The Ultimate Guide to Texas Auto Insurance: Everything You Need to Know

Mia Anderson

Photo: The Ultimate Guide to Texas Auto Insurance: Everything You Need to Know

Texas auto insurance can be a complex topic, and with a variety of coverage options available, it's essential for drivers in the Lone Star State to understand their choices and select the best policies for their needs. Texas has specific requirements and unique considerations when it comes to car insurance. Whether you're a long-time resident or new to the state, this comprehensive guide will answer all your questions about Texas auto insurance and help you navigate the intricacies of obtaining the right coverage.

Texas Auto Insurance Requirements and Laws

First and foremost, it's illegal to drive without insurance in Texas. The state mandates that all drivers carry a minimum level of auto insurance to protect themselves and others in the event of an accident. These are the minimum auto insurance limits, often referred to as the state Liability minimums:

- $30,000 for injury liability for one person in an accident you cause

- $60,000 total for everyone injured in an accident you cause

- $25,000 for property damage in an accident you cause

You may often see this written as 30/60/25, representing the dollar limits for each category. These minimum requirements are essential, but they only provide basic protection. To ensure you're adequately covered, consider opting for higher limits and exploring additional coverage options.

Types of Auto Insurance Coverage in Texas

Liability Insurance

As mentioned earlier, liability insurance is mandatory in Texas. This type of coverage protects other people if you cause bodily harm or property damage in an accident. It's important to note that liability insurance does not cover you, your vehicle, or your personal belongings. To protect yourself and your assets, consider the following additional coverage options:

Comprehensive Coverage

Comprehensive coverage helps pay for damages to your vehicle caused by events other than collisions. This includes incidents like hail, fire, theft, or vandalism. If you lease or finance your car, lenders typically require comprehensive coverage to protect their investment.

Collision Coverage

Collision coverage, as the name suggests, assists in covering the cost of repairing or replacing your vehicle if it's damaged in an accident involving a collision with another car or object. Even if you're a cautious driver, it's important to remember that accidents can happen to anyone, and collision coverage can provide valuable financial protection.

Uninsured/Underinsured Motorist Coverage

While not mandatory in Texas, uninsured/underinsured motorist coverage can provide crucial protection if you're in an accident with a driver who has insufficient or no insurance. This type of coverage is optional, but it's recommended, especially considering the number of uninsured drivers on Texas roads. You must opt out of this coverage in writing when purchasing a policy.

Factors Affecting Texas Auto Insurance Rates

Several factors influence the cost of auto insurance in Texas. Understanding these factors can help you make informed decisions when shopping for a policy:

Age and Driving Experience

Age plays a significant role in determining insurance rates. Younger drivers, particularly teens, often face higher insurance costs due to their lack of driving experience. Insurers consider inexperienced drivers to be at a higher risk of accidents, and as a result, premiums tend to be more expensive for this age group. On the other hand, mature drivers with years of experience behind the wheel may qualify for discounts, as they are statistically less likely to be involved in collisions.

Driving Record and History

Your driving record has a substantial impact on your insurance rates. A clean driving history, free of accidents, traffic violations, or claims, will work in your favor when it comes to securing lower premiums. Conversely, a record that includes speeding tickets, DUIs, or at-fault accidents will likely result in higher insurance costs. Insurance companies view such incidents as indicators of increased risk, and they may charge higher rates to offset potential future claims.

Location Within Texas

Where you live in Texas can also affect your auto insurance rates. Urban areas, particularly those with higher populations and denser traffic, tend to have higher insurance costs due to increased accident risks and higher rates of vehicle theft. On the other hand, rural areas may benefit from slightly lower premiums. Additionally, specific zip codes known for higher crime rates or natural disaster risks can influence insurance pricing.

Credit Score

In Texas, insurance providers can use your credit score as a factor in determining your insurance rates. A higher credit score can lead to lower premiums, as insurers may view you as a more responsible and lower-risk individual. Conversely, a lower credit score may result in higher insurance costs. However, it's important to note that Texas law prohibits insurance companies from refusing to renew your policy solely based on your credit score.

Type of Vehicle

The make, model, and age of your vehicle can also impact your insurance rates. Generally, more expensive cars or those with powerful engines tend to be more costly to insure due to higher repair or replacement costs. Older vehicles may qualify for lower coverage levels, such as liability-only insurance, which can result in more affordable premiums. Additionally, safety features and anti-theft devices can work in your favor, potentially lowering your insurance rates.

