Unleash Your Business Potential: Fast Invoice Factoring

Mia Anderson

Photo: Unleash Your Business Potential: Fast Invoice Factoring

Are you a business owner seeking to unleash your company's true potential? Fast invoice factoring may be the game-changer you need to boost cash flow, seize opportunities, and outpace your competitors. Discover how this innovative financing solution can revolutionize your operations and propel your business forward.

What is Fast Invoice Factoring?

Imagine transforming your outstanding invoices into immediate cash, waving goodbye to financial constraints, and embracing a world of new possibilities. That's the power of fast invoice factoring.

Invoice factoring is a financing strategy where businesses sell their accounts receivable (invoices) to a third-party factoring company at a slight discount in exchange for instant cash. It's a simple yet powerful concept that provides businesses with much-needed financial flexibility.

Why is it a Game-changer for Businesses?

Slow-paying clients can bring your operations to a grinding halt, leaving you struggling to pay bills, invest in new equipment, or hire the talent you need to grow. Traditional bank loans might seem like a solution, but they come with a hefty price tag, not to mention the debt and interest that can burden your business for years.

That's where fast invoice factoring steps in as a hero. It offers a debt-free alternative, providing immediate funds to seize growth opportunities. Here's how it unleashes your business potential:

Improved Cash Flow:

With fast invoice factoring, you're in the driver's seat when it comes to cash flow. No more waiting patiently (or impatiently!) for customers to pay their invoices. You sell your invoices to a factoring company and voila – instant cash in your pocket. This boosts your liquidity, enabling you to pay bills, invest in new projects, or simply maintain a healthy cash buffer for unexpected expenses.

Financial Freedom:

Say goodbye to the chains of long-term financial obligations. Unlike traditional loans, invoice factoring is debt-free financing. This means you can expand your business without the weight of debt holding you back. It's a sustainable financial model that promotes long-term growth and helps you stay agile in a dynamic market.

Seizing Opportunities:

In the business world, opportunities often knock only once. With improved cash flow, you're equipped to answer that door. Whether it's investing in new technology, expanding your team, or taking on larger projects, fast invoice factoring ensures you have the funds to embrace new ventures. Don't let slow-paying clients hold you back from achieving your business dreams.

Efficient Capital Management:

Invoice factoring offers a precise approach to managing your working capital. It enables you to align your financial resources with your strategic goals and quickly respond to changing market conditions. This agility is crucial in staying ahead of the competition and making informed financial decisions.

Super-Fast Approval:

Time is money, and fast invoice factoring understands that. While traditional bank loans can take months for approval and funding, invoice factoring provides quick approval and same-day funding in some cases. This lightning-fast process keeps your business running smoothly and ensures you don't miss out on time-sensitive opportunities.

Outsource the Waiting Game:

Why let your customers use your money interest-free while you wait patiently for payments? With fast invoice factoring, you outsource the waiting game to the factoring company. They handle the payment collection, so you can focus on what matters – growing your business.

A Real-Life Success Story:

Take the example of a small tech startup struggling with cash flow issues due to slow-paying clients. By adopting fast invoice factoring, they were able to access immediate funds, invest in R&D, and launch their innovative product ahead of their competitors. This timely injection of cash not only kept their business afloat but also propelled them towards success and market recognition.

So, is Fast Invoice Factoring Right for Your Business?

If you're a business owner facing funding challenges due to slow-paying customers, fast invoice factoring could be the key to unlocking your growth. It offers a debt-free, scalable funding solution tailored to your business needs. However, it is important to consider the fees involved and ensure that your customers are reliable in paying their invoices on time.

In conclusion, fast invoice factoring is a powerful tool that can transform your business finances, providing the agility and financial freedom needed to thrive in today's fast-paced market. It's time to unleash your business's true potential and write your own success story.

Get started today by reaching out to reputable invoice factoring companies, comparing rates, and exploring how this innovative financing solution can propel your business to new heights.

Marketing

View All

January 22, 2025

The Future of Digital Marketing RevealedExplore where digital marketing is headed in the next decade. From AI to VR, see what’s shaping the future of online marketing. Don’t get left behind!

Mia Anderson

January 21, 2025

Why Digital Marketing is Vital for SMBsDiscover why small businesses must adopt digital marketing in 2024. Learn tips and tactics to compete in the digital age. Take your business online today!

Mia Anderson

January 23, 2025

Social Media in Digital Marketing 2024Learn how social media is revolutionizing digital marketing in 2024. Boost your brand with actionable tips for viral campaigns!

Mia Anderson

Entertainment

View AllExplore the latest trends in fan fiction for 2024. Learn what fan fiction is, its impact on media, and why it’s a thriving creative outlet. Read now!

Mia Anderson

Discover the best streaming services of 2024 with our in-depth reviews. Find out which platforms offer the best value and why you should choose them. Read now!

Mia Anderson

Discover the top podcasting trends of 2024 and stay ahead in the industry. Learn how to leverage new insights click now to future-proof your podcast!

Mia Anderson

Unlock the secrets to an unforgettable movie trivia night with our ultimate guide. Get tips, trivia questions, and game ideas to boost your event's fun!

Mia Anderson

Automotive

View AllUnlock the secrets to getting top dollar for your car! Prep, price, and promote effectively.

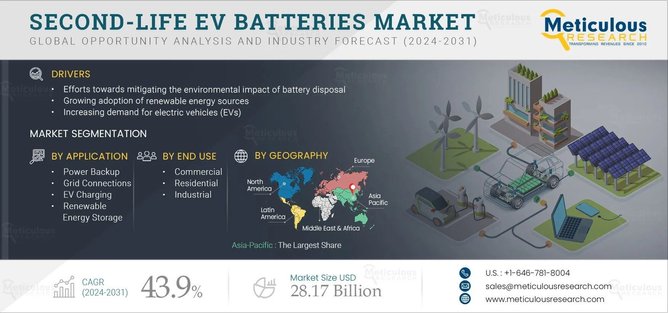

Read MoreLearn how second-life EV batteries are helping reduce environmental impact by providing sustainable energy solutions.

Read MoreCompare trends in luxury and budget EV offerings. Find out which one suits your needs and budget in 2024.

Read MorePolular🔥

View All

1

2

3

4

5

6

7

9

10

Technology

View All

September 15, 2024

Discover the Best Project Management Software of 2024

Discover the best project management software of 2024! Uncover top picks, latest trends, and expert reviews. Click now to streamline your projects!

December 10, 2024

Best Tech Gadgets for Remote Workers in 2024 – Don’t Miss These!

Boost your productivity with the top tech gadgets for remote work! Click to discover must-have tools to enhance your work-from-home setup.

August 29, 2024

Top SaaS Trends Shaping Business Success in 2024

Discover the latest SaaS trends revolutionizing businesses in 2024. Learn how these innovations can boost efficiency and drive growth. Read now!

Tips & Trick