How to Master Budgeting Like a Financial Pro in Just 30 Days

Mia Anderson

Photo: How to Master Budgeting Like a Financial Pro in Just 30 Days

Are you ready to take control of your finances and become a budgeting pro? In just 30 days, you can transform your relationship with money and set yourself on a path to financial success. Budgeting is a powerful tool that allows you to manage your money effectively, achieve your financial goals, and gain peace of mind. This article will guide you through a step-by-step process to master budgeting in a month, providing practical tips and strategies to make your financial journey enjoyable and rewarding. Let's dive in!

Understanding Budgeting Basics

What is Budgeting?

Budgeting is essentially a financial plan that outlines how you will allocate your income to various expenses and savings. It involves tracking your income, categorizing your expenses, and creating a spending plan to ensure your money is working for you. By budgeting, you gain a clear picture of your financial situation, enabling you to make informed decisions and take control of your financial future.

The Importance of Budgeting

Budgeting is a fundamental skill for anyone seeking financial stability and growth. It offers numerous benefits, including:

- Financial Awareness: Budgeting provides a comprehensive understanding of your income and expenses, helping you identify areas for improvement and make better financial choices.

- Debt Management: It allows you to prioritize debt repayment, reduce unnecessary spending, and avoid falling into debt traps.

- Savings and Investments: With a budget, you can allocate funds for savings and investments, building a safety net for emergencies and working towards long-term financial goals.

- Goal Achievement: Budgeting helps you stay focused on your financial objectives, whether it's saving for a dream vacation or buying a new home.

Creating Your 30-Day Budgeting Plan

Step 1: Assess Your Current Financial Situation

The first step to mastering budgeting is to evaluate your current financial standing. Gather your recent bank statements, pay stubs, and any other financial documents. Calculate your monthly income, including salary, investments, or any other sources of revenue. Then, list all your expenses, such as rent, utilities, groceries, entertainment, and debt payments. This process will give you a clear snapshot of your financial health and identify areas where you can make adjustments.

Step 2: Set Realistic Goals

Define your short-term and long-term financial goals. Short-term goals could include paying off a credit card debt within six months or saving for a new laptop. Long-term goals might involve buying a house or planning for retirement. Ensure your goals are specific, measurable, achievable, relevant, and time-bound (SMART). For instance, instead of saying, "I want to save more," set a goal like, "I will save $5000 for an emergency fund in the next year by allocating 10% of my monthly income."

Step 3: Choose a Budgeting Method

There are various budgeting methods to choose from, and finding the right one for you is essential. Here are a few popular approaches:

- The 50/30/20 Rule: This method allocates 50% of your income to needs (essential expenses), 30% to wants (non-essential expenses), and 20% to savings and debt repayment.

- Zero-Based Budgeting: In this approach, every dollar of your income is assigned a purpose, ensuring that expenses and savings are accounted for.

- Envelope System: This method involves allocating cash to different expense categories using physical envelopes, providing a tangible way to manage your spending.

Experiment with different methods and adapt them to suit your lifestyle and preferences.

Step 4: Track Your Spending

The key to successful budgeting is consistent tracking of your expenses. Use budgeting apps or spreadsheets to record your daily spending. Categorize your expenses and compare them to your budgeted amounts. This practice will help you identify areas where you might be overspending and make necessary adjustments. For instance, you might realize you're spending more on dining out than you thought, prompting you to cook more meals at home.

Step 5: Review and Adjust Regularly

Budgeting is an ongoing process that requires regular review and adjustment. Set aside time each week to evaluate your progress and make necessary changes. Did you stay within your budget this week? If not, what adjustments can you make to get back on track? Regular reviews will keep you accountable and motivated. Consider joining online communities or seeking support from friends who share similar financial goals to stay inspired.

Advanced Budgeting Strategies

Automate Your Finances

Make budgeting easier by automating your finances. Set up direct deposits for your paycheck and automate bill payments to ensure timely transactions. You can also automate transfers to your savings or investment accounts, making it effortless to save consistently.

Negotiate and Cut Expenses

Take control of your expenses by negotiating better deals. Review your subscriptions and services, and consider contacting providers to negotiate lower rates or cancel unnecessary services. Shop around for better insurance rates, and don't be afraid to switch providers for significant savings.

Embrace Frugality

Adopting a frugal mindset can significantly impact your budget. Look for ways to save money without compromising your quality of life. Cook meals at home, explore second-hand stores for bargains, and opt for free or low-cost entertainment options. These small changes can free up a surprising amount of money in your budget.

Stay Informed and Educated

Financial literacy is a powerful tool. Stay updated on personal finance trends, read books or blogs, and listen to podcasts to gain valuable insights. Understanding financial concepts and staying informed about economic trends will empower you to make better budgeting decisions.

