Best Home Refinance Options: How to Choose Wisely

Mia Anderson

Photo: Best Home Refinance Options: How to Choose Wisely

Introduction to Home Refinancing

Home refinancing refers to the process of obtaining a new mortgage to replace the existing one, presenting homeowners with an opportunity to secure improved loan terms. In today’s financial landscape, the significance of home refinancing cannot be overstated. With fluctuating interest rates and economic conditions, homeowners have the potential to enhance their financial standing by reevaluating their mortgage options.

One of the primary motivations for refinancing is the prospect of lowering interest rates. When market rates decrease, homeowners may find it advantageous to refinance, enabling them to reduce their monthly mortgage payments. This reduction not only alleviates financial pressure but can also facilitate the allocation of funds toward other essential expenses, savings, or investments. Additionally, many homeowners pursue refinancing to switch from an adjustable-rate mortgage (ARM) to a fixed-rate mortgage, providing long-term stability against future interest rate fluctuations.

Another compelling reason to consider home refinancing is the ability to tap into home equity. Homeowners accumulate equity as property values appreciate or as they pay down their mortgage balance. By refinancing, they may access this equity through a cash-out refinance, allowing them to obtain funds for renovations, debt consolidation, or other financial needs. This strategic financial maneuver can be beneficial, provided it aligns with the homeowner's financial goals and capabilities.

As we explore the various refinancing options available in this article, it is essential to approach this decision wisely. Evaluating the terms of a new mortgage, understanding associated costs, and assessing individual financial circumstances are crucial steps in selecting the right refinancing option. By making informed choices, homeowners can effectively leverage refinancing to enhance their financial health.

Understanding Different Types of Refinance Options

Homeowners have multiple refinancing options available, each designed to address specific financial needs and goals. Among the most common types is the rate-and-term refinance. This option primarily focuses on adjusting the interest rate and loan terms without changing the loan amount. Homeowners seeking to lower their monthly payments or to shorten the loan duration often choose this route, thus making it a popular and strategic choice.

Another option is the cash-out refinance. This type allows homeowners to borrow against the equity they have accumulated in their property. By refinancing their mortgage for a larger sum than owed, they can access cash to fund various projects, such as home improvements or consolidating high-interest debt. This method, however, increases the overall loan amount and introduces new financial responsibilities.

The streamline refinance is distinct because it is primarily designed for borrowers with existing loans backed by government-sponsored entities such as FHA or VA. This type often involves less paperwork and fewer requirements, allowing for a faster and simpler refinancing process. Eligibility is generally based on demonstrating timely payments on the existing mortgage. It is particularly beneficial for those looking to take advantage of lower interest rates without the complexities usually associated with refinancing.

Lastly, it is essential to consider the adjustable-rate mortgage (ARM) refinance. This option can offer lower initial rates compared to fixed-rate mortgages. However, borrowers should be prepared for potential rate increases in the future. Selecting the appropriate refinancing option hinges on an individual’s financial circumstances, future income expectations, and personal goals.

Understanding these various refinance options empowers homeowners to make informed decisions tailored to their specific financial needs.

Analyzing Your Financial Situation

Before pursuing any refinancing options, it is crucial to evaluate your personal financial situation comprehensively. This evaluation begins with an honest assessment of your credit score, which plays a significant role in determining the terms and interest rates for refinancing your home. Generally, a higher credit score can lead to more favorable loan conditions, while a lower score may limit options or result in a higher interest rate.

Current mortgage rates are also pivotal in the refinancing decision-making process. Monitoring prevailing rates helps identify the optimal time to refinance, especially if the rates are significantly lower than your existing mortgage rate. A difference of even a fraction of a percentage point can lead to substantial savings over the life of the loan. Additionally, it is important to consider how your chosen loan term will affect your overall financial health. Shorter loan terms usually come with lower interest rates but may result in higher monthly payments, while longer terms typically lower monthly outlays but may incur more interest over time.

Another critical aspect is the total equity in your home. Equity refers to the portion of the home that you own outright, and substantial equity can provide you with better refinancing options. A common guideline is that lenders prefer homeowners to have at least 20% equity, as it reduces risk for them. Understanding your equity position assists in deciding whether refinancing is worth the costs associated with it, such as closing costs and fees.

In assessing your finances effectively, it is beneficial to compile relevant data, including your current debt-to-income ratio, monthly expenses, and income stability. Using online calculators can aid in estimating potential savings and monthly payments, thus providing a clearer picture of how refinancing might fit into your broader financial strategy.

