Investment Scams 101: Don’t Get Fooled by These 5 Common Tricks

Mia Anderson

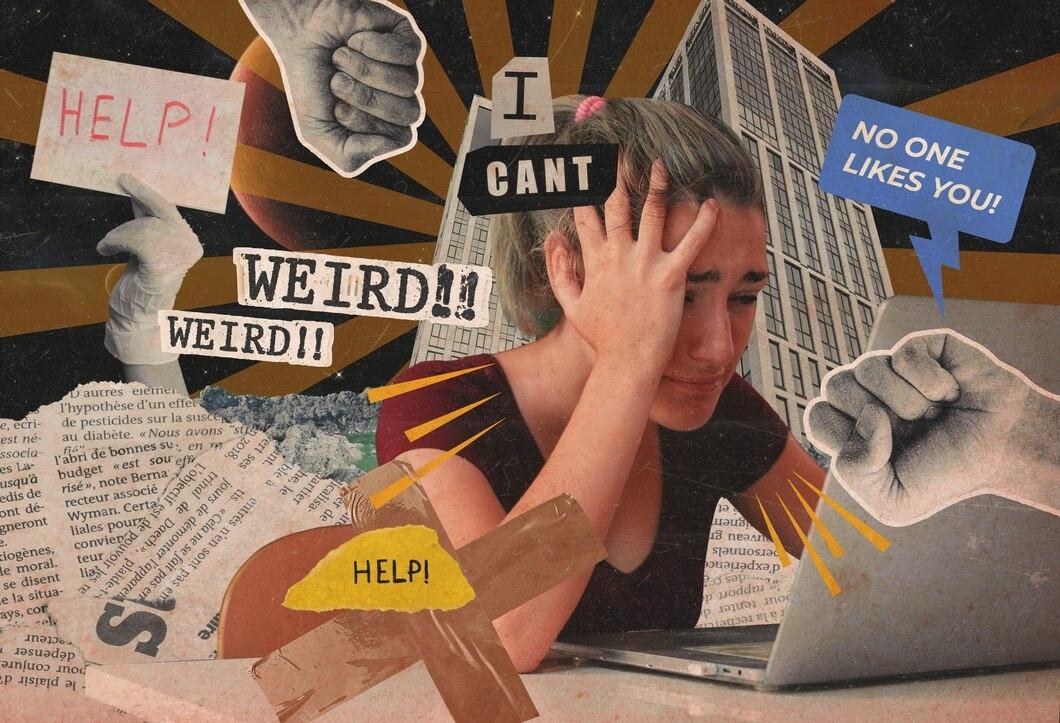

Photo: Investment Scams 101: Don’t Get Fooled by These 5 Common Tricks

In the world of investing, where the potential for significant returns attracts many aspiring investors, there are also those who seek to take advantage of others' financial aspirations. Investment scams are unfortunately prevalent, and falling victim to them can result in devastating financial losses. This article aims to shed light on some of the most common investment scam tactics and provide you with the knowledge to protect yourself in the complex world of finance.

Understanding Investment Scams

Investment scams are deceptive practices designed to trick individuals into making financial decisions that benefit the scammer. These scams can take various forms, from fraudulent investment opportunities to fake financial advisors. Scammers often exploit people's desire for quick profits or their lack of financial knowledge, making it crucial to stay vigilant and informed.

The Impact of Investment Scams

Falling prey to an investment scam can have severe consequences. Victims often lose substantial amounts of money, which can lead to financial hardship and even ruin. The psychological impact can be equally devastating, causing anxiety, stress, and a loss of trust in the financial system. It's essential to recognize the signs of a scam to protect yourself and your hard-earned money.

Common Investment Scam Tactics

1. Pyramid Schemes: The Never-Ending Chain

Pyramid schemes are a classic scam that continues to trap unsuspecting individuals. In this setup, participants are promised high returns for recruiting new members, rather than selling legitimate products or services. The scheme relies on a constant influx of new investors to sustain the payouts to earlier investors.

How it Works:

- Scammers entice people with the promise of easy money and quick returns.

- Participants are encouraged to recruit friends, family, or anyone they can convince to join.

- The focus is on recruitment rather than selling any tangible product.

- As the pyramid grows, it becomes increasingly difficult to find new recruits, leading to the collapse of the scheme.

Real-Life Example:

Imagine a scenario where your friend invites you to join a "revolutionary" investment club. They promise high returns and show you their own impressive earnings. However, upon closer inspection, you realize that the club's success relies solely on recruiting more members, with no actual investment strategy in place. By the time you realize it's a pyramid scheme, your friend has already recruited several others, and the cycle continues.

2. Fake Investment Opportunities: Too Good to be True

Scammers often lure victims with fake investment opportunities that promise extraordinary returns with minimal risk. These schemes often prey on people's greed or desperation, offering a chance to get rich quickly.

Red Flags to Watch Out For:

- Guaranteed High Returns: Legitimate investments carry inherent risks, and guaranteed returns are a major red flag.

- Unregistered Investments: Always verify that the investment is registered with the appropriate regulatory bodies.

- Pressure to Act Fast: Scammers create a sense of urgency to prevent you from doing thorough research.

A Cautionary Tale:

Consider the story of Mr. Johnson, who received an email about a once-in-a-lifetime investment opportunity in a secret tech startup. The email promised a 50% return in just a few months. Excited, Mr. Johnson invested his life savings without conducting proper due diligence. Unfortunately, the startup was a facade, and his money was gone, leaving him devastated and financially vulnerable.

