Tax Incentives for EV Buyers: Save Big in 2024

Mia Anderson

Photo: Tax Incentives for EV Buyers: Save Big in 2024

The electric vehicle (EV) revolution is gaining momentum, and for many buyers, 2024 presents an excellent opportunity to make the switch. With increasing government efforts to combat climate change and promote clean energy, tax incentives for EV buyers have become a significant motivator. These incentives can help reduce the cost of EV ownership, making sustainable transportation more accessible. In this article, we’ll explore the tax incentives available in 2024, how they work, and what you need to know to maximize your savings.

Why Governments Offer Tax Incentives for EV Buyers

Governments worldwide are pushing for cleaner energy solutions to reduce greenhouse gas emissions and dependence on fossil fuels. The transportation sector is one of the largest contributors to carbon emissions, making EVs an essential part of the green transition. Tax incentives aim to:

- Encourage Adoption: Financial incentives lower the initial cost barrier for EVs, which often have higher upfront costs compared to traditional vehicles.

- Boost Market Growth: Incentives create demand, encouraging automakers to invest in EV technologies.

- Reduce Carbon Footprints: By supporting EV purchases, governments aim to accelerate the shift to low-emission vehicles, contributing to global climate goals.

Key Tax Incentives for EV Buyers in 2024

1. Federal EV Tax Credits in the U.S.

In the United States, the federal government offers significant tax credits for EV buyers under the Inflation Reduction Act of 2022 (IRA). Here are the key details:

- Maximum Credit Amount: Up to $7,500 for new EVs and $4,000 for used EVs, depending on vehicle and buyer eligibility.

- Eligibility Requirements:

- EVs must be assembled in North America.

- Battery components must meet specific domestic sourcing requirements.

- Income caps apply: For joint filers, the adjusted gross income limit is $300,000, and for single filers, it is $150,000.

- Claiming the Credit: The credit is applied when you file your federal income taxes for the year in which you purchased the vehicle.

2. State and Local EV Incentives

Many U.S. states and cities supplement federal incentives with their own programs. For instance:

- California: Offers rebates of up to $7,500 through the Clean Vehicle Rebate Project (CVRP).

- New York: Provides rebates of up to $2,000 through the Drive Clean Rebate program.

- Colorado: Offers a state tax credit of up to $5,000 for new EV purchases.

These incentives vary widely by location, so check your state’s programs for details.

3. International EV Incentives

Countries like Norway, Germany, and Canada also provide lucrative tax incentives for EV buyers. For example:

- Norway: Exempts EVs from purchase taxes and VAT, significantly lowering costs.

- Germany: Offers grants of up to €9,000 for new EVs.

- Canada: Provides federal rebates of up to CAD 5,000, with additional provincial incentives.

How to Maximize EV Tax Incentives in 2024

1. Research Eligible Models

Not all EVs qualify for incentives. Ensure the model you’re considering meets federal and state requirements. Many automakers provide lists of eligible vehicles to streamline the process.

2. Understand Income Limits

Federal and some state incentives have income thresholds. If your income exceeds these limits, you may not qualify. Planning purchases and consulting a tax advisor can help you navigate these requirements.

3. Explore Financing Options

Some dealerships and financing companies allow you to integrate tax incentives into your down payment or lease terms, reducing upfront costs.

4. Act Quickly

Many state programs operate on a first-come, first-served basis with limited funding. Early action can secure your benefits before funds run out.

Benefits Beyond Tax Savings

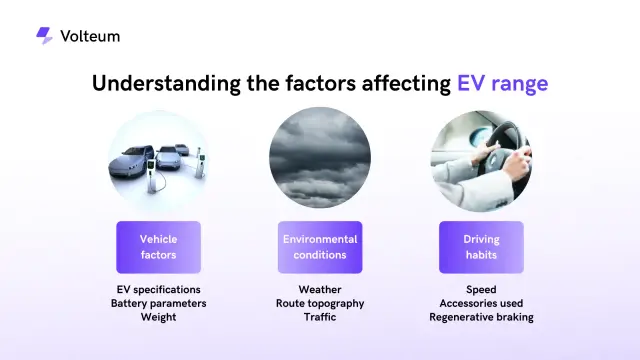

While tax incentives are a major attraction, EV ownership offers additional financial and environmental benefits:

- Lower Operating Costs: EVs are generally cheaper to maintain than gas-powered cars, with lower fuel and maintenance costs.

