Should You Really Use Buy Now, Pay Later? Pros and Cons Explained

Mia Anderson

Photo: Should You Really Use Buy Now, Pay Later? Pros and Cons Explained

Pay Later (BNPL) services has revolutionized the way consumers approach their purchases, especially in the e-commerce space. With a simple click, shoppers can acquire their desired items and pay for them in installments, often without any interest charges. This payment method has gained immense popularity, particularly among younger generations, but it also raises questions about financial responsibility and potential pitfalls. In this article, we'll delve into the world of BNPL, exploring its benefits, drawbacks, and everything in between to help you make an informed decision about whether it's the right choice for you.

What is Buy Now, Pay Later?

Buy Now, Pay Later is a payment method that allows customers to purchase products immediately and pay for them at a later date or in installments over a short period. This financing option has become increasingly popular, especially with the growth of online shopping and the desire for more flexible payment solutions.

The BNPL process typically involves a customer selecting the BNPL option at checkout, choosing their preferred payment plan, and then completing the purchase. The service provider pays the retailer in full, and the customer repays the BNPL company in installments, often interest-free. It's a convenient way to manage purchases without the need for traditional credit cards or loans.

Pros of Buy Now, Pay Later:

1. Convenience and Accessibility:

BNPL offers unparalleled convenience to shoppers. With just a few clicks, you can secure your desired purchase and pay for it in manageable installments. This accessibility is particularly appealing to those who may not have access to traditional credit lines or prefer not to use them for smaller purchases. For instance, a student with a limited credit history can use BNPL to buy a new laptop for their studies, paying it off in affordable monthly payments.

2. Interest-Free Payment Plans:

One of the most attractive features of BNPL is the absence of interest charges on many plans. This means that if you pay off your purchase within the specified timeframe, you won't incur any additional fees. This can be a significant advantage over credit cards, which often charge high-interest rates on outstanding balances. For example, a young professional might use BNPL to upgrade their work wardrobe, spreading the cost over several months without worrying about accumulating interest.

3. Improved Cash Flow Management:

BNPL can be a useful tool for managing cash flow, especially for those with irregular income or those who prefer to spread out large purchases. Instead of paying the full amount upfront, you can allocate a portion of your income to each installment, making budgeting more manageable. Imagine a freelance designer who lands a significant project they can use BNPL to purchase the necessary equipment and pay for it as they receive payments from their client.

4. No Hard Credit Checks:

Unlike traditional credit applications, BNPL services often only perform soft credit checks, which do not impact your credit score. This is beneficial for individuals who want to avoid the potential negative impact of hard inquiries on their credit report. Soft checks allow you to explore BNPL options without the risk of damaging your creditworthiness.

Cons of Buy Now, Pay Later:

1. Overspending and Debt Accumulation:

One of the primary concerns with BNPL is the potential for overspending and accumulating debt. The ease of making purchases without immediate consequences can lead to impulsive buying decisions. Since BNPL plans are often short-term, missing payments or defaulting can result in late fees, negatively affecting your credit score. It's essential to exercise self-control and ensure that BNPL purchases fit within your budget.

2. Hidden Fees and Interest Charges:

While many BNPL plans advertise interest-free payments, late or missed payments can result in additional fees and, in some cases, interest charges. These fees can quickly add up, making the overall cost of the purchase much higher than expected. It's crucial to read the fine print and understand the terms and conditions of your BNPL agreement to avoid unpleasant surprises.

3) Limited Consumer Protections:

BNPL services may not offer the same level of consumer protection as traditional credit cards. For instance, if a product is faulty or not as described, the BNPL provider may not be responsible for resolving the issue, leaving you to navigate the return process with the retailer. Additionally, BNPL companies may not provide the same level of fraud protection as credit card companies.

4. Impact on Credit Score:

While BNPL services typically perform soft credit checks, some providers may report missed payments to credit bureaus, potentially affecting your credit score. This can be a concern for those who are building or maintaining their credit history. It's essential to understand how each BNPL service handles credit reporting to make informed decisions.

Making an Informed Decision:

When considering whether to use BNPL, it's crucial to weigh the pros and cons and assess your financial situation and spending habits. Here are some questions to ask yourself:

- Do I have a clear understanding of my budget and can I afford the repayments?

- Am I disciplined enough to make payments on time, or might I be tempted to overspend?

- Have I thoroughly read and understood the terms and conditions, including any potential fees?

- Is the purchase essential, or can it wait until I've saved up the full amount?