3. Ponzi Schemes: The House of Cards

Named after Charles Ponzi, a notorious scammer, this scheme involves paying returns to existing investors using funds from new investors, rather than actual profits. Ponzi schemes can appear legitimate for a while, but they are destined to collapse.

The Ponzi Scheme Cycle:

- Scammers attract investors with promises of high returns.

- Early investors receive payouts, often from the funds of new investors.

- As the scheme grows, it becomes harder to find new investors to sustain the payouts.

- Eventually, the scheme collapses, leaving most investors with significant losses.

Protect Yourself:

- Research the investment thoroughly and be wary of promises that seem too good to be true.

- Diversify your investments to minimize the impact of potential scams.

4. Fake Financial Advisors: Wolves in Sheep's Clothing

Scammers may pose as financial advisors, offering personalized investment advice to gain trust and access to your finances.

How to Spot a Fake Advisor:

- Unsolicited Contact: Be cautious of advisors who reach out to you unexpectedly.

- Unregistered Advisors: Check their credentials and ensure they are licensed and registered.

- High-Pressure Sales Tactics: Legitimate advisors prioritize your financial goals, not quick sales.

A Real-Life Scenario:

Imagine receiving a call from a "financial expert" who claims to have insider knowledge of the stock market. They promise to double your investment in a short time. However, upon further investigation, you discover they are not registered advisors and have scammed others with similar tactics.

5. Pump and Dump Schemes: Manipulating the Market

In this scam, fraudsters artificially inflate the price of a stock or security through false and misleading statements, then sell their shares at a profit, leaving unsuspecting investors with devalued assets.

The Pump and Dump Process:

- Scammers spread false information to create hype around a specific investment.

- Unsuspecting investors buy into the hype, driving up the price.

- Once the price peaks, scammers sell their shares, causing the price to plummet.

Avoid the Trap:

- Conduct thorough research before investing in any stock, especially if it's experiencing sudden, unexplained growth.

- Be skeptical of unsolicited investment tips or hot stock recommendations.

Protecting Yourself from Investment Scams

- Education is Key: Stay informed about different types of scams and how to identify them.

- Research and Due Diligence: Always research investments and advisors thoroughly.

- Seek Professional Advice: Consult registered financial advisors for guidance.

- Diversify Your Portfolio: Spread your investments to minimize risk.

- Beware of High-Pressure Tactics: Legitimate opportunities don't require rushed decisions.

Conclusion

Investment scams are a constant threat in the financial world, but with knowledge and caution, you can protect yourself. Stay vigilant, conduct thorough research, and trust your instincts. Remember, if an investment opportunity seems too good to be true, it probably is. By understanding these common scams, you can navigate the investment landscape with confidence and safeguard your financial future.

Stay informed, stay safe, and always approach investment opportunities with a critical eye. Your financial well-being is worth the extra effort!

Marketing

View All

January 19, 2025

How to Master Digital Marketing BasicsLearn the essentials of digital marketing in this beginner-friendly guide. Kickstart your journey with step-by-step strategies. Start mastering today!

Mia Anderson

January 25, 2025

Email Marketing in the Digital AgeUnlock the power of email marketing with modern strategies tailored for the digital age. Connect with your audience like never before!

Mia Anderson

January 21, 2025

Why Digital Marketing is Vital for SMBsDiscover why small businesses must adopt digital marketing in 2024. Learn tips and tactics to compete in the digital age. Take your business online today!

Mia Anderson

Entertainment

View AllDiscover proven strategies for monetizing your blog in 2024. Learn how to boost revenue effectively. Read now for actionable insights and start earning today!

Mia Anderson

Discover top tips on streaming your favorite films legally & safely with our guide - click now, don't miss out!

Mia Anderson

Unlock the secrets of modern screenwriting with our expert tips and techniques. Start crafting compelling scripts today click to learn how!

Mia Anderson

Discover the latest trends in cinematic universes for 2024. Explore how interconnected storytelling is evolving and its impact on modern media. Learn more now!

Mia Anderson

Automotive

View AllExplore cutting-edge innovations shaping EV charging infrastructure and making electric vehicles more accessible globally.

Read MoreExplore resale value trends for electric vehicles and what buyers can expect when selling their EV in the future.

Read MoreLearn how electric vehicles (EVs) help reduce greenhouse gas emissions and combat climate change. Discover the environmental benefits!

Read MorePolular🔥

View All

1

2

3

4

5

7

8

9

10

News

View AllOctober 14, 2024

2024 Vaccination Updates: What You Need to Know for Flu & COVID-19 Protection

Read MoreTechnology

View All

December 7, 2024

Top 10 Smartphones with the Best Battery Life in 2024

Say goodbye to battery anxiety! Discover the top 10 smartphones with exceptional battery life. Click to explore and stay charged all day.

December 12, 2024

The Ultimate Tech Deals You Need to Grab Before They Disappear in 2024

Don't miss out on the hottest tech deals of 2024! Click to discover limited-time offers and save big on gadgets.

December 16, 2024

How to Upgrade Your PC for Under $500 – Best Components for 2024

Upgrade your PC on a budget! Discover the best components for 2024 to enhance performance. Click to learn more and build your dream PC.

Tips & Trick