Mastering the Art of Frugal Living Without Feeling Deprived

Mia Anderson

Photo: Mastering the Art of Frugal Living Without Feeling Deprived

In a world where consumerism often takes center stage, embracing frugal living can be a powerful way to take control of your finances and lead a more fulfilling life. Frugal living is not about deprivation or sacrificing every pleasure, but rather a mindful approach to spending that allows you to live within your means and achieve your financial goals. This article aims to guide you through the art of frugal living, offering practical tips and strategies to save money without compromising your happiness. Get ready to embark on a journey towards financial freedom and discover the joy of making every penny count!

Understanding Frugal Living: More Than Just Saving Money

Frugal living is an age-old concept that has gained renewed popularity in recent years, especially as people seek financial stability and a more sustainable lifestyle. At its core, frugal living is about making conscious choices to optimize your spending and maximize the value of your hard-earned money. It's a mindset shift that empowers you to take charge of your financial destiny.

Contrary to popular belief, frugal living is not about being cheap or miserly. It's about making thoughtful decisions to align your spending with your values and priorities. By adopting cost-saving measures, you can free up resources for the things that truly matter to you, whether it's travel, education, or building a secure future.

The Benefits of Frugal Living

- Financial Freedom: Frugal living is a cornerstone of financial discipline. By spending less than you earn and avoiding unnecessary expenses, you can build a solid financial foundation. This includes reducing debt, increasing savings, and having more control over your financial decisions.

- Reduced Stress: Living frugally can significantly lower financial stress. When you spend wisely, you're less likely to worry about unexpected expenses or struggle to make ends meet. This peace of mind allows you to focus on other aspects of life, such as personal growth and relationships.

- Environmental Impact: Frugal living often goes hand in hand with sustainability. By reducing consumption and embracing a more mindful approach to purchases, you contribute to a more eco-friendly lifestyle. This can include buying second-hand items, reducing waste, and supporting local businesses.

- Personal Growth: Embracing frugality encourages self-reflection and personal development. You learn to differentiate between needs and wants, make informed choices, and develop a sense of financial responsibility. These skills can positively impact various areas of your life.

Practical Tips for Mastering Frugal Living

1. Set Clear Financial Goals

The first step towards successful frugal living is setting clear financial goals. Determine what you want to achieve in the short and long term. Are you saving for a dream vacation, paying off student loans, or building an emergency fund? Define your goals and break them down into actionable steps. For instance, if you aim to save $5,000 in a year, calculate how much you need to save monthly and create a plan to achieve it.

2. Create a Realistic Budget

Budgeting is a fundamental aspect of frugal living. Create a detailed monthly budget that outlines your income, fixed expenses (rent, utilities), variable expenses (groceries, entertainment), and savings. Track your spending to identify areas where you can cut back without feeling deprived. Consider using budgeting apps or spreadsheets to simplify this process.

3. Embrace Smart Shopping Strategies

Shopping is an area where frugal living can make a significant impact. Here are some strategies to help you save:

- Plan Your Meals: Create a weekly meal plan and grocery list to avoid unnecessary purchases. Buy in bulk for non-perishable items and shop sales for fresh produce. Cooking at home is generally more cost-effective than dining out.

- Compare Prices: Utilize price comparison websites and apps to find the best deals on items you need. Look for discounts, coupons, and loyalty programs to maximize savings.

- Shop Second-Hand: Explore thrift stores, consignment shops, and online marketplaces for gently used items. You can find high-quality clothing, furniture, and electronics at a fraction of the retail price.

- Practice Patience: Delay gratification and avoid impulse buying. If you want something, wait a few days or weeks before purchasing. This gives you time to evaluate if it's a genuine need or a passing desire.

4. Cut Back on Non-Essential Expenses

Identify areas of discretionary spending that can be reduced without affecting your quality of life. Here are some ideas:

- Entertainment: Opt for free or low-cost activities like hiking, picnics, or hosting game nights with friends. Explore local community events and take advantage of free museum days or discounted movie tickets.

- Subscriptions and Memberships: Review your monthly subscriptions and cancel or downgrade those you rarely use. Consider sharing streaming services with family or friends to split costs.

- Transportation: If feasible, walk, bike, or use public transportation instead of driving. Carpooling and ride-sharing can also reduce transportation costs.

- Personal Care: Learn to do simple tasks yourself, such as haircuts, manicures, or basic car maintenance. These skills can save you money and provide a sense of accomplishment.

5. Embrace a Minimalist Lifestyle

Minimalism and frugal living often go hand in hand. By simplifying your life and focusing on what truly matters, you can reduce expenses and find contentment in the essentials. Here's how:

- Declutter Your Space: Go through your belongings and donate or sell items you no longer need. A clutter-free environment can lead to a clearer mind and less desire for unnecessary purchases.

- Buy with Purpose: Before buying something new, ask yourself if it adds value to your life. Avoid impulse purchases and focus on quality over quantity.

- Experience Over Possessions: Shift your focus from material possessions to experiences. Invest in activities that bring you joy and create lasting memories, such as learning a new skill or exploring a new hobby.

