How to Set Financial Goals and Actually Achieve Them

Mia Anderson

Photo: How to Set Financial Goals and Actually Achieve Them

Are you ready to take control of your financial future? Setting financial goals is a powerful practice that can transform your relationship with money and propel you towards prosperity. In this comprehensive guide, we'll explore the art of financial goal setting, providing you with practical strategies and insights to help you not only set but also achieve your financial aspirations. Whether you're aiming to build a robust savings account, pay off debts, or invest wisely, this article will be your roadmap to financial success.

Understanding the Importance of Financial Goal Setting

Financial goal setting is more than just a New Year's resolution; it's a strategic approach to managing your money and building wealth. By setting clear and specific financial goals, you're essentially creating a roadmap to guide your financial decisions and actions. This process is a cornerstone of effective wealth management and personal finance coaching, as it helps individuals align their daily financial choices with their long-term aspirations.

The Pitfalls of Vague Goals

Imagine embarking on a journey without a clear destination in mind. You might wander aimlessly, unsure of when or how to reach your desired outcome. Similarly, vague financial goals like "save money" or "get out of debt" lack the power to motivate and guide you. They are like a compass without a needle, offering little direction and leaving you susceptible to financial drift.

The SMART Way to Set Financial Goals

To ensure your financial goals are both effective and achievable, consider the SMART framework. This widely recognized approach stands for Specific, Measurable, Achievable, Relevant, and Time-bound. Let's delve into each aspect and understand how it contributes to successful financial goal setting.

Specific

When setting financial goals, specificity is your secret weapon. Instead of broad statements, be precise about the amount and purpose of your goal. For instance, "I want to save $10,000 for an emergency fund by the end of the year" is a specific goal. It provides a clear target and helps you stay focused on the steps needed to reach it.

Measurable

Measurability is key to tracking your progress and staying motivated. Attach a quantifiable metric to your goal so you can monitor your achievements. For example, "I will increase my retirement savings by 10% each quarter" allows you to measure your success and make adjustments as needed.

Achievable

While ambition is admirable, setting realistic and achievable goals is essential. Consider your current financial situation, income, and expenses when determining what is feasible. For instance, if you're aiming to save for a house deposit, calculate how much you can realistically save each month based on your income and existing commitments.

Relevant

Your financial goals should align with your personal values and aspirations. Ask yourself why this goal matters to you. Is it to provide financial security for your family? To fund a passion project? Ensuring your goals are relevant to your life's vision will keep you motivated and committed.

Time-bound

Setting a deadline for your financial goal adds a sense of urgency and accountability. It helps you prioritize and take action. For instance, "I will pay off my credit card debt within the next 12 months" gives you a clear timeframe to work towards.

From Goals to Action: Strategies for Success

Now that you've set SMART financial goals, it's time to turn them into reality. Here are some practical strategies to help you stay on track and achieve your financial objectives:

1. Create a Detailed Plan

Break down your financial goals into actionable steps. For example, if your goal is to save for a new car, research the cost, create a monthly savings plan, and identify ways to cut expenses or increase your income to meet your target. A well-structured plan will make your goal more attainable.

2. Automate Your Savings

Make saving effortless by automating your finances. Set up automatic transfers from your paycheck or bank account to your savings or investment accounts. This ensures that you save consistently without the temptation to spend the money elsewhere.

3. Practice Mindful Spending

Financial goals often require a shift in spending habits. Be mindful of your purchases and differentiate between needs and wants. Consider using budgeting apps or expense trackers to monitor your spending and identify areas where you can cut back. Small changes, like reducing daily coffee shop visits or cooking at home more often, can significantly impact your savings.

4. Stay Informed and Educated

Financial literacy is a powerful tool. Stay informed about personal finance topics through books, podcasts, or online courses. Understanding concepts like compound interest, investment strategies, and tax planning can help you make better financial decisions and optimize your wealth.

5. Seek Professional Guidance

Consider working with a financial advisor or personal finance coach, especially if you have complex financial goals or need expert guidance. These professionals can provide personalized advice, help you create a comprehensive financial plan, and keep you accountable.

