Secrets to Investing in the Stock Market for Long-Term Success

Mia Anderson

Photo: Secrets to Investing in the Stock Market for Long-Term Success

Are you ready to embark on a journey towards financial prosperity through the stock market? Investing in stocks can be an exciting yet intricate path to building wealth, but it's not without its challenges. This guide aims to unravel the secrets of successful stock market investing, providing you with the knowledge and strategies to navigate this complex world and achieve your long-term financial goals. So, let's dive in and explore the art of making your money work for you!

Understanding Your Investment Style

Before you dive into the vast ocean of stocks, it's crucial to understand your own investing style. This self-awareness is the compass that will guide your investment decisions and strategies.

Reflect and Choose

Start by reflecting on your preferences. Do you enjoy delving into the intricacies of stock analysis, or do you prefer a more hands-off approach? This fundamental choice will shape your investment journey. If you're a DIY enthusiast, you'll take charge of your portfolio, making trades and decisions independently. However, if you're more comfortable with a guided approach, you can seek assistance from financial advisors or automated investment platforms.

DIY Investing: The Hands-On Approach

For those who embrace the DIY investing style, the stock market becomes a playground of opportunities. This method requires a solid understanding of how stocks function and the confidence to navigate the market with minimal guidance. You'll be actively involved in researching, analyzing, and managing your trades, which can be both exhilarating and demanding.

Active vs. Less Active DIY Investors:

- Active DIY investors dedicate significant time to studying market trends, company performances, and industry news. They make frequent trades, aiming to capitalize on short-term fluctuations.

- Less active DIY investors take a more relaxed approach, focusing on long-term growth. They might monitor their portfolio less frequently but still make informed decisions based on thorough research.

The Benefits of a Detached Approach

Not everyone has the time or inclination to become a full-time stock analyst. If you prefer a more detached investment style, there are still opportunities to thrive in the stock market.

Index Funds: Diversification Made Easy:

Consider investing in index funds, which are collections of stocks representing a specific market or industry. This strategy offers diversification, reducing the impact of individual stock performance on your overall portfolio. If one stock underperforms, it's unlikely to significantly affect the index fund's overall value.

Choosing Your Stocks: A Conservative Start

When you're ready to pick your first stocks, it's wise to begin conservatively. This approach is especially beneficial for beginners, as it allows you to build a solid foundation and gain confidence in your investment decisions.

Focus on Stability and Track Record

Look for stocks or funds that have demonstrated stability and a strong track record. These investments are less likely to experience dramatic fluctuations, providing a sense of security as you learn the ropes. By starting with a conservative portfolio, you can minimize initial risks and gradually expand your investment horizons as your knowledge grows.

Example: Blue-Chip Stocks

A classic example of a conservative investment is blue-chip stocks. These are shares of well-established companies known for their reliability and consistent performance. Investing in blue-chip stocks can provide a solid foundation for your portfolio, offering stability and steady returns.

Learning and Adapting: The Key to Long-Term Success

The stock market is a dynamic environment, constantly evolving with global events, economic trends, and industry shifts. To become a successful long-term investor, you must embrace a culture of continuous learning and adaptation.

Stay Informed and Adapt Your Strategies

- Read Widely: Keep yourself informed by reading reputable financial news sites and publications. Stay updated on global economic trends, industry-specific news, and the performance of companies you're invested in or considering.

- Avoid Get-Rich-Quick Schemes: Be cautious of sources promising easy returns or tricks. Instead, focus on books and resources that provide genuine investment strategies, stock market fundamentals, and diversification techniques.

- Review and Reflect: Regularly review your investment goals and risk tolerance. As you gain experience, you may find that your goals evolve, and your risk appetite changes. Adapting your strategies to align with these shifts is essential for long-term success.

The Power of Patience

In the world of stock market investing, patience is a virtue. It's essential to understand that building long-term wealth takes time and consistency. Quick returns are possible, but they often come with higher risks. A patient investor focuses on the bigger picture, understanding that short-term losses or market downturns are part of the journey.

