How to Build a Bulletproof Emergency Fund in 30 Days

Mia Anderson

Photo: How to Build a Bulletproof Emergency Fund in 30 Days

In today's unpredictable economy, having a financial safety net is crucial. An emergency fund can be your lifeline during unexpected life events, providing the resources to navigate through challenging times. But how do you build this financial cushion, and is it possible to do so in just 30 days? This article will guide you through a rapid emergency fund-building strategy, offering practical tips and insights to help you take control of your financial future. Get ready to embark on a journey towards financial resilience!

Understanding the Importance of Emergency Funds

Before diving into the 30-day challenge, let's explore why emergency funds are essential. An emergency fund is a dedicated savings account set aside for unforeseen expenses, such as sudden medical bills, car repairs, or job loss. It acts as a buffer, ensuring you have the financial flexibility to handle life's surprises without going into debt or compromising your long-term financial goals.

Many financial experts recommend saving three to six months' worth of living expenses as a solid emergency fund. However, this can seem daunting, especially when you're just starting. The good news is that you can make significant progress in a short time with the right approach and mindset.

The 30-Day Emergency Fund Challenge

Now, let's break down the process of building your emergency fund in just one month. This challenge is designed to kickstart your savings journey and establish a strong foundation for your financial future.

Day 1-7: Assess Your Financial Situation

The first step is to understand your current financial landscape. Calculate your monthly income and expenses, including rent, utilities, groceries, transportation, and any existing debt payments. This will give you a clear picture of your financial health and help you determine a realistic savings goal.

Tip: Use budgeting apps or spreadsheets to track your expenses for a week. This will provide an accurate snapshot of your spending habits and identify areas where you can cut back.

Day 8-14: Set a Realistic Savings Goal

Based on your financial assessment, set a savings goal for your emergency fund. While the ultimate goal might be three to six months' worth of expenses, start with a more achievable target for the next 30 days.

For instance, if your monthly expenses are $2,000, aim to save $1,000 in the next month. This is a challenging yet attainable goal that will give you a sense of accomplishment and motivate you to continue.

Expert Advice: Financial advisor Chen recommends having multiple emergency funds with different purposes and time frames. Consider setting up a short-term fund for immediate needs, a mid-term fund for unexpected repairs, and a long-term fund for job loss or significant emergencies.

Day 15-21: Automate Your Savings

Automation is a powerful tool for successful savings. Set up automatic transfers from your checking account to your emergency fund savings account. Most banks and employers offer this feature, ensuring a portion of your income is saved effortlessly.

"The beauty of automating is that you're paying yourself first," says financial expert McBride. "You're forcing yourself to live on less, which is the key to building wealth over time."

Action Step: Contact your bank to set up automatic transfers or ask your employer about allocating a portion of your paycheck to your savings account.

Day 22-28: Cut Back and Boost Your Savings

Now it's time to get creative and find ways to boost your savings. Look for expenses you can reduce or eliminate temporarily to accelerate your emergency fund growth.

- Dining Out: Cook at home more often instead of eating out. You'll save money and may even discover a new passion for cooking!

- Subscriptions: Review your monthly subscriptions and cancel or pause those you don't use frequently.

- Negotiate Bills: Call your service providers and negotiate lower rates or discounts. Many companies are willing to offer deals to retain customers.

- Side Hustles: Consider taking on a temporary side job or selling unwanted items online to generate extra income.

Day 29-30: Review and Adjust

As you near the end of the challenge, take time to reflect on your progress. How close are you to your initial savings goal? What strategies worked best for you?

If you've achieved your goal, congratulations! You've taken a significant step towards financial security. If not, don't be discouraged. Building an emergency fund takes time and discipline, and you've already laid the foundation.

Tip: Consider making this challenge a monthly ritual. Continuously saving and adjusting your strategies will help you reach your long-term emergency fund goals.

Overcoming Common Challenges

Building an emergency fund in 30 days is an ambitious task, and you may encounter some hurdles along the way. Here's how to tackle them:

- Saving on a Tight Budget: If your income barely covers your expenses, focus on small, consistent savings. Even $20 or $50 per week can add up over time. Look for creative ways to earn extra income, such as selling handmade crafts or offering freelance services.

