Credit Score Secrets: 8 Tips for Faster Loan Approvals

Mia Anderson

Photo: Credit Score Secrets: 8 Tips for Faster Loan Approvals

a good credit score is the key that unlocks numerous opportunities, especially when it comes to securing loans. Whether you're planning to buy a new home, start a business, or finance your education, understanding the secrets to improving and maintaining an excellent credit score can significantly increase your chances of loan approval. Let's delve into some valuable tips to help you navigate the path to faster and more successful loan applications.

Understanding the Basics: What is a Credit Score?

Before we dive into the secrets, let's clarify the concept of a credit score. A credit score is a numerical representation of your creditworthiness, calculated based on your credit history. It's a snapshot of your financial reliability and responsibility, as seen through the lens of lenders. The most widely used credit scoring model is FICO, which ranges from 300 to 850. A higher score indicates lower credit risk, making it easier to secure loans with favorable terms.

8 Tips for Boosting Your Credit Score and Loan Approval Chances

1. Check Your Credit Report Regularly

The first step in your credit score journey is to become intimately familiar with your credit report. Obtain a copy of your report from the major credit bureaus (Equifax, Experian, and TransUnion) annually or more frequently. Review it thoroughly for any errors or discrepancies. Mistakes on your credit report can negatively impact your score, so dispute any inaccuracies promptly. Remember, you're entitled to a free credit report each year, making it a valuable, cost-free resource.

2. Pay Your Bills on Time

Payment history is a critical factor in determining your credit score. Lenders want to see a consistent track record of on-time payments. Late or missed payments can significantly damage your score. Set up automatic payments or reminders to ensure you never miss a due date. If you've had late payments in the past, focus on building a positive payment history moving forward. Over time, this will demonstrate your commitment to financial responsibility.

3. Reduce Your Credit Utilization Ratio

The credit utilization ratio is the percentage of your available credit that you're currently using. It's recommended to keep this ratio below 30%, and the lower, the better. For example, if you have a credit card with a $10,000 limit, aim to keep your balance below $3,000. High credit utilization can signal to lenders that you're financially stretched, potentially leading to loan rejections. Consider spreading your spending across multiple cards or requesting a credit limit increase to improve this ratio.

4. Maintain a Mix of Credit Types

Lenders like to see a diverse credit portfolio. This means having a mix of credit accounts, such as credit cards, personal loans, mortgages, and auto loans. A varied credit mix demonstrates your ability to manage different types of credit responsibly. However, this doesn't mean you should open multiple new accounts at once, as this can negatively impact your score due to hard inquiries and a shorter average account age.

5. Avoid Closing Old Credit Accounts

Closing old credit accounts, especially those with a positive payment history, can hurt your credit score. These accounts contribute to your credit history length, which is a significant factor in credit scoring models. Instead of closing them, consider keeping these accounts active by using them occasionally and paying off the balances promptly.

6. Limit New Credit Applications

Each time you apply for new credit, a hard inquiry is made on your credit report, which can temporarily lower your score. Multiple hard inquiries in a short period can be a red flag for lenders. Be strategic with your credit applications and only apply for new credit when necessary. If you're shopping for a loan, try to do so within a short time frame, as multiple inquiries for the same type of loan within a certain period are often treated as a single inquiry.

7. Consider a Secured Credit Card

If you're building or rebuilding your credit, a secured credit card can be a valuable tool. These cards require a security deposit, which typically becomes your credit limit. By using the card responsibly and making timely payments, you can demonstrate positive credit behavior, which will be reported to the credit bureaus. Over time, this can help improve your credit score and make you a more attractive candidate for loan approvals.

8. Negotiate with Lenders

When applying for a loan, don't be afraid to negotiate. Lenders may be willing to offer better terms if you have a strong credit score and a stable financial history. Discuss your credit score and its implications with the lender, and ask about any potential improvements they suggest. Sometimes, a simple conversation can lead to a more favorable loan offer.

Conclusion: Unlocking Loan Approvals with a Solid Credit Score

Improving your credit score is a journey that requires patience and discipline. By implementing these tips, you can gradually enhance your creditworthiness and increase your chances of loan approval. Remember, a good credit score not only opens doors to financing but also to better interest rates and loan terms. Start your credit score optimization journey today, and you'll be well on your way to achieving your financial goals.

Remember, building and maintaining a strong credit score is a long-term commitment, but the benefits are well worth the effort. With these secrets in your toolkit, you can confidently navigate the world of loans and credit, ensuring a brighter financial future.

Marketing

View All

January 23, 2025

Social Media in Digital Marketing 2024Learn how social media is revolutionizing digital marketing in 2024. Boost your brand with actionable tips for viral campaigns!

Mia Anderson

January 23, 2025

10 Content Strategies for Digital SuccessCreate winning content with these 10 proven digital marketing strategies. Enhance engagement and conversions starting today!

