How to Set Financial Goals That You’ll Actually Achieve

Mia Anderson

Photo: How to Set Financial Goals That You’ll Actually Achieve

Setting financial goals is an essential step towards taking control of your financial future and building the life you desire. However, many people struggle to set realistic and achievable financial goals, often leading to frustration and a lack of progress. In this article, we'll dive deep into the art of setting financial goals that you'll actually stick to and achieve. By the end, you'll have a clear roadmap to guide your financial journey and make your money work for you.

Understanding the Importance of Financial Goal Setting

Financial goal setting is not just about dreaming big; it's a strategic process that can transform your financial reality. Here's why this practice is crucial:

1. Provides Direction:

Financial goals give you a clear direction for your money. Instead of spending aimlessly, you allocate your resources towards specific targets, ensuring that every dollar has a purpose.

2. Motivates and Inspires:

Setting goals can be incredibly motivating. When you have a vision for your future, you're more likely to stay disciplined and make sacrifices today for a better tomorrow.

3. Encourages Smart Decisions:

With financial goals in mind, you'll make more informed decisions about spending, saving, and investing. This can lead to better financial habits and a more secure future.

4. Reduces Financial Stress:

Having a financial plan and working towards achievable goals can significantly reduce money-related stress. You'll feel more in control and confident in your financial decisions.

The Financial Planning Process: A Step-by-Step Guide

Now, let's explore the financial planning process and how to set goals that are both meaningful and achievable.

Step 1: Assess Your Current Financial Situation

Before setting any goals, it's crucial to understand your current financial standing. Here's what you should do:

- Evaluate Your Income: Calculate your monthly income, including salary, investments, or any other sources. Understanding your income is the foundation of your financial plan.

- Track Your Expenses: Keep a detailed record of your monthly expenses for at least a month. Categorize them into essentials (rent, utilities) and discretionary spending (entertainment, dining out). This exercise will reveal areas where you can cut back.

- Check Your Credit Score: Your credit score is a snapshot of your financial health. A good score can open doors to better loan rates and financial opportunities.

- Review Your Debt: Make a list of all your debts, including credit card balances, student loans, and mortgages. Prioritize high-interest debt for repayment.

Step 2: Define Your Short-Term and Long-Term Financial Goals

Financial goals can be categorized into short-term and long-term objectives.

Short-Term Financial Goals:

These are goals you aim to achieve within a year or less. Examples include:

- Building an emergency fund to cover 3-6 months of living expenses.

- Paying off high-interest credit card debt.

- Saving for a down payment on a car.

- Starting a side hustle to increase income.

Long-Term Financial Goals:

These are goals with a time horizon of several years or even decades.

- Buying a home.

- Saving for your child's education.

- Retiring comfortably at a specific age.

- Starting your own business.

Step 3: Make Your Goals SMART

To ensure your financial goals are achievable, use the SMART criteria:

- Specific: Define your goals clearly. Instead of saying, "I want to save money," say, "I want to save $10,000 for a down payment on a house in 2 years."

- Measurable: Quantify your goals to track progress. For example, "I will increase my retirement savings by 10% each year."

- Achievable: Set realistic goals based on your income and expenses. Avoid setting yourself up for failure with unrealistic expectations.

- Relevant: Ensure your goals align with your values and priorities. For instance, if travel is important to you, set a goal to save for an annual vacation.

- Time-Bound: Assign a deadline to each goal. This creates a sense of urgency and keeps you focused.

Step 4: Create a Budget to Support Your Goals

Budgeting is a powerful tool to align your spending with your financial goals. Here's how to create a budget:

- Allocate Money for Goals: Dedicate a portion of your income to each financial goal. For instance, set aside a fixed amount monthly for your emergency fund.

- Prioritize Essentials: Ensure your budget covers essential expenses like rent, groceries, and utilities.

- Cut Back on Discretionary Spending: Identify areas where you can reduce spending, such as dining out or subscription services.