Example: Warren Buffett's Long-Term Strategy

One of the most successful investors of all time, Warren Buffett, is known for his long-term investment philosophy. He advocates for buying and holding stocks in companies with strong fundamentals, waiting patiently for their value to appreciate over time. This approach has proven successful, showcasing the power of patience and long-term vision.

Managing Risks: A Balancing Act

Investing always carries a degree of risk, and the stock market is no exception. Understanding and managing these risks is a critical aspect of long-term investment success.

Assessing Risk Levels

Different asset classes and investment products carry varying levels of risk. Some, like individual stocks, can be highly volatile, while others, such as bonds or mutual funds, may offer more stability. It's essential to assess your risk tolerance and align your investments accordingly.

Diversification as a Risk Mitigation Strategy:

Diversifying your portfolio is a powerful way to manage risk. By spreading your investments across various asset classes, industries, and companies, you reduce the impact of any single investment's performance on your overall wealth. This strategy ensures that even if one investment underperforms, others can help balance your portfolio.

The Importance of Knowledge

Investing in individual stocks requires a deep understanding of the company, its industry, products, competitors, and financial health. This level of knowledge is crucial for making informed decisions and managing risks effectively.

Seeking Professional Guidance:

If you're new to investing or don't have the time to conduct extensive research, consider seeking guidance from financial advisors. They can provide valuable insights and help you navigate the complexities of the stock market, ensuring your investment decisions align with your goals and risk tolerance.

Conclusion: A Journey of Learning and Growth

Stock market investing is a fascinating journey that requires a combination of knowledge, strategy, and adaptability. By understanding your investment style, choosing stocks wisely, and staying informed, you can build a solid foundation for long-term success. Remember, the stock market is not a get-rich-quick scheme; it's a long-term commitment that rewards patience and continuous learning.

As you embark on this financial adventure, keep in mind that every investor's path is unique. Learn from your experiences, adapt to market changes, and never stop seeking knowledge. With time and dedication, you can unlock the secrets of the stock market and achieve your financial aspirations.

Happy investing!

Marketing

View All

January 27, 2025

PPC vs SEO: Digital Marketing ShowdownDiscover the differences between PPC and SEO in digital marketing. Find out which strategy is right for your goals and budget. Make an informed choice today!

Mia Anderson

January 21, 2025

Why Digital Marketing is Vital for SMBsDiscover why small businesses must adopt digital marketing in 2024. Learn tips and tactics to compete in the digital age. Take your business online today!

Mia Anderson

January 23, 2025

10 Content Strategies for Digital SuccessCreate winning content with these 10 proven digital marketing strategies. Enhance engagement and conversions starting today!

Mia Anderson

Entertainment

View AllUnlock the secrets to an unforgettable movie trivia night with our ultimate guide. Get tips, trivia questions, and game ideas to boost your event's fun!

Mia Anderson

Discover the latest online movie distribution trends driving success in 2024. Stay ahead with expert insights click now to revolutionize your strategy!

Mia Anderson

Explore the latest trends in virtual reality gaming for 2024. Our in-depth guide covers new technology and gameplay innovations. Discover more now!

Mia Anderson

Discover the latest trends in live streaming sports for 2024. Learn how to enhance your streaming experience with cutting-edge technology. Start streaming smarter today!

Mia Anderson

Automotive

View AllDiscover how Dealer Daily practices can foster customer loyalty and drive repeat business. Transform your dealership today!

