Top 7 Financial Habits That Will Change Your Life

Mia Anderson

Photo: Top 7 Financial Habits That Will Change Your Life

When it comes to personal finance, developing healthy habits can be a game-changer, setting you on a path to financial success and security. While it may seem daunting to overhaul your entire financial approach, adopting a few key habits can significantly impact your overall financial well-being. Here are seven powerful financial habits that will revolutionize your relationship with money and set you on the path to a brighter financial future.

1. Embrace Budgeting: The Foundation of Financial Control

The cornerstone of any successful financial journey is budgeting. It's time to bid farewell to the days of wondering where your money disappeared each month. Creating a budget is like crafting a roadmap for your finances, allowing you to take control and make informed decisions. Start by listing your monthly income and fixed expenses, then allocate funds for variable costs and savings.

A well-structured budget provides a clear picture of your financial situation, helping you identify areas where you can cut back and save more. It empowers you to prioritize your spending, ensuring that your money aligns with your values and goals. With a budget in place, you'll gain a sense of financial control and confidence, no longer feeling like your money is controlling you.

2. Pay Yourself First: Prioritize Savings

One of the most transformative financial habits is paying yourself first. This concept is simple yet powerful: allocate a portion of your income to savings before addressing any other expenses. Set up automatic transfers to your savings account each time you receive your paycheck, ensuring that saving becomes a priority.

By paying yourself first, you prioritize your financial well-being and future goals. Whether it's building an emergency fund, saving for a dream vacation, or investing for retirement, this habit ensures that you consistently contribute to your financial security. As your savings grow, you'll feel a sense of accomplishment and peace of mind, knowing you're prepared for life's unexpected twists and turns.

3. Live Below Your Means: A Key to Financial Freedom

Living below your means is a fundamental habit that can significantly impact your financial journey. It involves spending less than you earn, creating a gap between your income and expenses. This practice allows you to allocate more money towards savings, investments, or debt repayment, ultimately accelerating your financial progress.

Start by evaluating your current spending habits and identifying areas where you can cut back. Perhaps it's cooking more meals at home instead of dining out, negotiating better rates on your insurance policies, or finding more affordable entertainment options. By making conscious choices to live within a realistic budget, you'll gain financial freedom and reduce the stress associated with overspending.

4. Automate Your Finances: Effortless Money Management

Automation is your secret weapon in the quest for financial success. By setting up automatic transfers and payments, you simplify your financial life and ensure that essential tasks are completed without the risk of human error or forgetfulness.

Automate your savings by scheduling regular transfers from your checking account to your savings or investment accounts. Similarly, set up automatic payments for recurring bills, such as rent, utilities, and subscriptions. This habit not only saves you time and effort but also helps you avoid late fees and maintain a healthy credit score. With automation, you can focus on other aspects of your financial journey, knowing that the basics are taken care of.

5. Regularly Review and Adjust Your Financial Plan

Financial planning is not a set-it-and-forget-it endeavor it requires regular attention and adjustments. Make it a habit to review your financial situation periodically, ideally every quarter or at least twice a year. Assess your budget, savings progress, investment performance, and debt repayment plans.

During these reviews, identify areas where you can improve or optimize your financial strategies. Perhaps you've received a raise and can increase your savings rate, or maybe you've paid off a significant debt and can redirect those funds towards investments. Regularly evaluating your financial plan ensures that you stay on track, adapt to life changes, and make the most of your financial resources.

6. Educate Yourself: The Power of Financial Knowledge

Financial literacy is a valuable asset in your journey towards financial success. Make it a habit to continuously educate yourself about personal finance, investing, and money management. Stay updated on economic trends, tax laws, and investment opportunities.

Read books, listen to podcasts, attend webinars, or enroll in online courses to expand your financial knowledge. Understanding concepts like compound interest, diversification, and risk management will empower you to make better financial decisions. By investing time in your financial education, you'll gain the confidence to navigate the complexities of the financial world and make informed choices that align with your goals.

7. Set Clear Financial Goals: A Roadmap to Success

Setting clear and specific financial goals is a habit that provides direction and motivation. Whether it's saving for a down payment on a house, paying off student loans, or achieving financial independence, having defined goals keeps you focused and accountable.

Break down your goals into actionable steps and assign timelines. For example, if you aim to save a certain amount for a house down payment in three years, calculate the monthly savings required and adjust your budget accordingly. Regularly track your progress and celebrate milestones along the way. Setting clear goals and working towards them will keep you motivated and help you stay committed to your financial journey.

Conclusion

Transforming your financial life is within reach when you adopt these seven powerful habits. Budgeting, paying yourself first, living below your means, automating finances, regular reviews, financial education, and setting clear goals are all integral parts of a successful financial journey.

By implementing these habits, you'll gain control over your finances, build wealth, and achieve financial security. Remember, personal finance is a lifelong journey, and these habits will provide the foundation for a bright and prosperous future. Start small, stay consistent, and watch as these habits compound into significant financial success. Your financial freedom awaits!

