2024 Stock Market Crash: What Investors Need to Know Now

Mia Anderson

Photo: 2024 Stock Market Crash: What Investors Need to Know Now

ISEKUN - The stock market is a dynamic and unpredictable entity, often influenced by a complex array of economic, political, and social factors. As we navigate the ever-changing landscape of global finance, the possibility of a stock market crash in 2024 has become a pressing concern for investors. In this article, we will delve into the latest trends and data surrounding the potential for a stock market crash in 2024, exploring what investors need to know to protect their portfolios and make informed decisions.

Understanding the Stock Market Crash

A stock market crash refers to a significant and rapid decline in stock prices, often resulting in substantial losses for investors. These crashes can be triggered by various factors, including economic recessions, geopolitical tensions, and regulatory changes. The 2024 stock market crash, if it occurs, will likely be influenced by a combination of these factors.

Economic Recession 2024

One of the primary concerns driving the potential for a stock market crash is the looming threat of an economic recession in 2024. An economic recession is characterized by a decline in economic activity, often measured by GDP (Gross Domestic Product) growth rates. Several indicators suggest that the global economy may be heading towards a recession, including slowing GDP growth rates, rising unemployment, and decreased consumer spending.

For instance, in the first half of 2024, many countries have reported lower-than-expected GDP growth rates. This trend is particularly concerning for investors, as it can lead to reduced consumer spending and lower corporate profits, ultimately affecting stock prices.

Federal Reserve Rate Cuts

The Federal Reserve, the central bank of the United States, plays a crucial role in managing economic conditions through monetary policy. One of the tools at the Fed's disposal is setting interest rates. In response to economic downturns, the Fed may lower interest rates to stimulate borrowing and spending. However, excessive rate cuts can lead to inflationary pressures and devalue the currency.

In 2024, investors are closely watching the Fed's actions regarding interest rates. If the Fed decides to implement significant rate cuts, it could signal a broader economic slowdown and potentially trigger a stock market crash.

Global Stock Market Crash

A global stock market crash is not just a domestic issue it can have far-reaching consequences across international markets. The interconnectedness of global economies means that economic downturns in one region can quickly spread to others.

For example, during the 2008 financial crisis, the collapse of the US housing market led to a global financial crisis. Similarly, if a stock market crash were to occur in 2024, it could have devastating effects on international markets, leading to widespread economic instability.

Trends and Strategies

To navigate the potential risks associated with a stock market crash in 2024, investors need to stay informed about current trends and develop effective strategies to protect their portfolios.

Tech Stock Correction 2024

The tech sector has been particularly volatile in recent years, with stocks like those in the FAAMG (Facebook, Apple, Amazon, Microsoft, and Google) group experiencing significant fluctuations. A correction in tech stocks could have a ripple effect across the broader market, contributing to a broader stock market crash.

Investors should closely monitor tech stocks and consider diversifying their portfolios to mitigate potential losses. For instance, investing in sectors less correlated with tech, such as healthcare or consumer staples, could provide a more stable return.

Financial Crisis 2024

A financial crisis is often characterized by a combination of factors including high levels of debt, asset bubbles, and poor financial regulation. In 2024, concerns about high levels of corporate debt and potential asset bubbles in the tech sector have raised alarms among investors.

To prepare for a potential financial crisis, investors should focus on building robust financial portfolios with a mix of low-risk assets such as bonds and high-quality stocks. Additionally, maintaining an emergency fund can provide a safety net during times of market volatility.

Investing During a Recession

Investing during a recession requires a different mindset than during periods of economic growth. Here are some strategies that can help investors navigate these challenging times:

- Diversification: Spread investments across various asset classes to minimize risk. This could include stocks, bonds, real estate, and commodities.

- Value Investing: Look for undervalued stocks that have strong fundamentals but are currently trading at lower prices due to market volatility.

- Dividend Stocks: Invest in companies with a history of paying consistent dividends. These stocks can provide a steady income stream even during market downturns.

- Index Funds: Consider investing in index funds which track a specific market index like the S&P 500. These funds offer broad diversification and can be less volatile than individual stocks.

- Gold and Other Safe-Haven Assets: Historically, gold and other safe-haven assets like bonds have performed well during economic downturns. Adding these to your portfolio can provide an additional layer of protection.

Market Volatility Strategies

Market volatility is a natural part of investing, and there are several strategies that can help investors manage their portfolios during times of high volatility:

- Stop-Loss Orders: Set stop-loss orders to automatically sell a stock if it falls below a certain price level, limiting potential losses.

- Dollar-Cost Averaging: Invest a fixed amount of money at regular intervals regardless of the market conditions. This strategy helps reduce the impact of market fluctuations over time.

- Risk Management: Regularly review your portfolio to ensure it remains aligned with your risk tolerance and investment goals.

