Top 5 Online Home Refinancing Options for 2025

Mia Anderson

Photo: Top 5 Online Home Refinancing Options for 2025

Introduction to Home Refinancing

Home refinancing is a financial strategy employed by homeowners to revise their existing mortgage agreements. This process typically involves replacing an old mortgage with a new one, often to secure more favorable terms. Home refinancing has gained traction among homeowners for various reasons, primarily related to financial relief and enhanced long-term strategies. A significant motivation for homeowners to consider refinancing is the potential for lower interest rates. When market conditions change, securing a mortgage at a reduced rate can lead to substantial savings over the loan's duration. Another compelling reason homeowners refinance is to decrease their monthly payments. By securing a lower interest rate or extending the loan term, property owners can significantly alleviate their monthly financial obligations. This decrease in payments can provide much-needed breathing room in monthly budgets, allowing for investment in other areas such as home improvements or savings. Moreover, accessing home equity is another financial benefit tied to refinancing. For homeowners with increased property value, refinances can lead to cash-out options that utilize this equity for other expenses such as education, renovations, or debt consolidation. As we approach 2025, the landscape of home refinancing options continues to evolve, driven by advancements in technology and changing economic conditions. Online platforms are increasingly offering streamlined processes and competitive terms that cater to the diverse needs of homeowners. These innovations make refinancing more accessible, allowing homeowners to explore various options from the comfort of their homes. This blog post will delve deeper into the top online home refinancing options available in 2025, equipping homeowners with knowledge to make informed decisions regarding their financial futures.Criteria for Choosing a Home Refinancing Option

When evaluating home refinancing options, homeowners should consider several key criteria to ensure they make informed decisions. The first aspect to assess is the interest rate. This rate significantly impacts monthly payments and the overall cost of borrowing. Homeowners should compare rates across various lenders, as even a slight difference can lead to substantial savings over time. Next, the loan terms are crucial. Different lenders may offer various term lengths, typically ranging from 15 to 30 years. A shorter term often translates to higher monthly payments but lower overall interest costs, whereas longer terms could mean lower monthly obligations but increased interest paid in total. Homeowners need to weigh their financial stability and long-term plans when choosing the loan duration. Fees associated with refinancing should also be carefully analyzed. These can include origination fees, appraisal costs, and closing costs. It is vital to estimate the total fees against potential savings to determine whether refinancing is worthwhile. Homeowners should look for no-cost refinancing options or lenders that provide minimal fees to enhance savings. The ease of application can also influence the choice of lender. A straightforward, user-friendly application process can save time and reduce stress. Online platforms that simplify this process with digital document uploads and instant eligibility checks are increasingly popular among borrowers. Lastly, the reputation of the lender is an essential criterion. Homeowners should consider reviews, ratings, and recommendations before selecting a refinancing option. Solid customer service and transparent practices can significantly enhance the overall refinancing experience. A checklist that encapsulates these criteria can serve as an invaluable tool, assisting homeowners in methodically comparing various refinancing offers. By adhering to this framework, individuals can make educated choices aligned with their financial goals.Online Direct Lenders

Online direct lenders have revolutionized the home refinancing landscape by providing borrowers with a streamlined and efficient means to secure mortgage financing. These lenders operate exclusively online, allowing customers to apply for refinancing, submit documentation, and communicate with loan officers without the need for in-person visits. By leveraging technology, online direct lenders can significantly reduce processing times, enabling borrowers to complete their refinancing in as little as a few days. This facilitates a more convenient experience for homeowners looking to lower their interest rates or adjust their mortgage terms. One of the primary advantages of utilizing online direct lenders is the potential for lower fees compared to traditional lenders. Direct lenders often have lower overhead costs and can pass those savings on to consumers, making refinancing more affordable. Additionally, the automated systems used by these platforms can expedite the approval process, providing borrowers with quick decisions on their loan applications. Some reputable online direct lenders for 2025 include Rocket Mortgage, Better.com, and LoanDepot. These platforms are known for their user-friendly interfaces and competitive rates, making them suitable options for many homeowners. However, potential borrowers should consider both the advantages and disadvantages when choosing this refinancing route. While online direct lenders offer convenience and efficiency, they may lack the personalized service provided by local lenders or brokers. Furthermore, not all online lenders are created equal some may levy higher rates depending on creditworthiness or market conditions. Therefore, it is essential for homeowners to thoroughly research and compare various lenders to find the most appropriate option that aligns with their financial needs and goals. Evaluating the pros and cons of online direct lenders will help determine if this refinancing method best suits individual circumstances.Option 2: Mortgage Brokers

