Crypto Regulations in 2024: Key Changes You Need to Know

Mia Anderson

Photo: Crypto Regulations in 2024: Key Changes You Need to Know

ISEKUN - Cryptocurrency Regulations in 2024: Key Changes You Need to Know

Cryptocurrency regulations are evolving rapidly, reflecting the growing importance of digital assets in the global economy. As we move into 2024, several key changes are set to reshape the landscape of cryptocurrency regulation across various jurisdictions. This article explores these changes, focusing on the European Union's MiCA regulation, developments in the United States, and global trends that will influence how cryptocurrencies are regulated.

The world of cryptocurrency has often been characterized by its lack of regulation, leading to concerns about fraud, market manipulation, and financial stability. However, recent events including high-profile collapses like that of FTX have prompted governments worldwide to take action. In 2024, significant regulatory frameworks are being established to provide clarity and security to investors and businesses alike.

Background on Cryptocurrency Regulations

Historically, cryptocurrencies have operated in a regulatory gray area. The decentralized nature of these assets posed challenges for traditional regulatory frameworks. As adoption increased, so did the need for comprehensive regulations to protect consumers and ensure market integrity.

The Rise of MiCA in the EU

One of the most significant developments in 2024 is the implementation of the Markets in Crypto-Assets Regulation (MiCA) within the European Union. Effective from June 30, 2024, MiCA aims to create a harmonized legal framework for crypto-assets across EU member states. This regulation covers various aspects, including:

- Asset-Referenced Tokens: These tokens are pegged to stable assets and must adhere to strict issuance and operational guidelines.

- E-Money Tokens: Digital currencies that represent a claim on the issuer must comply with existing e-money regulations.

The MiCA regulation is designed to enhance consumer protection and mitigate risks associated with crypto-assets, thereby fostering trust in this burgeoning market.

U.S. Crypto Regulation Changes

In the United States, regulatory developments have been slower but are gaining momentum. The U.S. Securities and Exchange Commission (SEC) has taken steps toward clearer definitions regarding cryptocurrencies' legal status. Notably:

- In January 2024, the SEC granted approval for Bitcoin exchange-traded funds (ETFs), marking a significant step toward integrating cryptocurrencies into traditional financial markets.

- Legislative efforts such as the Financial Innovation and Technology (FIT) for the 21st Century Act aim to clarify when a cryptocurrency is classified as a security or commodity. However, progress on these bills has stalled in Congress.

Stablecoin Regulations

Stablecoins have emerged as a focal point for U.S. regulators due to their potential impact on monetary policy and financial stability. Proposed regulations will require issuers to maintain reserves equivalent to the value of issued stablecoins and adhere to stringent reporting requirements.

Global Trends in Crypto Oversight

As countries grapple with how best to regulate cryptocurrencies, several global trends are emerging:

- Increased Regulatory Cooperation: International bodies like the International Organization of Securities Commissions (IOSCO) are developing guidelines for crypto asset management that encourage cross-border cooperation among regulators.

- Focus on Privacy Coins: Countries are scrutinizing privacy coins due to their potential use in illicit activities. Regulations may require enhanced transparency measures for transactions involving these assets.

- Crypto Taxation Rules: As cryptocurrencies become more mainstream, tax authorities are implementing clearer guidelines on how digital assets should be taxed. This includes capital gains taxes on crypto transactions and reporting requirements for exchanges.

The Role of Central Bank Digital Currencies (CBDCs)

Central Bank Digital Currencies (CBDCs) are gaining traction as governments seek to maintain control over monetary policy while embracing digital innovation. Countries like China are at the forefront of CBDC development, with extensive pilot programs underway.

The introduction of CBDCs could significantly impact how cryptocurrencies operate within national economies by providing a state-backed alternative that may reduce reliance on decentralized currencies.

Conclusion

As we navigate through 2024, cryptocurrency regulations will continue to evolve rapidly in response to market developments and technological advancements. The MiCA regulation in Europe represents a landmark shift toward comprehensive oversight, while U.S. regulators are gradually clarifying their stance on digital assets.

Investors and businesses must stay informed about these changes as they will shape the future landscape of cryptocurrency trading and investment. The ongoing dialogue between regulators and industry stakeholders will be crucial in creating a balanced framework that fosters innovation while ensuring consumer protection.

In conclusion, understanding these regulatory changes is essential for anyone involved in or considering entering the cryptocurrency market. As regulations become more defined globally, they will play a pivotal role in shaping the future of digital assets.