The Role of Interest Rates in Refinancing

Interest rates play a crucial role in the decision-making process surrounding home refinancing. When homeowners consider refinancing their mortgage, one of the primary factors they assess is the current interest rate environment. A lower interest rate compared to the existing mortgage can lead to significant savings by reducing the monthly payment and the total interest paid over the life of the loan. The concept of the 'spread' pertains to the difference between the rate on the new mortgage and the existing loan's interest rate. A wider spread can often indicate a favorable opportunity to refinance.

Fluctuations in market interest rates directly influence the refinancing decision. For example, if rates decrease significantly, homeowners may find that refinancing can lead to a much lower monthly payment or allow them to pay off their mortgage more rapidly. Conversely, when rates rise, the benefits of refinancing diminish. With this in mind, it is essential for homeowners to monitor prevailing rates and trends in the mortgage market to make a well-informed choice. Various economic indicators such as inflation, employment data, and Federal Reserve policy can affect interest rates and should be considered.

Strategies to determine an optimal moment for refinancing include regularly reviewing market trends and consulting with mortgage professionals. Homeowners should also assess their personal financial situation, including credit scores and debt-to-income ratios, as these elements can influence the refinancing terms available. Utilizing online mortgage rate comparison tools can further assist homeowners in evaluating potential savings. In summary, understanding the significance of interest rates and the market's fluctuations is vital for homeowners contemplating refinancing, ensuring that they act wisely to achieve their financial goals.

Cost Considerations and Fees Associated with Refinancing

When considering home refinancing, it is crucial to assess various costs involved in the process. Understanding the associated fees plays a pivotal role in determining the overall financial benefits or drawbacks of refinancing your mortgage. One of the initial costs homeowners may face is the application fee. This fee can vary depending on the lender but is typically required to initiate the refinancing process. Additionally, lenders may require a home appraisal to establish the current market value of the property, which can incur appraisal fees. Homeowners should be prepared for this expense, as it can add to the overall cost of refinancing.

Another significant consideration is closing costs. These may encompass a range of fees, including title insurance, attorney fees, and recording fees, all of which contribute to the total expense of obtaining a new mortgage. Closing costs can average between 2% and 5% of the loan amount, creating a notable financial burden that borrowers must account for when evaluating their refinancing options. It is essential to request a loan estimate from potential lenders to gain a clear understanding of the expected closing costs.

Furthermore, homeowners should also take into consideration any potential penalties for early repayment of their current mortgage. Some loans may include prepayment penalties that add an unexpected cost to the refinancing process. It is advisable to thoroughly review the terms of the existing mortgage agreement to determine if any penalties apply. To calculate these costs, homeowners should sum all applicable fees and compare them against the projected monthly savings from refinancing. By understanding and accurately calculating these costs, homeowners can make an informed decision that effectively balances the immediate expenses against long-term financial benefits.

How to Shop for the Best Refinance Rates

Finding the best refinance rates can significantly impact your financial health and help you save money over the term of your loan. To embark on this process effectively, it is essential to follow a structured approach. One of the primary steps involves gathering information from multiple lenders. Start by researching various financial institutions, including banks, credit unions, and online lenders. Obtain quotes from at least three to five lenders to ensure that you have a comparative analysis of the rates available to you.

Next, it is crucial to compare not just the interest rates but also the associated costs involved in refinancing, which may include origination fees, closing costs, and any prepayment penalties. These additional costs can significantly affect the overall expense of the refinance, making it vital to consider the annual percentage rate (APR) rather than focusing solely on the nominal rate. Use online comparison tools that allow you to evaluate multiple lenders side by side, highlighting the most favorable options.

Negotiating terms is another critical aspect of securing beneficial refinancing options. Many lenders may be open to discussions, allowing you to secure a lower interest rate or reduced fees. Prepare to advocate for your needs, and don't hesitate to present competitive offers from other lenders during negotiations.

While digital resources can provide a wealth of information, a thorough understanding of the fine print cannot be overlooked. Each loan term may come with nuances that can affect your financial future. Make it a priority to read all the documentation carefully, ensuring you understand the terms of repayment, interest rate adjustments, and any conditions that could affect defaults or late payments. By doing so, you will be better equipped to make an informed decision aligned with your financial goals.

Evaluating Lenders: What to Look For

When considering refinancing your home, evaluating potential lenders is a crucial step that can significantly impact your financial future. The first aspect to consider is the lender's reputation. It's advisable to research lenders through reviews, testimonials, and ratings from previous customers. Websites that aggregate customer experiences can provide insight into lenders' reliability and overall performance in the market.

