Inflation Eases in 2024: What It Means for Your Finances

Mia Anderson

Photo: Inflation Eases in 2024: What It Means for Your Finances

ISEKUN - the rate at which prices for goods and services are rising, has been a significant concern for many individuals and businesses in recent years. However, as we enter 2024, there is a glimmer of hope: inflation is easing. This shift in economic trends brings about a mix of relief and uncertainty. In this article, we will delve into the latest inflation news, explore the trends and forecasts for 2024, and discuss how these changes might impact your finances.

Understanding Inflation

To grasp the significance of easing inflation, it's essential to understand what inflation is and how it affects the economy. Inflation is the rate at which the general level of prices for goods and services is rising, and, subsequently, purchasing power is falling. It's often measured using the Consumer Price Index (CPI), which tracks the prices of a basket of goods and services commonly purchased by households.

In the United States, the Federal Reserve closely monitors inflation rates to ensure they remain within a healthy range. The Federal Reserve's dual mandate includes maintaining maximum employment and keeping prices stable. When inflation rises too high, it can erode the purchasing power of consumers, reduce savings, and potentially lead to higher interest rates to combat it.

Inflation News 2024: Trends and Forecasts

As we navigate the economic landscape of 2024, several key trends and forecasts are emerging:

1. US Inflation Rate

The latest data from the Bureau of Labor Statistics (BLS) indicates that the US inflation rate has been trending downward. In July 2024, the annual inflation rate stood at 2.5%, down from its peak of 7.1% in January 2023. This decline is largely attributed to a decrease in energy prices and stabilizing food costs.

2. Consumer Price Index (CPI)

The CPI, a widely used indicator of inflation, has also shown a downward trajectory. The CPI measures the weighted average of prices of a basket of goods and services. In 2024, the CPI has been influenced by lower prices for housing, transportation, and healthcare services.

3. Federal Reserve Inflation Update

The Federal Reserve has been closely monitoring these trends and has adjusted its monetary policy accordingly. In response to easing inflation, the Fed has hinted at potential interest rate cuts in the coming months. This move aims to stimulate economic growth while maintaining price stability.

Impact on Savings and Investments

Easing inflation can have both positive and negative impacts on savings and investments:

1. Impact on Savings

For savers, lower inflation means that their money will retain more purchasing power over time. This is particularly beneficial for those relying on fixed-income investments like certificates of deposit (CDs) or savings accounts.

2. Impact on Investments

On the other hand, investors need to consider how lower inflation might affect their portfolios. For instance, bonds typically offer lower returns in a low-inflation environment because their value is tied to interest rates. Conversely, stocks and real estate might perform better as lower inflation can lead to increased consumer spending and economic growth.

Inflation Protection Strategies

While easing inflation is a welcome development, it's crucial to remain vigilant about protecting your finances from potential future price increases. Here are some strategies to consider:

1. Diversification

Spread your investments across various asset classes to mitigate the impact of any future inflation spikes. A diversified portfolio can help you ride out economic fluctuations.

2. Inflation-Linked Investments

Invest in assets that are directly linked to inflation, such as Treasury Inflation-Protected Securities (TIPS) or inflation-indexed annuities. These investments offer returns that are adjusted for inflation, ensuring your purchasing power remains intact.

3. Real Estate

Real estate can be a solid hedge against inflation. As prices rise, the value of your property increases, providing a potential source of wealth.

Economic Forecasts 2024

Economic forecasts for 2024 suggest a continued easing of inflationary pressures. However, it's essential to remain cautious and monitor developments closely. Here are some key forecasts:

1. GDP Growth

The US GDP is expected to grow at a moderate pace in 2024, driven by consumer spending and business investment. This growth should help sustain economic recovery while keeping inflation in check.

2. Interest Rates

As mentioned earlier, interest rates might see a downward trend in response to easing inflation. Lower interest rates can stimulate borrowing and spending, further supporting economic growth.

