How to Manage Your Personal Budget Like a Pro

Mia Anderson

Photo: How to Manage Your Personal Budget Like a Pro

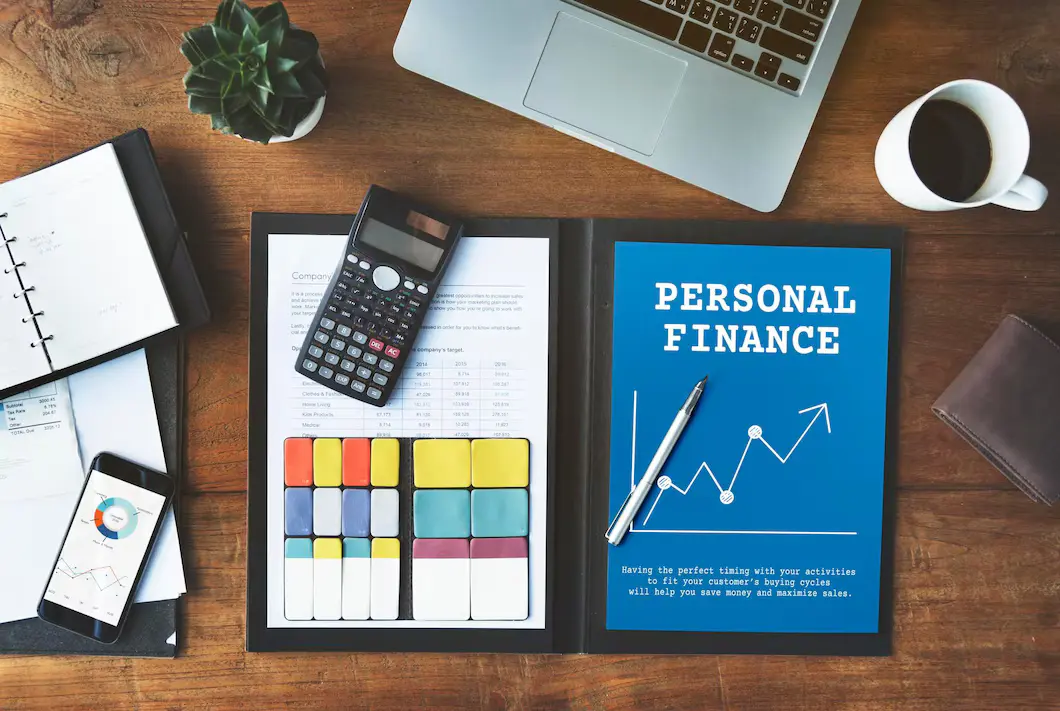

Feeling overwhelmed by your finances? You're not alone! Managing personal finances is a skill that many people struggle with, but it's a crucial aspect of achieving financial stability and long-term success. In this comprehensive guide, we'll delve into the art of personal budgeting, providing you with practical tips and insights to help you become a budgeting pro. Say goodbye to financial stress and hello to a brighter financial future!

Understanding the Importance of Personal Budgeting

Personal budgeting is more than just a financial exercise; it's a powerful tool for taking control of your money and shaping your future. Many people view budgeting as restrictive, but it's quite the opposite. It's about making informed choices to ensure your hard-earned money works for you.

In today's fast-paced world, where expenses can quickly spiral out of control, budgeting is essential for several reasons:

1. Financial Awareness

Creating a budget allows you to gain a deep understanding of your financial situation. By tracking your income and expenses, you can identify spending patterns and areas where your money is going. This awareness is the first step towards making positive changes.

2. Goal Achievement

Whether you're saving for a dream vacation, a new home, or simply building an emergency fund, budgeting is the key to achieving your financial goals. It helps you allocate your money effectively, ensuring you stay on track and reach your milestones.

3. Debt Management

If you're dealing with debt, budgeting can be a lifesaver. It enables you to create a plan to pay off debts strategically, reducing the burden of interest and improving your overall financial health.

4. Stress Reduction

Financial stress is a significant concern for many individuals. A well-planned budget provides clarity and peace of mind. It helps you avoid surprises and ensures you're prepared for unexpected expenses, reducing anxiety about your financial situation.

Getting Started: The Basics of Budgeting

Now that we've established the importance of personal budgeting, let's dive into the practical steps to get started.

Step 1: Calculate Your Income

Begin by calculating your total monthly income. This includes your salary, side hustle earnings, investments, or any other sources of money coming in. Understanding your income is the foundation of your budget.

Step 2: Track Your Expenses

Next, it's time to track your expenses. This is where budgeting gets exciting! Use budgeting software or personal finance apps to make this process easier. Categorize your expenses into fixed (e.g., rent, mortgage, insurance) and variable (groceries, entertainment, dining out) costs.

Pro Tip: Expense tracking is an eye-opening experience. You might be surprised by how much you spend on certain categories. This awareness is a powerful motivator for making positive changes.

Step 3: Create a Realistic Budget

Using your income and expense data, create a budget that aligns with your financial goals. Allocate funds to essential expenses first, then prioritize savings and debt repayment. Be realistic and flexible, allowing room for adjustments as you go.

Example: Let's say you're an avid coffee lover, and your daily latte habit is costing you a small fortune. By tracking this expense, you might decide to cut back and allocate that money towards a vacation fund instead.

Step 4: Choose the Right Tools

Budgeting software and personal finance apps can be game-changers. These tools automate expense tracking, provide real-time insights, and offer budgeting templates to simplify the process. Explore options like Mint, YNAB, or Personal Capital to find the right fit for your needs.

