Is a Financial Advisor Worth It? Here’s What You Need to Know

Mia Anderson

Photo: Is a Financial Advisor Worth It? Here’s What You Need to Know

In today's complex financial landscape, many individuals find themselves pondering the benefits of seeking professional guidance. The question, "Is a financial advisor worth it?" has likely crossed your mind, especially if you're striving for financial stability and growth. This article aims to provide an insightful exploration of the role of financial advisors, their value, and the considerations that will help you make an informed decision. By the end, you'll have a clearer understanding of whether engaging a financial advisor is the right move for your financial journey.

Understanding Financial Advisors: More Than Just Investment Tips

What is a Financial Advisor?

A financial advisor is a professional who offers comprehensive wealth management services, catering to individuals seeking assistance with various financial aspects. These experts provide financial advice, investment strategies, and planning for both short-term and long-term financial goals. They are not just for the wealthy; financial advisors can be valuable partners for anyone looking to gain control over their finances and secure their future.

The Role They Play

Financial advisors wear multiple hats, offering a range of services tailored to individual needs. They can help with investment management, retirement planning, estate planning, insurance advice, and even debt management. For instance, if you're a young professional starting your career, a financial advisor can guide you on saving for retirement, investing in stocks or mutual funds, and managing student loan debt. On the other hand, if you're nearing retirement, they can help you create a comprehensive plan to ensure a comfortable post-retirement life.

The Human Touch vs. Robo-Advisors

Financial advisors can be broadly categorized into two types: traditional, in-person advisors and online or robo-advisors. Traditional advisors offer a personalized, face-to-face experience, building trust and understanding through regular meetings. They provide tailored advice, considering your unique circumstances and goals. On the other hand, robo-advisors are digital platforms that use algorithms to provide automated investment advice. These are often more affordable and accessible, making them a popular choice for those with simpler financial needs.

Weighing the Benefits: Why Consider a Financial Advisor?

Expertise and Knowledge

Financial advisors are experts in their field, equipped with the knowledge and skills to navigate the complexities of the financial world. They stay up-to-date with market trends, investment strategies, and regulatory changes, ensuring that your financial decisions are well-informed. For instance, a financial advisor can help you understand the pros and cons of investing in cryptocurrencies, a topic that might be daunting for the average investor.

Personalized Guidance

One of the most significant advantages of hiring a financial advisor is the personalized approach they offer. They take the time to understand your financial situation, goals, and risk tolerance. This tailored advice can be invaluable, especially when making significant financial decisions. For example, if you're considering buying a house, a financial advisor can help you assess your affordability, recommend suitable mortgage options, and guide you through the process, ensuring you make a well-informed decision.

Time and Stress Savings

Managing finances can be time-consuming and stressful, especially for those with busy lifestyles. Financial advisors take on the burden of researching, analyzing, and monitoring your financial affairs, freeing up your time for other priorities. They can provide peace of mind, knowing that your finances are in capable hands. For instance, a financial advisor can handle the tedious task of reviewing and optimizing your investment portfolio, allowing you to focus on your career or family.

Considering the Costs: Is It Worth the Investment?

Fees and Charges

Engaging a financial advisor comes with costs, and it's essential to understand these expenses before committing. Fees can vary widely, depending on the type of advisor and the level of service required. Traditional advisors may charge a percentage of your assets under management, a flat fee, or an hourly rate. For example, Charles Schwab's fees range from $500,000 to $1 million, depending on the level of advice required. Online or robo-advisors often have lower fees, making them more accessible to those with smaller portfolios.

Weighing the Value

The value of a financial advisor is not solely determined by the fees they charge. It's crucial to consider the potential benefits they bring to your financial life. If you have a substantial portfolio or complex financial needs, the expertise and personalized guidance of a financial advisor can be invaluable. They can help you make informed decisions, potentially saving you money in the long run and providing peace of mind.

Finding the Right Fit: Key Considerations

Your Financial Situation and Goals

When deciding whether to hire a financial advisor, assess your financial situation and goals. If you have a straightforward financial situation and feel confident managing your finances, you may not need a financial advisor. However, if your financial life is becoming more complex, with multiple assets, investments, and financial goals, an advisor can provide the expertise and support you need.

Budget and Service Requirements

Your budget and the services you require are essential factors in your decision. If you're on a tight budget, consider online or robo-advisors, which offer more affordable options. Determine the level of service you need—do you require comprehensive financial planning, or are you primarily seeking investment management? This will help you choose the right type of advisor and ensure you get value for your money.

Trust and Compatibility

Building a relationship with a financial advisor is crucial, as you'll be sharing sensitive financial information. Look for an advisor you can trust and feel comfortable with. Consider whether you prefer the personal touch of a traditional advisor or the convenience and affordability of an online advisor. Compatibility is key, as you'll be working closely with your advisor to achieve your financial objectives.

Conclusion: Making the Right Choice for Your Financial Journey

The decision to hire a financial advisor is a personal one, dependent on your unique circumstances and goals. While financial advisors offer numerous benefits, they may not be necessary for everyone. Consider your financial situation, goals, budget, and the level of service you require. Remember, a financial advisor should complement your financial journey, providing the expertise and support needed to achieve your financial aspirations.

