Florida Business Loans: Unlocking Capital for Sunshine State Dreams

Mia Anderson

Photo: Florida Business Loans: Unlocking Capital for Sunshine State Dreams

Florida, the Sunshine State, is a vibrant hub of entrepreneurial spirit and innovation. From the bustling cities of Miami and Orlando to the thriving small towns, Florida attracts business ventures and ambitious startups alike. However, turning business dreams into reality requires capital, and that's where business loans in Florida come into the picture.

Access to financing is crucial for any enterprise, whether it's launching a new startup, expanding existing operations, or investing in innovative ideas. This comprehensive guide will take you on a journey through the diverse funding landscape of Florida, exploring the various loan options available to businesses in the state. By the end, you'll be equipped with the knowledge to navigate the world of Florida business loans and unlock the capital your venture needs to flourish.

Understanding Business Loans in Florida: The Basics

Business loans in Florida encompass a wide range of financing options tailored to support the diverse needs of the state's business community. These loans are specifically designed to help enterprises secure funding for a variety of purposes, including starting a new business, expanding current operations, purchasing equipment or inventory, investing in real estate, or simply managing cash flow during slower periods.

The Florida state government, along with various financial institutions and alternative lenders, offers an array of loan products to cater to these diverse needs. Understanding the different types of loans available and the unique characteristics of each is essential for business owners to make informed decisions about their funding strategies.

Types of Business Loans in Florida

Business loans in Florida can be broadly categorized into two main types: traditional loans and alternative funding options.

Traditional Loans

Traditional loans refer to financing options provided by banks, credit unions, and other conventional financial institutions. These loans typically have stricter eligibility criteria and may require substantial documentation and collateral. Here are some common types of traditional loans:

1. Small Business Loans

Small business loans in Florida are designed to support the state's vibrant community of small enterprises. These loans can be used for a variety of purposes, such as starting a new business, expanding an existing one, or purchasing inventory or equipment. Small business loans from traditional lenders often come with competitive interest rates and flexible repayment terms, making them an attractive option for established businesses with strong credit histories.

2. Commercial Loans

Commercial loans are tailored for businesses seeking substantial capital to fund major investments or expansions. These loans often involve larger amounts and longer repayment terms. Commercial real estate loans, for instance, can help businesses purchase or renovate commercial properties, providing the foundation for long-term growth.

3. SBA Loans

The Small Business Administration (SBA) is a government agency that guarantees loans provided by its approved lenders. SBA loans in Florida are highly sought-after by small business owners due to their attractive terms, including lower down payments, longer repayment periods, and competitive interest rates. These loans are particularly beneficial for businesses that may not qualify for traditional loans.

Alternative Funding Options

Alternative business funding in Florida offers a range of innovative loan options provided by non-bank lenders and specialized financing companies. These alternatives have emerged to fill the gaps left by traditional lenders, often providing faster access to capital and more flexible requirements. Here are some popular alternative loan types:

1. Business Lines of Credit

A business line of credit functions like a credit card, providing a revolving source of funds that businesses can draw upon as needed. This option offers flexibility, allowing businesses to manage cash flow fluctuations, seize short-term opportunities, or cover unexpected expenses.

2. Equipment Financing

Equipment financing is specifically designed to help businesses acquire the necessary machinery, vehicles, or technology for their operations. The equipment itself serves as collateral, making it easier for startups or businesses without substantial assets to secure funding.

3. Business Grants

While not technically loans, business grants in Florida offer funding that doesn't need to be repaid. These grants are often provided by government agencies, non-profit organizations, or private entities to support specific initiatives, such as innovation, community development, or minority-owned businesses.

Benefits of Business Loans in Florida

Business loans in Florida offer a multitude of advantages to entrepreneurs and business owners. Here are some key benefits:

- Access to Capital: The primary benefit is, of course, access to the capital needed to start, grow, or transform a business venture.

- Flexible Options: Florida offers a diverse range of loan options, ensuring that businesses of all sizes and stages can find financing that aligns with their unique needs.

- Competitive Rates: With a healthy lending environment, businesses in Florida can often secure loans with competitive interest rates, keeping borrowing costs manageable.

