The Ultimate Guide to Managing Small Business Finances

Mia Anderson

Photo: The Ultimate Guide to Managing Small Business Finances

Managing finances is a critical aspect of running a small business, yet it can often feel like a daunting task for many entrepreneurs. As an entrepreneur, you're likely passionate about your product or service, but the financial side of the business may seem like a complex and intimidating territory. Fear not! This comprehensive guide aims to demystify small business finance, providing you with the knowledge and tools to take control of your company's financial health and set it on a path to success.

Understanding the Basics: Laying the Foundation

Before diving into the depths of small business finance, let's start with the fundamentals. The financial health of your business is built upon a few key pillars, each contributing to a stable and prosperous enterprise.

Cash Flow Management: The Lifeblood of Your Business

At the heart of every successful business is effective cash flow management. Cash flow is the movement of money in and out of your business, and it's crucial to ensure that you have more money coming in than going out. This doesn't just mean making sales it's about managing your expenses, payment terms, and cash reserves strategically.

For instance, consider a small bakery owner who offers extended payment terms to a loyal customer. While this may foster a positive relationship, it could also impact the bakery's cash flow if not managed properly. The owner might need to negotiate shorter payment terms or offer a small discount for early payment to ensure a steady cash flow.

Bookkeeping and Accounting: Keeping Track of Every Penny

Accurate bookkeeping and accounting are essential for understanding your business's financial position. Bookkeeping involves recording all financial transactions, while accounting is the process of analyzing and interpreting this data. These practices provide a clear picture of your business's financial health, helping you make informed decisions.

##

Imagine a freelance graphic designer who meticulously records every expense, from software subscriptions to coffee meetings with clients. By categorizing these expenses and regularly reviewing the books, the designer can identify areas to cut costs or negotiate better deals, ensuring that their business remains profitable.

Strategies for Financial Success: Navigating the Journey

Now that we've covered the basics, let's explore some practical strategies to manage your small business finances effectively.

Budgeting: The Roadmap to Financial Control

Creating a budget is like drawing a financial roadmap for your business. It involves forecasting income and expenses, setting financial goals, and allocating resources accordingly. A well-crafted budget helps you stay on track, anticipate financial challenges, and make strategic decisions.

For a small boutique owner, budgeting might include setting aside funds for seasonal inventory purchases, marketing campaigns, and unexpected expenses. By regularly reviewing and adjusting the budget, the owner can ensure that the business remains financially agile and responsive to market changes.

Invoicing and Payment Collection: Getting Paid on Time

Efficient invoicing and timely payment collection are vital to maintaining a healthy cash flow. Clear and professional invoices, sent promptly after delivering goods or services, can significantly improve your payment turnaround. Consider offering various payment methods and providing incentives for early payment to encourage customers to settle their dues promptly.

A web developer, for instance, could use online invoicing software that sends automated payment reminders, reducing the time spent on administrative tasks and increasing the likelihood of prompt payments.

Tax Planning: Navigating the Complexities

Taxes are an inevitable part of running a business, but with proper planning, you can minimize the burden. Understanding the tax obligations for your business type and industry is crucial. Stay up-to-date with tax laws and consider consulting a tax professional to ensure compliance and explore potential deductions or incentives.

A small landscaping business, for example, might be eligible for tax deductions on equipment purchases or fuel expenses. By staying informed and planning ahead, the business owner can reduce tax liabilities and reinvest the savings back into the company.

Embracing Technology: Tools for Financial Management

In today's digital age, numerous tools and software solutions are available to simplify small business finance management. Embracing technology can streamline your financial processes, save time, and reduce the risk of errors.

Accounting Software: Automating the Numbers

Investing in accounting software can revolutionize your financial management. These tools automate many bookkeeping tasks, generate financial reports, and provide real-time insights into your business's financial health. Many software options cater to small businesses, offering user-friendly interfaces and customizable features.

A small marketing agency might use cloud-based accounting software to collaborate with a remote bookkeeper, ensuring that financial records are up-to-date and accessible from anywhere.

Online Banking and Payment Gateways: Secure and Efficient Transactions

Online banking and payment gateways offer secure and efficient ways to manage your business finances. These platforms provide features like automated bill payments, payroll services, and secure online transactions, reducing the time and effort required for routine financial tasks.

For an e-commerce startup, integrating a payment gateway into their website can streamline the checkout process, improve customer experience, and enhance payment security.

Financial Planning for the Long Haul

As your small business grows, so do your financial responsibilities and opportunities. Long-term financial planning is essential to ensure the sustainability and growth of your enterprise.

Business Loans and Funding: Scaling Your Business

At some point, your business may require external funding to expand, invest in new equipment, or weather a financial storm. Understanding the various financing options, such as bank loans, small business grants, or crowdfunding, is crucial. Prepare a solid business plan and financial projections to increase your chances of securing funding.

A local restaurant owner might seek a small business loan to renovate their dining area, attracting more customers and increasing revenue. By presenting a detailed business plan and demonstrating financial responsibility, the owner can secure the necessary funding for growth.

Retirement Planning and Employee Benefits: Investing in Your Team

As your business grows, so does your responsibility towards your employees. Offering competitive benefits, including retirement plans, can help attract and retain top talent. Research various retirement plan options and consult financial advisors to find the best fit for your business and employees.

