10 Best Factoring Companies: Get the Most Cash for Your Invoices

Mia Anderson

Photo: 10 Best Factoring Companies: Get the Most Cash for Your Invoices

Are you a business owner seeking ways to improve your cash flow and access much-needed funds? Look no further than invoice factoring – a powerful tool that can help you turn outstanding invoices into immediate cash. But with numerous factoring companies vying for your attention, how do you choose the right partner to ensure a seamless and beneficial experience?

This comprehensive guide will take you on a journey through the world of invoice factoring, offering insights into the benefits, fees, and potential pitfalls. By the end, you'll be equipped with the knowledge to make an informed decision and select the best factoring company for your unique business needs.

What is a Factoring Company?

A factoring company, or a invoice factoring service, is a financial institution that specializes in purchasing businesses' outstanding invoices at a discount and then collecting payment from the invoiced customers. This process is known as "factorizing." By selling your invoices to a factoring company, you can receive immediate cash, often within 24-48 hours, rather than waiting 30, 60, or even 90 days for your customers to pay.

This innovative financing solution is particularly advantageous for small businesses or startups that often face cash flow challenges due to delayed customer payments. It provides a much-needed injection of funds to cover expenses, invest in growth opportunities, or simply maintain day-to-day operations.

How Does Invoice Factoring Work?

The process of invoice factoring is straightforward and can be summarized in four simple steps:

- You deliver a product or service to your customer and generate an invoice, just as you normally would.

- You then send this invoice to the factoring company, who will purchase it from you at a small discount, typically ranging from 1-5% of the invoice value. This discount rate depends on various factors, including the creditworthiness of your customer and the terms of the invoice.

- The factoring company advances you a significant portion of the invoice amount, usually around 80-90%, as soon as they receive the invoice. This immediate cash injection is what makes invoice factoring so attractive to businesses.

- The factoring company takes on the responsibility of collecting payment from your customer on the due date. Once your customer pays in full, the factoring company will release the remaining amount to you, minus their fees and the initial discount.

Benefits of Using a Factoring Company

Invoice factoring offers a multitude of advantages for businesses, especially those facing working capital constraints or seeking to accelerate their growth trajectory:

- Improved Cash Flow: Factoring accelerates your cash flow by converting outstanding invoices into immediate cash. This helps you avoid the common challenge of waiting months for customer payments, bridging the gap between providing a service and getting paid.

- Quick Access to Capital: Factoring companies can provide funding much faster than traditional bank loans or lines of credit. The application and approval process is typically streamlined, and you can often receive funding within a few days or even hours.

- Business Growth and Opportunities: With improved cash flow, you'll be in a stronger position to seize growth opportunities. Whether it's investing in new equipment, expanding your team, or taking on larger projects, invoice factoring can be a catalyst for business expansion.

- Flexible Financing: Unlike rigid bank loans, invoice factoring offers a flexible financing solution. You can choose which invoices to factor and how often, giving you control over your financing strategy. It's a great way to manage seasonal fluctuations or unexpected expenses.

- Credit and Risk Management: Factoring companies assume the risk of customer non-payment, provided the transaction is made in good faith. They also handle credit checks on your customers, helping you make informed decisions about extending credit terms.

- Reduced Administrative Burden: By outsourcing your accounts receivable function, you can free up time and resources. Factoring companies handle invoice processing, payment collection, and even provide online platforms to track your transactions, simplifying your back-office operations.

Factors to Consider When Choosing a Factoring Company

When it comes to selecting the right factoring company, there are several important considerations to keep in mind:

Industry Experience and Reputation

Opt for a factoring company with a strong reputation and extensive experience in your industry. This ensures they understand the unique dynamics and challenges of your sector, and can offer tailored solutions. Look for online reviews, testimonials, and case studies showcasing their success stories.

Funding Speed and Flexibility

Speed is a critical factor in choosing a factoring company. Inquire about their funding timeline – how quickly can they provide advances after receiving your invoices? Also, consider their flexibility in terms of invoice size, customer credit limits, and contract length to ensure they align with your business needs.

Fees and Transparency

Factoring companies charge various fees, including discount rates, transaction fees, and sometimes additional charges for extra services. Be sure to understand all the costs involved and ask for clarity on any hidden or unexpected fees. A reputable company will be transparent about their pricing structure and help you navigate any complexities.

Customer Service and Support

Excellent customer service is essential when dealing with financial matters. Assess the responsiveness and professionalism of the factoring company's team. Do they offer dedicated account managers? What kind of support can you expect during the onboarding process and beyond? Remember, you're not just choosing a financial service but also a long-term partner.

Online Platforms and Technology

Technology plays a significant role in modern factoring. Opt for a company that offers an intuitive online platform, enabling you to submit invoices, track transactions, and access real-time data anytime, anywhere. This not only streamlines your operations but also provides transparency throughout the factoring process.

Top 10 Factoring Companies to Consider

Now that we've explored the benefits and key considerations, let's dive into our list of the top 10 factoring companies that can help transform your business:

- Company A: Known for its lightning-fast funding, Company A has a simple online application process and can provide advances within 24 hours. They offer competitive rates and specialize in serving small businesses across various industries.