- Support for Small Businesses: Many loan options, including SBA loans and small business grants, are specifically designed to support the state's thriving small business community.

- Innovative Alternatives: Beyond traditional loans, Florida businesses can explore alternative funding sources that offer faster, more flexible solutions, catering to the dynamic nature of today's business landscape.

Real-World Success Story: Sunshine Coffee Roasters

To bring the power of business loans in Florida to life, let's look at a success story from a fictional business, Sunshine Coffee Roasters.

Sunshine Coffee Roasters is a small-batch coffee roastery and café based in Tampa, Florida. The owner, Sarah, had a passion for coffee and a dream to build a thriving business. With a background in hospitality, she knew that creating a unique customer experience and sourcing the best coffee beans were key to her success.

Sarah approached a local credit union for a small business loan to fund her venture. With a well-crafted business plan and her industry experience, she secured a $50,000 loan to lease a space, purchase equipment, and launch her roastery.

The loan provided the foundation for Sunshine Coffee Roasters to become a beloved local hotspot. Sarah's passion and attention to detail shone through in the quality of her coffee and the ambiance of her café. Within a year, she was able to pay off her loan and begin planning for expansion.

Today, Sunshine Coffee Roasters has three locations across Tampa, employs a dedicated team of coffee enthusiasts, and continues to source and roast exceptional coffee beans from around the world. Sarah's success is a testament to the power of business loans in Florida, helping turn dreams into thriving enterprises.

How to Apply for a Business Loan in Florida

The process of applying for a business loan in Florida will vary depending on the type of loan and the lender. Here are some general steps to guide you through the application process:

- Prepare Your Business Plan: Lenders will want to see a well-thought-out business plan that outlines your venture's goals, products or services, target market, financial projections, and growth strategy. A strong business plan demonstrates your seriousness and enhances your chances of loan approval.

- Gather Documentation: Traditional lenders typically require extensive documentation, including financial statements, tax returns, business licenses, and personal information. Alternative lenders may have more streamlined requirements, but they still often ask for basic financial and business documentation.

- Shop Around: Don't settle for the first lender you find. Research and compare multiple lenders in Florida to find the best fit for your needs. Consider interest rates, repayment terms, loan amounts, and the lender's reputation and customer service.

- Complete the Application: Whether it's an online application or a paper-based process, carefully fill out all the required fields and provide honest, accurate information. Incomplete or inaccurate applications may lead to delays or rejection.

- Wait for Approval: The approval process can vary in duration depending on the lender and loan type. Traditional loans may take several weeks, while alternative lenders often provide faster decisions.

- Negotiate and Finalize: Once you receive loan approval, carefully review the terms and conditions. If needed, negotiate certain aspects, such as interest rates or repayment schedules, to ensure they align with your business needs and capabilities.

Best Practices and Considerations

When navigating business loans in Florida, it's important to keep certain best practices and considerations in mind:

- Understand Your Needs: Clearly define why you need the loan and how you plan to use the funds. This will help you choose the most suitable loan type and ensure you borrow responsibly.

- Shop for Competitive Rates: Don't settle for the first interest rate offered. Take the time to compare rates from multiple lenders to ensure you get the best deal. Even a small difference in interest rates can significantly impact your overall borrowing costs.

- Consider Collateral: Many loans, especially traditional ones, require collateral. Carefully assess your business assets and their value to determine what you can offer as security for the loan.

- Read the Fine Print: Always read the fine print of any loan agreement before signing. Understand the fees, penalties, and other potential costs associated with the loan to avoid unpleasant surprises down the line.

- Seek Expert Advice: Consult with a trusted financial advisor or accountant who can provide personalized guidance based on your business's unique circumstances. Their expertise can help you navigate the loan process and make informed decisions.

Conclusion

Business loans in Florida offer a wealth of opportunities for entrepreneurs and business owners to bring their visions to life. The Sunshine State provides a vibrant ecosystem of financing options, from traditional loans to innovative alternatives, ensuring that capital is accessible to those with ambition and drive.