- Access to HOV Lanes: Some states grant EV owners access to high-occupancy vehicle lanes, reducing commute times.

- Reduced Carbon Footprint: EVs produce no tailpipe emissions, contributing to cleaner air and a healthier planet.

Challenges to Consider

While incentives are appealing, it’s important to consider potential challenges:

- Initial Costs: Even with incentives, some EVs remain more expensive than gas-powered alternatives.

- Charging Infrastructure: Although charging networks are expanding, they may not yet meet the needs of all drivers.

- Eligibility Complexity: Navigating the eligibility criteria for various programs can be daunting.

These challenges highlight the importance of thorough research before making a purchase decision.

The Future of EV Incentives

Tax incentives are expected to evolve as governments aim to balance sustainability goals with market demands. In the coming years, we may see:

- Stricter Requirements: Future incentives might favor EVs with domestically sourced batteries or renewable energy production.

- Phased Reductions: As EV adoption grows, some governments may gradually reduce incentives, encouraging a self-sustaining market.

- Focus on Used EVs: Expanding incentives for used EV purchases could make sustainable transportation more accessible to budget-conscious buyers.

Conclusion

Tax incentives for EV buyers in 2024 offer a golden opportunity to save big while contributing to a greener future. By taking advantage of federal, state, and international programs, buyers can significantly reduce the cost of EV ownership. However, understanding eligibility requirements and acting promptly is essential to maximizing benefits. As governments continue to prioritize sustainability, EV incentives will remain a key driver of the transition to clean transportation.

If you’re considering making the switch, there’s no better time than now. Research your options, consult with experts, and take the first step toward driving a cleaner, more sustainable future.

Marketing

View All

January 22, 2025

The Future of Digital Marketing RevealedExplore where digital marketing is headed in the next decade. From AI to VR, see what’s shaping the future of online marketing. Don’t get left behind!

Mia Anderson

January 18, 2025

Top 10 Digital Marketing Trends for 2024Discover the must-know digital marketing trends for 2024. Stay ahead of the curve and elevate your strategies with these insights! Read more now!

Mia Anderson

January 21, 2025

Why Digital Marketing is Vital for SMBsDiscover why small businesses must adopt digital marketing in 2024. Learn tips and tactics to compete in the digital age. Take your business online today!

Mia Anderson

Entertainment

View AllThe definitive manual on how internet streaming services have evolved. Learn how to keep ahead of the curve by exploring the theories, tactics, and inventions influencing the future of streaming.

Mia Anderson

Discover the latest strategies for creating a successful podcast in 2024. Learn key tips and techniques to launch and grow your show effectively. Read now!

Mia Anderson

Discover the best streaming services of 2024 with our in-depth reviews. Find out which platforms offer the best value and why you should choose them. Read now!

Mia Anderson

Discover essential stand-up comedy tips for 2024. Elevate your routine with proven strategies and grab the audience's attention. Start your comedy journey now!

Mia Anderson

Automotive

View AllLearn how owning an EV is reshaping daily life, from commuting habits to charging practices. Discover the lifestyle shift.

Read MoreUncover why EV adoption varies across regions. Explore the drivers behind disparities and their impact on the EV market.

Read MoreExplore how electric commercial and heavy-duty vehicles are transforming industries. Learn about their growing role in logistics.

Read MorePolular🔥

View All

1

2

3

4

5

6

7

8

9

10

Technology

View All

December 13, 2024

How to Score the Best Deals on Laptops in 2024

Learn the secrets to finding incredible laptop deals! Click to access our guide and save big on your next purchase.

August 9, 2024

7 Ways NLP Is Revolutionizing Business Operations

Find out how Natural Language Processing (NLP) may improve your business like a secret weap*n. The 7 main advantages of NLP for organizations are discussed in this article, which ranges from cost savings to enhanced customer experience.

August 9, 2024

Evolution of Video Game Graphics: A Historical Visual Journey

Explore the history of video game visuals, from the earliest 8-bit games to the engrossing Ultra HD environments of the present day. Discover how the development of new hardware transformed gaming!

Tips & Trick