Why You’re Not Saving Enough for Retirement and How to Fix It

Mia Anderson

Photo: Why You’re Not Saving Enough for Retirement and How to Fix It

Retirement planning is a crucial aspect of financial security, yet many individuals find themselves falling short of their savings goals. The thought of not having enough money for retirement can be daunting, leaving you wondering where you might have gone wrong. This article aims to delve into the reasons why you may not be saving enough for retirement and provide practical solutions to help you get back on track. By understanding the common pitfalls and implementing effective strategies, you can ensure a comfortable and worry-free retirement.

Understanding the Retirement Savings Gap

The Reality of Inadequate Savings

Imagine this: you're approaching your retirement age, eagerly anticipating the freedom and relaxation you've worked hard for. But as you crunch the numbers, a sense of unease creeps in. You realize that your retirement savings might not be sufficient to maintain your desired lifestyle. This scenario is all too common, and it's essential to recognize the factors contributing to this retirement savings gap.

Many individuals struggle with saving for retirement due to various financial challenges and a lack of awareness about long-term financial planning. The reality is that retirement savings is a complex journey, and it's easy to underestimate the amount needed for a secure future.

Common Reasons for Insufficient Savings

- Living Paycheck to Paycheck: Some people find it challenging to save for retirement because they are constantly living from one paycheck to the next. High living expenses, debt repayments, and unexpected costs can leave little room for long-term savings.

- Lack of Financial Education: Financial literacy plays a significant role in retirement planning. Without understanding investment options, tax advantages, and compound interest, individuals may not make the most of their savings potential.

- Procrastination and Delayed Planning: Starting retirement savings early is crucial, but many people tend to delay this important step. Procrastination can lead to missed opportunities for compound growth and a more significant financial burden later in life.

- Unforeseen Circumstances: Life is unpredictable, and unforeseen events like job loss, medical emergencies, or economic downturns can disrupt savings plans. These circumstances can significantly impact retirement savings, especially if they occur during peak earning years.

Strategies to Boost Your Retirement Savings

Taking Control of Your Financial Future

Now that we've identified some of the reasons why retirement savings may fall short, let's explore effective strategies to address these challenges and boost your savings.

1. Create a Realistic Budget and Stick to It

The foundation of successful retirement planning is a well-structured budget. Start by calculating your monthly income and expenses, including essentials like housing, utilities, transportation, and groceries. Then, allocate a portion of your income towards retirement savings. Consider using budgeting apps or spreadsheets to track your spending and identify areas where you can cut back. By creating a realistic budget and adhering to it, you can ensure that your savings goals are achievable and sustainable.

2. Automate Your Savings

One of the simplest yet most effective ways to save for retirement is to automate your contributions. Set up automatic transfers from your paycheck or bank account to your retirement savings accounts, such as a 401(k) or IRA. This way, you save effortlessly without the temptation to spend the money elsewhere. Many employers offer retirement plans with automatic enrollment, making it even easier to start saving.

3. Take Advantage of Employer-Sponsored Plans

If your employer offers a retirement savings plan, such as a 401(k) or 403(b), make sure to participate. These plans often include employer matching contributions, which is essentially free money added to your retirement savings. For example, if your employer matches 50% of your contributions up to 6% of your salary, you should aim to contribute at least that amount to maximize this benefit. Employer-sponsored plans also provide tax advantages, allowing your savings to grow tax-deferred or even tax-free in the case of Roth accounts.

4. Explore Catch-Up Contributions

For those aged 50 and over, catch-up contributions can significantly boost retirement savings. The SECURE 2.0 Act allows individuals to make additional contributions beyond the regular limits. For instance, in 2024, the catch-up contribution limit for 401(k) and IRA accounts is $1,000 for individuals aged 50 and above. Taking advantage of these catch-up provisions can help you make up for lost time and accelerate your savings.

5. Diversify Your Investments

Diversification is a key principle in retirement planning. Instead of relying solely on one type of investment, spread your savings across different asset classes, such as stocks, bonds, mutual funds, and real estate. Diversification helps reduce risk and can lead to more consistent long-term growth. Consider consulting a financial advisor to create a well-diversified portfolio tailored to your risk tolerance and financial goals.

6. Stay Informed and Adapt

Retirement planning is not a set-it-and-forget-it process. Stay informed about changes in tax laws, contribution limits, and investment options. For example, the SECURE 2.0 Act, enacted in 2022, includes various provisions that impact retirement savings, such as increased catch-up contribution limits and federal matching contributions starting in 2027. By staying up-to-date with retirement savings trends and regulations, you can make informed decisions and adapt your strategy accordingly.