- Automate Savings: Set up automatic transfers to savings accounts to make saving effortless.

Step 5: Implement Strategies to Reach Your Goals

Now that you have a plan, it's time to put it into action:

- Pay Off High-Interest Debt: Focus on paying off credit cards or loans with high interest rates first. Consider using the debt snowball or avalanche method.

- Build an Emergency Fund: Start small and gradually increase your savings until you reach your target amount.

- Save and Invest: Explore different savings accounts and investment options to grow your wealth. Consider speaking with a financial advisor for guidance.

- Monitor Progress: Regularly review your progress and make adjustments as needed. Celebrate milestones to stay motivated.

Overcoming Common Challenges in Financial Goal Setting

Setting financial goals is just the beginning; staying on track can be challenging. Here's how to tackle common obstacles:

1. Lack of Discipline

Staying disciplined is crucial for achieving financial goals. Here are some tips:

- Automate Your Finances: Set up automatic payments for bills and savings to reduce the temptation to spend.

- Create a Visual Reminder: Display your goals visibly, like a vision board, to keep them top of mind.

- Find an Accountability Partner: Share your goals with a trusted friend or family member who can hold you accountable.

2. Unexpected Expenses

Life is unpredictable, and unexpected expenses can derail your plans. Here's how to prepare:

- Build a Robust Emergency Fund: Aim to save enough to cover at least 6 months of living expenses.

- Prioritize Insurance: Ensure you have adequate health, home, and auto insurance to protect against unforeseen events.

- Create a Contingency Plan: Have a backup strategy for handling unexpected costs without derailing your long-term goals.

3. Changing Priorities

As life evolves, your financial priorities may shift. Here's how to adapt:

- Regularly Review Your Goals: Revisit your financial plan annually or when significant life changes occur (marriage, job change).

- Be Flexible: Adjust your goals and budget as needed to accommodate new priorities without sacrificing long-term financial health.

Real-Life Success Stories: Achieving Financial Goals

Hearing about others' success can be inspiring. Here are a few real-life examples of individuals who set and achieved their financial goals:

1. Saving for a Dream Vacation

Sarah, a young professional, had always dreamed of traveling to Europe. She set a goal to save $5,000 in 18 months for her trip. By creating a detailed budget, cutting back on non-essential expenses, and picking up a side hustle, Sarah successfully reached her goal and enjoyed a memorable vacation.

2. Paying Off Student Loans

John, a recent college graduate, was burdened by $30,000 in student loans. He created a plan to pay off his loans within 5 years by making extra payments, negotiating lower interest rates, and finding ways to increase his income. With discipline and perseverance, John became debt-free ahead of schedule.

3. Building a Retirement Nest Egg

Emily, a 30-something professional, realized the importance of saving for retirement early on. She set a goal to max out her 401X(k) contributions each year and invest in a diversified portfolio. Through consistent savings and smart investing, Emily is on track to retire comfortably at 60.

Conclusion

Setting financial goals is a powerful way to shape your financial future and achieve your dreams. By following the financial planning process, creating SMART goals, and staying disciplined, you can turn your financial aspirations into reality. Remember, financial goal setting is a journey, and it's okay to adjust your plans as life unfolds. Stay focused, be patient, and celebrate your progress along the way.

With the right mindset and strategies, you can achieve financial success and build a life of financial freedom and security. Start setting your financial goals today and watch your money work for you!

Marketing

View All

January 22, 2025

The Future of Digital Marketing RevealedExplore where digital marketing is headed in the next decade. From AI to VR, see what’s shaping the future of online marketing. Don’t get left behind!

Mia Anderson

January 21, 2025

Why Digital Marketing is Vital for SMBsDiscover why small businesses must adopt digital marketing in 2024. Learn tips and tactics to compete in the digital age. Take your business online today!

Mia Anderson

January 23, 2025

Social Media in Digital Marketing 2024Learn how social media is revolutionizing digital marketing in 2024. Boost your brand with actionable tips for viral campaigns!

