How to Protect Your Finances from Inflation: Essential Tips

Mia Anderson

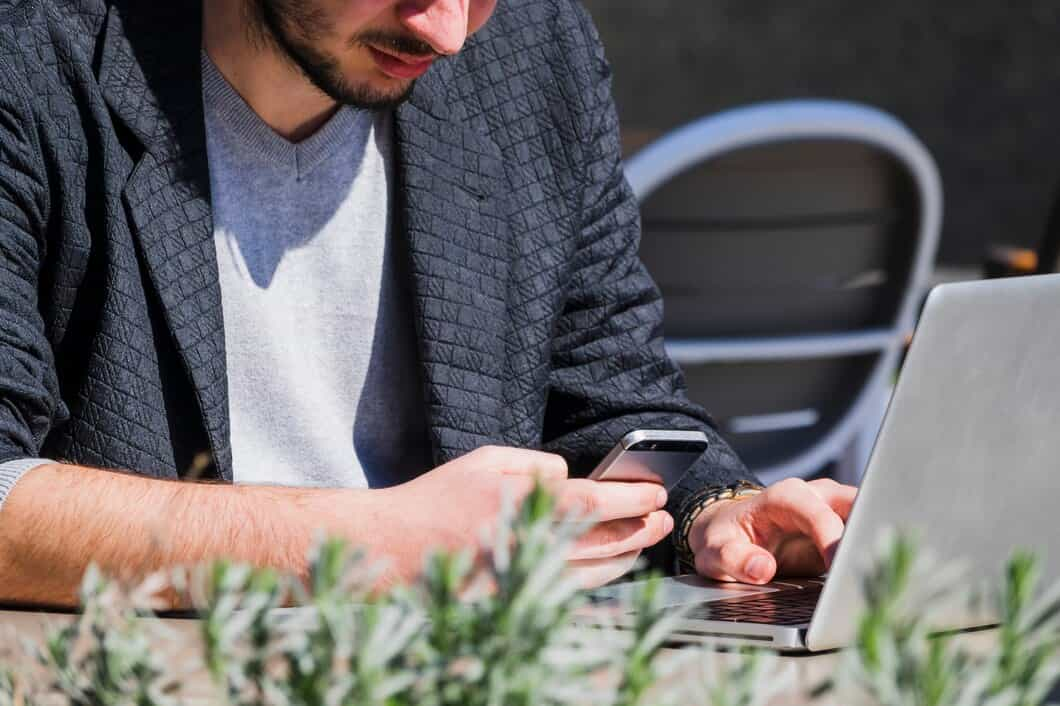

Photo: How to Protect Your Finances from Inflation: Essential Tips

Inflation can silently erode your purchasing power and pose a significant threat to your financial well-being. As we navigate an uncertain economic landscape in 2024, it's crucial to be proactive in protecting your finances from the impact of rising prices. This article aims to provide you with practical tips and strategies to safeguard your hard-earned money, ensuring your financial security and peace of mind. Get ready to explore essential inflation-proofing measures that will help you stay ahead of the curve in these challenging times.

Understanding the Inflationary Environment

Before diving into the protection strategies, let's grasp the current inflationary scenario. Inflation, in simple terms, is the increase in the general price level of goods and services over time. In 2024, many countries are grappling with high inflation rates, which can significantly impact personal finances if not managed effectively.

The Impact of Inflation:

Inflation affects everyone, from individuals to businesses. When inflation rises, your money loses value, meaning you can buy fewer goods and services with the same amount of money. This erosion of purchasing power can be particularly concerning for those on fixed incomes, such as retirees, as their savings may not keep up with the rising cost of living.

Practical Tips for Inflation Protection

Now, let's explore some actionable steps to shield your finances from inflation's grip:

1. Diversify Your Investments

One of the most effective ways to protect your finances from inflation is through smart investment diversification. Here's how you can do it:

- Stocks and Equity Funds: Historically, stocks have outperformed inflation over the long term. Consider investing in a mix of growth and value stocks across various sectors to minimize risk. Mutual funds and ETFs that track broad market indices can be a great way to get started with equity investments.

- Real Estate: Property investments can provide a hedge against inflation. As property values and rental income tend to rise with inflation, owning real estate can help preserve your wealth. Consider investing in rental properties or exploring real estate investment trusts (REITs) for diversified exposure.

- Commodities: Investing in commodities like gold, silver, and other precious metals can act as a natural hedge against inflation. These assets often maintain their value during periods of high inflation. You can invest in physical bullion, coins, or consider commodity-based mutual funds and ETFs.

2. Adjust Your Savings Strategy

Inflation can quickly devalue your savings if they are not earning a competitive rate of return. Here's how to adapt your savings approach:

- High-Yield Savings Accounts: Move your savings to high-yield savings accounts or money market accounts that offer higher interest rates. Online banks often provide more competitive rates than traditional brick-and-mortar banks.

- Short-Term Bonds: Consider investing in short-term government or corporate bonds with maturities of 2-3 years. These bonds offer a relatively stable return and can help protect your capital from inflation's impact.

- Certificate of Deposits (CDs): CDs are time deposits that offer higher interest rates than regular savings accounts. Choose CDs with terms that align with your financial goals, ensuring you don't lock up funds for too long, as you may need them for other investments.