Marketing

View All

January 21, 2025

Why Digital Marketing is Vital for SMBsDiscover why small businesses must adopt digital marketing in 2024. Learn tips and tactics to compete in the digital age. Take your business online today!

Mia Anderson

January 19, 2025

How to Master Digital Marketing BasicsLearn the essentials of digital marketing in this beginner-friendly guide. Kickstart your journey with step-by-step strategies. Start mastering today!

Mia Anderson

January 27, 2025

PPC vs SEO: Digital Marketing ShowdownDiscover the differences between PPC and SEO in digital marketing. Find out which strategy is right for your goals and budget. Make an informed choice today!

Mia Anderson

Entertainment

View AllDiscover the best streaming services of 2024 with our in-depth reviews. Find out which platforms offer the best value and why you should choose them. Read now!

Mia Anderson

Explore the latest trends in virtual reality gaming for 2024. Our in-depth guide covers new technology and gameplay innovations. Discover more now!

Mia Anderson

Discover the top 10 TV series that everyone is talking about. Dive into binge-worthy shows that will keep you hooked click to start your next TV obsession!

Mia Anderson

Explore the latest trends in fan fiction for 2024. Learn what fan fiction is, its impact on media, and why it’s a thriving creative outlet. Read now!

Mia Anderson

Automotive

View AllWhat are the unique challenges to EV adoption in Latin America? Discover the barriers and potential solutions for growth.

Read MoreDiscover trends driving EV range improvements. Learn how automakers are tackling range anxiety with groundbreaking solutions.

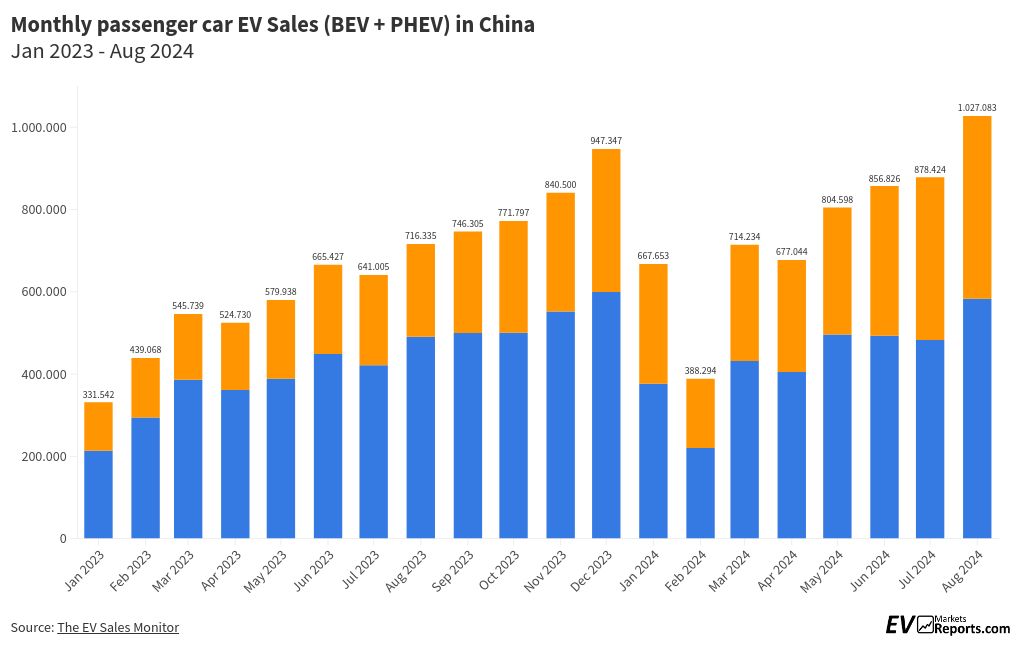

Read MoreDiscover the latest trends in electric vehicle adoption in China. What factors are driving this rapid growth?

Read MorePolular🔥

View All

1

2

3

4

5

6

7

8

9

10

Technology

View All

December 5, 2024

How to Save Big on High-End Tech Products: 6 Hacks You Need to Try

Unlock massive savings on high-end tech! Discover 6 insider hacks to get the best deals. Click to learn more and start saving today.

December 18, 2024

How to Get the Best Deals on Smartphones This Month

Discover the hottest smartphone deals this month! Click to learn insider tips and save big on your next purchase.

August 9, 2024

The Evolution of Mobile Technology: A Journey to Super Connectivity

Learn about the amazing evolution of mobile technology from 1G to 5G and beyond! Discover the inventions that impacted our world and altered communication. Discover the future with quantum & 6G technology!