Achieve Financial Freedom: Top Financial Planning Services You Need to Know

Mia Anderson

Photo: Achieve Financial Freedom: Top Financial Planning Services You Need to Know

Achieving financial freedom is a goal many people strive for but often find challenging to attain. This aspiration is more than just accumulating wealth; it’s about having the freedom to live life on your own terms, free from financial stress. To reach this milestone, engaging with the right financial planning services is crucial. These services not only help you manage your current finances but also guide you in making sound decisions for your future.

The Role of Financial Planning Services in Your Journey

Financial Planning Services play a pivotal role in securing your financial future. These services encompass a wide range of offerings, from investment management to retirement planning, and are designed to help you achieve specific financial goals. The process involves assessing your current financial situation, setting objectives, and devising strategies to meet those goals.

For example, consider Sarah, a 35-year-old professional who dreams of retiring at 55. Without a concrete plan, her goal might seem out of reach. However, by working with a certified financial planner, Sarah can develop a personalized strategy that includes investment planning, tax optimization, and risk management. Over time, these strategies can help her build a retirement fund that allows her to retire comfortably.

Why You Need the Best Financial Planning Services

Not all financial planning services are created equal. To maximize your chances of success, it’s essential to work with the best financial planning services available. But what makes a service the best?

- Experience and Expertise: The best services are those run by experienced financial advisors who are certified and have a proven track record. They understand the complexities of the financial world and can offer advice tailored to your specific needs.

- Personalization: Financial planning is not a one-size-fits-all approach. The top services offer personalized plans that consider your unique circumstances, such as your income level, family situation, and long-term goals.

- Comprehensive Services: The best financial planners provide a comprehensive range of services, including investment planning, retirement strategies, tax planning, and estate planning. This holistic approach ensures that all aspects of your financial life are covered.

Top Financial Advisors Near Me: How to Choose the Right One

When searching for top financial advisors near me, it’s important to consider several factors. Firstly, look for credentials such as CFP (Certified Financial Planner) or CFA (Chartered Financial Analyst). These certifications indicate that the advisor has undergone rigorous training and adheres to high ethical standards.

Secondly, consider the advisor’s approach to financial planning. Do they offer a personalized financial planning service? Are they willing to work closely with you to understand your financial goals and craft a plan that fits your needs? A good financial advisor will take the time to get to know you and provide advice that aligns with your objectives.

Lastly, don’t underestimate the importance of trust. Your financial advisor will have access to sensitive information about your finances, so it’s crucial to work with someone you trust. Take the time to meet with potential advisors, ask questions, and gauge their willingness to communicate openly.

Certified Financial Planners: Why Credentials Matter

When it comes to financial planning, credentials matter. Certified Financial Planners (CFPs) are held to rigorous standards of competence and ethics, making them a reliable choice for those seeking financial guidance. The CFP designation requires passing a comprehensive exam, gaining relevant work experience, and committing to ongoing education.

One reason why working with a CFP is beneficial is their adherence to a fiduciary standard, meaning they are legally obligated to act in your best interest. This contrasts with some other financial advisors who may recommend products or services that benefit them more than you.

As an anecdote, consider John, who initially worked with a non-certified advisor. He found that the advice he received often leaned towards high-commission products that didn’t necessarily serve his long-term goals. After switching to a CFP, John noticed a significant improvement in the quality of advice and felt more confident that his financial plan was truly in his best interest.

Wealth Management Services: Building and Protecting Your Wealth

Wealth management services go beyond basic financial planning by offering a more in-depth approach to building and protecting your wealth. These services typically cater to individuals with substantial assets and include investment management, tax planning, estate planning, and more.

For instance, a wealth manager might help you diversify your investment portfolio to mitigate risk while maximizing returns. They may also work with tax professionals to minimize your tax liability, ensuring that more of your wealth is preserved for future generations.

Wealth management is particularly beneficial for those who have complex financial situations, such as business owners or individuals with significant investment portfolios. By integrating various aspects of your financial life into a cohesive plan, wealth management services can help you achieve and maintain financial freedom.

Financial Planning for Retirement: Securing Your Golden Years

Retirement planning is one of the most critical components of financial planning. Without a solid retirement plan, you may find yourself struggling to maintain your standard of living in your later years. Financial planning for retirement involves estimating your future expenses, determining how much you need to save, and choosing the right investment vehicles to reach your goals.

