Your Financial Blueprint: How to Secure Your Future in 5 Easy Steps

Mia Anderson

Photo: Your Financial Blueprint: How to Secure Your Future in 5 Easy Steps

In the complex world of personal finance, having a solid financial plan is like having a map to navigate your monetary journey. It's easy to feel overwhelmed by the myriad of investment options, retirement strategies, and economic uncertainties. But fear not! This article aims to simplify the process and provide you, dear reader, with a comprehensive yet easy-to-follow guide to financial planning in 2024. By the end, you'll have the tools to create your financial blueprint, ensuring a secure and prosperous future.

Understanding the Importance of Financial Planning

Financial planning is more than just budgeting and saving; it's a strategic approach to managing your money to achieve your life goals. It involves making informed decisions about your finances, considering both short-term needs and long-term aspirations. Whether you're aiming to buy a house, fund your child's education, or secure a comfortable retirement, a well-structured financial plan is your compass.

The Benefits of Early Planning

Starting early is key. The power of compound interest and long-term investment growth can significantly boost your wealth over time. Imagine your savings as a snowball rolling down a hill, gathering more snow and momentum as it goes. The earlier you start, the more time your investments have to grow, and the larger your financial snowball becomes. This is especially crucial when planning for retirement, as it allows you to build a substantial nest egg without putting excessive pressure on your current income.

5 Steps to Financial Mastery

Now, let's delve into the five essential steps to crafting your financial plan:

1. Assess Your Current Financial Situation

The first step is to take stock of your financial health. Calculate your net worth by adding up your assets (cash, investments, property, etc.) and subtracting your liabilities (debts, loans, etc.). This snapshot will reveal your financial starting point and help identify areas for improvement. Additionally, analyze your income and expenses to understand your cash flow. Are you living within your means, or is there a need to adjust your spending habits?

2. Define Your Financial Goals

What do you want to achieve financially? This step is about setting clear and measurable goals. Do you dream of owning a home, starting a business, or ensuring your children's college education is fully funded? Perhaps you want to retire early and travel the world. Whatever your aspirations, break them down into specific, achievable targets. For instance, if you aim to buy a house, set a timeline and calculate the required down payment and monthly mortgage expenses. This clarity will guide your financial decisions and keep you motivated.

3. Create a Budget and Stick to It

Budgeting is a cornerstone of financial planning. It's about allocating your income to cover expenses, savings, and investments. Start by listing your fixed expenses (rent, utilities, insurance, etc.) and variable costs (groceries, entertainment, etc.). Then, determine how much you can realistically save each month. Consider using budgeting apps or spreadsheets to track your spending and ensure you stay on course. Remember, a budget is not about restriction; it's about empowerment, giving you control over your financial destiny.

4. Explore Investment Opportunities

Investing is a crucial aspect of wealth creation and protection. It's time to dive into the world of stocks, bonds, mutual funds, and other investment vehicles. Research and understand the risks and potential rewards of each option. Diversification is key to managing risk, so consider spreading your investments across different asset classes. For instance, you might invest in a mix of stocks for growth, bonds for stability, and real estate for long-term appreciation. Regularly review your investment portfolio and make adjustments as needed to maintain a healthy balance.

5. Plan for Retirement

Retirement planning is an essential component of financial security. As the article from Forbes Advisor India suggests, it's never too early to start planning for retirement. Consider your desired retirement age and lifestyle, and calculate the savings required to sustain it. Take advantage of retirement accounts like 401(k)s or IRAs, which offer tax benefits and employer contributions. Regularly review and adjust your retirement plan as your life circumstances change, ensuring it remains adaptable and robust.

Staying on Track

Financial planning is not a one-time activity but an ongoing process. Life is full of surprises, and your financial plan should be flexible enough to accommodate them. Regularly review and update your plan, especially after significant life events such as marriage, the birth of a child, or a career change. Stay informed about economic trends and market conditions, and don't be afraid to seek professional advice from certified financial planners or advisors.

Conclusion

In conclusion, financial planning is a powerful tool to secure your future and achieve your dreams. By following these five steps, you can create a personalized financial blueprint tailored to your goals and circumstances. Remember, the journey to financial freedom requires discipline, patience, and a willingness to learn. Start today, and you'll be well on your way to a life of financial security and prosperity.

Final Thoughts

Financial planning is an empowering journey, one that allows you to take control of your destiny and make your money work for you. It's a process that evolves with you, adapting to your changing needs and aspirations. So, embrace the challenge, educate yourself, and seek guidance when needed. The rewards of a well-planned financial future are truly life-changing.