- Discouragement: Don't get discouraged if you can't save as much as you'd like initially. Building an emergency fund is a marathon, not a sprint. Celebrate your progress, no matter how small, and stay motivated by visualizing the financial security you're working towards.

- Unexpected Expenses: Life happens, and you may face unexpected costs during the challenge. In such cases, prioritize your emergency fund savings and consider using a credit card or short-term loan for the expense. Just be sure to replenish your emergency fund as soon as possible.

Long-Term Strategies for Financial Resilience

While the 30-day challenge is an excellent way to jumpstart your emergency fund, maintaining and growing it is a long-term commitment. Here are some strategies for ongoing financial resilience:

- Consistency is Key: Make saving a habit. Set up regular contributions to your emergency fund, even after the challenge. Treat it as a non-negotiable expense, and you'll watch your savings grow.

- Increase Savings Gradually: As your financial situation improves, aim to increase your savings rate. Consider setting up a direct deposit from your paycheck into your emergency fund, ensuring a portion of your income is saved before you even see it.

- Regularly Review and Adjust: Life circumstances change, and so should your emergency fund. Review your savings periodically and adjust your goals accordingly. For example, if you get a raise, allocate a portion of the additional income to your emergency fund.

Real-Life Success Stories

To illustrate the power of rapid emergency fund building, let's hear from some individuals who have successfully tackled this challenge:

"I was always worried about unexpected expenses, but I never seemed to have enough left at the end of the month to save. When I took on the 30-day challenge, I focused on cutting back on dining out and negotiated a better deal on my internet bill. I also sold some old electronics online. In just one month, I managed to save $1,200, which gave me a huge sense of relief and motivation to keep going." - Sarah, 28, Software Developer

"As a freelancer, my income varies each month, making it challenging to save consistently. I set a goal to save 10% of my income for the next 30 days. I automated my savings and took on a few extra projects. By the end of the month, I had saved over $1,500, which was a massive achievement for me. I now have a solid emergency fund and continue to save regularly." - Michael, 35, Freelance Designer

Conclusion

Building an emergency fund in 30 days is an achievable goal with the right mindset and strategies. By assessing your finances, setting realistic goals, and implementing creative savings methods, you can establish a solid financial safety net. Remember, this challenge is just the beginning. Continuously working on your emergency fund will provide long-term financial security and peace of mind.

So, are you ready to take on the 30-day emergency fund challenge? Your financial future is worth the effort, and the sense of security you'll gain is invaluable. Start today, and in just one month, you'll be well on your way to financial resilience!

Marketing

View All

January 23, 2025

10 Content Strategies for Digital SuccessCreate winning content with these 10 proven digital marketing strategies. Enhance engagement and conversions starting today!

Mia Anderson

January 20, 2025

5 Best Digital Marketing Tools for GrowthUncover the top 5 digital marketing tools every marketer needs. Boost efficiency, drive results, and streamline your campaigns now!

Mia Anderson

January 22, 2025

The Future of Digital Marketing RevealedExplore where digital marketing is headed in the next decade. From AI to VR, see what’s shaping the future of online marketing. Don’t get left behind!

Mia Anderson

Entertainment

View AllUncover how rap influences film storytelling and style. Dive into the transformative impact of rap on movies and see why this matters. Click to explore!

Mia Anderson

Discover the latest online movie distribution trends driving success in 2024. Stay ahead with expert insights click now to revolutionize your strategy!

Mia Anderson

Learn how to edit videos like a pro without breaking the bank. Explore the latest tools, techniques, and trends in 2024 video editing. Start creating today!

Mia Anderson

Discover the latest tips for creating a top-notch home theater in 2024. Learn expert advice on setup, gear, and design. Start your home theater journey today!