Advanced Budgeting Strategies

Once you've mastered the basics, it's time to level up your budgeting game with these advanced strategies:

1. Zero-Based Budgeting

This method involves allocating every dollar of your income to a specific purpose, ensuring nothing is left unaccounted for. It's a meticulous approach that requires discipline but can lead to significant financial gains.

2. Envelope System

The envelope system is a physical budgeting technique. Allocate cash to different expense categories and place it in labeled envelopes. This tactile approach can help you stay within your budget and provide a visual representation of your spending.

3. 50/30/20 Rule

A popular budgeting rule of thumb is the 50/30/20 rule. Allocate 50% of your income to needs (essential expenses), 30% to wants (discretionary spending), and 20% to savings and debt repayment. This simple guideline ensures a balanced approach to budgeting.

4. Automate Your Savings

Make saving effortless by automating your finances. Set up automatic transfers from your checking account to savings or investment accounts. This way, you save consistently without even thinking about it.

Overcoming Common Budgeting Challenges

Budgeting isn't always a smooth journey. Here's how to tackle some common challenges:

1. Unexpected Expenses

Life is full of surprises, and unexpected expenses can throw your budget off course. Build an emergency fund to cover these costs without derailing your financial plans. Aim to save at least three to six months' worth of living expenses.

2. Impulse Spending

Impulse buying can be a budget breaker. To curb this habit, implement a "cooling-off" period before making non-essential purchases. Also, consider using cash for discretionary spending to make it more tangible and discourage overspending.

3. Budget Fatigue

Sticking to a budget requires discipline, but it doesn't have to be a lifelong sentence. Set short-term financial goals and celebrate your achievements. Regularly review and adjust your budget to keep it aligned with your evolving needs and goals.

The Power of Budgeting Software and Apps

In today's digital age, budgeting software and personal finance apps have revolutionized the way we manage our money. Here's why they're worth considering:

- Convenience: These tools automate expense tracking, saving you time and effort.

- Real-Time Insights: Get instant updates on your financial situation, helping you make informed decisions.

- Budgeting Templates: Pre-designed templates make creating a budget a breeze, even for beginners.

- Security: Reputable budgeting apps prioritize data security, ensuring your financial information is protected.

Real-Life Budgeting Success Stories

Let's draw inspiration from real people who have transformed their finances through budgeting:

1. Sarah's Journey to Debt Freedom

Sarah, a 30-year-old marketing professional, was burdened by credit card debt. She decided to take control by creating a budget and using a budgeting app to track her expenses. By allocating extra payments towards her debt and cutting back on non-essential spending, she became debt-free within two years.

2. John's Retirement Savings Plan

John, a 45-year-old engineer, realized he needed to boost his retirement savings. He created a budget, reduced unnecessary expenses, and started investing in his company's 401K plan. With consistent contributions, he's on track to retire comfortably at 65.

Conclusion: Take Control of Your Financial Destiny

Personal budgeting is a powerful tool that empowers you to take charge of your financial future. It's not about deprivation but making conscious choices to align your spending with your goals. By following the steps outlined in this guide, you can become a budgeting pro, achieving financial stability and security.

Remember, budgeting is a journey, and it's okay to make adjustments along the way. Embrace the process, stay committed, and celebrate your financial milestones. With the right tools and mindset, you can master personal budgeting and unlock a world of financial possibilities.

Are you ready to take control of your finances? Start your budgeting journey today and watch your financial dreams become a reality!

Marketing

View All

January 18, 2025

Top 10 Digital Marketing Trends for 2024Discover the must-know digital marketing trends for 2024. Stay ahead of the curve and elevate your strategies with these insights! Read more now!

Mia Anderson

January 25, 2025

Email Marketing in the Digital AgeUnlock the power of email marketing with modern strategies tailored for the digital age. Connect with your audience like never before!

Mia Anderson

January 27, 2025

PPC vs SEO: Digital Marketing ShowdownDiscover the differences between PPC and SEO in digital marketing. Find out which strategy is right for your goals and budget. Make an informed choice today!

Mia Anderson

Entertainment

View AllUncover the top TV series of 2024! From thrilling dramas to binge-worthy comedies, find your next obsession. Don’t miss out click now to explore!

Mia Anderson

Discover the best online gaming platforms that offer unparalleled gameplay. Click now to find your perfect match and elevate your gaming experience.

Mia Anderson

Discover the hottest celebrity gossip websites of 2024. Get insider info and juicy updates. Click to stay updated with the latest celebrity news!

Mia Anderson

Discover the top 10 entertainment trends of 2024 that will captivate you. Stay ahead with our expert insights and click to explore now!

Mia Anderson

Automotive

View AllUncover the economic benefits of local EV manufacturing, from job creation to reduced costs for consumers.

Read MoreNeed cash fast? Discover how to sell your car for cash with quick and reliable methods!

Read MoreExplore the growing trend of integrating renewable energy with EV charging stations. Learn how clean energy is fueling EVs.

Read MorePolular🔥

View All

1

2

3

4

5

6

7

8

9

10

Technology

View All

December 21, 2024

Why You Need These 5 Essential Tech Gadgets for Your Home Office

Transform your home office with these must-have gadgets! Click to learn why they're essential and create the ultimate workspace.

December 10, 2024

Should You Buy a Smart Fridge? Here’s Why It Might Be Worth the Investment

Discover the benefits of a smart fridge! Learn how it can revolutionize your kitchen. Click to explore and decide if it's worth the investment.

September 14, 2024

Top Virtual Reality Trends Transforming 2024 Technology

Explore the latest virtual reality trends shaping 2024. Discover cutting-edge innovations and trends that will redefine the VR landscape. Read more now!

Tips & Trick