Another important factor is customer service. A lender with strong customer service is vital throughout the refinancing process. You should seek a lender known for prompt responses and attentive support. This aspect becomes particularly essential if you encounter complications or require clarifications during the application process. A dedicated customer service team can make this complex procedure more manageable and alleviate any potential stress.

The ease of the application process is also critical. Lenders that offer a user-friendly online experience, coupled with clear guidelines, can facilitate a smoother application. It is beneficial to evaluate how straightforward the process is, including the documentation required and the time frame for approval. A transparent and well-structured application process reflects a lender's professionalism and efficiency.

Furthermore, a review of the terms offered by different lenders can shed light on which ones provide the most favorable conditions. This includes interest rates, loan terms, and any associated fees. Comparing multiple offers not only ensures that you secure the best possible deal but also helps in identifying lenders who are willing to work with you to find a solution that fits your financial situation.

Lastly, transparency in communication should be a non-negotiable criterion when selecting a lender. Trustworthiness is paramount ensure that the lender provides clear answers to your questions and comprehensible details about any costs or potential penalties involved. A lender that prioritizes transparency can offer you the peace of mind needed in such a significant financial decision.

Deciding on the Right Loan Term

When considering home refinancing options, the loan term is a critical component that influences various aspects of the overall cost of borrowing. The loan term refers to the duration over which the loan will be repaid, typically ranging from 10 to 30 years. It is essential to understand how this term converts to monthly payments, the total interest paid, and the overall financial implications for homeowners.

Short-term loans, usually 10 to 15 years, tend to feature higher monthly payments due to the abbreviated repayment period. However, they often come with lower interest rates and result in less total interest paid over the lifespan of the loan. This may be particularly beneficial for homeowners looking to build equity swiftly and minimize long-term financial commitments. Additionally, opting for a shorter loan term can fulfill those financial goals focused on long-term savings.

Conversely, long-term loans, typically spanning 30 years, present lower monthly payments, making them more manageable for homeowners with tighter budgets. Although they allow for more flexibility in monthly expenses, they usually come with higher interest rates and increased total interest payments over time. It is crucial for borrowers to weigh factors such as current financial stability, future income prospects, and overall investment strategies when determining whether a short-term or long-term loan better aligns with their goals.

Ultimately, the decision regarding the loan term should reflect a homeowner’s financial priorities and ability to commit to a certain monthly payment. Whether looking to prioritize lower payments or reduce interest costs over the long run, evaluating the myriad refinancing options available will empower homeowners to make informed choices.

Common Mistakes to Avoid When Refinancing

Homeowners often seek to refinance their mortgages to take advantage of lower interest rates, reduce monthly payments, or tap into home equity. However, this process is fraught with potential pitfalls that can lead to unfavorable financial outcomes. To navigate the refinancing maze successfully, homeowners should be aware of common mistakes and actively avoid them.

One prevalent mistake is not thoroughly reading the fine print associated with refinancing offers. Mortgage documents often contain specific conditions, fees, and penalties that, if overlooked, could significantly impact the overall cost of the new loan. Homeowners should ensure they comprehensively review all terms, including the interest rate, annual percentage rate (APR), and any hidden charges that may not be immediately apparent. This diligence helps in understanding the true financial implications of the refinancing process.

Another significant error is failing to consider the long-term effects of refinancing. While a lower monthly payment can be enticing, it is crucial to assess how the new loan structure will affect overall financial health in the years to come. Extending the loan term may reduce payments but can increase the total interest paid over the life of the loan. Homeowners must weigh their immediate needs against long-term financial goals.

Additionally, many homeowners rush into refinancing without conducting thorough comparison shopping. Each lender may offer different terms and conditions, and failing to compare rates and fees could result in missing out on better deals. A systematic evaluation of multiple refinancing options allows homeowners to select a mortgage that aligns with their needs and financial objectives.

By avoiding these common mistakes reading the fine print, considering long-term implications, and taking time to shop around homeowners can enhance their refinancing experience and make more informed decisions about their financial future.

Conclusion and Next Steps

In the journey of home refinancing, it is essential to thoroughly analyze and weigh your options to make an informed decision. Choosing the right refinance option can significantly impact your financial future, affecting your monthly payments, overall interest rates, and even the length of your mortgage term. Given the variations in lenders, rates, and loan features, one must approach the refinancing process with care and diligence.