Tips for Saving Money on Texas Auto Insurance

While adequate coverage is essential, it's also understandable that you want to keep costs down. Here are some strategies to help you save money on your Texas auto insurance:

Shop Around and Compare Rates

Don't settle for the first insurance quote you receive. Take the time to get multiple quotes from different insurance providers. Rates can vary significantly between companies, so it's worth comparing options to find the most affordable coverage that meets your needs. Online tools and insurance comparison websites can streamline this process, making it easier to find the best deal.

Ask About Discounts

Insurers often offer a range of discounts that can lower your premium. For example, you may be eligible for a discount if you have a clean driving record, own a home, or have multiple vehicles insured with the same company. Some companies offer discounts for students with good grades, those who complete a defensive driving course, or individuals who belong to certain organizations or associations. Don't be afraid to inquire about potential savings opportunities.

Consider Higher Deductibles

Opting for a higher deductible can result in lower monthly or annual premiums. The deductible is the amount you pay out of pocket before your insurance coverage kicks in. By agreeing to a higher deductible, you're essentially taking on more financial responsibility for smaller incidents, but you'll benefit from reduced overall costs. Just ensure that you have enough savings to cover the higher deductible in case of an accident.

Bundle Your Policies

If you have multiple insurance needs, such as home, renters, or life insurance, consider bundling them with your auto insurance. Many companies offer significant discounts when you purchase multiple policies from them. Not only will this simplify your insurance management, but it can also result in substantial savings.

Pay Attention to Your Credit Score

As mentioned earlier, your credit score can impact your insurance rates. Taking steps to improve your credit score, such as paying bills on time and reducing debt, can lead to lower insurance costs over time. Regularly review your credit report and take proactive measures to maintain a positive credit history.

Understanding the Claims Process

Knowing what to do if you're involved in an accident or need to file a claim is crucial. Here's a simplified outline of the typical claims process in Texas:

Step 1: Gather Information

If you're involved in an accident, remain calm and ensure everyone's safety. Call for emergency services if necessary. Exchange information with the other driver(s), including names, contact details, insurance information, and vehicle details. Take photos of the accident scene, capturing vehicle positions, damage, and any relevant road conditions. If there are witnesses, obtain their contact information as well.

Step 2: Notify Your Insurance Company

Contact your insurance provider as soon as possible to report the accident and initiate the claims process. They will assign a claims adjuster to handle your case and guide you through the next steps. Provide them with the information you gathered at the accident scene, including photos and witness statements if available.

Step 3: Vehicle Assessment

Your insurance company will assess the damage to your vehicle to determine the cost of repairs or replacement. They may request that you take your car to one of their approved repair shops for an estimate, or they may send an appraiser to inspect the damage. During this time, you may need to arrange for alternate transportation while your vehicle is being repaired or replaced.

Step 4: Claims Approval and Repairs

Once the damage assessment is complete, your insurance company will approve the necessary repairs and provide you with a list of approved repair facilities. If your vehicle is deemed a total loss, they will offer you a settlement based on the actual cash value of your car at the time of the accident. Ensure you understand the terms of your settlement and ask questions if needed.

Step 5: Claim Resolution

After the repairs are completed or the total loss settlement is accepted, your insurance company will close the claim. It's important to review the repair work and ensure you're satisfied with the results. If you have any concerns or issues, don't hesitate to contact your insurance provider and discuss possible resolutions.

Frequently Asked Questions About Texas Auto Insurance

Is Texas a No-Fault Insurance State?

No, Texas follows a traditional at-fault system when it comes to car accidents and insurance. This means that the driver found to be at fault for an accident is responsible for the resulting damages, and their insurance company typically covers the costs. In no-fault states, each driver's insurance company covers their own policyholder's damages, regardlessof fault.

What Happens If I Drive Without Insurance in Texas?

Driving without insurance in Texas is illegal and can result in serious consequences. If caught, you may face fines, license suspension, or even jail time. The penalties increase for subsequent offenses. It's essential to maintain the minimum required insurance coverage to avoid these legal repercussions and ensure you're financially protected in the event of an accident.

How Do I File a Claim If I'm in an Accident?

The first step is to ensure everyone's safety and call for emergency services if needed. Exchange information with the other driver(s) and gather evidence, such as photos and witness statements. Contact your insurance provider as soon as possible to report the accident and initiate the claims process. They will guide you through the necessary steps, including vehicle assessment, repairs, and claim resolution.

What Is the Average Cost of Auto Insurance in Texas?

The average cost of auto insurance in Texas can vary depending on several factors, including age, driving record, location, and type of vehicle. According to a 2022 report, the average annual cost of full coverage car insurance in Texas is $1,820. However, this can range widely, and it's important to shop around and compare rates to find the most affordable option for your specific circumstances.

