Unlocking the Secrets to Low-Interest Loans: What Banks Don’t Tell You

Mia Anderson

Photo: Unlocking the Secrets to Low-Interest Loans: What Banks Don’t Tell You

Securing a loan with a favorable interest rate is often a challenging task for many individuals and businesses. While banks and financial institutions offer a variety of loan options, understanding how to access low-interest loans can be a mystery to many. The process might seem like a complex puzzle, but with the right knowledge and strategies, you can navigate the financial landscape and unlock the secrets to obtaining these desirable loans. In this article, we'll delve into the world of low-interest loans, uncovering the hidden insights that banks might prefer to keep under wraps.

Understanding Interest Rates

Before we embark on the quest for low-interest loans, it's essential to grasp the basics of interest rates. Interest rates are the cost of borrowing money, expressed as a percentage of the loan amount. These rates can vary significantly, and understanding the factors that influence them is crucial. Banks often consider various elements when determining interest rates, including your creditworthiness, the type of loan, and the current market conditions.

The Role of Creditworthiness

One of the most significant factors affecting your ability to secure low-interest loans is your creditworthiness. Banks and lenders rely heavily on credit scores and credit reports to assess the risk associated with lending to you. A good credit score can be your golden ticket to lower interest rates. It signifies to lenders that you are a responsible borrower, increasing your chances of obtaining favorable loan terms.

Here's an interesting anecdote: Imagine two friends, Emma and John, both seeking loans for their dream projects. Emma, with her excellent credit history, effortlessly secures a loan with a remarkably low-interest rate, while John, who has struggled with credit card debt, faces higher rates. This scenario highlights the power of a strong credit profile.

Strategies for Improving Credit Score

If your credit score isn't where you'd like it to be, fear not! There are proven strategies to enhance your creditworthiness:

1. Review Your Credit Report Regularly

Start by obtaining a copy of your credit report from major credit bureaus. Look for any errors or discrepancies and dispute them promptly. A single mistake can impact your score significantly.

2. Pay Bills on Time

Late payments can haunt your credit report for years. Set up automatic payments or reminders to ensure you never miss a due date. This simple habit can work wonders for your credit score.

35. Reduce Credit Card Balances

High credit card balances can negatively affect your score. Aim to keep your credit utilization ratio below 30%. This means using only a small portion of your available credit limit.

4. Build a Credit History

If you're new to credit, consider starting with a secured credit card or becoming an authorized user on someone's account. Building a positive credit history takes time, but it's a worthwhile investment.

Negotiating with Banks

Once you've optimized your creditworthiness, it's time to approach banks with confidence. Remember, banks are in the business of lending, and they want your business. Here are some negotiation tactics to consider:

1. Shop Around

Don't settle for the first offer. Compare interest rates and terms from multiple lenders. Competition among banks can work in your favor, as they may be willing to match or beat a competitor's offer.

2. Highlight Your Strengths

When negotiating, emphasize your financial stability and reliability. Showcase your consistent income, stable employment history, and any assets you possess. Banks appreciate borrowers who demonstrate a low-risk profile.

3. Consider Collateral

Offering collateral, such as a home or vehicle, can significantly improve your chances of securing a low-interest loan. This reduces the risk for the lender and may result in more favorable terms.

Alternative Lending Options

In today's digital age, traditional banks are not the only game in town. Alternative lending platforms and online lenders have emerged, offering competitive loan options:

1. Peer-to-Peer Lending

Peer-to-peer lending platforms connect borrowers directly with individual investors. These platforms often provide competitive rates, especially for borrowers with strong credit profiles.

2. Online Lenders

Online lenders have streamlined the loan application process, making it quicker and more accessible. They may offer lower interest rates for well-qualified borrowers.

3. Credit Unions

Credit unions are member-owned financial cooperatives that often provide more favorable terms and rates to their members. Consider joining one if you're eligible.

Final Thoughts

Obtaining low-interest loans is not an elusive dream but a realistic goal with the right approach. By understanding the importance of creditworthiness, implementing strategies to improve your credit score, and negotiating with lenders, you can unlock the secrets to financial success. Remember, knowledge is power, and being informed about your options can lead to significant savings over the life of your loan.

So, take control of your financial destiny, and don't be afraid to explore the various lending avenues available. With persistence and a solid financial foundation, you can achieve the low-interest loans you desire and make those dream projects a reality.

Marketing

View All

January 21, 2025

Why Digital Marketing is Vital for SMBsDiscover why small businesses must adopt digital marketing in 2024. Learn tips and tactics to compete in the digital age. Take your business online today!