Mia Anderson

Entertainment

View AllExplore the latest trends in fan fiction for 2024. Learn what fan fiction is, its impact on media, and why it’s a thriving creative outlet. Read now!

Mia Anderson

Discover the best streaming services of 2024 with our in-depth reviews. Find out which platforms offer the best value and why you should choose them. Read now!

Mia Anderson

Discover the top podcasting trends of 2024 and stay ahead in the industry. Learn how to leverage new insights click now to future-proof your podcast!

Mia Anderson

Unlock the secrets to an unforgettable movie trivia night with our ultimate guide. Get tips, trivia questions, and game ideas to boost your event's fun!

Mia Anderson

Automotive

View AllUnlock the secrets to getting top dollar for your car! Prep, price, and promote effectively.

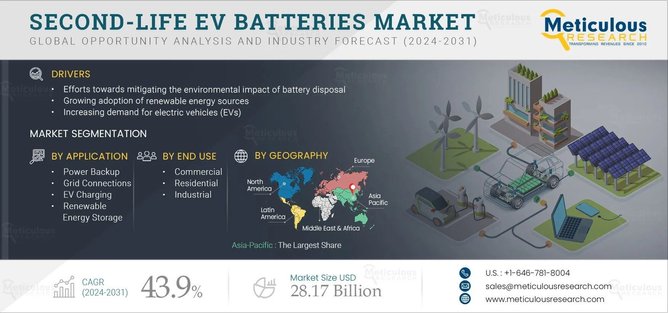

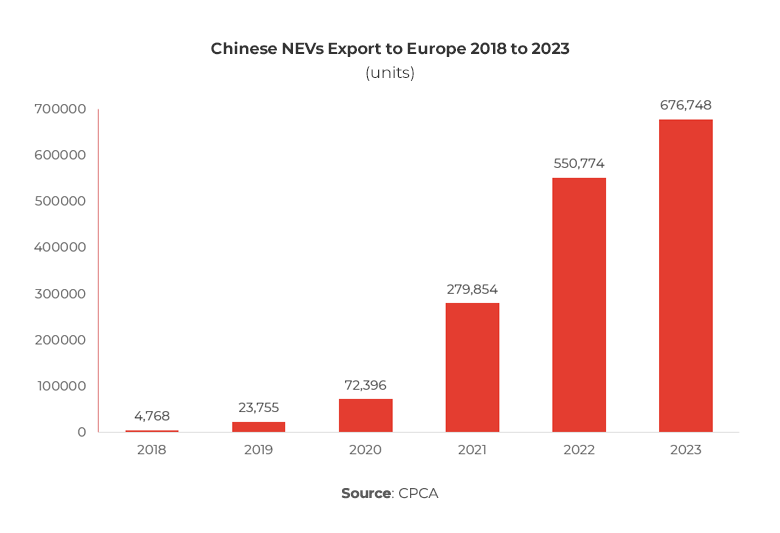

Read MoreLearn how second-life EV batteries are helping reduce environmental impact by providing sustainable energy solutions.

Read MoreCompare trends in luxury and budget EV offerings. Find out which one suits your needs and budget in 2024.

Read MorePolular🔥

View All

1

2

3

4

5

6

7

9

10

Technology

View All

September 15, 2024

Discover the Best Project Management Software of 2024

Discover the best project management software of 2024! Uncover top picks, latest trends, and expert reviews. Click now to streamline your projects!

December 10, 2024

Best Tech Gadgets for Remote Workers in 2024 – Don’t Miss These!

Boost your productivity with the top tech gadgets for remote work! Click to discover must-have tools to enhance your work-from-home setup.

August 29, 2024

Top SaaS Trends Shaping Business Success in 2024

Discover the latest SaaS trends revolutionizing businesses in 2024. Learn how these innovations can boost efficiency and drive growth. Read now!

Tips & Trick