Mia Anderson

January 25, 2025

Email Marketing in the Digital AgeUnlock the power of email marketing with modern strategies tailored for the digital age. Connect with your audience like never before!

Mia Anderson

Entertainment

View AllFind out which movie streaming platforms are the best in 2024. Get insights, compare options, and choose your ideal service. Click to learn more!

Mia Anderson

Having trouble deciding between Netflix and Disney+? Consider the advantages and disadvantages of each streaming service to help you choose the best one for your needs.

Mia Anderson

Discover top tips for attending music festivals in 2024. Learn how to prepare, stay safe, and enhance your festival experience. Read more to get ready!

Mia Anderson

Learn how to edit videos like a pro without breaking the bank. Explore the latest tools, techniques, and trends in 2024 video editing. Start creating today!

Mia Anderson

Automotive

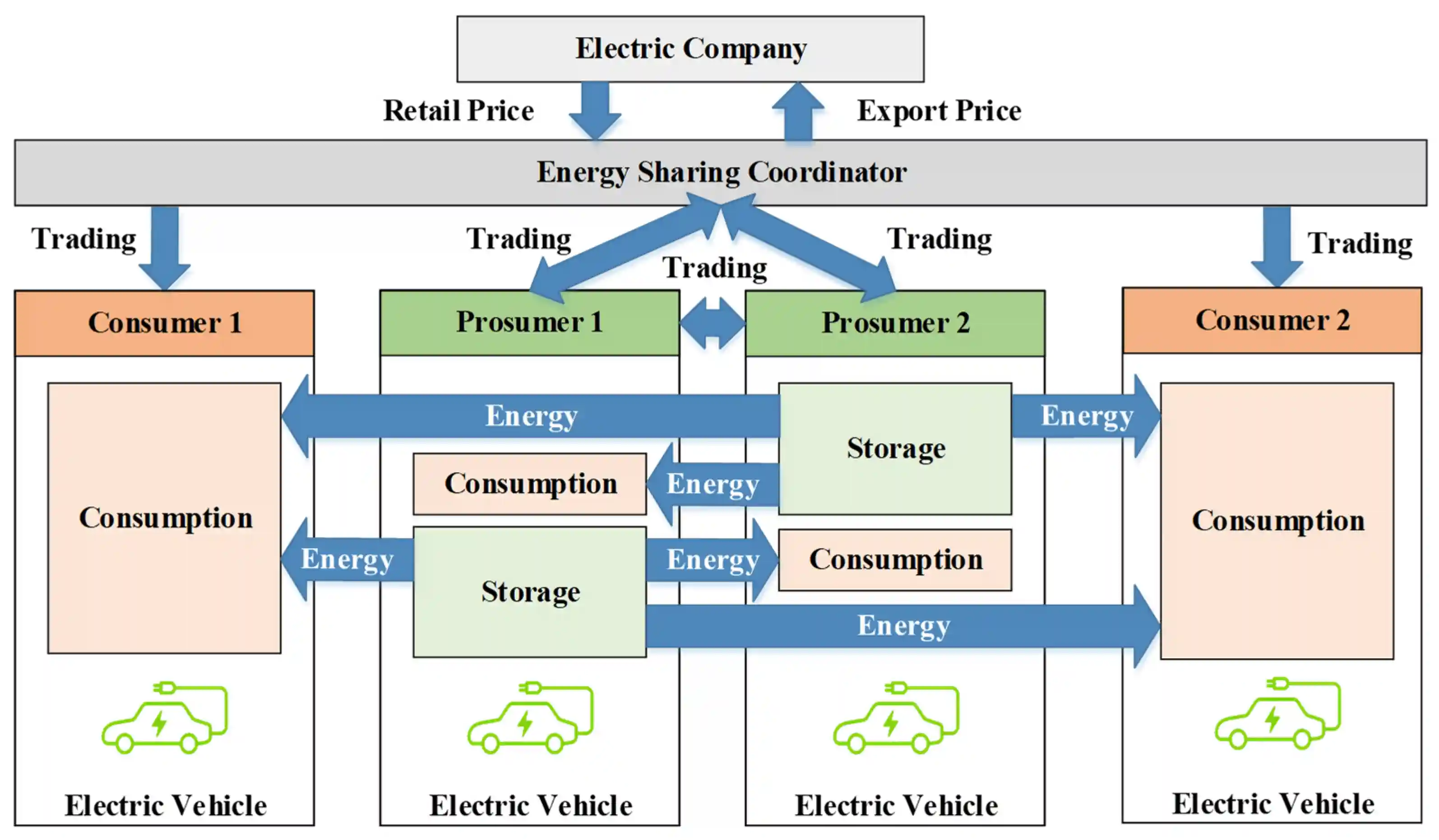

View AllExplore the role of EVs in peer-to-peer energy sharing. Could EVs become key players in the decentralized energy market?