Conclusion

Mastering budgeting in 30 days is an achievable goal that can set you on a path to financial freedom. By following the steps outlined in this article, you'll gain control over your finances, develop essential money management skills, and work towards your financial dreams. Remember, budgeting is a journey, and it may take time to find the right approach for you. Stay committed, be flexible, and celebrate your progress along the way.

Pro Tip: Consider seeking advice from a financial advisor or planner who can provide personalized guidance based on your unique financial situation. Their expertise can help you navigate complex financial decisions and ensure you're on the right track.

Final Thoughts: Budgeting is a powerful tool that can transform your financial life. It empowers you to make informed choices, save for the future, and achieve your dreams. With dedication and the right strategies, you can master budgeting and unlock your financial potential. Start your 30-day journey today and watch your financial confidence soar!

Marketing

View All

January 23, 2025

Social Media in Digital Marketing 2024Learn how social media is revolutionizing digital marketing in 2024. Boost your brand with actionable tips for viral campaigns!

Mia Anderson

January 23, 2025

10 Content Strategies for Digital SuccessCreate winning content with these 10 proven digital marketing strategies. Enhance engagement and conversions starting today!

Mia Anderson

January 20, 2025

5 Best Digital Marketing Tools for GrowthUncover the top 5 digital marketing tools every marketer needs. Boost efficiency, drive results, and streamline your campaigns now!

Mia Anderson

Entertainment

View AllDiscover the fascinating history of superhero movies, from early adaptations to modern blockbusters. Uncover surprising facts and insights click to explore!

Mia Anderson

Unlock the secrets to going viral on TikTok with these 2024 strategies. From trend-spotting to unique twists, learn how to boost your visibility and engagement. Start creating viral content today!

Mia Anderson

Learn the key steps to start a YouTube channel in 2024, from content strategy to monetization. Click here for expert advice and actionable tips!

Mia Anderson

Discover the latest tips and trends for making a short film in 2024. Learn from experts and get started on your cinematic journey today!

Mia Anderson

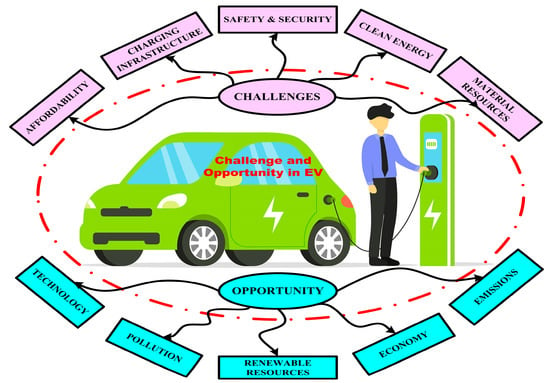

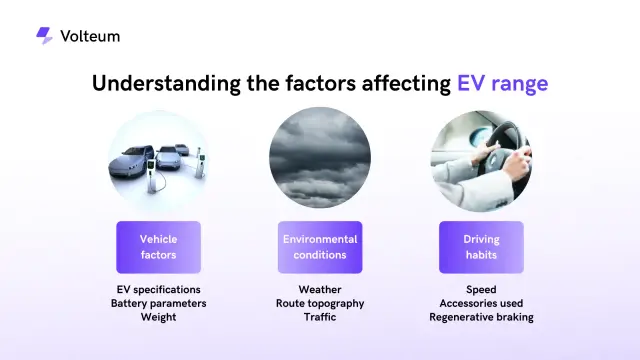

Automotive

View AllExplore the growth of residential EV charging solutions, from home setups to energy-efficient charging options.

Read MoreDiscover the latest innovations in lightweight materials for EVs. How do these advancements improve performance and efficiency?

Read MoreDiscover real-world experiences of long-distance EV travel. Learn how EV owners tackle range anxiety and plan road trips.

Read MorePolular🔥

View All

1

2

3

4

5

6

7

8

9

10

Technology

View All

September 12, 2024

Comprehensive Machine Learning Tutorial for Beginners

Master machine learning with our detailed tutorial. Learn the fundamentals and advance your skills today. Start your journey into AI now!

August 13, 2024

The Top SOC 2 Compliance Companies: Securing Your Data

Discover the leading SOC 2 Compliance companies and learn how they can help protect your organization's sensitive data. Click to explore the best options for safeguarding your business.

December 17, 2024

The Best Tech Gifts for 2024 – Shop Before They Sell Out!

Find the perfect tech gifts for everyone on your list! Click to explore the hottest gadgets and shop before they're gone.

Tips & Trick