5 High-Yield Investments for Beginners You Can Start Today

Mia Anderson

Photo: 5 High-Yield Investments for Beginners You Can Start Today

Are you a novice investor looking to make your money work harder? High-yield investments might be the answer you're seeking. These financial instruments offer the potential for impressive returns, making them an attractive strategy for those eager to grow their wealth. But where do you start, especially if you're new to the investing game? In this article, we'll explore five high-yield investment options that are not only lucrative but also accessible for beginners. Get ready to dive into a world of financial opportunities!

Understanding High-Yield Investments

Before we dive into the specifics, let's clarify what we mean by high-yield investments. In simple terms, these are investments that offer the potential for above-average returns compared to traditional savings accounts or low-risk investment options. The allure lies in the possibility of significant gains, but it's essential to understand that higher returns often come with increased risk.

5 High-Yield Investments for Beginners

1. High-Yield Savings Accounts

Let's kick things off with a relatively low-risk option: high-yield savings accounts. These are not your typical savings accounts; they offer higher interest rates, making your money grow faster. Online banks, with their lower operating costs, often provide some of the best high-yield savings accounts. This investment strategy is ideal for short-term savings goals, allowing you to earn more interest without sacrificing safety. For instance, imagine you have $5,000 set aside for an upcoming vacation. By placing it in a high-yield savings account, you could earn a few hundred dollars in interest over a year, a nice bonus for your travel fund!

2. Money Market Funds

If you're seeking a step up in terms of yield, consider money market funds. These funds invest in short-term debt instruments, such as government securities and certificates of deposit (CDs), offering higher yields than traditional savings accounts while maintaining a high level of safety and liquidity. Money market funds are a great way to diversify your portfolio and potentially earn more than with a regular savings account. Think of it as a bridge between savings and more aggressive investment options.

3. AAA Bonds

For those willing to venture slightly deeper into the world of investing, AAA bonds are an excellent choice. These investment-grade bonds, particularly short-duration ones with the highest AAA rating, offer a moderate level of risk and attractive returns. The AAA rating indicates a minimal default risk, providing a sense of security. However, it's crucial to remember that bond prices can be sensitive to interest rate changes, and the issuer's financial health can impact their riskiness. A well-diversified portfolio might include AAA bonds as a stable, income-generating component.

4. Investment Grade Corporate Bonds

Corporate bonds are another avenue for high-yield investing. Investment-grade corporate bonds are those issued by companies with strong credit ratings, typically indicating a lower risk of default. These bonds offer moderate returns and are a great way to diversify your portfolio beyond stocks and government securities. As with any investment, it's essential to research the issuing company and understand the specific bond's terms and conditions.

5. High-Quality ETFs

Exchange-Traded Funds (ETFs) are a fantastic option for beginners, especially those seeking a low-cost, diversified investment. ETFs are baskets of securities that trade on an exchange, much like stocks. They can contain various assets, including stocks, bonds, or commodities, providing instant diversification. High-quality ETFs, often recommended by experts, offer a balanced approach, combining low-risk and higher-risk assets. This strategy ensures that you're not putting all your eggs in one basket, which is a common pitfall for inexperienced investors.

Navigating the Risk-Return Tradeoff

As you explore these high-yield investment options, it's crucial to understand the risk-return tradeoff. In the world of investing, higher returns are often accompanied by increased risk. For instance, a new tech startup might promise high returns but also carries a higher chance of failure, potentially resulting in a complete loss of investment. On the other hand, lower-risk investments, like government bonds, typically offer lower returns. It's a balancing act, and the key is to find the right mix that aligns with your financial goals, timeline, and risk tolerance.

Starting Your Investment Journey

Embarking on your investment journey can be both exciting and daunting. The key is to start small and learn as you go. Begin with a clear understanding of your investment goals. Are you saving for a house, retirement, or simply looking to grow your wealth over time? This clarity will guide your investment choices.

Once you've set your goals, consider starting with a conservative approach, as suggested by many experts. Focus on stable investments with a proven track record. This strategy will help you build confidence and gain valuable experience. As you become more comfortable, you can gradually explore riskier options, always keeping in mind the importance of diversification.

Staying Informed and Adapting

The world of investing is dynamic, and staying informed is crucial. Keep an eye on reputable financial news sites to stay abreast of market trends, industry developments, and company-specific news. Avoid sources that promise quick riches or easy tricks, as these often lead to disappointment. Instead, focus on building a solid foundation of investment knowledge.

