Maximizing Your Retirement Contributions with These Smart Moves

Mia Anderson

Photo: Maximizing Your Retirement Contributions with These Smart Moves

When it comes to planning for retirement, making the most of your contributions is crucial to ensure a comfortable and financially secure future. With the right strategies, you can boost your savings and set yourself up for a retirement that meets your goals. Let's explore some smart moves to maximize your retirement contributions and make your hard-earned money work harder for you.

Understanding the Basics of Retirement Contributions

Retirement contributions are an essential part of building a nest egg for your golden years. These contributions are typically made through employer-sponsored plans, such as 401(k)s, or individual retirement accounts (IRAs). Understanding the different types of retirement accounts and their benefits is the first step towards maximizing your savings.

Employer-Sponsored Plans:

Many employers offer retirement savings plans, such as 401(k)s, 403(b)s, or Thrift Savings Plans (TSPs). These plans often come with valuable benefits, including employer matching contributions. For instance, your employer might match your contributions up to a certain percentage of your salary. Taking full advantage of these matching programs is like receiving free money towards your retirement! Make sure you understand your employer's plan and contribute at least enough to get the maximum match.

Individual Retirement Accounts (IRAs):

IRAs are another popular way to save for retirement. There are two main types: Traditional IRAs and Roth IRAs. Traditional IRAs offer tax-deductible contributions, meaning you may be able to lower your taxable income in the year you make the contribution. On the other hand, Roth IRAs are funded with after-tax dollars, allowing tax-free withdrawals in retirement. Consider your current tax situation and future goals to determine which IRA option is best for you.

Smart Strategies to Boost Your Retirement Savings

Now, let's dive into some practical strategies to maximize your retirement contributions and grow your savings:

1. Start Early and Automate Your Contributions

Time is your most powerful ally when it comes to retirement savings. The earlier you start, the more time your money has to grow through compound interest. Consider this: If you start saving at 25 and contribute $5000 annually with a 7% annual return, you could have over $1 million by the time you're 65. But if you wait until you're 35, you'd need to contribute nearly double that amount to reach the same goal.

Automating your contributions is a simple yet effective way to ensure consistent savings. Set up automatic transfers from your paycheck or bank account to your retirement accounts. This way, you'll save effortlessly without even noticing the money is gone.

2. Increase Your Contributions Gradually

While it's essential to start saving early, it's equally important to increase your contributions over time. As your income grows, consider increasing the percentage you contribute to your retirement accounts. Even small increases can make a significant difference in the long run.

For example, let's say you're currently contributing 5% of your salary to your 401(k). If you receive a 3% raise, consider increasing your contribution by 1% or 2%. This way, you'll still have more take-home pay, but you're also boosting your retirement savings.

3. Take Advantage of Catch-Up Contributions

If you're age 50 or older, you're eligible for catch-up contributions, which allow you to save even more in your retirement accounts. For 2023, the catch-up contribution limit for 401(k)s and IRAs is $6,500. This extra savings opportunity can significantly boost your retirement nest egg, especially if you're behind on your savings goals.

4. Explore Self-Directed Retirement Accounts

Self-directed retirement accounts provide more investment options than traditional retirement plans. These accounts allow you to invest in a broader range of assets, such as real estate, private equity, or cryptocurrencies. While these investments come with higher risk, they can also offer higher potential returns.

If you're comfortable with a more hands-on approach to investing and have a good understanding of alternative assets, self-directed accounts can be a powerful tool to diversify your retirement portfolio.

Overcoming Common Challenges

Maximizing your retirement contributions may come with its fair share of challenges. Here's how to tackle some common hurdles:

1. Dealing with Limited Funds

If you're struggling to find extra funds to contribute to your retirement, consider reviewing your budget and identifying areas where you can cut back. Small lifestyle adjustments, like reducing dining out or negotiating lower bills, can free up money for savings. Remember, even small contributions add up over time.

2. Navigating Complex Investment Options

The world of investing can be overwhelming, especially for beginners. If you're unsure about where to invest your retirement savings, consider seeking guidance from a financial advisor or utilizing online resources and educational materials. Many investment platforms offer tools and resources to help you make informed decisions based on your risk tolerance and goals.

3. Staying Motivated

Saving for retirement can be a long-term commitment, and it's easy to lose motivation along the way. To stay on track, set short-term and long-term goals, and celebrate your progress. Visualize your future self and the retirement lifestyle you desire. Regularly reviewing your retirement plan and making adjustments as needed can help keep you motivated and engaged.

Conclusion

Maximizing your retirement contributions is a powerful way to secure your financial future. By starting early, automating contributions, and taking advantage of employer matches and catch-up contributions, you can significantly boost your savings. Remember, retirement planning is a journey, and it's never too late to make smart moves. With a well-thought-out strategy and a disciplined approach, you can look forward to a retirement filled with financial security and peace of mind.

Remember, the key to success is consistency and adaptability. Stay informed, seek professional advice when needed, and make adjustments to your plan as your life circumstances change. Happy retirement planning!

