Transform Your Credit with These Top Credit Repair Services

Mia Anderson

Photo: Transform Your Credit with These Top Credit Repair Services

Managing your credit can often feel like navigating a complex maze. With a multitude of credit repair services available, selecting the right one can make all the difference in improving your financial health. This article delves into some of the best credit repair services, helping you understand how to choose the right solution for your needs and offering insights into effective credit restoration strategies.

Understanding Credit Repair Services

Credit repair services are designed to help individuals improve their credit scores and overall credit profiles. These services work by addressing inaccuracies on your credit report, negotiating with creditors, and providing advice on how to build better credit habits. While many services promise quick fixes, it's crucial to differentiate between those that are reputable and those that may not deliver on their promises.

Best Credit Repair Services

When searching for the best credit repair services, consider looking for companies that offer comprehensive solutions. These services typically include:

- Credit Report Analysis: A thorough review of your credit reports to identify errors or discrepancies.

- Dispute Resolution: Assistance with disputing incorrect information with credit bureaus.

- Negotiation with Creditors: Help in negotiating with creditors to settle outstanding debts or remove negative marks.

- Credit Counseling: Guidance on how to manage your finances and build positive credit habits.

Top Credit Repair Companies

Among the top credit repair companies, several stand out for their effectiveness and customer satisfaction:

- Lexington Law: Known for its comprehensive credit repair services and experienced team of attorneys, Lexington Law offers personalized credit repair solutions and in-depth credit analysis.

- CreditRepair.com: This company provides a user-friendly platform with tools for tracking progress and managing disputes. It is particularly noted for its customer support and transparent pricing.

- Sky Blue Credit: With a focus on affordability and simplicity, Sky Blue Credit offers a straightforward approach to credit repair, including credit report analysis and dispute management.

Credit Score Improvement Services

Improving your credit score requires more than just repairing inaccuracies. Effective credit score improvement services include:

- Credit Monitoring: Continuous monitoring of your credit report to catch and address issues early.

- Debt Management Plans: Structured plans to help you pay down debts and improve your credit utilization ratio.

- Financial Education: Resources and advice on managing finances, budgeting, and understanding credit scores.

Affordable Credit Repair Solutions

For those concerned about the cost of credit repair, there are affordable solutions available. These options often include:

- DIY Credit Repair Kits: Tools and resources that allow you to manage credit repair on your own, typically at a lower cost.

- Budget-Friendly Services: Companies that offer tiered pricing based on the level of service required, making it easier to find an option that fits your budget.

Professional Credit Repair Help

Sometimes, professional assistance is necessary for more complex credit issues. Professional credit repair help can be invaluable in situations such as:

- Debt Settlement: Negotiating with creditors to reduce the amount owed and improve your credit profile.

- Complex Disputes: Addressing intricate credit report errors that may require legal expertise.

Credit Repair Experts

Credit repair experts bring specialized knowledge to the table. They can provide:

- In-Depth Credit Analysis: A detailed examination of your credit history and current status.

- Strategic Advice: Tailored recommendations for improving your credit based on your unique situation.

Effective Credit Restoration

Effective credit restoration involves a combination of strategies, including:

- Timely Bill Payments: Ensuring that all bills are paid on time to avoid late payments affecting your credit score.

- Reducing Credit Utilization: Keeping credit card balances low relative to your credit limits.

Trusted Credit Repair Providers

Choosing a trusted credit repair provider involves:

- Reputation Check: Researching the company's track record and customer reviews.

- Transparent Practices: Ensuring the provider offers clear information about their services and pricing.

Quick Credit Repair Services

If you need to see results quickly, look for credit repair services that offer:

- Expedited Dispute Resolution: Fast processing of disputes to correct inaccuracies swiftly.

- Rapid Credit Monitoring: Immediate alerts on changes to your credit report.

Credit Repair for Bad Credit

For those with poor credit, specialized services can provide:

- Customized Repair Plans: Tailored strategies to address specific credit issues and improve your score over time.

- Support for Rebuilding Credit: Assistance with creating a plan to gradually rebuild your credit profile.

Conclusion

Transforming your credit is a journey that requires careful consideration of available services. By choosing the right credit repair service, you can effectively address inaccuracies, improve your credit score, and achieve better financial health. Whether you opt for professional assistance or affordable DIY solutions, the key is to select a service that aligns with your needs and offers proven results.

Marketing

View All

January 23, 2025

Social Media in Digital Marketing 2024Learn how social media is revolutionizing digital marketing in 2024. Boost your brand with actionable tips for viral campaigns!

Mia Anderson

January 23, 2025

10 Content Strategies for Digital SuccessCreate winning content with these 10 proven digital marketing strategies. Enhance engagement and conversions starting today!

Mia Anderson

January 20, 2025

5 Best Digital Marketing Tools for GrowthUncover the top 5 digital marketing tools every marketer needs. Boost efficiency, drive results, and streamline your campaigns now!

Mia Anderson

Entertainment

View AllDiscover the fascinating history of superhero movies, from early adaptations to modern blockbusters. Uncover surprising facts and insights click to explore!

Mia Anderson

Unlock the secrets to going viral on TikTok with these 2024 strategies. From trend-spotting to unique twists, learn how to boost your visibility and engagement. Start creating viral content today!

Mia Anderson

Learn the key steps to start a YouTube channel in 2024, from content strategy to monetization. Click here for expert advice and actionable tips!

Mia Anderson

Discover the latest tips and trends for making a short film in 2024. Learn from experts and get started on your cinematic journey today!

Mia Anderson

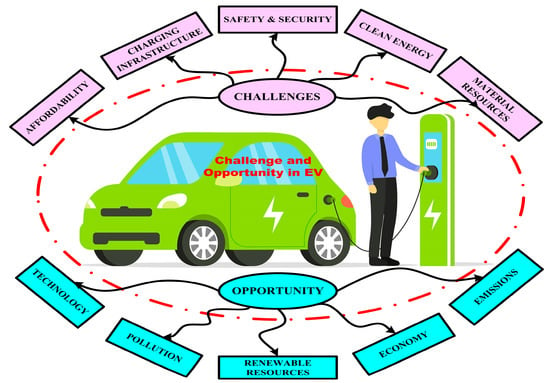

Automotive

View AllExplore the growth of residential EV charging solutions, from home setups to energy-efficient charging options.

Read MoreDiscover the latest innovations in lightweight materials for EVs. How do these advancements improve performance and efficiency?

Read MoreDiscover real-world experiences of long-distance EV travel. Learn how EV owners tackle range anxiety and plan road trips.

Read MorePolular🔥

View All

1

2

3

4

5

6

7

8

9

10

Technology

View All

August 12, 2024

Top HR Software for Small Businesses

Streamline your small business with the best HR software solutions. Discover the top picks for HR management tools to revolutionize your business and boost productivity.

January 21, 2025

CI/CD for Machine Learning: A Complete Guide

Master continuous integration and deployment (CI/CD) for machine learning models. Learn how to streamline your MLOps pipeline!

August 28, 2024

Harnessing Machine Learning Algorithms to Transform Your Insights

Discover the top machine learning algorithms driving innovation today. Learn how they can enhance your data analysis. Click to explore and revolutionize your insights!

Tips & Trick