3. Optimize Your Debt Management

Inflation can affect your debt in different ways. Here's how to manage your debt wisely:

- Refinance High-Interest Debt: If you have outstanding loans or credit card debt, consider refinancing to lower interest rates. Inflation can make it harder to pay off high-interest debt, so consolidating or refinancing can provide some relief.

- Mortgage Strategies: For homeowners, inflation can impact mortgage payments. Consider fixed-rate mortgages to lock in a stable interest rate. If you have an adjustable-rate mortgage (ARM), keep a close eye on interest rate movements and consider refinancing if rates become more favorable.

- Student Loan Repayment: Student loan borrowers can explore income-driven repayment plans, which adjust monthly payments based on income and family size. This can provide some relief during periods of high inflation.

4. Embrace Frugal Living

Adopting a frugal mindset can significantly enhance your financial resilience against inflation. Here are some practical tips:

- Budgeting and Expense Tracking: Create a detailed budget and track your expenses regularly. Identify areas where you can cut back without compromising your quality of life. Consider using budgeting apps or spreadsheets to stay organized.

- Negotiate Bills and Subscriptions: Regularly review and negotiate your bills, such as cable, internet, and insurance. Many service providers offer discounts or promotions to retain customers. You can also cancel unnecessary subscriptions to save money.

- Smart Shopping: Practice conscious consumption by comparing prices, using coupons, and buying in bulk for non-perishable items. Shop during sales and consider second-hand options for certain purchases.

5. Explore Alternative Income Streams

Generating additional income can help offset the effects of inflation. Here are some ideas:

- Freelancing and Side Hustles: Utilize your skills and hobbies to earn extra income through freelancing or starting a side business. Online platforms offer various opportunities, from content writing to graphic design and consulting.

- Renting Out Assets: If you have underutilized assets like a spare room, parking space, or even your car, consider renting them out to generate passive income. Sharing economy platforms make it easy to connect with potential renters.

- Dividend Investing: Invest in dividend-paying stocks or funds to create a steady stream of income. Dividends can provide a hedge against inflation and offer a regular cash flow.

Long-Term Financial Security

Protecting your finances from inflation is a long-term game that requires discipline and adaptability. Here are some additional considerations:

- Regularly Review and Adjust: Stay vigilant and monitor your financial situation regularly. Inflation rates and economic conditions can change, so be prepared to adjust your strategies accordingly.

- Seek Professional Advice: Consider consulting a financial advisor who can provide personalized guidance based on your unique circumstances. They can help you create a comprehensive financial plan that accounts for inflation and other economic factors.

- Stay Informed: Keep yourself updated on economic trends and financial news. Understanding the broader economic landscape can help you make more informed decisions about your investments and savings.

Conclusion

In an era of rising prices, taking proactive measures to protect your finances from inflation is essential for maintaining financial security. By diversifying your investments, adjusting your savings strategy, managing debt wisely, embracing frugal living, and exploring alternative income streams, you can build a robust financial fortress. Remember, the key to success is staying informed, being adaptable, and taking a long-term view of your financial journey. With these strategies, you can navigate the challenges of inflation and secure your financial future.

Now, you're equipped with the knowledge to safeguard your wealth and make your money work harder in the face of inflation. Take control of your financial destiny and ensure your hard-earned money retains its value for years to come!

Marketing

View All

January 20, 2025

5 Best Digital Marketing Tools for GrowthUncover the top 5 digital marketing tools every marketer needs. Boost efficiency, drive results, and streamline your campaigns now!

Mia Anderson

January 22, 2025

The Future of Digital Marketing RevealedExplore where digital marketing is headed in the next decade. From AI to VR, see what’s shaping the future of online marketing. Don’t get left behind!

Mia Anderson

January 25, 2025

SEO’s Role in Digital Marketing StrategyDive into the importance of SEO in crafting a digital marketing strategy that works. Rank higher and drive organic traffic today!

Mia Anderson

Entertainment

View AllDiscover the essential steps to becoming a video game tester in 2024. Learn the skills, qualifications, and tips needed to start your gaming career today.

Mia Anderson

Unlock the best entertainment subscription deals today. Save big on top services and get more for your money. Click now to find your perfect plan!

Mia Anderson

Discover the latest tips and trends for becoming a successful music producer in 2024. Learn how to start your career today and make your mark in the industry!

Mia Anderson

Learn how influencer marketing is used by the entertainment sector to generate buzz and increase engagement. Discover the keys to campaign success, as well as how to choose the proper influencers and produce interesting content.

Mia Anderson

Automotive

View AllDiscover how AI applications are transforming EV technology, from autonomous driving to predictive maintenance.

Read MoreA complete guide to selling your car like a pro! From pricing to paperwork, we cover it all.

Read MoreDiscover how government policies are accelerating EV adoption. Explore tax incentives, regulations, and global policy success stories.

Read MorePolular🔥

View All

2

3

4

5

6

7

8

9

10

Technology

View All

August 31, 2024

Boost Your Workflow Efficiency with Robotics Process Automation

Discover how Robotics Process Automation (RPA) can streamline your processes and boost efficiency. Read our expert guide for actionable insights and tips!

December 20, 2024

How to Choose the Perfect Smart Thermostat for Your Home

Optimize your home comfort with a smart thermostat! Click to learn how to select the ideal one for your space.

December 18, 2024

How to Get the Best Deals on Smartphones This Month

Discover the hottest smartphone deals this month! Click to learn insider tips and save big on your next purchase.

Tips & Trick