Avoiding Financial Burnout: Tips for Smart Spending and Saving

Mia Anderson

Photo: Avoiding Financial Burnout: Tips for Smart Spending and Saving

it's easy to get caught up in the cycle of spending and find yourself struggling to keep your finances under control. Financial burnout is a real concern for many individuals, leading to stress, anxiety, and even long-term financial struggles. However, with a thoughtful approach to managing your money, you can avoid this common pitfall and build a healthier relationship with your finances. Let's explore some practical tips and strategies to help you spend and save smartly, ensuring a more stable and stress-free financial future.

Understanding Financial Burnout

Financial burnout is a state of emotional and mental exhaustion caused by prolonged financial stress and poor money management. It often stems from overspending, accumulating debt, or feeling overwhelmed by financial responsibilities. This burnout can impact various aspects of your life, affecting your overall well-being and relationships. Recognizing the signs of financial burnout is the first step towards making positive changes. Do you often feel anxious about your financial situation? Are you constantly juggling bills and struggling to make ends meet? These could be indicators that it's time to reassess your spending habits and adopt a more mindful approach to money management.

Smart Spending Strategies

Create a Realistic Budget

The foundation of smart spending lies in creating a budget that works for you. Start by calculating your monthly income and fixed expenses like rent, utilities, and insurance. Then, allocate funds for variable expenses such as groceries, entertainment, and personal care. Ensure your budget is realistic and adaptable. Leave room for unexpected expenses and emergencies. Regularly reviewing and adjusting your budget will help you stay on track and make necessary changes as your financial situation evolves.

Prioritize Needs Over Wants

Distinguishing between needs and wants is crucial for making smart spending decisions. Needs are essential expenses that are necessary for survival and well-being, such as housing, food, and healthcare. Wants, on the other hand, are discretionary purchases that bring pleasure or convenience but are not essential. Prioritize your needs first and allocate your budget accordingly. By ensuring your basic needs are met, you can then allocate a portion of your budget for wants, allowing yourself some flexibility and enjoyment without compromising your financial stability.

Embrace Frugal Living

Embracing frugal living doesn't mean sacrificing your quality of life it's about making conscious choices to spend wisely. Look for ways to save on everyday expenses. For instance, opt for cooking at home instead of dining out regularly, or consider second-hand purchases for items like furniture or clothing. These small changes can significantly impact your overall spending. Additionally, seek out discounts, coupons, and loyalty programs to stretch your money further without compromising on the things you love.

Practice Mindful Shopping

Impulse buying can quickly derail your financial goals. Before making a purchase, ask yourself if it aligns with your budget and long-term financial plans. Consider the value and necessity of the item. Waiting for a day or two before buying can help you make more rational decisions, ensuring you're not spending on items you might later regret. Mindful shopping also involves researching and comparing prices to find the best deals without compromising on quality.

Effective Saving Strategies

Set Clear Financial Goals

Saving without a clear purpose can be challenging to maintain. Set specific financial goals, whether it's for a dream vacation, a down payment on a house, or building an emergency fund. Having defined goals will motivate you to save consistently. Break down these goals into smaller, achievable milestones, and celebrate your progress along the way. This approach will keep you focused and committed to your savings plan.

Automate Your Savings

One of the most effective ways to save is to make it automatic. Set up regular transfers from your checking account to a dedicated savings account. By automating your savings, you ensure that a portion of your income is consistently put aside, making it easier to build a substantial savings fund over time. Consider setting up multiple savings accounts for different goals, allowing you to allocate your funds efficiently.

Explore High-Interest Savings Options

Traditional savings accounts often offer low-interest rates, which can make it challenging to grow your savings significantly. Explore alternative savings options like high-yield savings accounts or certificates of deposit (CDs) that offer better returns. While these options may have specific terms and conditions, they can be a great way to boost your savings and reach your financial goals faster.

Reduce and Refinance Debt

Debt can be a significant contributor to financial burnout. Evaluate your debt situation and create a plan to reduce it. Consider consolidating or refinancing high-interest loans or credit cards to lower your overall interest payments. By reducing your debt, you'll free up more funds for savings and other financial goals.

Conclusion

Avoiding financial burnout requires a mindful and proactive approach to managing your finances. By implementing smart spending and saving strategies, you can take control of your financial future. Creating a realistic budget, prioritizing needs, embracing frugal living, and practicing mindful shopping are all essential steps towards responsible spending. At the same time, setting clear savings goals, automating your savings, exploring high-interest options, and reducing debt will help you build a solid financial foundation. Remember, financial wellness is a journey, and by adopting these strategies, you'll be well on your way to a healthier and more secure financial future.

Remember, financial management is a skill that can be learned and improved over time. Stay committed to your financial goals, and don't be afraid to seek advice from financial experts or utilize budgeting apps to streamline your money management. With dedication and a thoughtful approach, you can achieve financial stability and avoid the pitfalls of burnout.

Marketing

View All

January 25, 2025

SEO’s Role in Digital Marketing StrategyDive into the importance of SEO in crafting a digital marketing strategy that works. Rank higher and drive organic traffic today!

Mia Anderson

January 19, 2025

How to Master Digital Marketing BasicsLearn the essentials of digital marketing in this beginner-friendly guide. Kickstart your journey with step-by-step strategies. Start mastering today!

Mia Anderson

January 27, 2025

PPC vs SEO: Digital Marketing ShowdownDiscover the differences between PPC and SEO in digital marketing. Find out which strategy is right for your goals and budget. Make an informed choice today!