A tech startup, for instance, might offer a 401(k) plan with employer matching contributions, providing employees with a valuable benefit and fostering a sense of loyalty and commitment.

Conclusion: Empowering Your Financial Journey

Managing small business finances is a journey that requires knowledge, discipline, and adaptability. By understanding the fundamentals, implementing effective strategies, and embracing technology, you can take control of your business's financial future. Remember, financial management is an ongoing process that evolves with your business. Stay informed, seek professional advice when needed, and continuously review and adjust your financial strategies to ensure long-term success.

As you navigate the financial landscape, keep in mind that every successful business started with a dream and a well-managed financial plan. Your entrepreneurial spirit, combined with sound financial practices, will pave the way for a thriving and sustainable business.

Marketing

View All

January 22, 2025

The Future of Digital Marketing RevealedExplore where digital marketing is headed in the next decade. From AI to VR, see what’s shaping the future of online marketing. Don’t get left behind!

Mia Anderson

January 21, 2025

Why Digital Marketing is Vital for SMBsDiscover why small businesses must adopt digital marketing in 2024. Learn tips and tactics to compete in the digital age. Take your business online today!

Mia Anderson

January 23, 2025

Social Media in Digital Marketing 2024Learn how social media is revolutionizing digital marketing in 2024. Boost your brand with actionable tips for viral campaigns!

Mia Anderson

Entertainment

View AllExplore the latest trends in fan fiction for 2024. Learn what fan fiction is, its impact on media, and why it’s a thriving creative outlet. Read now!

Mia Anderson

Discover the best streaming services of 2024 with our in-depth reviews. Find out which platforms offer the best value and why you should choose them. Read now!

Mia Anderson

Discover the top podcasting trends of 2024 and stay ahead in the industry. Learn how to leverage new insights click now to future-proof your podcast!

Mia Anderson

Unlock the secrets to an unforgettable movie trivia night with our ultimate guide. Get tips, trivia questions, and game ideas to boost your event's fun!

Mia Anderson

Automotive

View AllUnlock the secrets to getting top dollar for your car! Prep, price, and promote effectively.

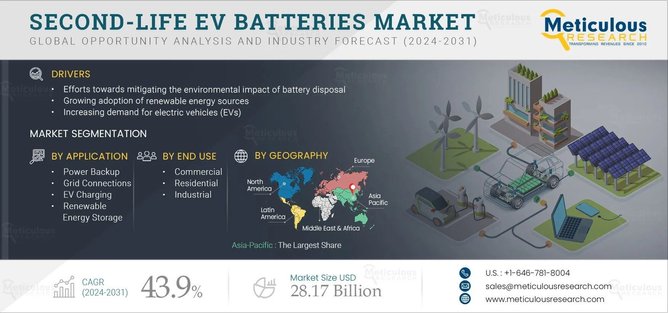

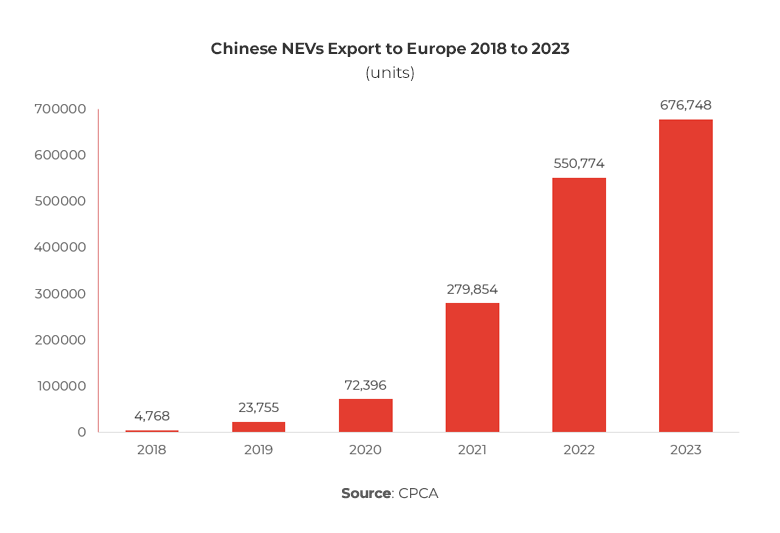

Read MoreLearn how second-life EV batteries are helping reduce environmental impact by providing sustainable energy solutions.

Read MoreCompare trends in luxury and budget EV offerings. Find out which one suits your needs and budget in 2024.

Read MorePolular🔥

View All

1

2

3

4

5

6

7

9

10

Technology

View All

September 15, 2024

Discover the Best Project Management Software of 2024

Discover the best project management software of 2024! Uncover top picks, latest trends, and expert reviews. Click now to streamline your projects!

December 10, 2024

Best Tech Gadgets for Remote Workers in 2024 – Don’t Miss These!

Boost your productivity with the top tech gadgets for remote work! Click to discover must-have tools to enhance your work-from-home setup.

August 29, 2024

Top SaaS Trends Shaping Business Success in 2024

Discover the latest SaaS trends revolutionizing businesses in 2024. Learn how these innovations can boost efficiency and drive growth. Read now!

Tips & Trick