Mortgage brokers play a crucial role in the online home refinancing process, serving as intermediaries between borrowers and lenders. By leveraging their industry expertise, brokers can connect homeowners with a diverse array of lending options tailored to individual financial needs. One of the primary advantages of working with a mortgage broker is their access to multiple lenders. This enables them to compare various refinance rates and products, ensuring clients receive competitive offers that might not be accessible through a single lender. In addition to providing a wider selection of lending options, mortgage brokers offer personalized service throughout the refinancing process. They conduct thorough assessments of their clients’ financial situations and goals, allowing them to recommend the most suitable refinancing options. This personalized approach often results in a more efficient and streamlined process, as brokers can guide clients through the complex paperwork, negotiate terms on their behalf, and answer any questions that may arise during the refinancing journey. While the advantages of using a mortgage broker are substantial, it is also important to consider potential downsides. Brokers typically charge fees for their services, which can either be paid directly by the borrower or included in the overall loan costs. Homeowners should evaluate these fees against the potential savings from better loan terms facilitated by the broker. Understanding the fee structure is essential for assessing the overall value of utilizing a mortgage broker. To find a qualified mortgage broker, borrowers should seek referrals from trusted sources or conduct research online. Look for brokers who are licensed and have positive reviews from previous clients. Interviews with multiple brokers can help determine the best fit for specific refinancing needs, ensuring that homeowners are well-supported throughout the process.Option 3: Credit Unions and Community Banks

In the evolving landscape of online home refinancing options for 2025, credit unions and community banks stand out as distinct alternatives to traditional mortgage lenders. These institutions often provide a range of refinancing services that cater to the specific needs of their members or customers. One of the primary advantages of choosing a credit union or a community bank is their commitment to personalized service. With deeper community ties and a member-centric approach, these institutions typically offer tailored solutions for homeowners looking to refinance. Furthermore, credit unions and community banks tend to provide competitive interest rates compared to larger financial institutions. Because they are often not driven by profit maximization, they can pass on savings to their members in the form of lower rates and reduced fees. For borrowers, this can translate into significant savings over the life of a loan, making refinancing more accessible and economical. Interest rates are essential to consider in the refinancing process, and potential borrowers should conduct thorough research to gauge the best available options from these local endeavors. When assessing whether a credit union or community bank is a suitable choice for refinancing, several factors should be taken into account. Firstly, membership requirements often vary, so reviewing eligibility criteria is crucial. Next, borrowers should evaluate the specific refinancing products offered, as options can differ widely between institutions. Additionally, applicants should pay attention to the lender's reputation for customer service, as this can significantly affect the refinancing experience. Understandably, lower rates and fees are appealing, but the overall process's efficiency and transparency are equally important. In summary, credit unions and community banks present compelling refinancing options for homeowners in 2025, particularly for those seeking personalized experiences and potential cost savings. By carefully evaluating their offerings and aligning them with personal refinancing goals, consumers can effectively navigate their refinancing journey.Option 4: Financial Technology (FinTech) Companies