Marketing

View All

January 23, 2025

Social Media in Digital Marketing 2024Learn how social media is revolutionizing digital marketing in 2024. Boost your brand with actionable tips for viral campaigns!

Mia Anderson

January 25, 2025

Email Marketing in the Digital AgeUnlock the power of email marketing with modern strategies tailored for the digital age. Connect with your audience like never before!

Mia Anderson

January 19, 2025

How to Master Digital Marketing BasicsLearn the essentials of digital marketing in this beginner-friendly guide. Kickstart your journey with step-by-step strategies. Start mastering today!

Mia Anderson

Entertainment

View AllUncover the top TV series of 2024! From thrilling dramas to binge-worthy comedies, find your next obsession. Don’t miss out click now to explore!

Mia Anderson

Discover the best streaming services for 2024 and find your next favorite show. Read now for expert recommendations and start streaming today!

Mia Anderson

The definitive manual on how internet streaming services have evolved. Learn how to keep ahead of the curve by exploring the theories, tactics, and inventions influencing the future of streaming.

Mia Anderson

Discover the fascinating history of superhero movies, from early adaptations to modern blockbusters. Uncover surprising facts and insights click to explore!

Mia Anderson

Automotive

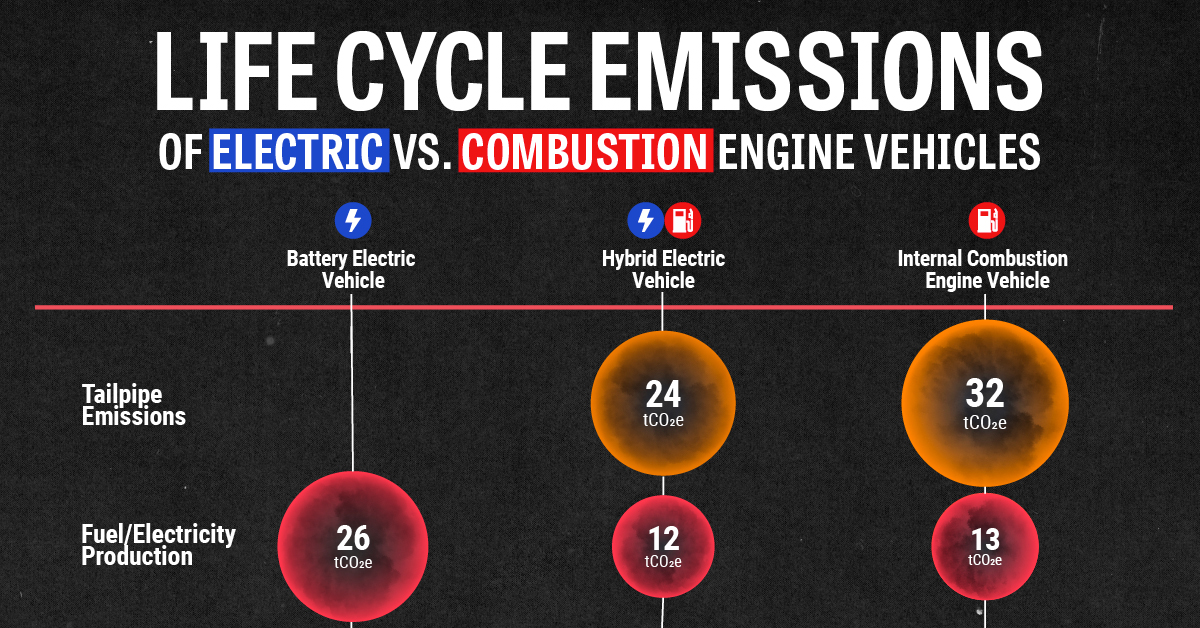

View AllCompare the lifecycle emissions of electric vehicles (EVs) and internal combustion engines (ICE). Which is better for the planet?

Read MoreExplore how government subsidies are driving EV sales globally. Learn the impact on adoption rates and market growth.

Read MoreSimplify dealership management with these Dealer Daily hacks. Master your workflow and enhance customer satisfaction today!

Read MorePolular🔥

View All

1

2

4

5

6

7

8

9

10

Technology

View All

August 13, 2024

The Top SOC 2 Compliance Companies: Securing Your Data

Discover the leading SOC 2 Compliance companies and learn how they can help protect your organization's sensitive data. Click to explore the best options for safeguarding your business.

August 9, 2024

The Power of NLP and Machine Learning: Friends or Foes?

Discover the possibilities of natural language processing and how machine learning relates to it. Discover the fascinating possibilities these technologies have for the future as well as how they are reshaping our reality.

September 15, 2024

Discover the Top Fintech Startups Revolutionizing 2024

Explore 2024 leading fintech startups driving innovation. Uncover new trends and insights. Read now to stay ahead in the fintech revolution!