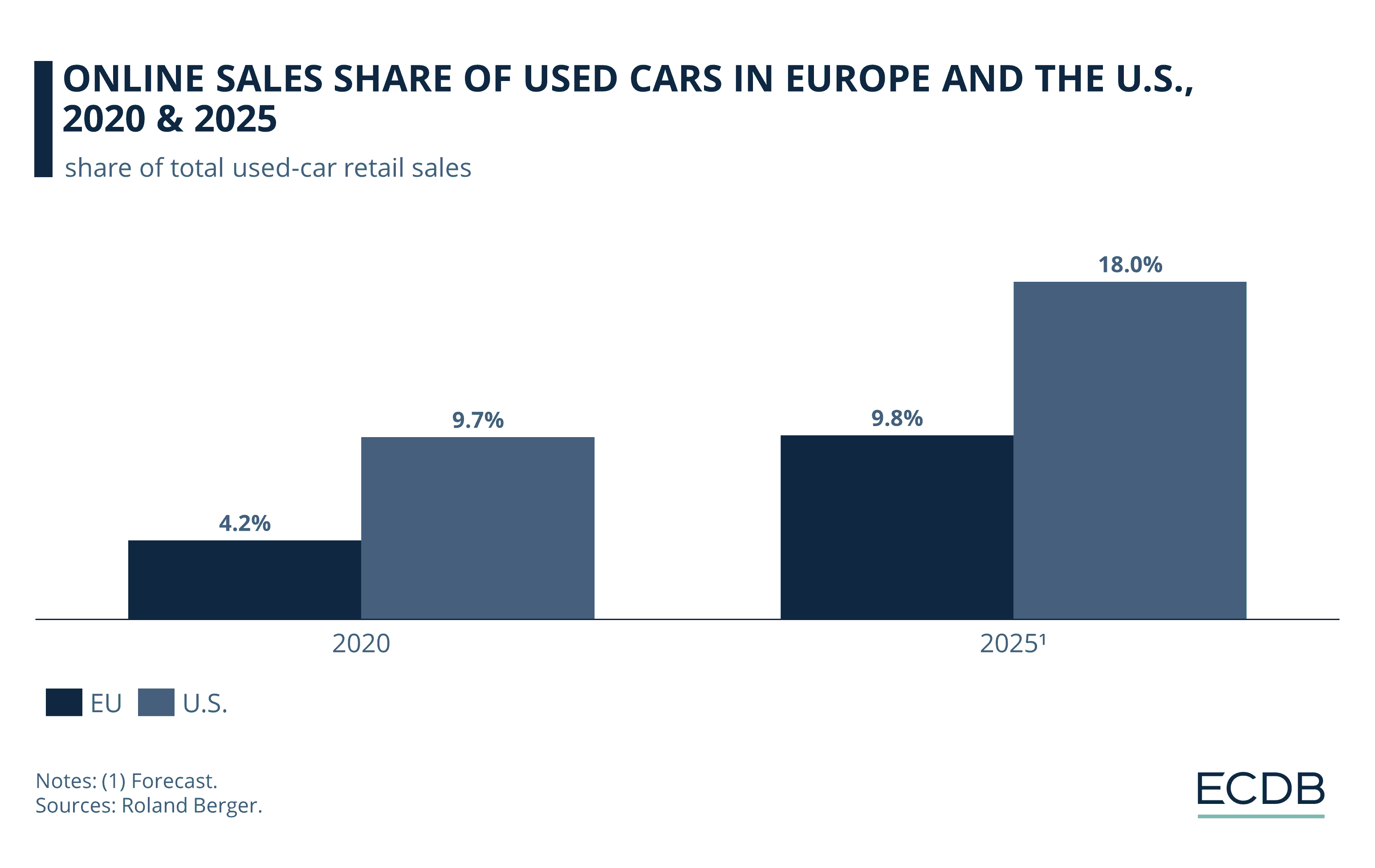

Read MoreExplore the pros and cons of selling your car online vs. locally. Find out which suits you best!

Read MoreExplore how autonomous vehicles (AVs) are driving the future of EV adoption. Will AVs be the key to widespread electric mobility?

Read MorePolular🔥

View All

1

2

3

4

5

6

7

8

9

10

Technology

View All

December 8, 2024

How to Find the Best Deals on Tech Products This Holiday Season

Holiday shopping made easy! Learn how to score the best deals on tech gifts. Click to discover and save big this season.

November 10, 2024

The Ultimate Guide to Building Your Own PC

Ready to build your own PC? Follow our ultimate guide for step-by-step instructions and tips. Build your dream machine today!

August 9, 2024

The Power of NLP for Sentiment Analysis: A Complete Guide

Learn how to analyze sentiment with Natural Language Processing (NLP). Discover how NLP approaches may transform the way you interpret client feedback and provide you with insightful information that will help your business grow.

Tips & Trick

View All