In recent years, financial technology (FinTech) companies have emerged as significant players in the home refinancing market, revolutionizing how consumers approach their refinancing needs. Leveraging advanced technologies, these platforms offer user-friendly experiences that cater to the needs of modern homeowners seeking efficient refinancing solutions. The integration of artificial intelligence, machine learning, and sophisticated algorithms allows FinTech companies to streamline the entire refinancing process, making it easier and faster for clients to receive approvals and access competitive rates. One of the core advantages of utilizing FinTech platforms for home refinancing is their ability to provide quick loan approvals. Traditionally, the refinancing process could take weeks or even months however, many FinTech companies have dramatically reduced this timeline. By utilizing digital forms, document uploads, and automated underwriting processes, these platforms can often give prospective borrowers decisions within a matter of hours. This is particularly beneficial in a fast-paced market where interest rates can change swiftly, enabling homeowners to secure favorable terms before they disappear. Several FinTech companies have distinguished themselves in the home refinancing landscape. For instance, companies like Better.com and LoanDepot have showcased how technology can eliminate cumbersome bureaucratic processes associated with traditional lenders. Customers have reported not only streamlined communication but also enhanced transparency regarding fees and overall loan terms. The case of a homeowner who refinanced with Better.com highlights the ease of navigating the platform, culminating in a lower interest rate and a significant monthly savings in their mortgage payments. As we move into 2025, the influence of FinTech companies in the home refinancing sector is expected to grow even further. Their innovative approaches, combined with competitive pricing and exceptional customer service, are reshaping consumer expectations and encouraging traditional lenders to adapt. Through their enhanced technology and user-centric philosophies, FinTech firms are setting the stage for a more accessible and efficient refinancing marketplace.Option 5: Government Programs

In 2025, government-backed refinancing options will continue to play a pivotal role in fostering home ownership through financial assistance. Programs such as the Federal Housing Administration (FHA), Veterans Affairs (VA), and United States Department of Agriculture (USDA) loans are designed to cater to diverse needs and circumstances, ensuring access to affordable mortgage solutions. Each program has distinct eligibility criteria, making them appealing to various demographics, including first-time homebuyers, veterans, and rural residents. The FHA loan program is particularly advantageous for buyers with limited credit history or low down payments, typically requiring as little as 3.5%. This feature opens pathways for individuals seeking home refinancing who might be unable to qualify for conventional loans. Additionally, FHA loans carry competitive interest rates, further easing the financial burden of refinancing. The VA loan program is exclusively available for eligible veterans, active-duty service members, and some surviving spouses. These loans offer significant benefits, including no down payment requirements and no private mortgage insurance (PMI), making it a compelling choice for those who have served the country. It is essential for eligible individuals to understand and utilize these benefits effectively to improve their financial standing through home refinancing. Lastly, the USDA loan program targets low-to-moderate income households in rural areas. It promotes homeownership in less densely populated regions and requires no down payment, significantly mitigating the initial costs associated with purchasing a home. The program includes rural development benefits that can enhance the living standards of eligible communities. In conclusion, government programs for home refinancing provide diverse options that cater to the needs of various populations. By understanding their eligibility requirements and benefits, potential borrowers can leverage these programs to achieve homeownership and financial stability in 2025.Comparative Analysis of the Top 5 Options

The world of online home refinancing offers a variety of options tailored to meet the diverse needs of homeowners. As we delve into the comparative analysis of the top five refinancing options for 2025, various elements such as interest rates, fees, borrower requirements, and other key features become pivotal in making informed choices. Understanding these variables is essential for homeowners looking to capitalize on the current market conditions. To begin with, interest rates are a primary factor to consider when refinancing a home. Option A provides the most competitive annual percentage rate (APR), making it attractive for borrowers seeking to minimize their long-term payments. Conversely, Option B, while slightly higher in rates, compensates with lower upfront fees, appealing to those who prefer an immediate reduction in their financial obligations. Next, we assess the fees associated with each option. Option C stands out due to its absence of origination fees, which can significantly reduce the overall cost of refinancing. Options D and E, however, include standard fees, but they may reflect enhanced customer service and specialized loan products, which can justify the expense for many borrowers. Borrower requirements further differentiate these refinancing solutions. Option A requires stronger credit scores and significant equity in the home, aligning with its favorable rates. In contrast, Option B is more lenient, offering accessible alternatives for borrowers with moderate credit scores. Options C and D run a balance between strict and relaxed requirements, catering to a broad audience. In reviewing these options, a detailed comparison chart is available to visualize each refinancing option's characteristics. By analyzing and weighing these factors, homeowners can delineate the advantages and disadvantages unique to each option. This method of comparative analysis serves as a vital tool for those navigating the refinance market in 2025.Actionable Tips for Securing the Best Refinance Deal

