Debt Repayment Plans That Work: Which One Is Right for You?

Mia Anderson

Photo: Debt Repayment Plans That Work: Which One Is Right for You?

Are you feeling overwhelmed by debt and looking for effective ways to regain control of your finances? You're not alone! Many individuals find themselves in a similar situation, seeking a clear path to debt freedom. In this comprehensive guide, we'll explore various debt repayment plans that work, helping you understand which strategy is best suited to your financial situation. Say goodbye to debt stress and hello to a brighter financial future!

Understanding Debt Repayment Plans

Debt repayment is a journey, and choosing the right plan can make all the difference. It's like having a roadmap to guide you out of the financial maze. Let's delve into some popular and effective debt repayment strategies and find the one that aligns with your goals.

1. The Debt Snowball Method:

This method is all about building momentum and celebrating small wins. Here's how it works:

- Identify Your Debts: Make a list of all your debts, including credit cards, personal loans, and any outstanding bills.

- Prioritize by Amount: Arrange your debts from the smallest to the largest balance, regardless of interest rates.

- Focus on the Smallest Debt: Put all your effort into paying off the smallest debt first while making minimum payments on the others.

- Snowball Effect: Once the smallest debt is cleared, take the amount you were paying towards it and roll it into paying off the next smallest debt.

The Debt Snowball Method provides quick wins, which can be highly motivating. Seeing debts disappear from your list can boost your confidence and keep you committed to the process.

2. The Debt Avalanche Method:

This strategy is a more mathematically-driven approach, focusing on interest rates.

- List Your Debts: Similar to the Snowball Method, start by listing all your debts.

- Prioritize by Interest Rates: Arrange your debts from the highest interest rate to the lowest.

- Tackle High-Interest Debt: Allocate as much of your budget as possible to pay off the debt with the highest interest rate while making minimum payments on others.

- Repeat and Conquer: Once the highest-interest debt is paid off, move on to the next highest and repeat the process.

The Debt Avalanche Method saves you money on interest, making it an appealing choice for those with high-interest debts. It's a strategic approach that can significantly reduce the overall time and cost of debt repayment.

3. Debt Consolidation:

Debt consolidation is a strategy that involves combining multiple debts into a single, more manageable payment.

- Consolidation Loan: Obtain a loan to pay off all your existing debts, leaving you with one loan to repay.

- Lower Interest Rates: The goal is to secure a loan with a lower interest rate than the average of your current debts.

- Simplified Repayment: Instead of managing multiple payments, you focus on a single monthly payment.

Debt consolidation can simplify your financial life and potentially save you money on interest. However, it's essential to ensure you don't accumulate new debt while repaying the consolidation loan.

4. Debt Management Plans:

Debt management plans are often facilitated by credit counseling agencies and involve negotiating with creditors to create a structured repayment plan.

- Credit Counseling: Seek guidance from a certified credit counselor who will assess your financial situation.

- Negotiate with Creditors: The counselor may negotiate lower interest rates or waive certain fees to make your debt more manageable.

- Structured Repayment: You'll make a single monthly payment to the credit counseling agency, which will distribute the funds to your creditors.

This approach can provide relief by reducing monthly payments and interest rates, making debt repayment more feasible. It's a structured plan that offers support and guidance throughout the process.

Choosing the Right Debt Repayment Plan for You

Now that we've explored some popular debt repayment strategies, it's time to find the perfect fit for your financial situation. Here's how to make the right choice:

- Evaluate Your Debt: Consider the types of debt you have, their interest rates, and the total amount owed. Different strategies work better for various debt scenarios.

- Income and Budget: Assess your income and create a realistic budget. Some methods require more aggressive repayment, while others focus on long-term sustainability.

- Psychological Factor: Don't underestimate the power of motivation. The Debt Snowball Method, for instance, is popular because of its psychological impact, providing a sense of accomplishment early on.

- Seek Professional Advice: If you're unsure, consult a financial advisor or credit counselor. They can provide personalized guidance based on your unique circumstances.

Real-Life Debt Repayment Success Stories

Let's take a moment to draw inspiration from real people who have successfully navigated their debt journeys.

Sarah's Story:

Sarah, a young professional, found herself burdened with student loans and credit card debt. She opted for the Debt Snowball Method, focusing on her smallest debt first. "It was incredible to see the progress. Each time I paid off a debt, I felt more empowered. It motivated me to stick to my budget and make sacrifices for my financial freedom." Within two years, Sarah became debt-free and is now saving for her dream home.