- Company B: With over two decades of experience, Company B has a strong reputation in the market. They provide flexible funding solutions, including non-recourse factoring, and cater to a wide range of industries, including transportation, staffing, and construction.

- Company C: Renowned for their customer-centric approach, Company C offers a dedicated account manager to each client. They provide customized funding programs and have expertise in industries with unique requirements, such as government contracting and healthcare.

- Company D: Specializing in startup and small business funding, Company D understands the unique challenges of early-stage companies. They offer flexible terms, low minimums, and a simple application process, making them an ideal partner for young businesses.

- Company E: With a focus on transparency and ethical practices, Company E provides clear pricing structures and personalized quotes. They have a strong presence in the wholesale, manufacturing, and service industries, and offer non-recourse factoring to reduce risk for their clients.

- Company F: Boasting a fully digital platform, Company F offers a seamless and fast invoice factoring experience. Their online portal provides 24/7 access to submit invoices, track payments, and manage your account, making the process highly efficient.

- Company G: As a specialist in construction invoice factoring, Company G understands the unique payment cycles and challenges of the construction industry. They offer competitive rates, flexible terms, and a dedicated team familiar with construction-specific payment processes.

- Company H: With a global reach, Company H is a leading provider of international invoice factoring services. They facilitate trade between importers and exporters, offering funding in multiple currencies and handling the complexities of cross-border transactions.

- Company I: Known for their innovative approach, Company I utilizes advanced technology to streamline the factoring process. Their platform integrates with popular accounting software, enabling a seamless flow of data and an efficient funding experience.

- Company J: Focusing on relationships and personalized service, Company J assigns a dedicated funding specialist to each client. They take the time to understand your business and offer customized solutions, making them a trusted partner in your success.

Conclusion

Choosing the right factoring company can be a transformative decision for your business, unlocking much-needed capital and setting your company up for growth. Whether you're a small business owner, a startup founder, or an established enterprise, the benefits of invoice factoring are undeniable.

By selecting from the list of top factoring companies provided and considering the key factors outlined in this guide, you can make an informed decision to secure your business's financial future. Remember, each business is unique, so take the time to evaluate your specific needs, compare offerings, and choose a factoring company that aligns with your goals and values.

With this knowledge in hand, you're now empowered to take control of your cash flow and harness the power of invoice factoring to propel your business forward.

Marketing

View All

January 19, 2025

How to Master Digital Marketing BasicsLearn the essentials of digital marketing in this beginner-friendly guide. Kickstart your journey with step-by-step strategies. Start mastering today!

Mia Anderson

January 20, 2025

5 Best Digital Marketing Tools for GrowthUncover the top 5 digital marketing tools every marketer needs. Boost efficiency, drive results, and streamline your campaigns now!

Mia Anderson

January 25, 2025

Email Marketing in the Digital AgeUnlock the power of email marketing with modern strategies tailored for the digital age. Connect with your audience like never before!

Mia Anderson

Entertainment

View AllExplore the latest trends in fan fiction for 2024. Learn what fan fiction is, its impact on media, and why it’s a thriving creative outlet. Read now!

Mia Anderson

Discover the best movies and TV shows with top ratings. Stay updated on what's trending. Click now to find your next binge-worthy favorite!

Mia Anderson

Discover the best premium TV shows streaming right now. Get exclusive recommendations and top picks to enhance your viewing experience. Click to explore!

Mia Anderson

Explore the latest trends in virtual reality gaming for 2024. Our in-depth guide covers new technology and gameplay innovations. Discover more now!

Mia Anderson

Automotive

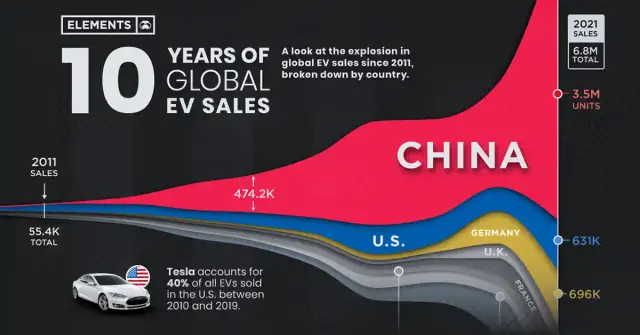

View AllExplore how the oil and gas industry resists the EV revolution. What are the challenges and how can we overcome them?

Read MoreUncover why Dealer Daily is revolutionizing the auto industry. Gain a competitive edge with these powerful strategies.

Read MoreDiscover the rapid growth of electric vehicle models in the global market. Learn which brands are leading the way in 2024.

Read MorePolular🔥

View All

1

2

3

4

5

6

7

8

9

10

Technology

View All

January 20, 2025

AutoML: Automating Machine Learning Workflows

Explore how AutoML simplifies machine learning with automated workflows. Learn how to build, train, and deploy models faster!

December 7, 2024

5 Reasons You Need a Smart Speaker Right Now – Don’t Miss Out!

Elevate your home with a smart speaker! Discover 5 compelling reasons to invest. Click to learn more and transform your space today.

November 10, 2024

The Ultimate Guide to Building Your Own PC

Ready to build your own PC? Follow our ultimate guide for step-by-step instructions and tips. Build your dream machine today!

Tips & Trick