Mia Anderson

Entertainment

View AllDiscover top tips for binge-watching without breaking the bank. Explore budget-friendly streaming options and start enjoying your favorite shows today!

Mia Anderson

Discover the latest entertainment industry trends for 2024. Stay ahead of the curve with insights on what's next. Click to explore and stay informed!

Mia Anderson

Learn how to edit videos like a pro without breaking the bank. Explore the latest tools, techniques, and trends in 2024 video editing. Start creating today!

Mia Anderson

Discover the ultimate 2024 guide to becoming a successful influencer. Learn strategies, tips, and trends. Start your influencer journey now click to begin!

Mia Anderson

Automotive

View AllUncover why Dealer Daily is revolutionizing the auto industry. Gain a competitive edge with these powerful strategies.

Read MoreDiscover trends driving EV range improvements. Learn how automakers are tackling range anxiety with groundbreaking solutions.

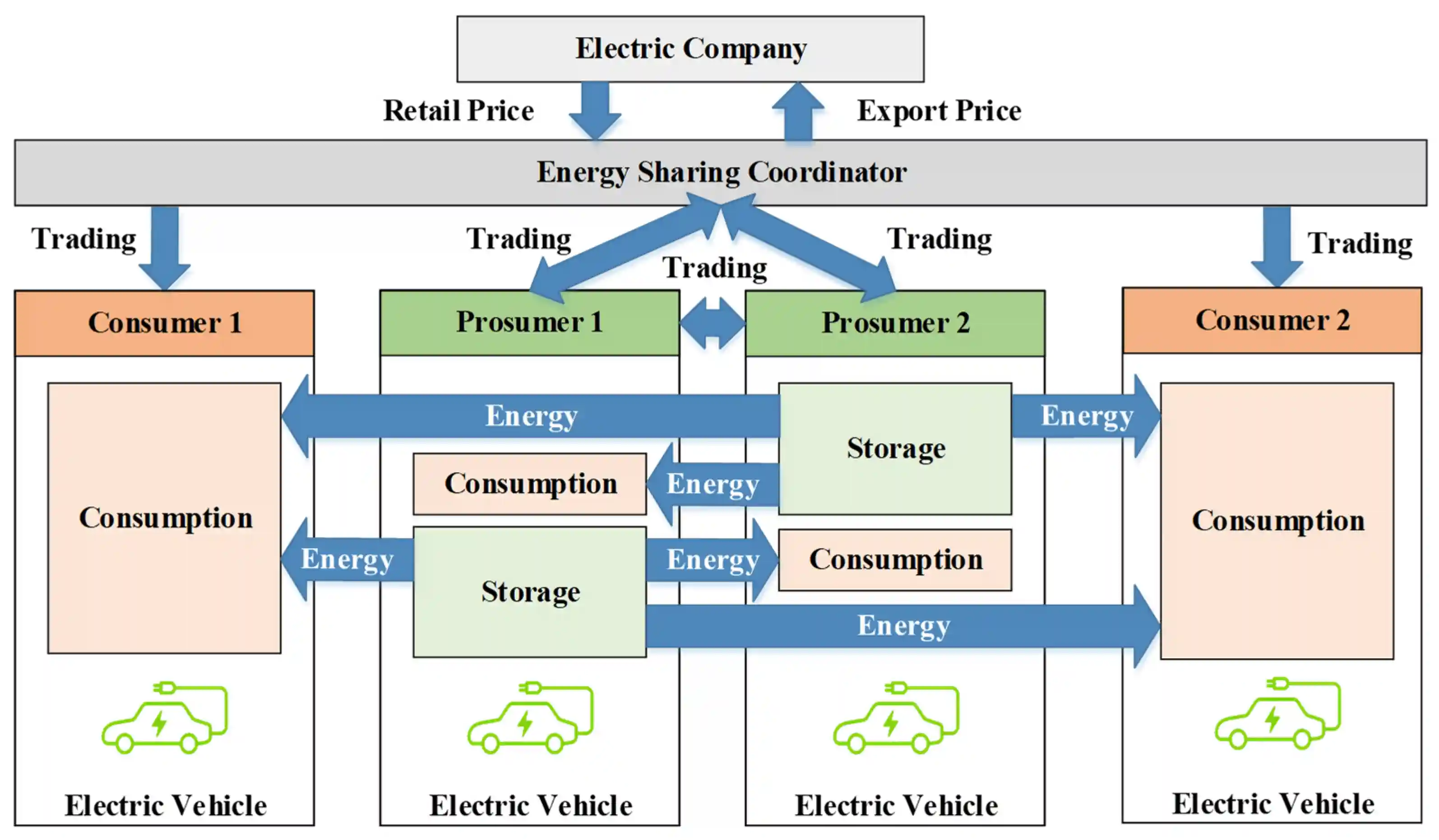

Read MoreExplore the role of EVs in peer-to-peer energy sharing. Could EVs become key players in the decentralized energy market?

Read MorePolular🔥

View All

1

2

3

4

5

6

7

8

9

10

Technology

View All

December 15, 2024

Is This the Best Smartwatch for Fitness? You Won’t Believe What It Can Do!

Uncover the ultimate fitness companion! Click to explore this smartwatch's incredible features and take your workouts to the next level.

August 29, 2024

Top SaaS Trends Shaping Business Success in 2024

Discover the latest SaaS trends revolutionizing businesses in 2024. Learn how these innovations can boost efficiency and drive growth. Read now!

December 14, 2024

How to Save Big on Your Next Tech Purchase: 7 Tips You Need to Know

Save big on your next tech investment! Our 7 expert tips will help you find the best deals. Click to learn more and shop smart.

Tips & Trick