In conclusion, a financial advisor can be a valuable asset, offering expertise, personalized guidance, and time savings. However, it's essential to weigh the costs and benefits carefully, ensuring that the advisor you choose aligns with your financial needs and objectives. By making an informed decision, you can unlock the potential for a more secure and prosperous financial future.

Marketing

View All

January 23, 2025

Social Media in Digital Marketing 2024Learn how social media is revolutionizing digital marketing in 2024. Boost your brand with actionable tips for viral campaigns!

Mia Anderson

January 25, 2025

Email Marketing in the Digital AgeUnlock the power of email marketing with modern strategies tailored for the digital age. Connect with your audience like never before!

Mia Anderson

January 19, 2025

How to Master Digital Marketing BasicsLearn the essentials of digital marketing in this beginner-friendly guide. Kickstart your journey with step-by-step strategies. Start mastering today!

Mia Anderson

Entertainment

View AllUncover the top TV series of 2024! From thrilling dramas to binge-worthy comedies, find your next obsession. Don’t miss out click now to explore!

Mia Anderson

Discover the best streaming services for 2024 and find your next favorite show. Read now for expert recommendations and start streaming today!

Mia Anderson

The definitive manual on how internet streaming services have evolved. Learn how to keep ahead of the curve by exploring the theories, tactics, and inventions influencing the future of streaming.

Mia Anderson

Discover the fascinating history of superhero movies, from early adaptations to modern blockbusters. Uncover surprising facts and insights click to explore!

Mia Anderson

Automotive

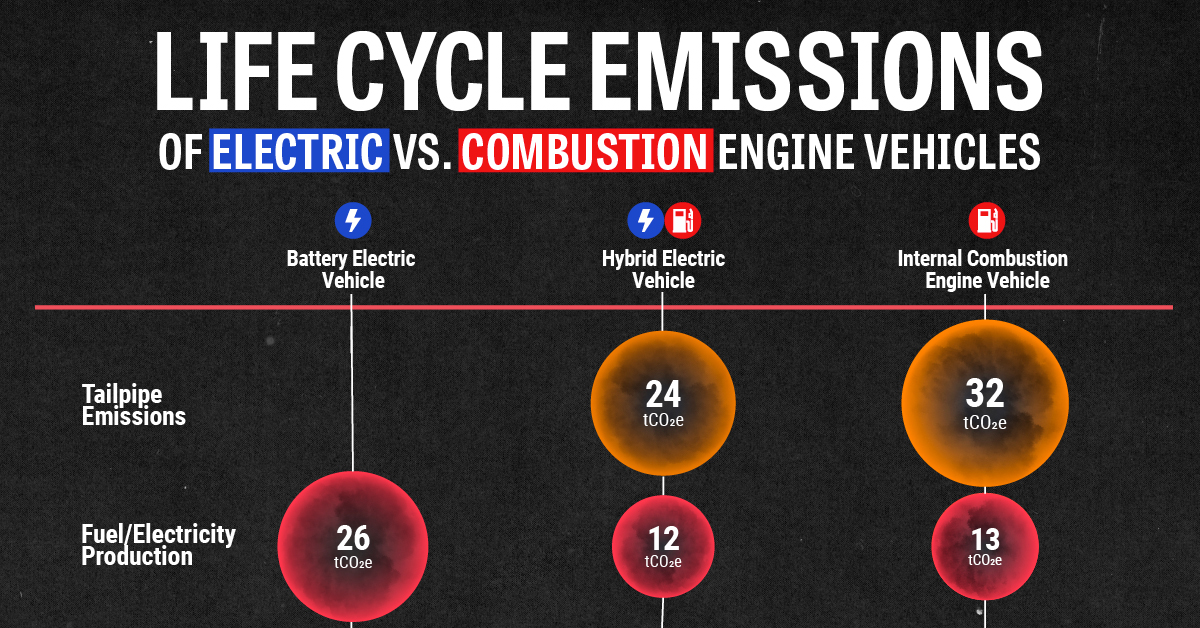

View AllCompare the lifecycle emissions of electric vehicles (EVs) and internal combustion engines (ICE). Which is better for the planet?

Read MoreExplore how government subsidies are driving EV sales globally. Learn the impact on adoption rates and market growth.

Read MoreSimplify dealership management with these Dealer Daily hacks. Master your workflow and enhance customer satisfaction today!

Read MorePolular🔥

View All

1

2

4

5

6

7

8

9

10

Technology

View All

August 13, 2024

The Top SOC 2 Compliance Companies: Securing Your Data

Discover the leading SOC 2 Compliance companies and learn how they can help protect your organization's sensitive data. Click to explore the best options for safeguarding your business.

August 9, 2024

The Power of NLP and Machine Learning: Friends or Foes?

Discover the possibilities of natural language processing and how machine learning relates to it. Discover the fascinating possibilities these technologies have for the future as well as how they are reshaping our reality.

September 15, 2024

Discover the Top Fintech Startups Revolutionizing 2024

Explore 2024 leading fintech startups driving innovation. Uncover new trends and insights. Read now to stay ahead in the fintech revolution!