Unlocking Cash Flow for Staffing Agencies: The Power of Invoice Factoring

Mia Anderson

Photo: Unlocking Cash Flow for Staffing Agencies: The Power of Invoice Factoring

Staffing agencies play a critical role in connecting talented individuals with businesses in need of their skills. However, one of the biggest challenges these agencies face is maintaining a healthy cash flow, especially when clients have lengthy payment terms. This is where invoice factoring comes into play, offering a powerful solution to unlock much-needed funds and stabilize operations.

In this comprehensive guide, we will explore the world of invoice factoring for staffing companies, shedding light on how it works, its immense benefits, and why it has become an increasingly popular financing option. By the end, you will understand how this innovative approach can transform your agency's financial health and overall growth trajectory.

What is Invoice Factoring for Staffing Companies?

Invoice factoring is a form of short-term financing that provides staffing agencies with rapid access to working capital. It is specifically designed to address the challenges faced by staffing companies that rely heavily on timely client invoice payments to meet their weekly or bi-weekly payroll obligations.

Here's a simple analogy to understand the concept: imagine your staffing agency as a garden, and invoice factoring as a watering can. When you water the plants in your garden, they thrive and grow, just as your agency flourishes when invoices are paid on time. But what happens when those invoices are delayed? That's where the watering can, or invoice factoring, comes to the rescue, providing the much-needed liquidity to keep your garden vibrant and healthy.

In the context of staffing agencies, invoice factoring involves selling your agency's outstanding invoices to a specialized factoring company. This company then provides an advance on the value of those invoices, typically within 24-48 hours, allowing you to meet immediate financial obligations, such as payroll.

How Does Invoice Factoring Work?

The process of invoice factoring is straightforward and efficient. Here's a step-by-step breakdown to illustrate how it works:

Step 1: You Submit Invoices

When you partner with a factoring company, you submit the invoices your staffing agency has issued to its clients. These invoices represent the money owed to your agency for the services provided, such as placing temporary or permanent staff in various roles.

Step 2: Advance Payment

Upon receiving your invoices, the factoring company will typically advance you a significant percentage (usually around 90-95%) of the total invoice value. This advance is deposited into your account promptly, often within a day or two. This immediate access to funds ensures that you can meet payroll demands and other financial commitments without delay.

Step 3: The Factoring Company Collects Payment

Once the advance has been made, the responsibility for collecting payment on those invoices shifts to the factoring company. They will follow up with your clients to ensure timely payment, just as your agency would have done otherwise. This step frees up your time and resources, allowing you to focus on core business activities.

Step 4: Remaining Funds Released

After the factoring company has received full payment from your clients, they will release the remaining percentage of the invoice value to you, minus a small fee for their services. This fee is typically a small percentage of the total invoice amount and varies depending on the factoring company and the terms of your agreement.

Why is Invoice Factoring Beneficial for Staffing Agencies?

Invoice factoring offers a multitude of advantages for staffing agencies, especially those that struggle with inconsistent cash flow due to delayed client payments. Here are some key benefits:

Improved Cash Flow

The most significant advantage of invoice factoring is its ability to enhance your agency's cash flow. By providing immediate access to funds, you no longer have to worry about covering payroll or other expenses while awaiting client payments. This stability allows you to run your business with confidence and pursue growth opportunities.

Quick Setup and Streamlined Process

Many funding companies for staffing agencies have cumbersome, manual processes that slow down funding. However, invoice factoring companies utilize technology to streamline and speed up the entire process. This means you can set up invoice factoring quickly and start enjoying the benefits without unnecessary delays.

Flexibility and Growth Potential

Invoice factoring provides the flexibility to scale your funding alongside your business. As your staffing agency grows and takes on more clients, you can factor more invoices to access higher levels of funding. This flexibility ensures that you always have the necessary capital to support your operations and expansion plans.

Reduced Administrative Burden

When you engage in invoice factoring, the responsibility for collecting payments shifts to the factoring company. This significantly reduces the administrative burden on your agency, freeing up time and resources that can be redirected towards more strategic activities, such as business development and client relationship management.

Access to Expertise

Factoring companies bring a wealth of expertise in accounts receivable management and debt collection. They employ skilled professionals who understand the intricacies of invoice collection and can navigate potential challenges effectively. This means you benefit from their specialized knowledge and experience in ensuring timely payments.

Real-World Example: A Snapshot

To illustrate how invoice factoring can work in practice, let's consider a hypothetical example of a staffing agency called "Talent Scouters."

Talent Scouters provides temporary administrative and customer service staff to various companies. Their clients typically pay invoices within 30 days, but Talent Scouters must meet payroll obligations every two weeks. To bridge this gap, they decide to partner with a factoring company, "Fast Funding Solutions."

Here's how the process unfolds:

- Talent Scouters sends invoices totaling $200,000 to Fast Funding Solutions.

- Fast Funding Solutions applies a 2% discount and purchases the invoices for $196,000.

- They advance Talent Scouters 95% of the purchase amount, wiring $186,200 into their account within 48 hours.

- Talent Scouters uses these funds to cover their upcoming payroll, ensuring their temporary staff receive their wages on time.

- The remaining $9,800 is held in a reserve account by Fast Funding Solutions until the clients pay their invoices.