Throughout this guide, we have explored the diverse landscape of business loans available in Florida, highlighting the benefits, success stories, and practical steps to securing funding. With this knowledge, you can now chart a confident path towards unlocking the capital your business needs to flourish in the Sunshine State.

Remember, every successful businessjourney begins with a bold step forward, and taking control of your financial strategy is a crucial part of that journey.

Marketing

View All

January 23, 2025

Social Media in Digital Marketing 2024Learn how social media is revolutionizing digital marketing in 2024. Boost your brand with actionable tips for viral campaigns!

Mia Anderson

January 23, 2025

10 Content Strategies for Digital SuccessCreate winning content with these 10 proven digital marketing strategies. Enhance engagement and conversions starting today!

Mia Anderson

January 20, 2025

5 Best Digital Marketing Tools for GrowthUncover the top 5 digital marketing tools every marketer needs. Boost efficiency, drive results, and streamline your campaigns now!

Mia Anderson

Entertainment

View AllDiscover the fascinating history of superhero movies, from early adaptations to modern blockbusters. Uncover surprising facts and insights click to explore!

Mia Anderson

Unlock the secrets to going viral on TikTok with these 2024 strategies. From trend-spotting to unique twists, learn how to boost your visibility and engagement. Start creating viral content today!

Mia Anderson

Learn the key steps to start a YouTube channel in 2024, from content strategy to monetization. Click here for expert advice and actionable tips!

Mia Anderson

Discover the latest tips and trends for making a short film in 2024. Learn from experts and get started on your cinematic journey today!

Mia Anderson

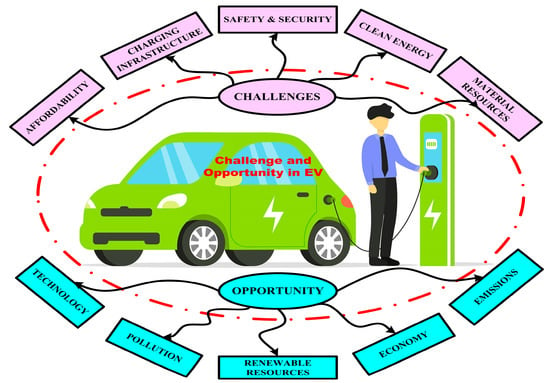

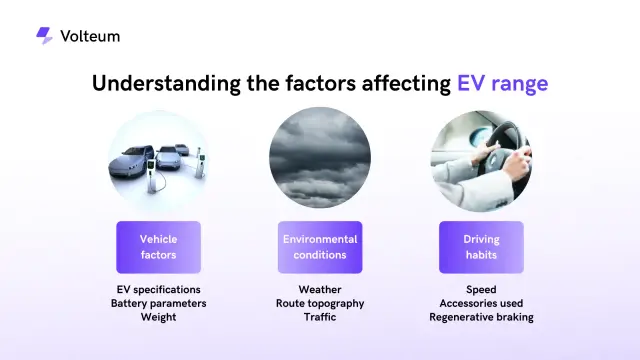

Automotive

View AllExplore the growth of residential EV charging solutions, from home setups to energy-efficient charging options.

Read MoreDiscover the latest innovations in lightweight materials for EVs. How do these advancements improve performance and efficiency?

Read MoreDiscover real-world experiences of long-distance EV travel. Learn how EV owners tackle range anxiety and plan road trips.

Read MorePolular🔥

View All

1

2

3

4

5

6

7

8

9

10

Technology

View All

September 12, 2024

Comprehensive Machine Learning Tutorial for Beginners

Master machine learning with our detailed tutorial. Learn the fundamentals and advance your skills today. Start your journey into AI now!

August 13, 2024

The Top SOC 2 Compliance Companies: Securing Your Data

Discover the leading SOC 2 Compliance companies and learn how they can help protect your organization's sensitive data. Click to explore the best options for safeguarding your business.

December 17, 2024

The Best Tech Gifts for 2024 – Shop Before They Sell Out!

Find the perfect tech gifts for everyone on your list! Click to explore the hottest gadgets and shop before they're gone.

Tips & Trick