Top Credit Cards for Rewards in 2024: Maximize Your Benefits

Mia Anderson

Photo: Top Credit Cards for Rewards in 2024: Maximize Your Benefits

In 2024, the landscape of credit cards continues to evolve, offering consumers a range of options to maximize their rewards. Whether you're seeking cash back, travel perks, or reward points, the best credit cards for rewards can significantly enhance your financial benefits. This guide explores the top credit cards for rewards this year, helping you make an informed choice to optimize your spending and earn more.

Why Choose Credit Cards for Rewards?

Credit cards with rewards programs are designed to give back a percentage of what you spend, making them a valuable tool for savvy consumers. By selecting the right card, you can earn points, cash back, or travel miles that can be redeemed for various benefits. This not only adds value to your purchases but also helps you save money on everyday expenses.

Best Credit Cards for Rewards in 2024

1. Chase Sapphire Preferred® Card

The Chase Sapphire Preferred® Card remains a top choice for 2024, offering exceptional travel rewards and flexible redemption options. Cardholders earn 2x points on travel and dining and 1x point on all other purchases. Additionally, new members receive a substantial sign-up bonus after meeting the spending requirement. The points earned can be transferred to numerous travel partners, providing great value for frequent travelers.

2. American Express® Gold Card

For those who prioritize dining rewards, the American Express® Gold Card stands out. This card offers 4x points at restaurants, including takeout and delivery, and 3x points on flights booked directly with airlines or on amextravel.com. The card also provides a significant sign-up bonus and a range of dining credits, making it a top pick for food enthusiasts.

3. Capital One Venture Rewards Credit Card

The Capital One Venture Rewards Credit Card is ideal for those seeking a straightforward rewards structure. With 2x miles on every purchase and a generous sign-up bonus, this card is perfect for travelers who prefer simplicity. Miles can be redeemed for travel purchases or transferred to various airline partners, adding flexibility to your rewards.

4. Citi Double Cash Card

If you prefer a cash-back card with no annual fee, the Citi Double Cash Card is a solid choice. It offers 2% cash back on all purchases—1% when you buy and an additional 1% when you pay. This straightforward rewards structure allows you to earn cash back on every purchase without the complexity of rotating categories or spending limits.

5. Discover it® Cash Back

The Discover it® Cash Back card is known for its rotating 5% cash back categories, which change quarterly. Cardholders earn 5% cash back on up to $1,500 in purchases in bonus categories each quarter, plus 1% on other purchases. Additionally, Discover matches all the cash back earned in the first year, making it a great option for those who can maximize the bonus categories.

Factors to Consider When Choosing a Rewards Credit Card

When selecting a rewards credit card, it's essential to consider various factors to ensure it aligns with your spending habits and financial goals.

Annual Fees

Some credit cards charge an annual fee, which can offset the rewards you earn. Weigh the benefits of the rewards program against the fee to determine if the card is worth the cost.

Rewards Structure

Different cards offer varying rewards structures. Some cards provide higher rewards rates in specific categories, such as dining or travel, while others offer flat-rate rewards. Choose a card that matches your spending patterns to maximize your earnings.

Sign-Up Bonuses

Many credit cards offer lucrative sign-up bonuses, which can significantly enhance the value of the card. Be sure to check the requirements to earn the bonus and ensure they align with your spending habits.

Redemption Options

The flexibility of redeeming rewards is crucial. Some cards offer more versatile redemption options, such as transferring points to travel partners or using them for statement credits. Evaluate the redemption options to ensure they meet your preferences.

Foreign Transaction Fees

If you travel internationally, consider a card with no foreign transaction fees. This feature can save you money on purchases made abroad.

Real-Life Examples

To illustrate the value of rewards credit cards, consider the experience of Sarah, a frequent traveler. By using the Chase Sapphire Preferred® Card, she earned substantial points on her travel and dining expenses, which she later redeemed for flights and hotel stays. Sarah’s choice of card allowed her to maximize her rewards and enjoy significant travel benefits.

In contrast, John, who prefers a straightforward cash-back approach, opted for the Citi Double Cash Card. With its 2% cash back on all purchases, John earned substantial cash back without having to keep track of rotating categories or bonus offers.

Conclusion

Choosing the best credit card for rewards in 2024 depends on your spending habits, lifestyle, and financial goals. Whether you prefer travel rewards, cash back, or a combination of both, there is a card designed to enhance your financial benefits. By evaluating factors such as annual fees, rewards structure, and redemption options, you can select the card that offers the most value for your money. As always, consider your personal preferences and spending habits to make the most informed choice and maximize your rewards.

Marketing

View All

January 23, 2025

Social Media in Digital Marketing 2024Learn how social media is revolutionizing digital marketing in 2024. Boost your brand with actionable tips for viral campaigns!