For instance, if you're considering using BNPL for a non-essential item, like a new gaming console, it might be worth saving up and buying it outright to avoid potential debt. However, for essential purchases like a laptop for work or school, BNPL can be a helpful tool to manage the cost over time.

Conclusion:

Buy Now, Pay Later services offer a convenient and flexible way to manage purchases, especially for those who prefer not to use traditional credit options. However, it's essential to approach BNPL with caution and financial responsibility. By understanding the pros and cons and considering your individual circumstances, you can make informed decisions about when and how to use BNPL.

While BNPL can provide a helpful boost to your purchasing power, it's crucial to remember that it's still a form of debt. Managing your finances wisely and using BNPL as a strategic tool rather than a default payment method can help you avoid potential pitfalls and maintain a healthy financial outlook.

In the end, the decision to use BNPL should be based on your financial goals, self-awareness, and a clear understanding of the terms and conditions. With careful consideration, you can navigate the world of Buy Now, Pay Later and make it work for your unique financial situation.

Marketing

View All

January 23, 2025

10 Content Strategies for Digital SuccessCreate winning content with these 10 proven digital marketing strategies. Enhance engagement and conversions starting today!

Mia Anderson

January 20, 2025

5 Best Digital Marketing Tools for GrowthUncover the top 5 digital marketing tools every marketer needs. Boost efficiency, drive results, and streamline your campaigns now!

Mia Anderson

January 19, 2025

How to Master Digital Marketing BasicsLearn the essentials of digital marketing in this beginner-friendly guide. Kickstart your journey with step-by-step strategies. Start mastering today!

Mia Anderson

Entertainment

View AllDiscover the fascinating history of superhero movies, from early adaptations to modern blockbusters. Uncover surprising facts and insights click to explore!

Mia Anderson

Discover how the Metaverse is revolutionizing entertainment in 2024. Read about the latest trends and innovations shaping the future of digital experiences.

Mia Anderson

Find out which movie streaming platforms are the best in 2024. Get insights, compare options, and choose your ideal service. Click to learn more!

Mia Anderson

Discover the amazing history of animated films and how they came to rule the world. Discover how animation has captured the attention of viewers all across the world, from the first attempts to the greatest works of today!

Mia Anderson

Automotive

View AllDominate the auto market with these Dealer Daily tips. Learn strategies to increase efficiency and outshine competitors!

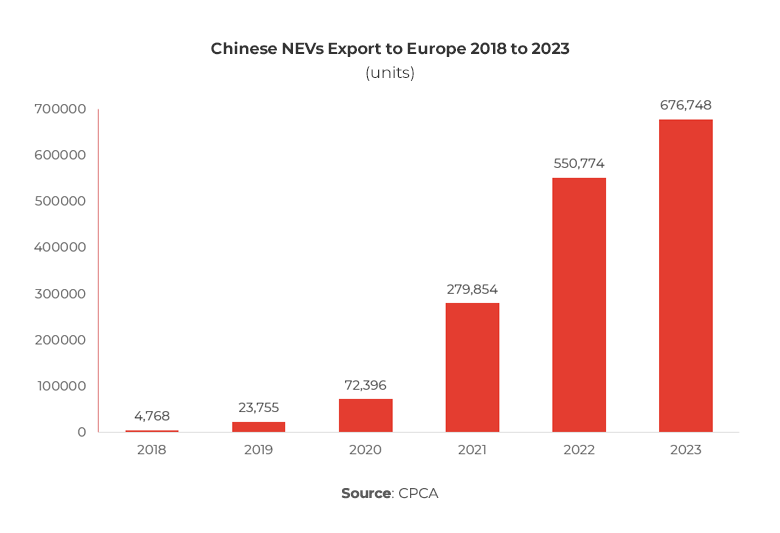

Read MoreLearn how import and export tariffs affect EV prices globally and what that means for buyers and manufacturers.

Read MoreExplore resale value trends for electric vehicles and what buyers can expect when selling their EV in the future.

Read MorePolular🔥

View All

1

2

4

6

7

8

9

10

Technology

View All

August 9, 2024

The Best Video Game Graphics in 2024

Find out which video games from 2024 provide the most amazing graphics and captivating gameplay. These games will wow you with their beautiful settings and minute features!

August 27, 2024

How Expert IT Consulting Services Can Transform Your Business

Discover top IT consulting services to drive business growth. Explore expert solutions tailored to your needs and boost your tech efficiency. Click to learn more!

December 13, 2024

Should You Upgrade to a Smart Home? 6 Reasons to Start Today

Upgrade your home with smart tech! Learn 6 compelling reasons to embrace the future. Click to explore and transform your living space.

Tips & Trick