Mia Anderson

January 19, 2025

How to Master Digital Marketing BasicsLearn the essentials of digital marketing in this beginner-friendly guide. Kickstart your journey with step-by-step strategies. Start mastering today!

Mia Anderson

January 27, 2025

PPC vs SEO: Digital Marketing ShowdownDiscover the differences between PPC and SEO in digital marketing. Find out which strategy is right for your goals and budget. Make an informed choice today!

Mia Anderson

Entertainment

View AllDiscover the best streaming services of 2024 with our in-depth reviews. Find out which platforms offer the best value and why you should choose them. Read now!

Mia Anderson

Explore the latest trends in virtual reality gaming for 2024. Our in-depth guide covers new technology and gameplay innovations. Discover more now!

Mia Anderson

Discover the top 10 TV series that everyone is talking about. Dive into binge-worthy shows that will keep you hooked click to start your next TV obsession!

Mia Anderson

Explore the latest trends in fan fiction for 2024. Learn what fan fiction is, its impact on media, and why it’s a thriving creative outlet. Read now!

Mia Anderson

Automotive

View AllWhat are the unique challenges to EV adoption in Latin America? Discover the barriers and potential solutions for growth.

Read MoreDiscover trends driving EV range improvements. Learn how automakers are tackling range anxiety with groundbreaking solutions.

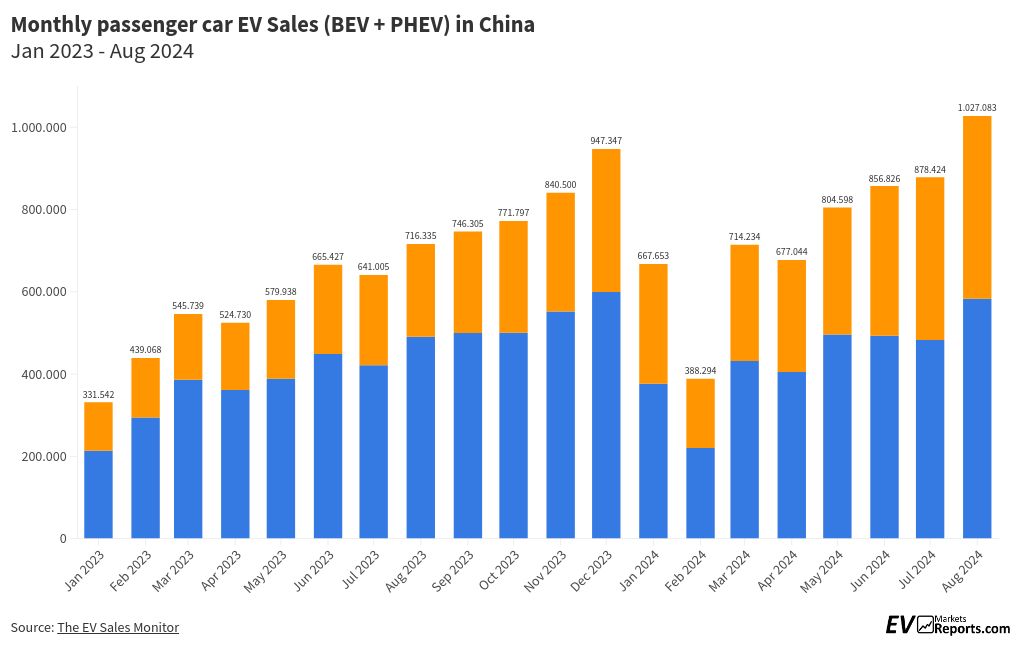

Read MoreDiscover the latest trends in electric vehicle adoption in China. What factors are driving this rapid growth?

Read MorePolular🔥

View All

1

2

3

4

5

6

7

8

9

10

Technology

View All

December 5, 2024

How to Save Big on High-End Tech Products: 6 Hacks You Need to Try

Unlock massive savings on high-end tech! Discover 6 insider hacks to get the best deals. Click to learn more and start saving today.

December 18, 2024

How to Get the Best Deals on Smartphones This Month

Discover the hottest smartphone deals this month! Click to learn insider tips and save big on your next purchase.

August 9, 2024

The Evolution of Mobile Technology: A Journey to Super Connectivity

Learn about the amazing evolution of mobile technology from 1G to 5G and beyond! Discover the inventions that impacted our world and altered communication. Discover the future with quantum & 6G technology!