In this scenario, invoice factoring ensures that Talent Scouters can meet their payroll commitments without worrying about late client payments. It provides a quick and efficient solution to a common challenge faced by staffing agencies, demonstrating the power of invoice factoring in action.

Best Practices for Engaging with Factoring Companies

When considering invoice factoring for your staffing agency, it's important to approach this financial partnership with care and attention to detail. Here are some best practices to keep in mind:

Research and Compare Factoring Companies

Take the time to research and compare multiple factoring companies. Look for companies with a strong reputation in the industry, competitive rates, and a track record of successful partnerships with staffing agencies. Review their terms, fees, and the level of customer support they offer.

Understand the Fees and Discounts

Invoice factoring companies typically charge a percentage of the total invoice value as their fee. This is often referred to as a "discount." Make sure you understand this fee structure and any other associated costs to ensure there are no surprises. Compare the discount rates offered by different companies to find the most competitive option.

Ensure a Good Fit for Your Agency

Not all factoring companies are created equal. Some may specialize in certain industries or have specific requirements that might not align with your agency's needs. Look for a company that understands the unique challenges and dynamics of the staffing industry and can offer tailored solutions.

Review the Contract Carefully

Before entering into a factoring agreement, carefully review the contract. Pay close attention to the terms and conditions, including the fees, payment timelines, and any restrictions or obligations. It's always a good idea to have a legal professional review the contract to ensure your agency's interests are protected.

Maintain Transparent Communication

Open and transparent communication is key to a successful partnership with a factoring company. Be clear about your agency's financial situation, the nature of your clients, and any potential challenges you foresee. This will help the factoring company understand your needs and tailor their services accordingly.

Conclusion

Invoice factoring is a powerful tool for staffing agencies to unlock their financial potential and stabilize their operations. By leveraging this innovative financing solution, agencies can transform their cash flow, meet obligations, and pursue growth strategies.

Throughout this guide, we have explored the ins and outs of invoice factoring, highlighting its benefits and providing a step-by-step understanding of the process. With this knowledge, staffing agency owners and decision-makers can make informed choices to secure their agency's financial health and future.

Remember, timely invoice payments are the lifeblood of your business, and invoice factoring ensures that late payments no longer hinder your success. Embrace the power of invoice factoring, and unlock the door to a thriving, prosperous staffing agency.

Marketing

View All

January 23, 2025

Social Media in Digital Marketing 2024Learn how social media is revolutionizing digital marketing in 2024. Boost your brand with actionable tips for viral campaigns!

Mia Anderson

January 23, 2025

10 Content Strategies for Digital SuccessCreate winning content with these 10 proven digital marketing strategies. Enhance engagement and conversions starting today!

Mia Anderson

January 20, 2025

5 Best Digital Marketing Tools for GrowthUncover the top 5 digital marketing tools every marketer needs. Boost efficiency, drive results, and streamline your campaigns now!

Mia Anderson

Entertainment

View AllDiscover the fascinating history of superhero movies, from early adaptations to modern blockbusters. Uncover surprising facts and insights click to explore!

Mia Anderson

Unlock the secrets to going viral on TikTok with these 2024 strategies. From trend-spotting to unique twists, learn how to boost your visibility and engagement. Start creating viral content today!

Mia Anderson

Learn the key steps to start a YouTube channel in 2024, from content strategy to monetization. Click here for expert advice and actionable tips!

Mia Anderson

Discover the latest tips and trends for making a short film in 2024. Learn from experts and get started on your cinematic journey today!

Mia Anderson

Automotive

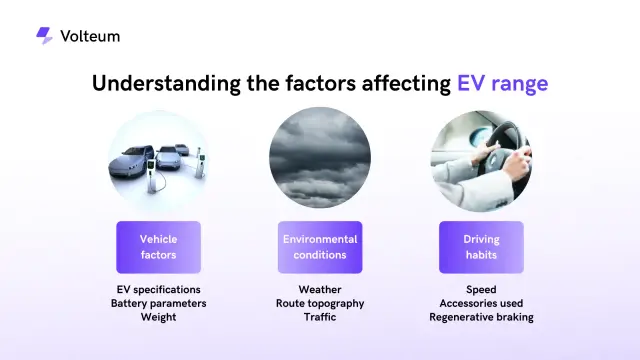

View AllExplore the growth of residential EV charging solutions, from home setups to energy-efficient charging options.

Read MoreDiscover the latest innovations in lightweight materials for EVs. How do these advancements improve performance and efficiency?

Read MoreDiscover real-world experiences of long-distance EV travel. Learn how EV owners tackle range anxiety and plan road trips.

Read MorePolular🔥

View All

1

2

3

4

5

6

7

8

9

10

Technology

View All

September 12, 2024

Comprehensive Machine Learning Tutorial for Beginners

Master machine learning with our detailed tutorial. Learn the fundamentals and advance your skills today. Start your journey into AI now!

August 13, 2024

The Top SOC 2 Compliance Companies: Securing Your Data

Discover the leading SOC 2 Compliance companies and learn how they can help protect your organization's sensitive data. Click to explore the best options for safeguarding your business.

December 17, 2024

The Best Tech Gifts for 2024 – Shop Before They Sell Out!

Find the perfect tech gifts for everyone on your list! Click to explore the hottest gadgets and shop before they're gone.

Tips & Trick