Mia Anderson

January 25, 2025

Email Marketing in the Digital AgeUnlock the power of email marketing with modern strategies tailored for the digital age. Connect with your audience like never before!

Mia Anderson

January 23, 2025

Social Media in Digital Marketing 2024Learn how social media is revolutionizing digital marketing in 2024. Boost your brand with actionable tips for viral campaigns!

Mia Anderson

Entertainment

View AllDiscover the latest viral marketing strategies that can catapult your brand to success in 2024. Learn proven tips to create buzz and engage your audience. Start now!

Mia Anderson

Discover the intriguing realm of celebrity culture and how it affects society. Learn about the possible effects of our infatuation and how celebrities turn their notoriety into brands. An must read for everybody curious about the contemporary celebrity phenomena.

Mia Anderson

Discover expert tips and strategies for organizing a film festival from start to finish. Learn key steps to ensure your event is a success read now!

Mia Anderson

Discover the top 10 entertainment trends of 2024 that will captivate you. Stay ahead with our expert insights and click to explore now!

Mia Anderson

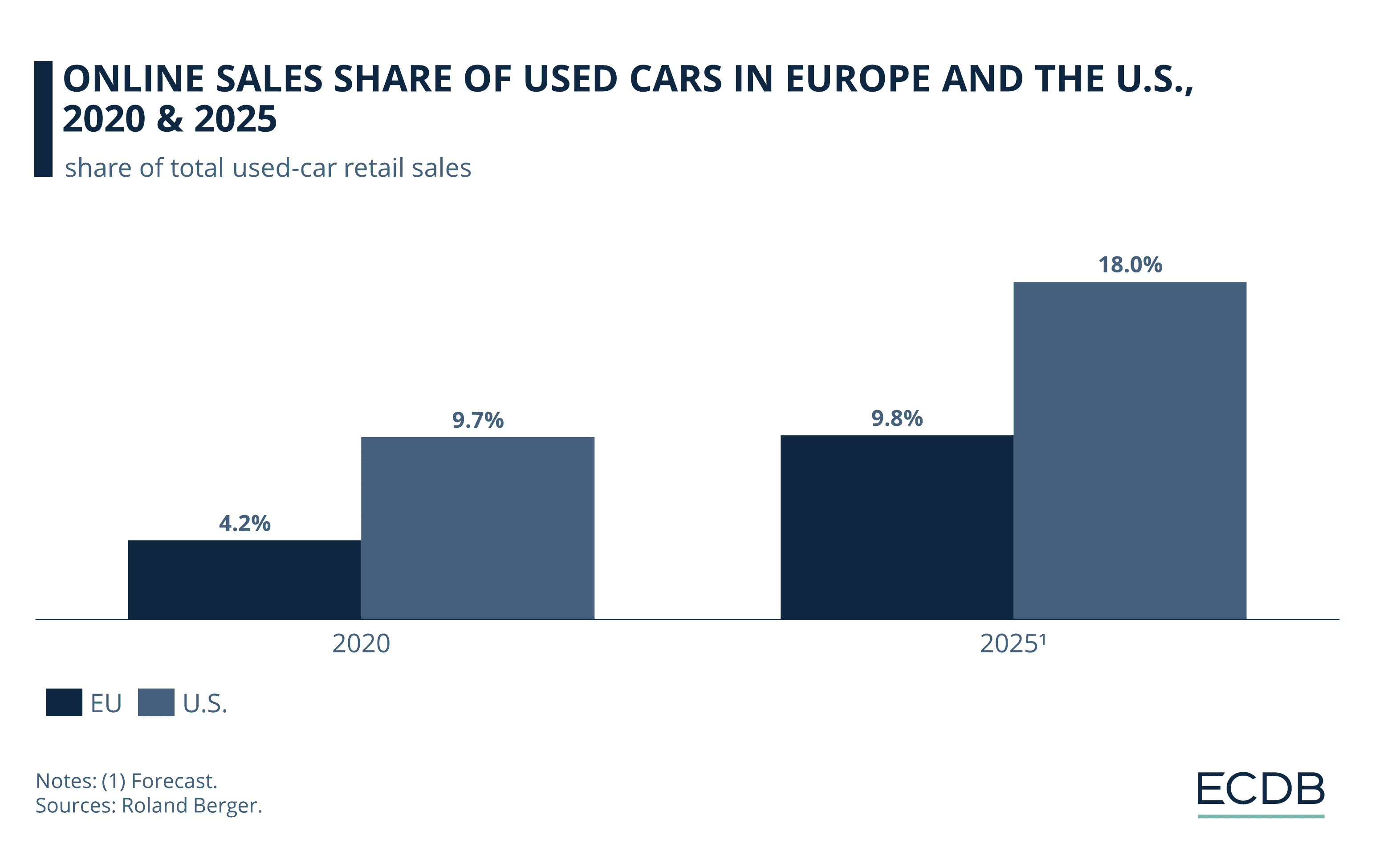

Automotive

View AllExplore the positive impact of EV adoption on urban air quality. See how EVs are cleaning the air in cities worldwide.

Read MoreExplore the pros and cons of selling your car online vs. locally. Find out which suits you best!

Read MoreExplore what drives consumer interest in EVs. Discover key insights into attitudes, barriers, and 2024’s hottest EV trends.

Read MorePolular🔥

View All

1

2

3

4

5

6

7

8

9

10

News

View AllAugust 13, 2024

The Ultimate Guide to Google Advertising: Secrets to Skyrocket Your Success

Read MoreTechnology

View All

December 8, 2024

Don’t Buy Another Laptop Until You Read This 2024 Comparison

Make an informed laptop purchase! Our 2024 comparison guide helps you find the perfect fit. Click to learn more and choose wisely.

August 30, 2024

Top Cloud Storage Solutions to Keep Your Data Safe

Discover the best cloud storage solutions to safeguard your data and boost efficiency. Explore top picks and make an informed choice today!

November 3, 2024

10 Tech Gadgets You Didn't Know You Needed in 2024

Discover the top 10 tech gadgets that will change your life in 2024. Uncover hidden must-haves read now!

Tips & Trick