Overcoming Challenges and Staying Motivated

Setting financial goals is just the beginning; the real challenge lies in staying committed and motivated throughout the journey. Here's how you can navigate common obstacles:

1. Adjust Your Mindset

Financial goal setting is a journey, and setbacks are inevitable. Embrace a growth mindset, viewing challenges as opportunities to learn and adapt. If you encounter a financial hurdle, reassess your plan, make adjustments, and keep moving forward.

2. Celebrate Milestones

Break your larger financial goals into smaller milestones and celebrate your progress. For instance, if you've saved $5,000 towards your house deposit, treat yourself to a small reward or celebrate with a loved one. Acknowledging your achievements can boost motivation and reinforce positive financial habits.

3. Stay Accountable

Share your financial goals with a trusted friend or family member who can hold you accountable. Regularly discuss your progress and challenges, and seek their support and encouragement. Alternatively, consider joining a financial accountability group or finding a mentor who can provide guidance and keep you on track.

Conclusion

Financial goal setting is a powerful tool to shape your financial future and achieve your dreams. By adopting the SMART framework and implementing the strategies outlined in this article, you can turn your financial aspirations into reality. Remember, the key to success lies in specificity, planning, and staying committed. Whether you're aiming to pay off debts, build wealth, or secure your retirement, setting and achieving financial goals will bring you one step closer to financial freedom and security.

As you embark on your financial journey, keep in mind that it's a continuous process of learning, adapting, and celebrating your progress. With the right mindset and tools, you can unlock the doors to financial success and create a life of financial abundance.

Marketing

View All

January 20, 2025

5 Best Digital Marketing Tools for GrowthUncover the top 5 digital marketing tools every marketer needs. Boost efficiency, drive results, and streamline your campaigns now!

Mia Anderson

January 25, 2025

Email Marketing in the Digital AgeUnlock the power of email marketing with modern strategies tailored for the digital age. Connect with your audience like never before!

Mia Anderson

January 23, 2025

Social Media in Digital Marketing 2024Learn how social media is revolutionizing digital marketing in 2024. Boost your brand with actionable tips for viral campaigns!

Mia Anderson

Entertainment

View AllDiscover the latest viral marketing strategies that can catapult your brand to success in 2024. Learn proven tips to create buzz and engage your audience. Start now!

Mia Anderson

Discover the intriguing realm of celebrity culture and how it affects society. Learn about the possible effects of our infatuation and how celebrities turn their notoriety into brands. An must read for everybody curious about the contemporary celebrity phenomena.

Mia Anderson

Discover expert tips and strategies for organizing a film festival from start to finish. Learn key steps to ensure your event is a success read now!

Mia Anderson

Discover the top 10 entertainment trends of 2024 that will captivate you. Stay ahead with our expert insights and click to explore now!