As you gain experience, you'll develop a sense of what works best for your financial situation and risk appetite. Remember, investing is a marathon, not a sprint. It's about making consistent, informed decisions that align with your long-term goals.

Conclusion

High-yield investments offer an exciting avenue for beginners to enter the world of investing. From high-yield savings accounts to ETFs, there are numerous options to suit different risk profiles and financial objectives. The key is to start with a clear plan, educate yourself, and adapt as you gain experience. While the potential for impressive returns is enticing, it's essential to approach high-yield investing with a balanced mindset, considering both the rewards and the risks.

So, whether you're saving for a dream vacation or planning for retirement, consider these high-yield investment options as tools to help you achieve your financial goals. Happy investing!

Marketing

View All

January 18, 2025

Top 10 Digital Marketing Trends for 2024Discover the must-know digital marketing trends for 2024. Stay ahead of the curve and elevate your strategies with these insights! Read more now!

Mia Anderson

January 23, 2025

10 Content Strategies for Digital SuccessCreate winning content with these 10 proven digital marketing strategies. Enhance engagement and conversions starting today!

Mia Anderson

January 21, 2025

Why Digital Marketing is Vital for SMBsDiscover why small businesses must adopt digital marketing in 2024. Learn tips and tactics to compete in the digital age. Take your business online today!

Mia Anderson

Entertainment

View AllExplore the latest trends in virtual reality gaming for 2024. Our in-depth guide covers new technology and gameplay innovations. Discover more now!

Mia Anderson

Discover the best movie soundtracks of 2024! Explore our list of top picks and enhance your playlist today. Click to find your next favorite soundtrack!

Mia Anderson

Discover the latest tips and trends for becoming a successful music producer in 2024. Learn how to start your career today and make your mark in the industry!

Mia Anderson

Discover the top podcasting trends of 2024 and stay ahead in the industry. Learn how to leverage new insights click now to future-proof your podcast!

Mia Anderson

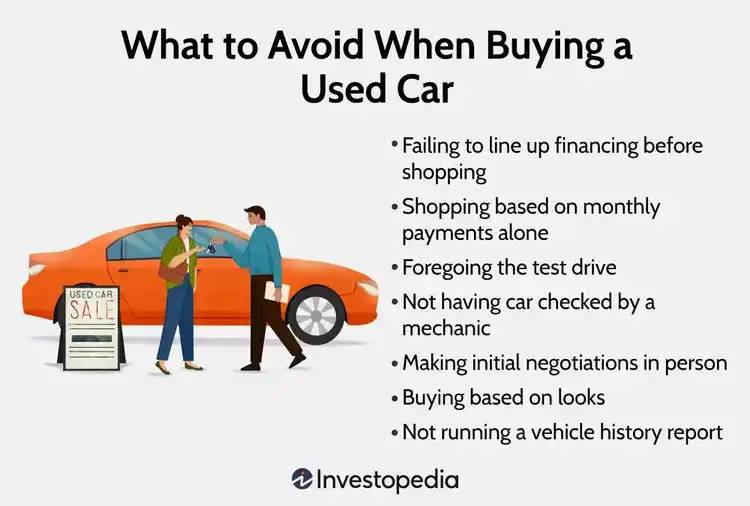

Automotive

View AllAvoid these common mistakes when selling your car. Save time and secure the best deal!

Read MoreLearn how innovative startups are accelerating EV adoption with cutting-edge technology and bold strategies.

Read MoreLearn how smart city initiatives are seamlessly integrating EV infrastructure to enhance mobility and sustainability.

Read MorePolular🔥

View All

1

2

3

4

5

6

7

8

9

10

News

View AllOctober 14, 2024

2024 Vaccination Updates: What You Need to Know for Flu & COVID-19 Protection

Read MoreTechnology

View All

January 19, 2025

Building Effective Data Science Teams

Learn how to build successful data science teams and workflows. Discover best practices for collaboration, project management, and scaling AI initiatives!

August 9, 2024

The Ultimate List of the Best RPGs of All Time

The best role-playing games ever made, compiled in one location! The best role-playing games, compiled into an enormous collection that will keep you occupied for years. Prepare to enter engrossing realms!

December 18, 2024

How to Get the Best Deals on Smartphones This Month

Discover the hottest smartphone deals this month! Click to learn insider tips and save big on your next purchase.

Tips & Trick

View All