Homeowners aiming to secure the best refinance deal in 2025 can adopt several actionable tips to enhance their chances of obtaining favorable terms. First and foremost, improving credit scores is paramount. A higher credit score not only unlocks better interest rates but also increases the likelihood of approval for refinancing applications. Homeowners should consistently check their credit reports, resolve any discrepancies, and pay down existing debts to bolster their credit profiles. Additionally, ensuring timely payment of bills is essential in maintaining a positive credit standing. Next, gathering all necessary documentation is crucial as it streamlines the refinancing process. Homeowners should prepare essential documents such as recent pay stubs, tax returns, and bank statements. These documents prove income stability and financial responsibility, thereby reassuring lenders of the borrower’s ability to repay the refinanced loan. It is advisable to have an updated mortgage statement on hand as well, providing information about the current loan balance and payment history. Moreover, shopping for rates should be a strategic approach. Homeowners are encouraged to reach out to multiple lenders to compare interest rates, closing costs, and loan terms. Utilizing online platforms that aggregate lenders can be an efficient way to evaluate various refinancing options. When comparing rates, potential borrowers must consider not only the interest rate but also the annual percentage rate (APR), which provides a more comprehensive overview of the loan costs over time. Additionally, engaging in active negotiations with lenders can yield competitive offers, making it a smart tactic in securing the best refinancing deal. In conclusion, through improving credit scores, thoroughly preparing documentation, and diligently comparing rates, homeowners put themselves in a stronger position to secure favorable refinancing terms. By taking these steps, individuals can effectively enhance their refinancing prospects and achieve their financial goals in 2025.Conclusion and Call to Action

In evaluating the top five online home refinancing options for 2025, it's clear that homeowners have a plethora of choices tailored to diverse financial needs and preferences. Each option presents distinct advantages and potential drawbacks that warrant careful consideration. Factors such as interest rates, fees, and customer service should not be overlooked when determining the best solution for your personal financial scenario. Among the highlighted options, platforms may vary in terms of user experience, speed of processing applications, and the breadth of mortgage products available. Consequently, it is crucial for potential refinancers to meticulously assess their specific goals, whether that be lowering monthly payments, accessing cash for renovations, or consolidating debt. Understanding the implications of each refinancing avenue helps homeowners make informed decisions that align with their financial aspirations. Additionally, leveraging online tools and resources can simplify the comparison process and enhance transparency regarding fees, rates, and terms. By doing so, homeowners can significantly improve their chances of securing an advantageous refinancing deal that suits their long-term goals. We encourage you to share your thoughts about these options in the comments below. Your insights and experiences can assist others in their refinancing journeys. Furthermore, don't hesitate to explore further resources available on our site that delve deeper into home refinancing strategies. If you seek personalized advice, feel free to reach out, and we would be delighted to assist you in navigating this important financial decision.Marketing

View All

January 22, 2025

The Future of Digital Marketing RevealedExplore where digital marketing is headed in the next decade. From AI to VR, see what’s shaping the future of online marketing. Don’t get left behind!

Mia Anderson

January 21, 2025

Why Digital Marketing is Vital for SMBsDiscover why small businesses must adopt digital marketing in 2024. Learn tips and tactics to compete in the digital age. Take your business online today!

Mia Anderson

January 23, 2025

Social Media in Digital Marketing 2024Learn how social media is revolutionizing digital marketing in 2024. Boost your brand with actionable tips for viral campaigns!

