Achieve Financial Freedom with These Essential Personal Finance Tips

Mia Anderson

Photo: Achieve Financial Freedom with These Essential Personal Finance Tips

Managing personal finances is an essential skill that can greatly impact your overall quality of life. Whether you're just starting out or looking to refine your strategies, mastering your money is the key to financial freedom. In this article, we will explore actionable tips on personal finance management, covering everything from budgeting to investing. Our goal is to provide you with the tools you need to take control of your financial future.

Why Personal Finance Management Matters

Personal finance management is about more than just keeping track of your income and expenses. It's about making informed decisions that align with your financial goals. Whether you're saving for a home, planning for retirement, or simply trying to stay out of debt, effective financial management can help you achieve your objectives.

The Impact of Poor Financial Management

Poor financial management can lead to a range of problems, including mounting debt, stress, and even a diminished quality of life. For instance, consider the case of someone who doesn't track their spending. They might overspend on non-essential items, leaving them with insufficient funds to cover important expenses like rent or utilities. Over time, this can lead to a cycle of debt that's difficult to escape.

Essential Personal Finance Management Tips

1. Create a Budget and Stick to It

One of the most fundamental aspects of personal finance management is budgeting. A budget is a plan that outlines your income and expenses over a specific period, typically a month. By creating a budget, you can ensure that you're living within your means and saving for future goals.

Personal Budgeting Tools

To help you stick to your budget, consider using personal budgeting tools like apps or spreadsheets. These tools can automate the process, making it easier to track your spending and adjust your budget as needed.

2. Build an Emergency Fund

An emergency fund is a savings account that you use only for unexpected expenses, such as medical bills or car repairs. Financial experts recommend having at least three to six months' worth of living expenses saved in your emergency fund.

Financial Planning for Beginners

If you're new to financial planning, start small. Set aside a portion of your income each month until you reach your emergency fund goal. The peace of mind that comes from knowing you're prepared for the unexpected is invaluable.

Effective Money Management Strategies

3. Reduce Unnecessary Expenses

Effective money management involves more than just earning and saving money; it also means being mindful of your spending. Take a close look at your expenses and identify areas where you can cut back. For example, you might find that you're spending too much on dining out or subscription services. By reducing these expenses, you can free up more money to put toward your financial goals.

Smart Personal Finance Habits

Developing smart financial habits is key to long-term success. This includes things like regularly reviewing your budget, avoiding impulse purchases, and making saving a priority.

4. Invest for the Future

Investing is an important part of personal finance management. While saving is essential, investing allows your money to grow over time. There are many different investment options available, from stocks and bonds to real estate and mutual funds. The right investment strategy for you will depend on your financial goals, risk tolerance, and time horizon.

Personal Finance Investment Tips

If you're new to investing, start by educating yourself on the basics. Consider working with a financial advisor to develop an investment strategy that aligns with your goals. Remember, investing is a long-term game, and patience is key.

Personal Finance for Millennials: Unique Challenges and Opportunities

Millennials face unique financial challenges, including student loan debt and a competitive job market. However, they also have opportunities that previous generations did not, such as the ability to leverage technology for financial management.

5. Navigating Student Loan Debt

One of the biggest financial challenges for millennials is student loan debt. It's important to have a plan for paying off your loans, whether that means making extra payments when possible or exploring loan forgiveness programs. By staying on top of your student loan debt, you can avoid letting it derail your financial goals.

Financial Freedom Planning

Despite these challenges, millennials also have opportunities to achieve financial freedom. By taking advantage of technology, such as budgeting apps and robo-advisors, they can manage their finances more effectively. Additionally, the gig economy offers opportunities to earn extra income, which can be used to pay off debt or invest for the future.

How to Manage Personal Finances for Long-Term Success

Long-term financial success requires discipline, planning, and a willingness to adapt to changing circumstances. As your life evolves, so too should your financial strategy.

6. Regularly Review and Adjust Your Financial Plan

Your financial plan should be a living document that you review and adjust as needed. Major life events, such as getting married, having children, or changing jobs, can all impact your financial situation. By regularly reviewing your plan, you can ensure that you're still on track to meet your goals.

Best Personal Finance Strategies

The best personal finance strategies are those that are tailored to your unique situation. What works for one person may not work for another, so it's important to find strategies that align with your goals and lifestyle.