Marketing

View All

January 22, 2025

The Future of Digital Marketing RevealedExplore where digital marketing is headed in the next decade. From AI to VR, see what’s shaping the future of online marketing. Don’t get left behind!

Mia Anderson

January 21, 2025

Why Digital Marketing is Vital for SMBsDiscover why small businesses must adopt digital marketing in 2024. Learn tips and tactics to compete in the digital age. Take your business online today!

Mia Anderson

January 23, 2025

Social Media in Digital Marketing 2024Learn how social media is revolutionizing digital marketing in 2024. Boost your brand with actionable tips for viral campaigns!

Mia Anderson

Entertainment

View AllExplore the latest trends in fan fiction for 2024. Learn what fan fiction is, its impact on media, and why it’s a thriving creative outlet. Read now!

Mia Anderson

Discover the best streaming services of 2024 with our in-depth reviews. Find out which platforms offer the best value and why you should choose them. Read now!

Mia Anderson

Discover the top podcasting trends of 2024 and stay ahead in the industry. Learn how to leverage new insights click now to future-proof your podcast!

Mia Anderson

Unlock the secrets to an unforgettable movie trivia night with our ultimate guide. Get tips, trivia questions, and game ideas to boost your event's fun!

Mia Anderson

Automotive

View AllUnlock the secrets to getting top dollar for your car! Prep, price, and promote effectively.

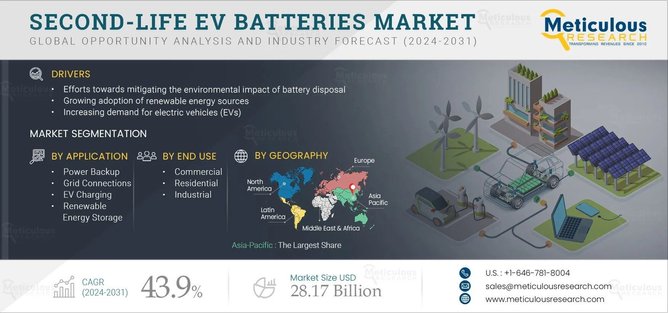

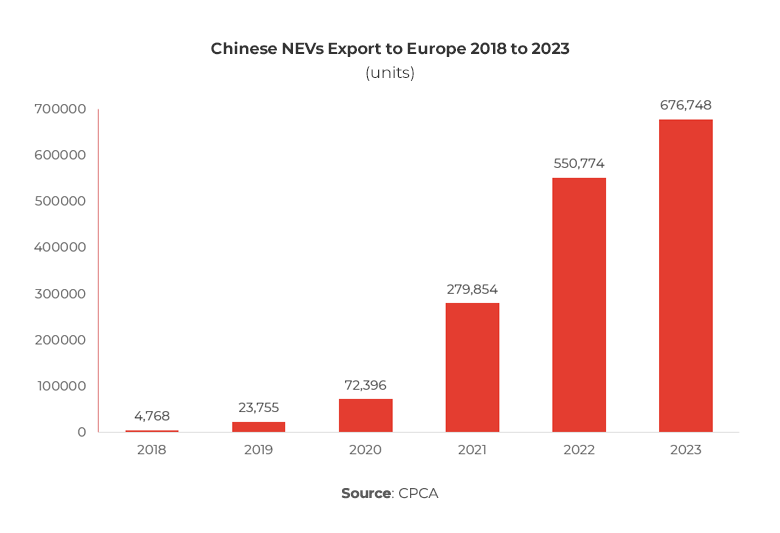

Read MoreLearn how second-life EV batteries are helping reduce environmental impact by providing sustainable energy solutions.

Read MoreCompare trends in luxury and budget EV offerings. Find out which one suits your needs and budget in 2024.

Read MorePolular🔥

View All

1

2

3

4

5

6

7

9

10

Technology

View All

September 15, 2024

Discover the Best Project Management Software of 2024

Discover the best project management software of 2024! Uncover top picks, latest trends, and expert reviews. Click now to streamline your projects!

December 10, 2024

Best Tech Gadgets for Remote Workers in 2024 – Don’t Miss These!

Boost your productivity with the top tech gadgets for remote work! Click to discover must-have tools to enhance your work-from-home setup.

August 29, 2024

Top SaaS Trends Shaping Business Success in 2024

Discover the latest SaaS trends revolutionizing businesses in 2024. Learn how these innovations can boost efficiency and drive growth. Read now!

Tips & Trick