The Ultimate Guide to Unlocking a Company Credit Line

Mia Anderson

Photo: The Ultimate Guide to Unlocking a Company Credit Line

A company credit line is a powerful tool for small businesses and startups seeking financial flexibility and growth. It serves as a safety net, providing quick access to funds whenever needed, much like a credit card with a set spending limit. This guide will take you through the ins and outs of unlocking a company credit line, offering valuable insights into the world of business financing.

Understanding the Benefits

A company credit line offers numerous advantages over traditional loans. Here are some key benefits:

- Financial Flexibility: With a credit line, businesses can easily manage cash flow and cover short-term expenses. It's a great way to bridge the gap between incoming and outgoing funds, ensuring smooth operations.

- Quick Access to Capital: Unlike lengthy loan applications, a credit line provides immediate access to funds. This is especially beneficial for seizing time-sensitive opportunities, such as inventory purchases or equipment upgrades.

- Improved Negotiating Power: Having a credit line enhances your negotiating position with suppliers. Businesses can negotiate better terms, take advantage of bulk purchase discounts, and improve overall profitability.

- Strategic Growth Opportunities: A credit line isn't just for covering expenses; it's an investment in your business's future. Funds can be used to expand product lines, enhance marketing efforts, or improve operational efficiency, positioning your company for long-term success.

Securing a Company Credit Line

Now, let's delve into the process of obtaining a company credit line. There are several steps to follow and requirements to meet, but with proper planning and preparation, you'll be well on your way.

Step 1: Build Your Business Credit History

Lenders will assess your business's creditworthiness, so it's crucial to establish a strong credit history. This includes obtaining a business credit score, which factors in elements like payment history, credit utilization, and public records. You can build business credit by obtaining a federal tax identification number, opening a business bank account, and responsibly using business credit cards or loans.

Step 2: Prepare the Necessary Documentation

Lenders will require various documents to verify your business's legitimacy and financial health. These typically include business certificates, licenses, tax returns, financial statements, and proof of business ownership. Online lenders may have more relaxed requirements, sometimes only needing a business checking account.

Step 3: Shop Around and Compare Lenders

Don't settle for the first lender you find. Compare interest rates, credit limits, repayment terms, and other factors across multiple lenders. Shop around for the best deal, just as you would for any other significant purchase. Online marketplaces and brokers can help you efficiently compare multiple offers.

Step 4: Meet Lender Requirements

Each lender has specific requirements, so it's essential to understand what they're looking for. Common criteria include a minimum time in business, annual revenue thresholds, and a good personal credit score (if your business credit history is limited). Meeting these requirements improves your chances of approval.

Success Story: Sarah's Experience

Sarah, the owner of a small bakery, shared her experience with unlocking a company credit line:

"As a small business owner, I needed financial flexibility to manage cash flow and invest in growth opportunities. With a company credit line, I was able to purchase a new commercial oven during a busy season, and it made all the difference. The quick approval process and access to funds were game-changers. My bakery saw a significant increase in sales, and I'm now considering expanding my product line with the confidence that I have the financial support to do so."

Conclusion

Unlocking a company credit line is a strategic move that empowers small businesses and startups. It provides financial flexibility, improves negotiating power, and enables business owners to seize growth opportunities. By following the steps outlined in this guide, you can confidently navigate the process of securing a company credit line and unlock the full potential of your business.

Marketing

View All

January 21, 2025

Why Digital Marketing is Vital for SMBsDiscover why small businesses must adopt digital marketing in 2024. Learn tips and tactics to compete in the digital age. Take your business online today!

Mia Anderson

January 19, 2025

How to Master Digital Marketing BasicsLearn the essentials of digital marketing in this beginner-friendly guide. Kickstart your journey with step-by-step strategies. Start mastering today!

Mia Anderson

January 27, 2025

PPC vs SEO: Digital Marketing ShowdownDiscover the differences between PPC and SEO in digital marketing. Find out which strategy is right for your goals and budget. Make an informed choice today!