Conclusion

The easing of inflation in 2024 brings both relief and opportunities. While it's essential to celebrate this development, it's equally important to remain proactive in managing your finances. By understanding the latest trends and forecasts, diversifying your investments, and employing inflation protection strategies, you can navigate the ever-changing economic landscape with confidence.

In conclusion, the easing of inflation is a positive sign for the economy, but it's crucial to stay informed and adaptable. By doing so, you can make the most of this trend and ensure your financial well-being in the years to come.

Additional Tips for Readers

- Stay Informed: Regularly check economic news and updates from reliable sources like the Federal Reserve or the Bureau of Labor Statistics.

- Diversify: Spread your investments across different asset classes to minimize risk.

- Review Budget: Adjust your budget according to the current economic conditions to maximize savings.

- Consider Long-Term Goals: Think about long-term financial goals and plan accordingly, taking into account potential future economic scenarios.

By following these tips and staying informed about inflation news, you can better navigate the complexities of the economy and make informed decisions about your finances.

Marketing

View All

January 22, 2025

The Future of Digital Marketing RevealedExplore where digital marketing is headed in the next decade. From AI to VR, see what’s shaping the future of online marketing. Don’t get left behind!

Mia Anderson

January 21, 2025

Why Digital Marketing is Vital for SMBsDiscover why small businesses must adopt digital marketing in 2024. Learn tips and tactics to compete in the digital age. Take your business online today!

Mia Anderson

January 23, 2025

Social Media in Digital Marketing 2024Learn how social media is revolutionizing digital marketing in 2024. Boost your brand with actionable tips for viral campaigns!

Mia Anderson

Entertainment

View AllExplore the latest trends in fan fiction for 2024. Learn what fan fiction is, its impact on media, and why it’s a thriving creative outlet. Read now!

Mia Anderson

Discover the best streaming services of 2024 with our in-depth reviews. Find out which platforms offer the best value and why you should choose them. Read now!

Mia Anderson

Discover the top podcasting trends of 2024 and stay ahead in the industry. Learn how to leverage new insights click now to future-proof your podcast!

Mia Anderson

Unlock the secrets to an unforgettable movie trivia night with our ultimate guide. Get tips, trivia questions, and game ideas to boost your event's fun!

Mia Anderson

Automotive

View AllUnlock the secrets to getting top dollar for your car! Prep, price, and promote effectively.

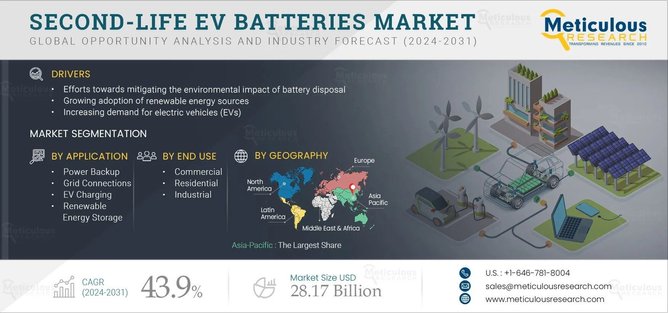

Read MoreLearn how second-life EV batteries are helping reduce environmental impact by providing sustainable energy solutions.

Read MoreCompare trends in luxury and budget EV offerings. Find out which one suits your needs and budget in 2024.

Read MorePolular🔥

View All

1

2

3

4

5

6

7

9

10

Technology

View All

September 15, 2024

Discover the Best Project Management Software of 2024

Discover the best project management software of 2024! Uncover top picks, latest trends, and expert reviews. Click now to streamline your projects!

December 10, 2024

Best Tech Gadgets for Remote Workers in 2024 – Don’t Miss These!

Boost your productivity with the top tech gadgets for remote work! Click to discover must-have tools to enhance your work-from-home setup.

August 29, 2024

Top SaaS Trends Shaping Business Success in 2024

Discover the latest SaaS trends revolutionizing businesses in 2024. Learn how these innovations can boost efficiency and drive growth. Read now!

Tips & Trick