7. Seek Professional Advice When Needed

While it's possible to manage your finances on your own, there are times when it may be beneficial to seek professional advice. A financial advisor can help you navigate complex decisions, such as investing or retirement planning. They can also provide an objective perspective, helping you avoid common pitfalls.

How to Manage Personal Finances with Professional Help

When choosing a financial advisor, look for someone who is certified and has a fiduciary responsibility to act in your best interest. This ensures that the advice you receive is unbiased and focused on helping you achieve your financial goals.

Conclusion: Take Control of Your Financial Future

Personal finance management is a journey, not a destination. By following the tips outlined in this article, you can take control of your financial future and work toward achieving financial freedom. Remember, the key to success is consistency and a willingness to adapt as your circumstances change.

Start today by reviewing your budget, setting financial goals, and taking small steps toward those goals. Over time, these small actions will add up, helping you build the financial future you desire.

Marketing

View All

January 27, 2025

PPC vs SEO: Digital Marketing ShowdownDiscover the differences between PPC and SEO in digital marketing. Find out which strategy is right for your goals and budget. Make an informed choice today!

Mia Anderson

January 19, 2025

How to Master Digital Marketing BasicsLearn the essentials of digital marketing in this beginner-friendly guide. Kickstart your journey with step-by-step strategies. Start mastering today!

Mia Anderson

January 25, 2025

Email Marketing in the Digital AgeUnlock the power of email marketing with modern strategies tailored for the digital age. Connect with your audience like never before!

Mia Anderson

Entertainment

View AllDiscover the top indie movies of all time that will captivate and inspire you. Dive in to see which films made the list click to explore cinematic gems!

Mia Anderson

Learn how influencer marketing is used by the entertainment sector to generate buzz and increase engagement. Discover the keys to campaign success, as well as how to choose the proper influencers and produce interesting content.

Mia Anderson

Discover the latest entertainment industry trends for 2024. Stay ahead of the curve with insights on what's next. Click to explore and stay informed!

Mia Anderson

Discover the latest strategies for creating a successful podcast in 2024. Learn key tips and techniques to launch and grow your show effectively. Read now!

Mia Anderson

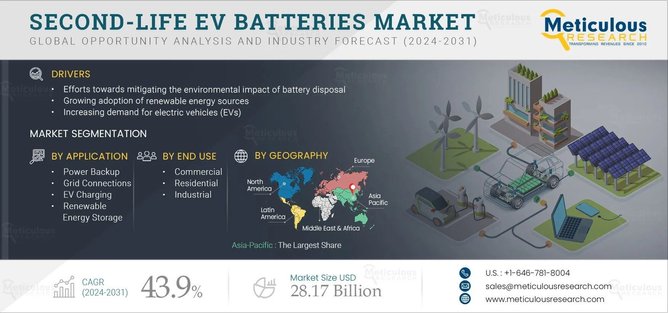

Automotive

View AllLearn how second-life EV batteries are helping reduce environmental impact by providing sustainable energy solutions.

Read MoreDiscover how government policies are accelerating EV adoption. Explore tax incentives, regulations, and global policy success stories.

Read MoreLearn the key factors influencing EV adoption, from cost and range to charging infrastructure and environmental concerns.

Read MorePolular🔥

View All

1

2

3

4

5

6

7

8

9

10

News

View AllAugust 7, 2024

2024 Presidential Candidates: The Ultimate Guide to the Upcoming US Election

Read MoreTechnology

View All

August 9, 2024

The Power of NLP and Machine Learning: Friends or Foes?

Discover the possibilities of natural language processing and how machine learning relates to it. Discover the fascinating possibilities these technologies have for the future as well as how they are reshaping our reality.

August 9, 2024

7 Ways NLP Is Revolutionizing Business Operations

Find out how Natural Language Processing (NLP) may improve your business like a secret weap*n. The 7 main advantages of NLP for organizations are discussed in this article, which ranges from cost savings to enhanced customer experience.

December 6, 2024

The Best Tech Deals You Can’t Miss This Week – Limited Time Only!

Don't miss out on this week's hottest tech deals! From smartphones to gadgets, click to grab limited-time offers and save big.

Tips & Trick