Overcoming Psychological Barriers

Changing Your Mindset for Financial Success

Sometimes, the biggest obstacle to saving for retirement is not financial but psychological. Our mindset and attitudes towards money can significantly impact our savings behavior. Here are some ways to overcome psychological barriers:

- Addressing Fear and Uncertainty: The fear of the unknown can deter people from saving for retirement. Educate yourself about retirement planning and seek professional advice to gain confidence in your financial decisions.

- Breaking Bad Habits: If overspending or impulsive buying is holding you back, identify the triggers and develop strategies to change your spending habits. Consider setting short-term savings goals and rewarding yourself for achieving them.

- Visualizing Your Future: Create a clear vision of your retirement lifestyle. Imagine the activities you'll enjoy, the places you'll travel to, and the financial security you'll have. This visualization can serve as a powerful motivator to save more.

- Seeking Support: Retirement planning can be a daunting task, and seeking support from financial advisors, friends, or family can provide valuable guidance and accountability. Sharing your goals and progress with a trusted network can help keep you on track.

Conclusion: Securing Your Financial Future

In conclusion, saving for retirement is a journey that requires discipline, knowledge, and adaptability. By understanding the reasons why you may not be saving enough, you can take proactive steps to enhance your financial security. Implementing the strategies outlined in this article, such as budgeting, automation, and diversification, will help you build a robust retirement savings plan. Remember, it's never too late to start saving, and every dollar contributed brings you closer to a comfortable and fulfilling retirement.

Stay informed, stay disciplined, and take control of your financial future. With the right mindset and a well-structured plan, you can achieve the retirement lifestyle you desire.

Marketing

View All

January 22, 2025

The Future of Digital Marketing RevealedExplore where digital marketing is headed in the next decade. From AI to VR, see what’s shaping the future of online marketing. Don’t get left behind!

Mia Anderson

January 21, 2025

Why Digital Marketing is Vital for SMBsDiscover why small businesses must adopt digital marketing in 2024. Learn tips and tactics to compete in the digital age. Take your business online today!

Mia Anderson

January 23, 2025

Social Media in Digital Marketing 2024Learn how social media is revolutionizing digital marketing in 2024. Boost your brand with actionable tips for viral campaigns!

Mia Anderson

Entertainment

View AllExplore the latest trends in fan fiction for 2024. Learn what fan fiction is, its impact on media, and why it’s a thriving creative outlet. Read now!

Mia Anderson

Discover the best streaming services of 2024 with our in-depth reviews. Find out which platforms offer the best value and why you should choose them. Read now!

Mia Anderson

Discover the top podcasting trends of 2024 and stay ahead in the industry. Learn how to leverage new insights click now to future-proof your podcast!

Mia Anderson

Unlock the secrets to an unforgettable movie trivia night with our ultimate guide. Get tips, trivia questions, and game ideas to boost your event's fun!

Mia Anderson

Automotive

View AllUnlock the secrets to getting top dollar for your car! Prep, price, and promote effectively.

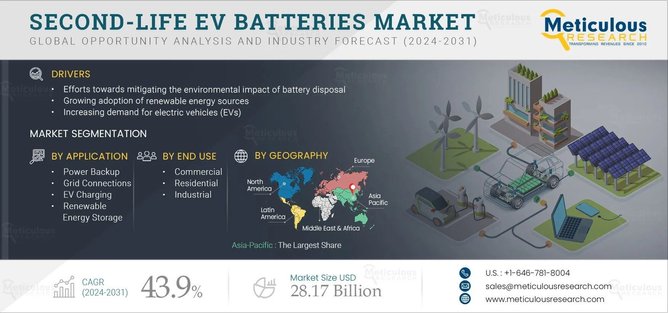

Read MoreLearn how second-life EV batteries are helping reduce environmental impact by providing sustainable energy solutions.

Read MoreCompare trends in luxury and budget EV offerings. Find out which one suits your needs and budget in 2024.

Read MorePolular🔥

View All

1

2

3

4

5

6

7

9

10

Technology

View All

September 15, 2024

Discover the Best Project Management Software of 2024

Discover the best project management software of 2024! Uncover top picks, latest trends, and expert reviews. Click now to streamline your projects!

December 10, 2024

Best Tech Gadgets for Remote Workers in 2024 – Don’t Miss These!

Boost your productivity with the top tech gadgets for remote work! Click to discover must-have tools to enhance your work-from-home setup.

August 29, 2024

Top SaaS Trends Shaping Business Success in 2024

Discover the latest SaaS trends revolutionizing businesses in 2024. Learn how these innovations can boost efficiency and drive growth. Read now!

Tips & Trick