Additionally, the choice of refinancing strategy should align with your long-term financial goals, whether that means lowering your monthly payments to increase cash flow, securing a lower interest rate to save on overall costs, or tapping into equity to fund home improvements or other expenses. Each homeowner's situation is unique, making personalized assessments crucial. Therefore, it is advisable to review your current financial circumstances and project future needs before proceeding.

To progress effectively from this point, consider taking actionable steps such as gathering the necessary financial documentation, exploring various lenders, and comparing their offerings to ensure you grasp the complete picture. Furthermore, it may be worthwhile to consult with a mortgage advisor or financial expert who can provide tailored guidance based on your specific situation.

We encourage you to share your own refinancing experiences or ask any questions in the comments section below. Engaging with others can provide valuable insights and foster a community of support. Additionally, don't hesitate to explore further resources on home financing to deepen your understanding. Remember, the right choice in refinancing can pave the way to a more secure and happier financial future.

Marketing

View All

January 22, 2025

The Future of Digital Marketing RevealedExplore where digital marketing is headed in the next decade. From AI to VR, see what’s shaping the future of online marketing. Don’t get left behind!

Mia Anderson

January 21, 2025

Why Digital Marketing is Vital for SMBsDiscover why small businesses must adopt digital marketing in 2024. Learn tips and tactics to compete in the digital age. Take your business online today!

Mia Anderson

January 23, 2025

Social Media in Digital Marketing 2024Learn how social media is revolutionizing digital marketing in 2024. Boost your brand with actionable tips for viral campaigns!

Mia Anderson

Entertainment

View AllExplore the latest trends in fan fiction for 2024. Learn what fan fiction is, its impact on media, and why it’s a thriving creative outlet. Read now!

Mia Anderson

Discover the best streaming services of 2024 with our in-depth reviews. Find out which platforms offer the best value and why you should choose them. Read now!

Mia Anderson

Discover the top podcasting trends of 2024 and stay ahead in the industry. Learn how to leverage new insights click now to future-proof your podcast!

Mia Anderson

Unlock the secrets to an unforgettable movie trivia night with our ultimate guide. Get tips, trivia questions, and game ideas to boost your event's fun!

Mia Anderson

Automotive

View AllUnlock the secrets to getting top dollar for your car! Prep, price, and promote effectively.

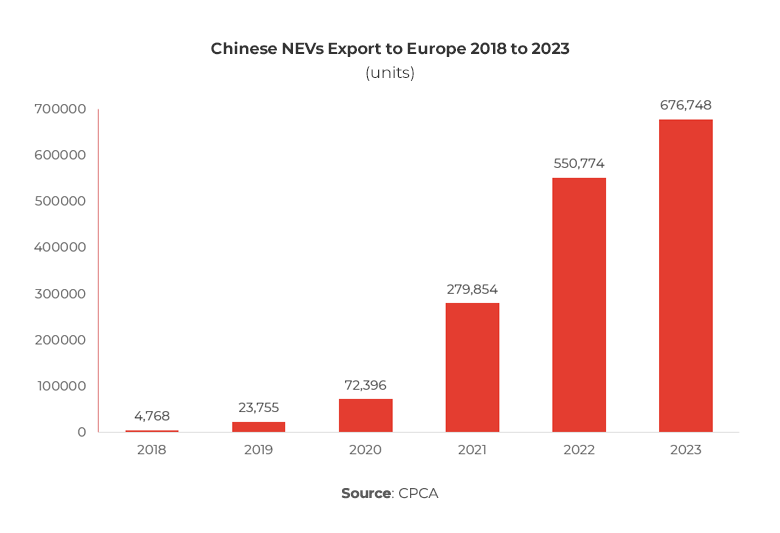

Read MoreLearn how second-life EV batteries are helping reduce environmental impact by providing sustainable energy solutions.

Read MoreCompare trends in luxury and budget EV offerings. Find out which one suits your needs and budget in 2024.

Read MorePolular🔥

View All

1

2

3

4

5

6

7

9

10

Technology

View All

September 15, 2024

Discover the Best Project Management Software of 2024

Discover the best project management software of 2024! Uncover top picks, latest trends, and expert reviews. Click now to streamline your projects!

December 10, 2024

Best Tech Gadgets for Remote Workers in 2024 – Don’t Miss These!

Boost your productivity with the top tech gadgets for remote work! Click to discover must-have tools to enhance your work-from-home setup.

August 29, 2024

Top SaaS Trends Shaping Business Success in 2024

Discover the latest SaaS trends revolutionizing businesses in 2024. Learn how these innovations can boost efficiency and drive growth. Read now!

Tips & Trick