Mia Anderson

January 21, 2025

Why Digital Marketing is Vital for SMBsDiscover why small businesses must adopt digital marketing in 2024. Learn tips and tactics to compete in the digital age. Take your business online today!

Mia Anderson

January 19, 2025

How to Master Digital Marketing BasicsLearn the essentials of digital marketing in this beginner-friendly guide. Kickstart your journey with step-by-step strategies. Start mastering today!

Mia Anderson

Entertainment

View AllDiscover the intriguing realm of celebrity culture and how it affects society. Learn about the possible effects of our infatuation and how celebrities turn their notoriety into brands. An must read for everybody curious about the contemporary celebrity phenomena.

Mia Anderson

Discover the top podcasting trends of 2024 and stay ahead in the industry. Learn how to leverage new insights click now to future-proof your podcast!

Mia Anderson

Discover expert tips to elevate your binge-watching sessions in 2024. Stay entertained and healthy with these essential tricks. Click now for the ultimate guide!

Mia Anderson

Discover the latest tips and trends for becoming a successful music producer in 2024. Learn how to start your career today and make your mark in the industry!

Mia Anderson

Automotive

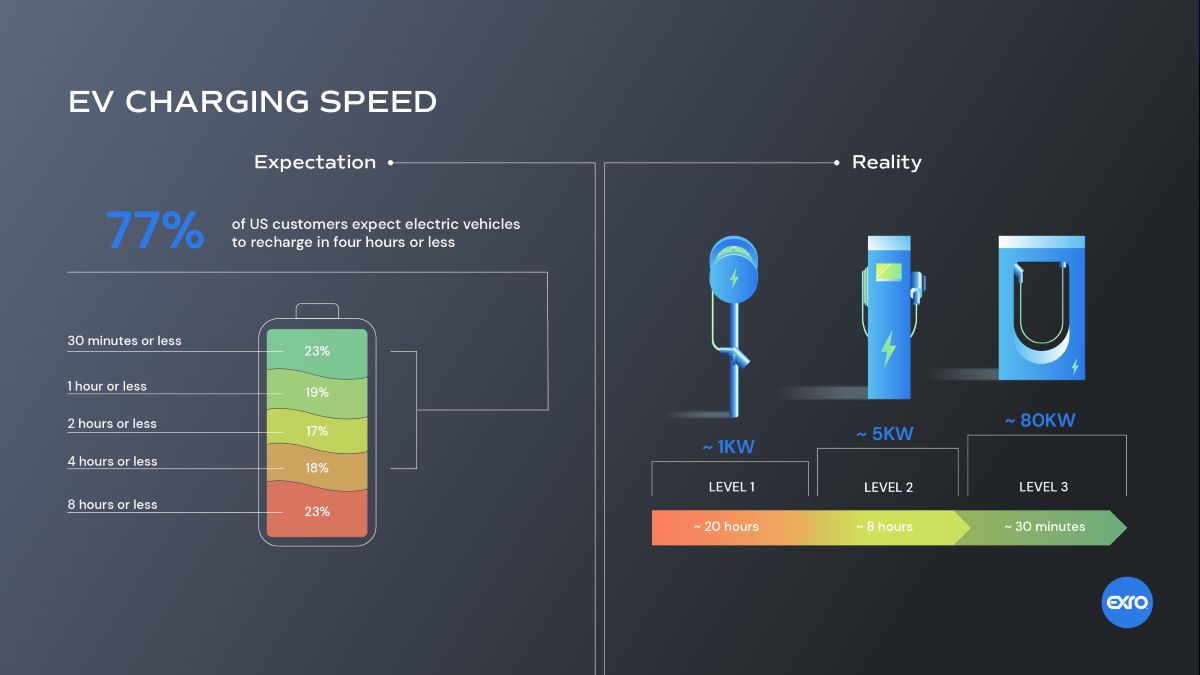

View AllDiscover trends driving EV range improvements. Learn how automakers are tackling range anxiety with groundbreaking solutions.

Read MoreDiscover how government policies are accelerating EV adoption. Explore tax incentives, regulations, and global policy success stories.

Read MoreDiscover the main barriers preventing widespread EV adoption and how they can be overcome. Learn more to drive EV growth.

Read MorePolular🔥

View All

1

2

3

4

5

6

7

8

9

10

Technology

View All

September 11, 2024

Top 10 Digital Transformation Strategies to Elevate Your Business in 2024

Discover the top 10 digital transformation strategies to elevate your business in 2024. Get actionable insights and start transforming today!

September 15, 2024

Exploring Edge Computing Trends and Innovations for 2024

Discover the latest in edge computing for 2024. Explore key trends, innovations, and their impact. Read now to stay ahead in this evolving field!

November 7, 2024

The Pros and Cons of the Latest Wearable Tech

Thinking about wearable tech? Discover the latest pros and cons to help you decide. Make an informed choice today!

Tips & Trick