Mia Anderson

Entertainment

View AllDiscover the best streaming services of 2024 with our in-depth reviews. Find out which platforms offer the best value and why you should choose them. Read now!

Mia Anderson

Explore the latest trends in virtual reality gaming for 2024. Our in-depth guide covers new technology and gameplay innovations. Discover more now!

Mia Anderson

Discover the top 10 TV series that everyone is talking about. Dive into binge-worthy shows that will keep you hooked click to start your next TV obsession!

Mia Anderson

Explore the latest trends in fan fiction for 2024. Learn what fan fiction is, its impact on media, and why it’s a thriving creative outlet. Read now!

Mia Anderson

Automotive

View AllWhat are the unique challenges to EV adoption in Latin America? Discover the barriers and potential solutions for growth.

Read MoreDiscover trends driving EV range improvements. Learn how automakers are tackling range anxiety with groundbreaking solutions.

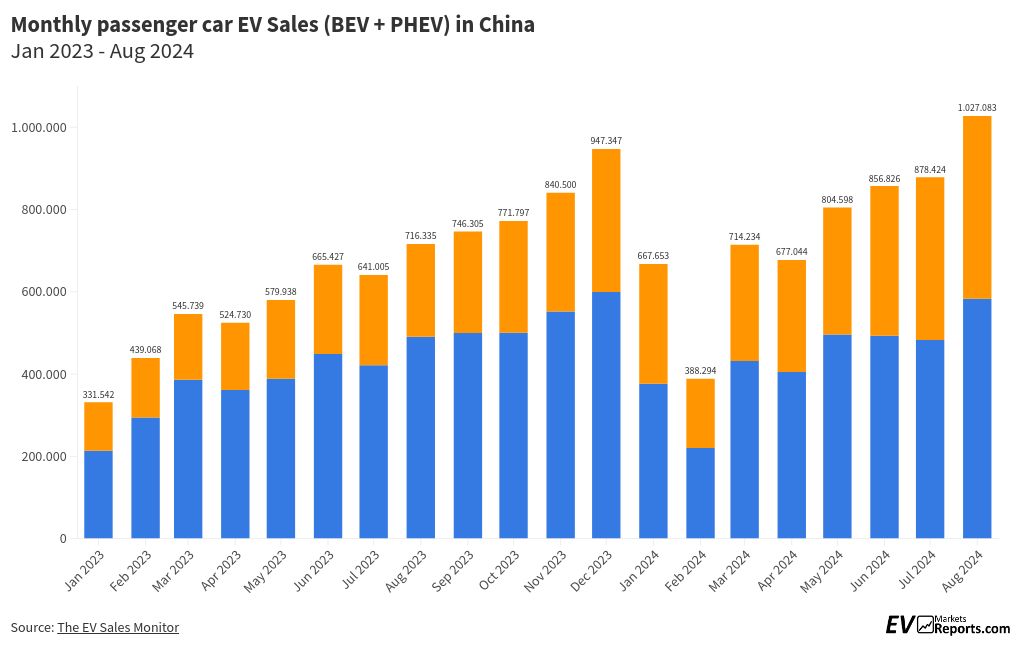

Read MoreDiscover the latest trends in electric vehicle adoption in China. What factors are driving this rapid growth?

Read MorePolular🔥

View All

1

2

3

4

5

6

7

8

9

10

Technology

View All

December 5, 2024

How to Save Big on High-End Tech Products: 6 Hacks You Need to Try

Unlock massive savings on high-end tech! Discover 6 insider hacks to get the best deals. Click to learn more and start saving today.

December 18, 2024

How to Get the Best Deals on Smartphones This Month

Discover the hottest smartphone deals this month! Click to learn insider tips and save big on your next purchase.

August 9, 2024

The Evolution of Mobile Technology: A Journey to Super Connectivity

Learn about the amazing evolution of mobile technology from 1G to 5G and beyond! Discover the inventions that impacted our world and altered communication. Discover the future with quantum & 6G technology!