John's Journey:

John had accumulated significant credit card debt due to unexpected medical expenses. He chose the Debt Avalanche Method, targeting high-interest debts first. "It was a challenging journey, but seeing the interest savings was eye-opening. I realized how much money I was losing to interest. Now, I'm debt-free and more financially aware than ever." John's story highlights the power of strategic debt management.

Frequently Asked Questions (FAQs)

1. How long will it take to become debt-free using these methods?

The time it takes to become debt-free varies based on your debt amount, income, and chosen repayment strategy. The Debt Snowball Method may provide quicker wins, while the Debt Avalanche Method focuses on long-term interest savings. Debt consolidation and management plans can also vary in duration.

2. Are these strategies suitable for all types of debt?

These strategies can be adapted to various types of debt, including credit cards, personal loans, and even student loans. However, each debt type may have unique considerations. For example, student loan repayment plans often have specific options and benefits.

3. What if I can't afford the minimum payments on my debts?

If you're struggling to make minimum payments, consider seeking professional advice from a credit counselor or financial advisor. They can help you explore options like debt negotiation or, in extreme cases, bankruptcy. It's essential to address financial challenges early on to prevent further complications.

4. Can I use a combination of these strategies?

Absolutely! Combining strategies is a personalized approach. For instance, you might use debt consolidation to simplify your payments and then apply the Debt Snowball or Avalanche Method to accelerate repayment. Tailor the plan to your needs and preferences.

Conclusion: Taking Control of Your Financial Future

Embarking on a debt repayment journey is a significant step towards financial freedom. By understanding and choosing the right debt repayment plan, you can transform your financial situation and gain control over your money.

Whether you opt for the quick wins of the Debt Snowball Method or the strategic approach of the Debt Avalanche, remember that consistency and commitment are key. Celebrate your progress, stay motivated, and seek support when needed.

Debt repayment is not just about numbers; it's about empowering yourself to make better financial decisions and building a brighter future. Take the first step today, and watch your debt gradually fade away. Your financial recovery is within reach!

Marketing

View All

January 25, 2025

SEO’s Role in Digital Marketing StrategyDive into the importance of SEO in crafting a digital marketing strategy that works. Rank higher and drive organic traffic today!

Mia Anderson

olivia.parker@outlook.com

January 23, 2025

10 Content Strategies for Digital SuccessCreate winning content with these 10 proven digital marketing strategies. Enhance engagement and conversions starting today!

Mia Anderson

olivia.parker@outlook.com

January 27, 2025

PPC vs SEO: Digital Marketing ShowdownDiscover the differences between PPC and SEO in digital marketing. Find out which strategy is right for your goals and budget. Make an informed choice today!

Mia Anderson

olivia.parker@outlook.com

Entertainment

View AllDiscover the latest tips and trends for becoming a successful music producer in 2024. Learn how to start your career today and make your mark in the industry!

Mia Anderson

olivia.parker@outlook.com

Unlock the secrets of social media marketing for artists in 2024. Learn strategies to grow your online presence and monetize your art. Start your journey today!

Mia Anderson

olivia.parker@outlook.com

Learn how influencer marketing is used by the entertainment sector to generate buzz and increase engagement. Discover the keys to campaign success, as well as how to choose the proper influencers and produce interesting content.

Mia Anderson

olivia.parker@outlook.com

Discover the best movie soundtracks of 2024! Explore our list of top picks and enhance your playlist today. Click to find your next favorite soundtrack!

Mia Anderson

olivia.parker@outlook.com

Automotive

View AllLearn how electric vehicles are helping countries meet global climate targets. See the role of EVs in reducing carbon emissions.

Read MoreDominate the auto market with these Dealer Daily tips. Learn strategies to increase efficiency and outshine competitors!

Read MoreGet answers to the most common questions about selling your car. Make informed decisions today!

Read MorePolular🔥

View All

1

2

3

4

5

6

7

8

9

10

Technology

View All

December 19, 2024

The Best Laptop for Remote Work in 2024 – Find Out Which One Wins!

Discover the ultimate laptop for remote work! Click to learn about the top contenders and choose the perfect productivity partner.

