Is DIY Financial Planning Worth It? Here’s What You Should Know

Mia Anderson

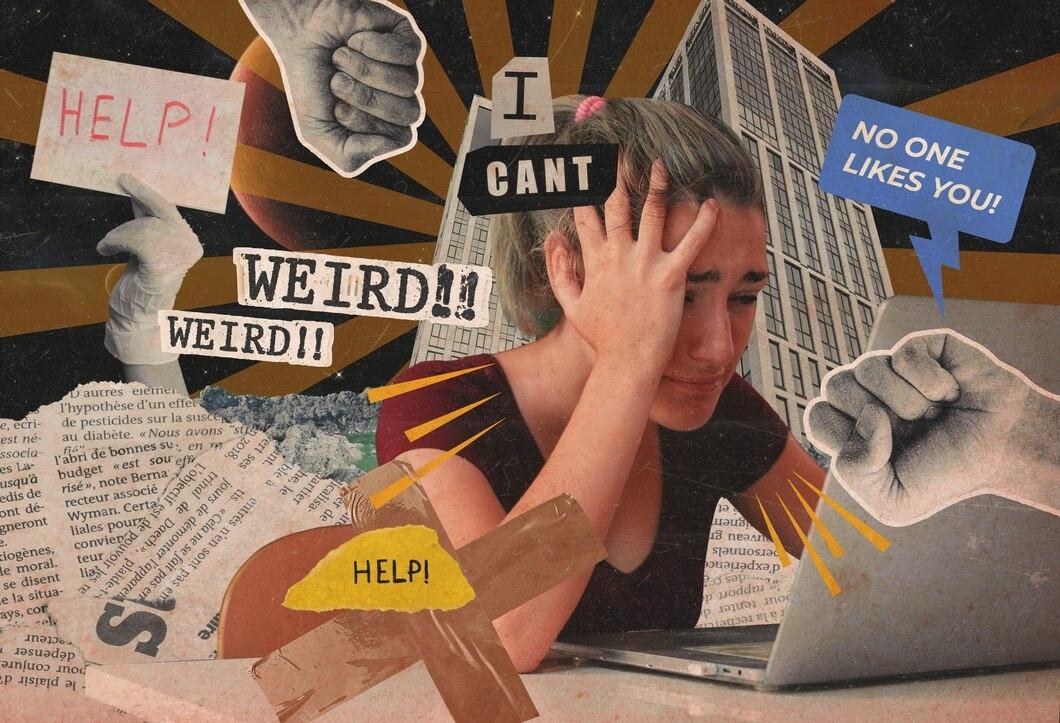

Photo: Is DIY Financial Planning Worth It? Here’s What You Should Know

with a wealth of information at our fingertips, many individuals are tempted to take financial planning into their own hands. DIY (Do-It-Yourself) financial planning can be an appealing option for those who want to take control of their financial future and save on professional advisor fees. But is it really worth the effort and potential risks? In this article, let's delve into the world of DIY financial planning, exploring its advantages and disadvantages to help you decide if it's the right path for your financial journey.

The Rise of DIY Financial Planning

The concept of managing your finances independently has gained traction in recent years, thanks to the abundance of online resources and user-friendly financial tools. With a few clicks, you can access investment platforms, budgeting apps, and financial calculators, making it easier than ever to create your own financial strategy. But is this newfound accessibility a blessing or a potential pitfall?

Pros of DIY Financial Planning: Taking Control of Your Finances

1. Cost Savings

One of the most attractive benefits of DIY financial planning is the potential for significant cost savings. Hiring a financial advisor often comes with substantial fees, which can eat into your investment returns over time. By managing your own investments, creating a budget, and making financial decisions independently, you eliminate these costs, allowing more of your money to work for you.

2. Personalized Approach

DIY financial planning allows you to tailor your strategy to your unique needs and goals. You have the freedom to choose investments that align with your risk tolerance and values. Whether you're passionate about sustainable investing or have specific retirement goals, you can create a personalized plan that suits your preferences. This level of customization can be empowering and may lead to greater satisfaction with your financial decisions.

3. Enhanced Financial Literacy

Taking the DIY route can significantly improve your financial literacy. As you research investment options, tax strategies, and market trends, you'll gain a deeper understanding of how the financial world works. This knowledge can be invaluable, enabling you to make more informed decisions and adapt to changing economic conditions.

Real-Life Example: Sarah's DIY Journey

Let's consider the story of Sarah, a 30-year-old marketing professional who decided to embark on a DIY financial planning adventure. Sarah started by setting clear financial goals: buying a house within the next five years and retiring comfortably by age 60. She began by educating herself through online courses and personal finance blogs, learning about investment strategies and the power of compounding.

Sarah opened a brokerage account and started investing in a mix of stocks and bonds, carefully researching each company before making a decision. She also set up a high-yield savings account for her emergency fund and house down payment. By creating a detailed budget, Sarah identified areas where she could cut back on expenses, freeing up more money for her financial goals.

Cons of DIY Financial Planning: Navigating the Challenges

While DIY financial planning has its perks, it's not without its drawbacks. Let's explore some of the potential pitfalls:

1. Time Commitment

Managing your finances independently requires a significant time investment. Researching investment options, analyzing market trends, and staying updated on tax laws can be time-consuming. For busy individuals, finding the time to dedicate to financial planning may be challenging, leading to rushed decisions or a lack of attention to detail.