Can I Get Auto Insurance Without a Driver's License in Texas?

Yes, it is possible to obtain auto insurance in Texas even if you don't have a valid driver's license. This type of policy is known as a 'named operator policy' and can provide coverage for vehicles owned by someone without a license or those who have a suspended or revoked license. However, these policies may be more expensive, and the options may be limited.

Conclusion

Navigating the world of Texas auto insurance can be complex, but it's essential to ensure you have the right coverage to protect yourself, your vehicle, and your finances. By understanding the state's unique requirements, exploring coverage options, and taking advantage of cost-saving strategies, you can make informed decisions about your auto insurance. Remember to shop around, ask about discounts, and regularly review your policy to ensure it meets your evolving needs.

Stay informed, stay safe, and enjoy the peace of mind that comes with knowing you're adequately covered on the roads of the Lone Star State.

Marketing

View All

January 23, 2025

Social Media in Digital Marketing 2024Learn how social media is revolutionizing digital marketing in 2024. Boost your brand with actionable tips for viral campaigns!

Mia Anderson

January 23, 2025

10 Content Strategies for Digital SuccessCreate winning content with these 10 proven digital marketing strategies. Enhance engagement and conversions starting today!

Mia Anderson

January 20, 2025

5 Best Digital Marketing Tools for GrowthUncover the top 5 digital marketing tools every marketer needs. Boost efficiency, drive results, and streamline your campaigns now!

Mia Anderson

Entertainment

View AllDiscover the fascinating history of superhero movies, from early adaptations to modern blockbusters. Uncover surprising facts and insights click to explore!

Mia Anderson

Unlock the secrets to going viral on TikTok with these 2024 strategies. From trend-spotting to unique twists, learn how to boost your visibility and engagement. Start creating viral content today!

Mia Anderson

Learn the key steps to start a YouTube channel in 2024, from content strategy to monetization. Click here for expert advice and actionable tips!

Mia Anderson

Discover the latest tips and trends for making a short film in 2024. Learn from experts and get started on your cinematic journey today!

Mia Anderson

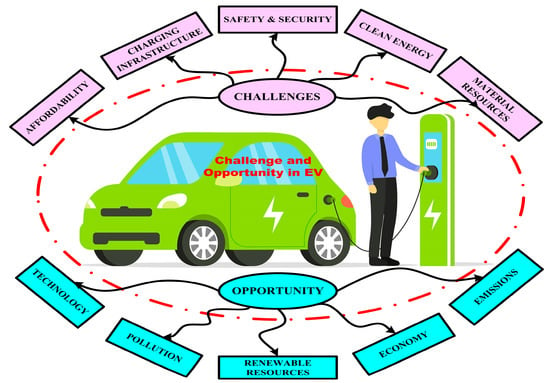

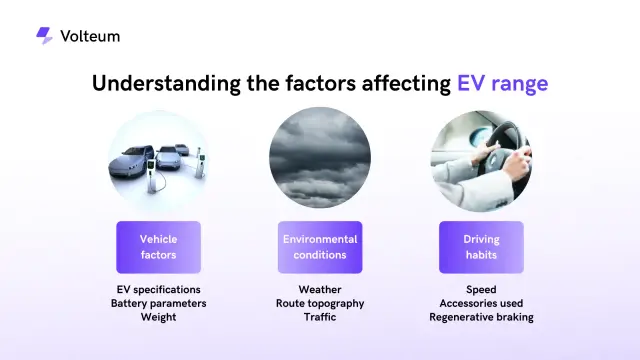

Automotive

View AllExplore the growth of residential EV charging solutions, from home setups to energy-efficient charging options.

Read MoreDiscover the latest innovations in lightweight materials for EVs. How do these advancements improve performance and efficiency?

Read MoreDiscover real-world experiences of long-distance EV travel. Learn how EV owners tackle range anxiety and plan road trips.

Read MorePolular🔥

View All

1

2

3

4

5

6

7

8

9

10

Technology

View All

September 12, 2024

Comprehensive Machine Learning Tutorial for Beginners

Master machine learning with our detailed tutorial. Learn the fundamentals and advance your skills today. Start your journey into AI now!

August 13, 2024

The Top SOC 2 Compliance Companies: Securing Your Data

Discover the leading SOC 2 Compliance companies and learn how they can help protect your organization's sensitive data. Click to explore the best options for safeguarding your business.

December 17, 2024

The Best Tech Gifts for 2024 – Shop Before They Sell Out!

Find the perfect tech gifts for everyone on your list! Click to explore the hottest gadgets and shop before they're gone.

Tips & Trick