Mia Anderson

Entertainment

View AllExplore the latest trends in fan fiction for 2024. Learn what fan fiction is, its impact on media, and why it’s a thriving creative outlet. Read now!

Mia Anderson

Discover the best streaming services of 2024 with our in-depth reviews. Find out which platforms offer the best value and why you should choose them. Read now!

Mia Anderson

Discover the top podcasting trends of 2024 and stay ahead in the industry. Learn how to leverage new insights click now to future-proof your podcast!

Mia Anderson

Unlock the secrets to an unforgettable movie trivia night with our ultimate guide. Get tips, trivia questions, and game ideas to boost your event's fun!

Mia Anderson

Automotive

View AllUnlock the secrets to getting top dollar for your car! Prep, price, and promote effectively.

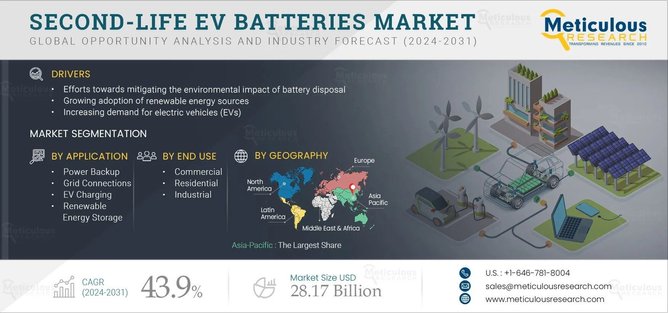

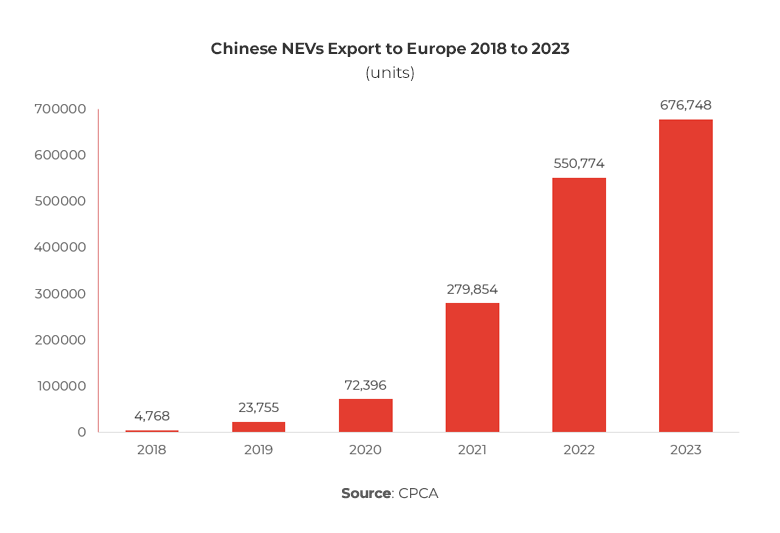

Read MoreLearn how second-life EV batteries are helping reduce environmental impact by providing sustainable energy solutions.

Read MoreCompare trends in luxury and budget EV offerings. Find out which one suits your needs and budget in 2024.

Read MorePolular🔥

View All

1

2

3

4

5

6

7

9

10

Technology

View All

September 15, 2024

Discover the Best Project Management Software of 2024

Discover the best project management software of 2024! Uncover top picks, latest trends, and expert reviews. Click now to streamline your projects!

December 10, 2024

Best Tech Gadgets for Remote Workers in 2024 – Don’t Miss These!

Boost your productivity with the top tech gadgets for remote work! Click to discover must-have tools to enhance your work-from-home setup.

August 29, 2024

Top SaaS Trends Shaping Business Success in 2024

Discover the latest SaaS trends revolutionizing businesses in 2024. Learn how these innovations can boost efficiency and drive growth. Read now!

Tips & Trick