Take the case of Alice and Bob, a couple in their 50s who want to retire within the next 10 years. By working with a financial planner, they were able to create a detailed retirement plan that accounted for their desired lifestyle, healthcare costs, and inflation. This plan included a mix of investment strategies, such as stocks, bonds, and real estate, to ensure they had enough income during retirement.

Comprehensive Financial Planning: A Holistic Approach

Comprehensive financial planning involves looking at the big picture and addressing all areas of your financial life. This includes budgeting, saving, investing, tax planning, insurance, and estate planning. The goal is to create a cohesive plan that helps you achieve your financial goals while minimizing risks.

For example, comprehensive financial planning might involve setting up an emergency fund, creating a diversified investment portfolio, and purchasing insurance to protect against unforeseen events. By addressing all aspects of your financial life, comprehensive planning helps ensure that no stone is left unturned.

Financial Consulting Services: Expert Guidance When You Need It

Sometimes, you may need expert advice on specific financial matters. This is where financial consulting services come into play. These services provide targeted advice on issues such as debt management, investment strategies, or tax planning.

For instance, if you’re considering a major financial decision, such as buying a home or starting a business, a financial consultant can provide valuable insights to help you make an informed choice. By seeking expert guidance, you can avoid costly mistakes and make decisions that align with your long-term financial goals.

Investment Planning Strategies: Growing Your Wealth

Investment planning strategies are essential for growing your wealth over time. Whether you’re saving for retirement, your child’s education, or a major purchase, the right investment strategy can help you achieve your goals.

There are various strategies to consider, from conservative approaches like bonds and savings accounts to more aggressive options like stocks and real estate. The key is to find a strategy that matches your risk tolerance and time horizon. For example, younger investors may opt for a more aggressive strategy, while those closer to retirement might prefer a conservative approach.

Affordable Financial Planning Services: Quality Without Breaking the Bank

Contrary to popular belief, you don’t have to be wealthy to benefit from financial planning services. Affordable financial planning services are available that offer quality advice at a price that fits your budget. These services often provide a la carte options, allowing you to pay only for the services you need.

For instance, if you’re just starting your financial journey, you might opt for a basic financial plan that covers budgeting and saving. As your financial situation becomes more complex, you can add services such as investment management or retirement planning.

Conclusion: Taking the First Step Towards Financial Freedom

Achieving financial freedom is within your reach, but it requires careful planning and expert guidance. By engaging with top financial planning services, you can develop a personalized plan that aligns with your goals and secures your future. Whether you’re just starting out or looking to optimize your wealth, the right financial planner can make all the difference.

Remember, the journey to financial freedom begins with a single step. Take that step today by exploring the financial planning services available to you and choosing one that meets your needs. Your future self will thank you.

Marketing

View All

January 20, 2025

5 Best Digital Marketing Tools for GrowthUncover the top 5 digital marketing tools every marketer needs. Boost efficiency, drive results, and streamline your campaigns now!

Mia Anderson

January 25, 2025

Email Marketing in the Digital AgeUnlock the power of email marketing with modern strategies tailored for the digital age. Connect with your audience like never before!

Mia Anderson

January 23, 2025

Social Media in Digital Marketing 2024Learn how social media is revolutionizing digital marketing in 2024. Boost your brand with actionable tips for viral campaigns!

Mia Anderson

Entertainment

View AllDiscover the latest viral marketing strategies that can catapult your brand to success in 2024. Learn proven tips to create buzz and engage your audience. Start now!

Mia Anderson

Discover the intriguing realm of celebrity culture and how it affects society. Learn about the possible effects of our infatuation and how celebrities turn their notoriety into brands. An must read for everybody curious about the contemporary celebrity phenomena.

Mia Anderson

Discover expert tips and strategies for organizing a film festival from start to finish. Learn key steps to ensure your event is a success read now!

Mia Anderson

Discover the top 10 entertainment trends of 2024 that will captivate you. Stay ahead with our expert insights and click to explore now!

Mia Anderson

Automotive

View AllExplore the positive impact of EV adoption on urban air quality. See how EVs are cleaning the air in cities worldwide.