- Active Trading vs Passive Investing: Decide whether you want to actively trade stocks or adopt a passive investment strategy. Active trading involves frequent buying and selling based on market conditions, while passive investing involves holding onto your investments for the long term.

- Stay Informed but Avoid Emotional Decisions: Stay updated with the latest news and trends but avoid making emotional decisions based on short-term market fluctuations.

Conclusion

The possibility of a stock market crash in 2024 is a serious concern for investors. By understanding the underlying factors such as economic recession, Federal Reserve rate cuts, and global market interconnectedness, investors can better prepare themselves for potential risks.

Diversification, value investing, dividend stocks, index funds, and safe-haven assets are all effective strategies for navigating market volatility. Additionally, employing risk management techniques such as stop-loss orders and dollar-cost averaging can help mitigate losses.

While no one can predict with certainty when or if a stock market crash will occur, being informed and prepared is key to protecting your investments. By staying vigilant and adapting your investment strategies accordingly, you can navigate even the most challenging economic conditions with confidence.

Marketing

View All

January 23, 2025

Social Media in Digital Marketing 2024Learn how social media is revolutionizing digital marketing in 2024. Boost your brand with actionable tips for viral campaigns!

Mia Anderson

January 23, 2025

10 Content Strategies for Digital SuccessCreate winning content with these 10 proven digital marketing strategies. Enhance engagement and conversions starting today!

Mia Anderson

January 20, 2025

5 Best Digital Marketing Tools for GrowthUncover the top 5 digital marketing tools every marketer needs. Boost efficiency, drive results, and streamline your campaigns now!

Mia Anderson

Entertainment

View AllDiscover the fascinating history of superhero movies, from early adaptations to modern blockbusters. Uncover surprising facts and insights click to explore!

Mia Anderson

Unlock the secrets to going viral on TikTok with these 2024 strategies. From trend-spotting to unique twists, learn how to boost your visibility and engagement. Start creating viral content today!

Mia Anderson

Learn the key steps to start a YouTube channel in 2024, from content strategy to monetization. Click here for expert advice and actionable tips!

Mia Anderson

Discover the latest tips and trends for making a short film in 2024. Learn from experts and get started on your cinematic journey today!

Mia Anderson

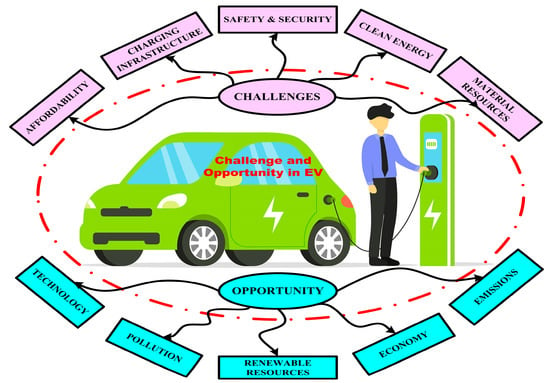

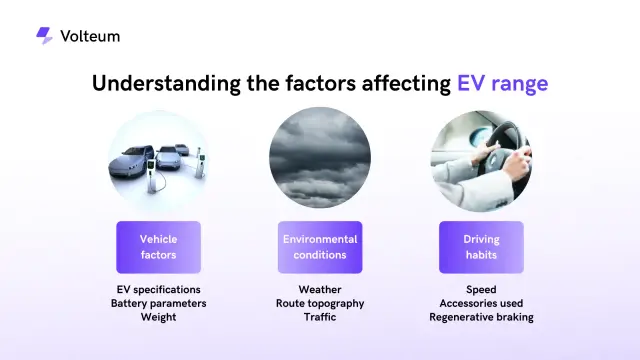

Automotive

View AllExplore the growth of residential EV charging solutions, from home setups to energy-efficient charging options.

Read MoreDiscover the latest innovations in lightweight materials for EVs. How do these advancements improve performance and efficiency?

Read MoreDiscover real-world experiences of long-distance EV travel. Learn how EV owners tackle range anxiety and plan road trips.

Read MorePolular🔥

View All

1

2

3

4

5

6

7

8

9

10

Technology

View All

September 12, 2024

Comprehensive Machine Learning Tutorial for Beginners

Master machine learning with our detailed tutorial. Learn the fundamentals and advance your skills today. Start your journey into AI now!

August 13, 2024

The Top SOC 2 Compliance Companies: Securing Your Data

Discover the leading SOC 2 Compliance companies and learn how they can help protect your organization's sensitive data. Click to explore the best options for safeguarding your business.

December 17, 2024

The Best Tech Gifts for 2024 – Shop Before They Sell Out!

Find the perfect tech gifts for everyone on your list! Click to explore the hottest gadgets and shop before they're gone.

Tips & Trick