Marketing

View All

January 20, 2025

5 Best Digital Marketing Tools for GrowthUncover the top 5 digital marketing tools every marketer needs. Boost efficiency, drive results, and streamline your campaigns now!

Mia Anderson

January 18, 2025

Top 10 Digital Marketing Trends for 2024Discover the must-know digital marketing trends for 2024. Stay ahead of the curve and elevate your strategies with these insights! Read more now!

Mia Anderson

January 21, 2025

Why Digital Marketing is Vital for SMBsDiscover why small businesses must adopt digital marketing in 2024. Learn tips and tactics to compete in the digital age. Take your business online today!

Mia Anderson

Entertainment

View AllDiscover the intriguing realm of celebrity culture and how it affects society. Learn about the possible effects of our infatuation and how celebrities turn their notoriety into brands. An must read for everybody curious about the contemporary celebrity phenomena.

Mia Anderson

Discover the top 10 entertainment trends of 2024 that will captivate you. Stay ahead with our expert insights and click to explore now!

Mia Anderson

Discover the best online gaming platforms that offer unparalleled gameplay. Click now to find your perfect match and elevate your gaming experience.

Mia Anderson

Discover the latest tips and trends for making a short film in 2024. Learn from experts and get started on your cinematic journey today!

Mia Anderson

Automotive

View AllLearn how using Dealer Daily tools can skyrocket your auto sales and improve efficiency. Get ready to dominate the market!

Read MoreLearn how rising fuel prices are making EVs a more attractive option. See why EV adoption is soaring in 2024.

Read MoreLearn how eco-conscious consumers are leading the charge in EV adoption. Find out what motivates them in 2024.

Read MorePolular🔥

View All

1

2

3

4

5

6

7

8

9

10

Technology

View All

August 10, 2024

Get Fit and Stay Healthy with Fitness Apps: Reaping the Benefits of Technology

Learn how fitness apps may change your life and assist you in reaching your fitness and health objectives. Find out how these applications may encourage and enhance your well-being!

August 28, 2024

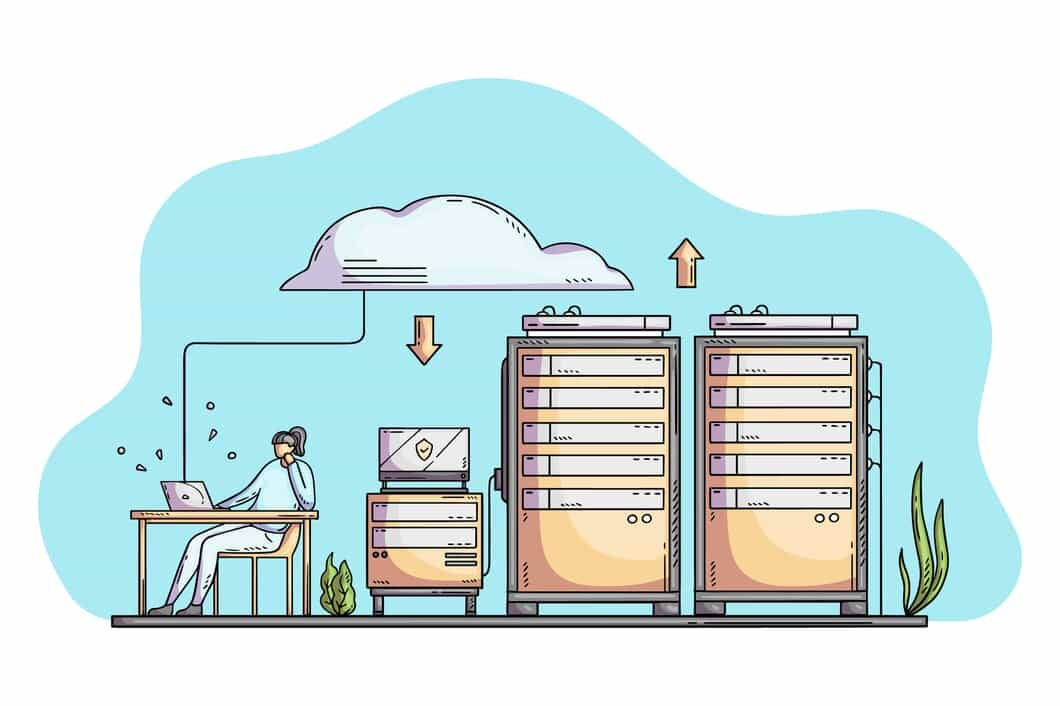

Discover the Best Web Hosting Services for Your Website

Discover the best web hosting services for your website. Get expert tips, reviews, and recommendations to find the perfect hosting solution. Click to learn more!

August 12, 2024

Unlocking Employee Potential: The Ultimate Guide to HR Performance Review Software

Discover the ultimate tool to unlock your employees' true potential. Learn how HR performance review software can revolutionize the way you manage performance and drive exceptional results. Read now to transform your business!

Tips & Trick