2. Emotional Biases

Personal biases and emotions can cloud your judgment when making financial decisions. It's easy to get caught up in the excitement of a hot stock tip or panic during market downturns. Emotional decision-making can lead to costly mistakes, such as selling investments at the wrong time or chasing short-term trends. Overcoming these biases requires discipline and a rational mindset.

3. Limited Expertise

Professional financial advisors bring years of experience and specialized knowledge to the table. They can provide valuable insights into complex financial matters, such as estate planning, tax optimization, and retirement strategies. DIY planners may struggle with these more intricate aspects of financial planning, potentially missing out on opportunities or making costly errors.

Finding the Right Balance

So, is DIY financial planning worth it? The answer depends on your individual circumstances, preferences, and level of commitment. For those with the time, discipline, and interest in learning about personal finance, DIY planning can be a rewarding and cost-effective approach.

However, it's essential to acknowledge the limitations and potential risks. Complex financial situations, such as managing substantial wealth or navigating intricate tax strategies, might require the expertise of a professional advisor. Many individuals find value in a hybrid approach, seeking professional advice for specific aspects of their financial plan while managing other areas independently.

Conclusion: Weighing the Options

DIY financial planning can be a powerful tool for those willing to dedicate the time and effort to learn and manage their finances. It offers cost savings, personalization, and a sense of empowerment. However, it's crucial to recognize the potential challenges, including time constraints, emotional biases, and the need for specialized knowledge.

Ultimately, the decision to go the DIY route should be based on a thorough understanding of your financial goals, risk tolerance, and the resources available to you. Whether you choose to go it alone or seek professional guidance, the key is to take control of your financial future and make informed decisions that align with your long-term objectives. Remember, financial planning is a journey, and finding the right approach for your unique situation is essential to achieving your financial dreams.

Marketing

View All

January 19, 2025

How to Master Digital Marketing BasicsLearn the essentials of digital marketing in this beginner-friendly guide. Kickstart your journey with step-by-step strategies. Start mastering today!

Mia Anderson

January 25, 2025

Email Marketing in the Digital AgeUnlock the power of email marketing with modern strategies tailored for the digital age. Connect with your audience like never before!

Mia Anderson

January 21, 2025

Why Digital Marketing is Vital for SMBsDiscover why small businesses must adopt digital marketing in 2024. Learn tips and tactics to compete in the digital age. Take your business online today!

Mia Anderson

Entertainment

View AllDiscover proven strategies for monetizing your blog in 2024. Learn how to boost revenue effectively. Read now for actionable insights and start earning today!

Mia Anderson

Discover top tips on streaming your favorite films legally & safely with our guide - click now, don't miss out!

Mia Anderson

Unlock the secrets of modern screenwriting with our expert tips and techniques. Start crafting compelling scripts today click to learn how!

Mia Anderson

Discover the latest trends in cinematic universes for 2024. Explore how interconnected storytelling is evolving and its impact on modern media. Learn more now!

Mia Anderson

Automotive

View AllExplore cutting-edge innovations shaping EV charging infrastructure and making electric vehicles more accessible globally.

Read MoreExplore resale value trends for electric vehicles and what buyers can expect when selling their EV in the future.

Read MoreLearn how electric vehicles (EVs) help reduce greenhouse gas emissions and combat climate change. Discover the environmental benefits!

Read MorePolular🔥

View All

1

2

3

4

5

7

8

9

10

News

View AllOctober 14, 2024

2024 Vaccination Updates: What You Need to Know for Flu & COVID-19 Protection

Read MoreTechnology

View All

December 7, 2024

Top 10 Smartphones with the Best Battery Life in 2024

Say goodbye to battery anxiety! Discover the top 10 smartphones with exceptional battery life. Click to explore and stay charged all day.

December 12, 2024

The Ultimate Tech Deals You Need to Grab Before They Disappear in 2024

Don't miss out on the hottest tech deals of 2024! Click to discover limited-time offers and save big on gadgets.

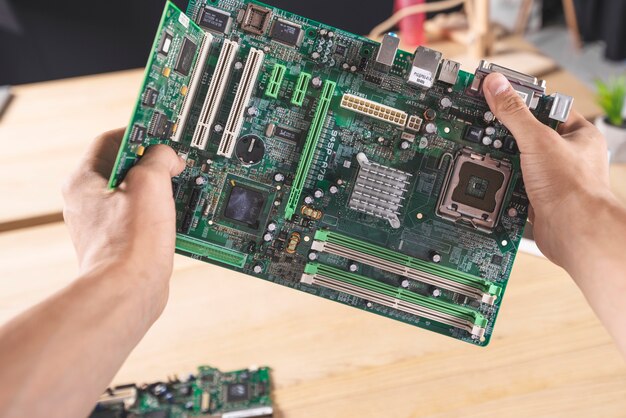

December 16, 2024

How to Upgrade Your PC for Under $500 – Best Components for 2024

Upgrade your PC on a budget! Discover the best components for 2024 to enhance performance. Click to learn more and build your dream PC.

Tips & Trick