Mia Anderson

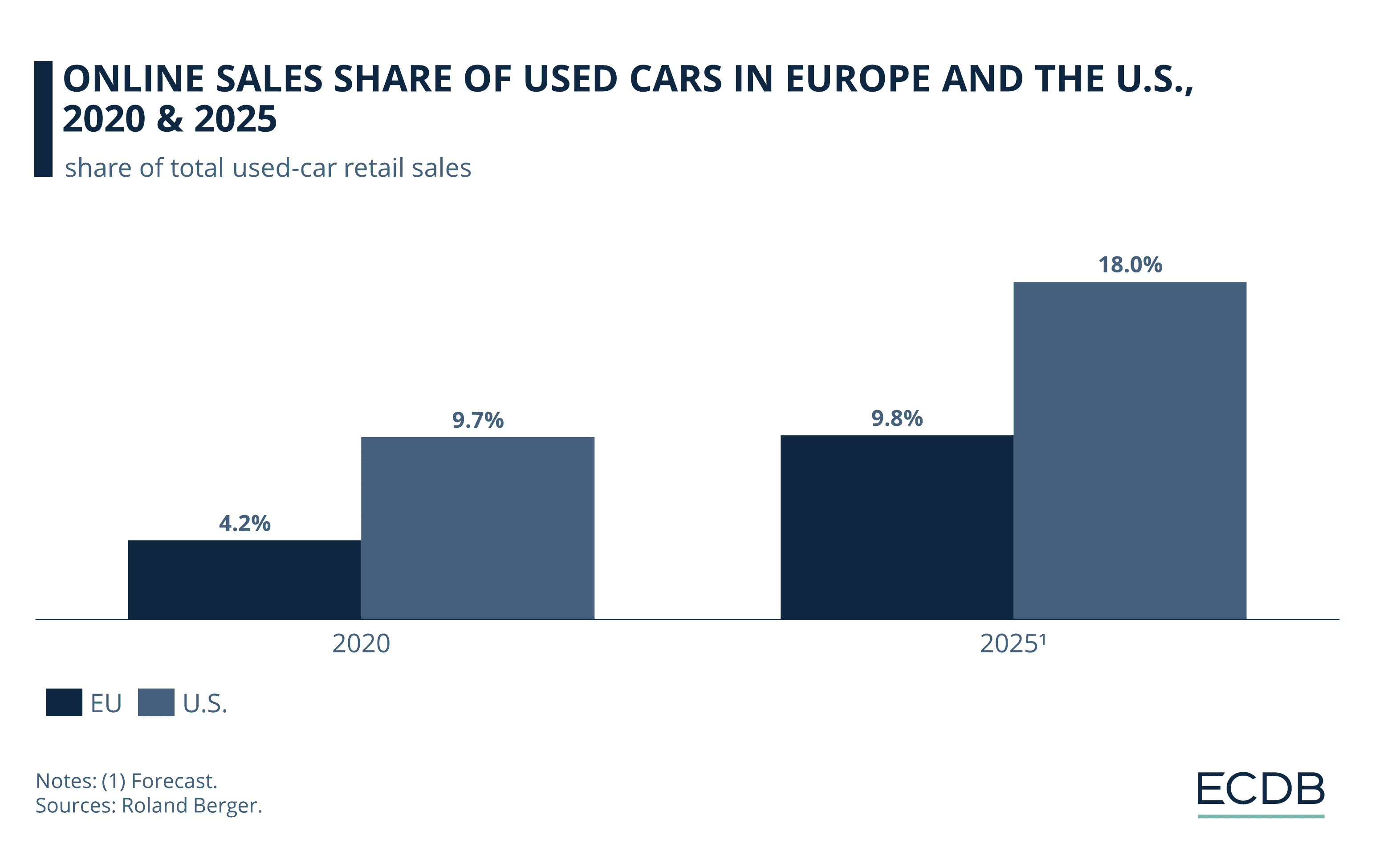

Automotive

View AllExplore the positive impact of EV adoption on urban air quality. See how EVs are cleaning the air in cities worldwide.

Read MoreExplore the pros and cons of selling your car online vs. locally. Find out which suits you best!

Read MoreExplore what drives consumer interest in EVs. Discover key insights into attitudes, barriers, and 2024’s hottest EV trends.

Read MorePolular🔥

View All

1

2

3

4

5

6

7

8

9

10

News

View AllAugust 13, 2024

The Ultimate Guide to Google Advertising: Secrets to Skyrocket Your Success

Read MoreTechnology

View All

December 8, 2024

Don’t Buy Another Laptop Until You Read This 2024 Comparison

Make an informed laptop purchase! Our 2024 comparison guide helps you find the perfect fit. Click to learn more and choose wisely.

August 30, 2024

Top Cloud Storage Solutions to Keep Your Data Safe

Discover the best cloud storage solutions to safeguard your data and boost efficiency. Explore top picks and make an informed choice today!

November 3, 2024

10 Tech Gadgets You Didn't Know You Needed in 2024

Discover the top 10 tech gadgets that will change your life in 2024. Uncover hidden must-haves read now!

Tips & Trick