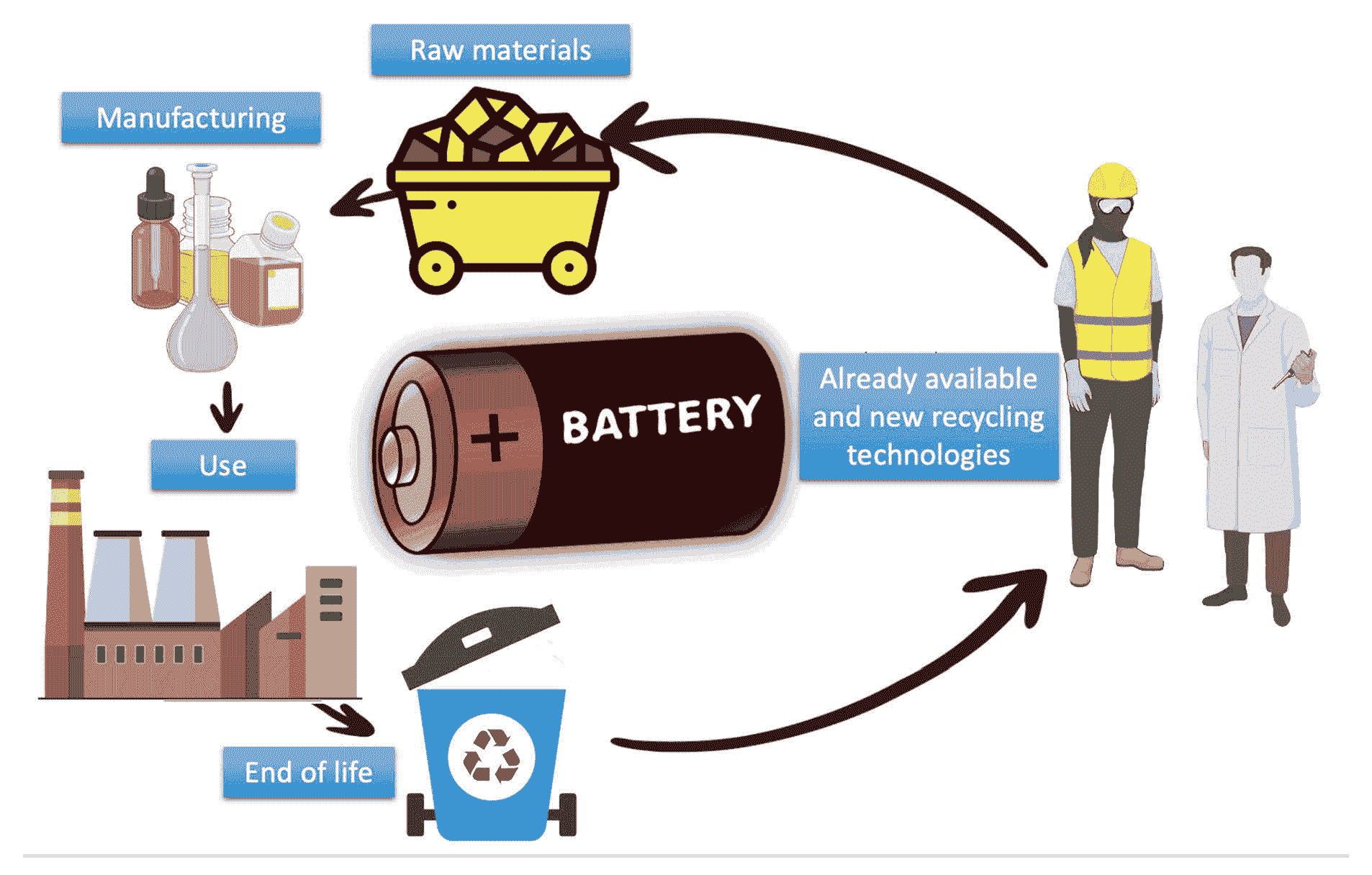

Read MoreUncover the environmental concerns surrounding EV battery recycling. What are the solutions to ensure sustainable practices?

Read MoreSimplify dealership management with these Dealer Daily hacks. Master your workflow and enhance customer satisfaction today!

Read MorePolular🔥

View All

1

2

3

4

5

6

7

8

9

Technology

View All

November 9, 2024

Why Now is the Best Time to Invest in Smart Home Devices

Smart home devices are evolving! Learn why now is the best time to invest and make your home smarter. Start building your smart home today!

September 14, 2024

Step-by-Step Guide to Creating an App in 2024

Learn how to create an app with our 2024 guide. Discover the latest trends, tools, and tips to turn your app idea into reality. Start building now!

December 9, 2024

How to Set Up the Ultimate Home Theater System – Step-by-Step Guide

Create the ultimate home theater! Our guide takes you through every step. Click to learn how to build an immersive entertainment experience.

Tips & Trick

View All