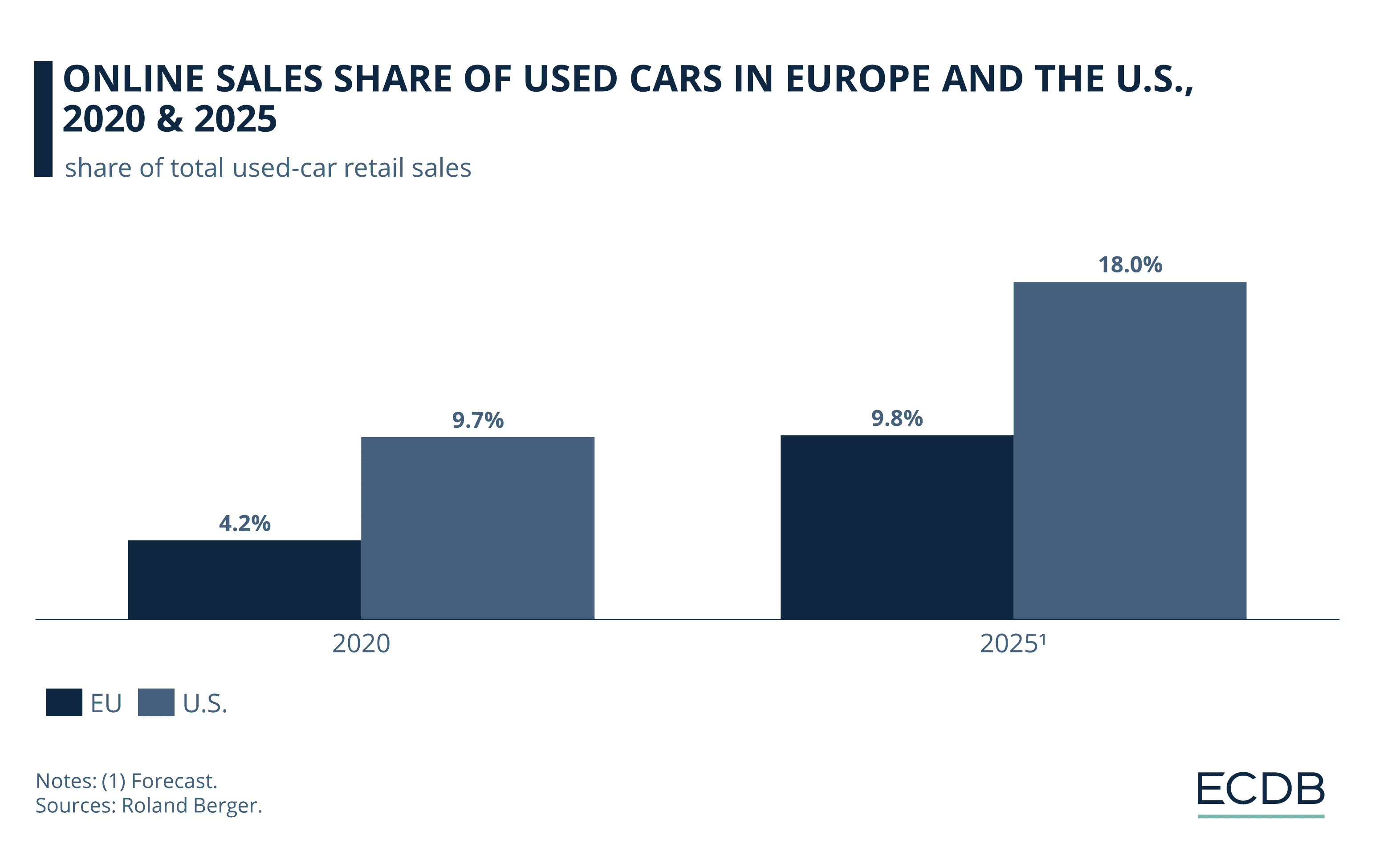

Read MoreExplore the pros and cons of selling your car online vs. locally. Find out which suits you best!

Read MoreExplore what drives consumer interest in EVs. Discover key insights into attitudes, barriers, and 2024’s hottest EV trends.

Read MorePolular🔥

View All

1

2

3

4

5

6

7

8

9

10

News

View AllAugust 13, 2024

The Ultimate Guide to Google Advertising: Secrets to Skyrocket Your Success

Read MoreTechnology

View All

December 8, 2024

Don’t Buy Another Laptop Until You Read This 2024 Comparison

Make an informed laptop purchase! Our 2024 comparison guide helps you find the perfect fit. Click to learn more and choose wisely.

August 30, 2024

Top Cloud Storage Solutions to Keep Your Data Safe

Discover the best cloud storage solutions to safeguard your data and boost efficiency. Explore top picks and make an informed choice today!

November 3, 2024

10 Tech Gadgets You Didn't Know You Needed in 2024

Discover the top 10 tech gadgets that will change your life in 2024. Uncover hidden must-haves read now!

Tips & Trick