Mia Anderson

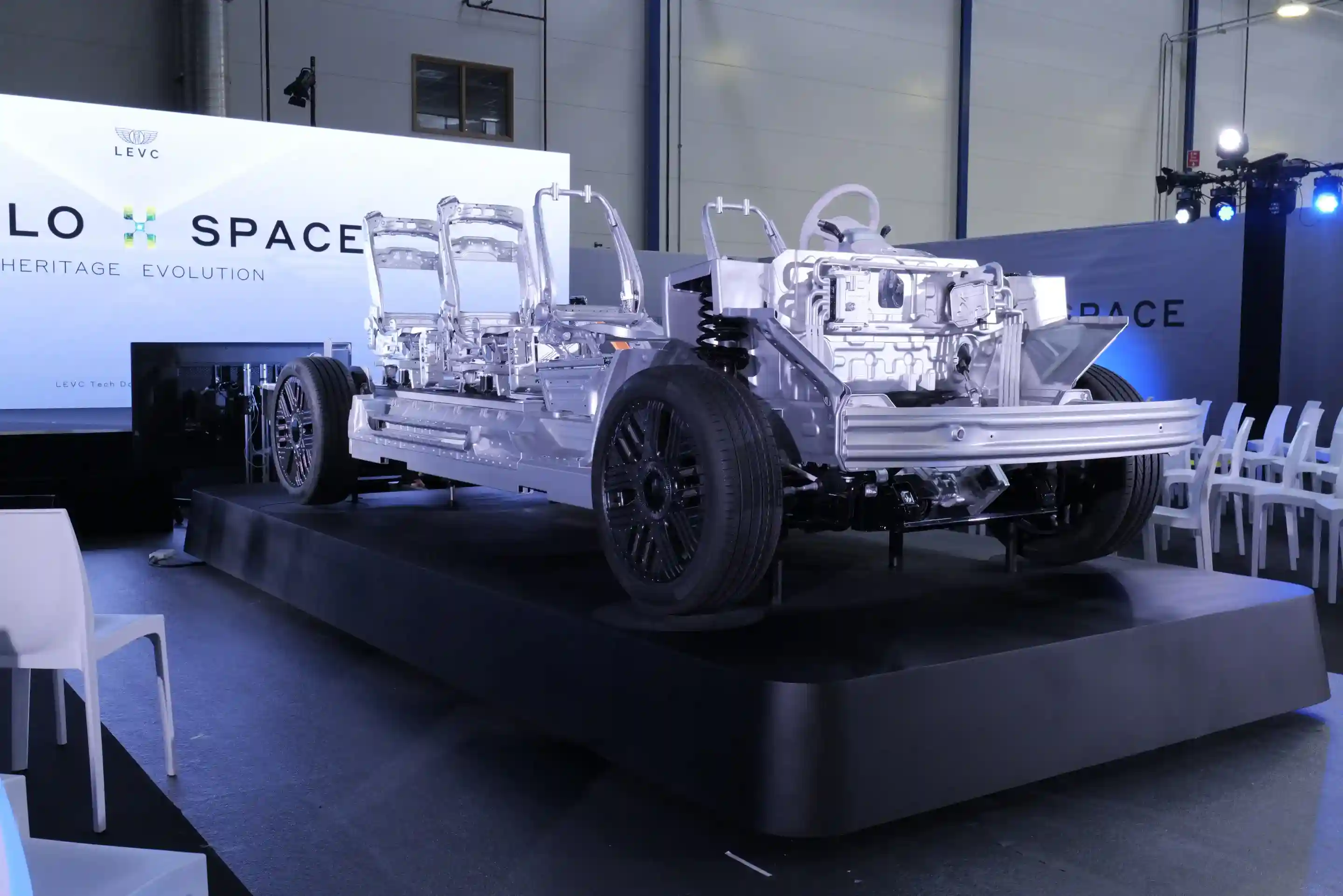

Automotive

View AllLearn about trends in modular EV design. How can this flexibility shape the future of electric cars and reduce production costs?

Read MoreDiscover the latest trends in fleet electrification. How are businesses adopting EVs for commercial use in 2024?

Read MoreLearn about the challenges of recycling and disposing of EV batteries. How can we create sustainable solutions?

Read MorePolular🔥

View All

1

2

3

4

5

6

8

9

10

Technology

View All

August 10, 2024

The Future Unveiled: Exploring the Top AR Apps of 2024

Check out our selection of the top augmented reality applications for 2024! We've selected the best applications that highlight the fascinating potential of augmented reality, ranging from gaming to astronomy.

December 9, 2024

10 Secret Features of the Latest iPad You Probably Didn’t Know About

Uncover the hidden potential of the latest iPad! Explore 10 secret features you won't find elsewhere. Click to learn more and maximize your iPad experience.

December 19, 2024

The Best Laptop for Remote Work in 2024 – Find Out Which One Wins!

Discover the ultimate laptop for remote work! Click to learn about the top contenders and choose the perfect productivity partner.

Tips & Trick