September 14, 2024

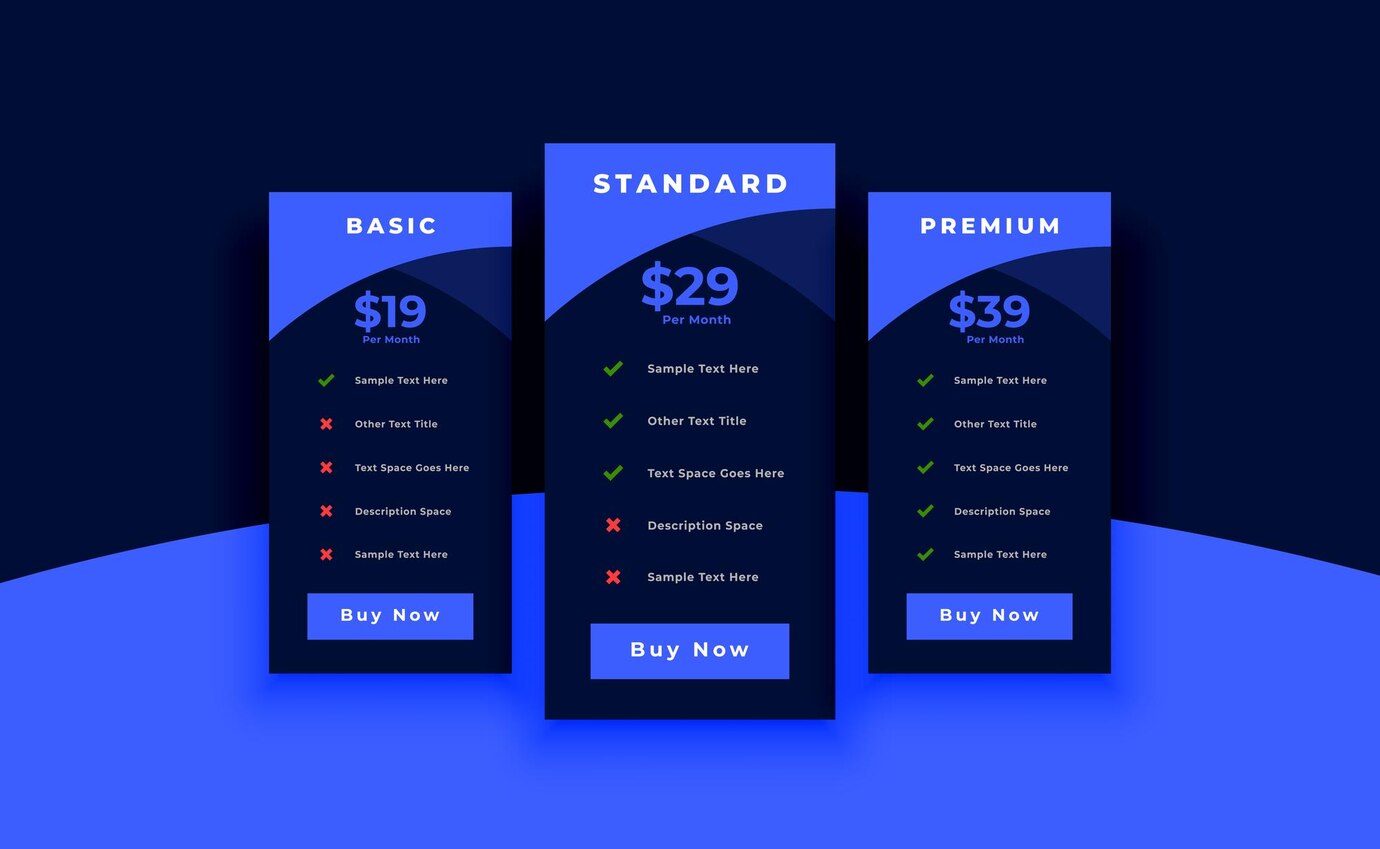

Compare the Best Web Hosting Services of 2024 and Choose Wisely

Explore our 2024 web hosting comparison to discover the best providers for your needs. Get insights, stats, and find the perfect match for your website today!

December 20, 2024

Don’t Buy That Smartphone Until You Read This 2024 Comparison

Make an informed smartphone purchase! Our 2024 comparison guide helps you find the perfect match. Click to learn more.

Tips & Trick