Overcoming Challenges and Staying Motivated

Adopting a frugal lifestyle can be challenging, especially when it feels like you're missing out on certain experiences. Here are some tips to stay motivated:

- Define Your 'Why': Remind yourself of your financial goals and the reasons behind your frugal choices. Whether it's achieving financial independence or supporting a cause close to your heart, keep your motivation front and center.

- Find Frugal Friends: Surround yourself with like-minded individuals who share your values. They can provide support, share money-saving tips, and make frugal living more enjoyable.

- Celebrate Small Wins: Acknowledge and celebrate your progress, no matter how small. Whether it's paying off a credit card or saving a certain amount, reward yourself with a frugal treat, like a homemade meal or a free outdoor activity.

- Stay Informed: Stay updated on personal finance topics and frugal living strategies. Read blogs, listen to podcasts, or join online communities where you can learn and share experiences.

Conclusion: A Fulfilling Life Through Frugal Living

Frugal living is not about sacrificing happiness or living a life of deprivation. It's about making intentional choices to align your spending with your values and goals. By embracing cost-saving measures, you gain control over your finances, reduce stress, and create a more sustainable future.

Remember, frugal living is a journey, and it's okay to make mistakes along the way. Stay focused on your 'why,' adapt these strategies to your unique circumstances, and celebrate the progress you make. With time and consistency, you'll master the art of frugal living and discover a more fulfilling and financially secure life.

So, are you ready to embark on this exciting journey? Start small, stay motivated, and watch your financial dreams become a reality!

Marketing

View All

January 23, 2025

Social Media in Digital Marketing 2024Learn how social media is revolutionizing digital marketing in 2024. Boost your brand with actionable tips for viral campaigns!

Mia Anderson

January 23, 2025

10 Content Strategies for Digital SuccessCreate winning content with these 10 proven digital marketing strategies. Enhance engagement and conversions starting today!

Mia Anderson

January 20, 2025

5 Best Digital Marketing Tools for GrowthUncover the top 5 digital marketing tools every marketer needs. Boost efficiency, drive results, and streamline your campaigns now!

Mia Anderson

Entertainment

View AllDiscover the fascinating history of superhero movies, from early adaptations to modern blockbusters. Uncover surprising facts and insights click to explore!

Mia Anderson

Unlock the secrets to going viral on TikTok with these 2024 strategies. From trend-spotting to unique twists, learn how to boost your visibility and engagement. Start creating viral content today!

Mia Anderson

Learn the key steps to start a YouTube channel in 2024, from content strategy to monetization. Click here for expert advice and actionable tips!

Mia Anderson

Discover the latest tips and trends for making a short film in 2024. Learn from experts and get started on your cinematic journey today!

Mia Anderson

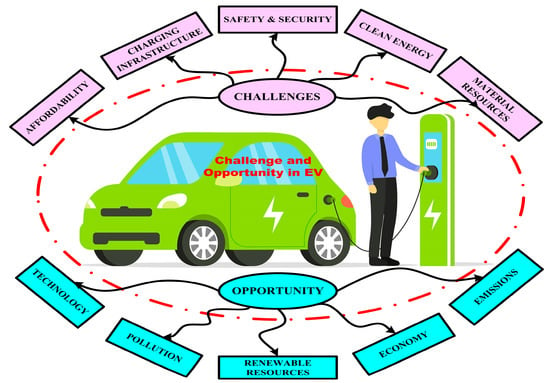

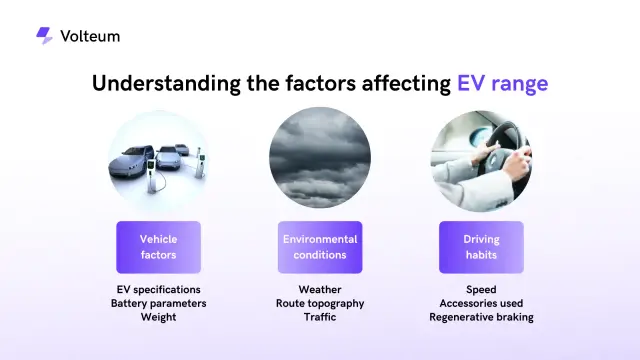

Automotive

View AllExplore the growth of residential EV charging solutions, from home setups to energy-efficient charging options.

Read MoreDiscover the latest innovations in lightweight materials for EVs. How do these advancements improve performance and efficiency?

Read MoreDiscover real-world experiences of long-distance EV travel. Learn how EV owners tackle range anxiety and plan road trips.

Read MorePolular🔥

View All

1

2

3

4

5

6

7

8

9

10

Technology

View All

September 12, 2024

Comprehensive Machine Learning Tutorial for Beginners

Master machine learning with our detailed tutorial. Learn the fundamentals and advance your skills today. Start your journey into AI now!

August 13, 2024

The Top SOC 2 Compliance Companies: Securing Your Data

Discover the leading SOC 2 Compliance companies and learn how they can help protect your organization's sensitive data. Click to explore the best options for safeguarding your business.

December 17, 2024

The Best Tech Gifts for 2024 – Shop Before They Sell Out!

Find the perfect tech gifts for everyone on your list! Click to explore the hottest gadgets and shop before they're gone.

Tips & Trick