Master Business Financial Planning with Proven Success Strategies

Mia Anderson

Photo: Master Your Business Financial Planning: Strategies for Success

Effective business financial planning is the cornerstone of any successful enterprise. Whether you are a seasoned entrepreneur or just starting, understanding how to manage and optimize your finances can significantly impact your business's growth and stability. This article delves into essential strategies and tips for mastering business financial planning, helping you navigate the complexities of financial management with confidence.

Understanding Business Financial Planning

Business financial planning involves creating a comprehensive roadmap that outlines your company's financial goals, strategies, and tactics. It is crucial for steering your business towards profitability and sustainability. Effective planning encompasses various elements, including budgeting, forecasting, and financial strategy development.

For instance, consider a small tech startup that successfully implemented a detailed financial plan. By focusing on business financial strategies and employing effective budgeting techniques, they managed to streamline their operations and allocate resources more efficiently, leading to increased profitability and growth.

Key Strategies for Effective Business Financial Planning

Develop a Clear Financial Strategy

A robust financial strategy is fundamental for any business. It involves setting clear financial goals, understanding your current financial position, and devising plans to achieve those goals. Business financial strategies often include cost management, revenue growth, and investment planning.

For example, a retail company aiming to expand its market presence might develop a financial strategy that includes increasing marketing budgets, optimizing inventory management, and exploring new sales channels. This strategic approach helps the company stay competitive and achieve its growth targets.

Implement Effective Budgeting Techniques

Budgeting is a vital aspect of financial planning. An effective budget helps businesses track their expenses, manage cash flow, and ensure that resources are allocated efficiently. Successful business budgeting involves setting realistic budgets, monitoring spending, and adjusting as needed.

Take the case of a manufacturing firm that faced challenges with overspending. By implementing a detailed budgeting process and regularly reviewing financial reports, they identified areas of excessive expenditure and took corrective actions. This led to improved financial control and better alignment with their strategic goals.

Focus on Financial Forecasting

Business financial forecasting involves predicting future financial performance based on historical data and market trends. Accurate forecasting helps businesses anticipate cash flow needs, plan for growth, and make informed decisions.

For instance, a growing e-commerce business might use financial forecasting to project future sales and identify potential cash flow issues. By analyzing past performance and market trends, they can make data-driven decisions about inventory management and marketing investments.

Prioritize Financial Management for Entrepreneurs

Financial planning for entrepreneurs requires a deep understanding of financial principles and practices. Entrepreneurs must manage their business finances effectively, balancing growth aspirations with financial realities. This includes managing expenses, optimizing revenue streams, and ensuring financial stability.

An entrepreneur starting a new venture may face challenges in managing initial costs and achieving profitability. By focusing on expert business finance advice and leveraging financial management tools, they can navigate these challenges and build a solid financial foundation for their business.

Optimize Your Financial Decisions

Smart business financial decisions are critical for long-term success. This involves evaluating investment opportunities, managing risks, and making informed choices based on financial data.

For example, a tech company considering an expansion into a new market might evaluate the potential return on investment (ROI) and assess associated risks before proceeding. By making data-driven decisions, they can enhance their chances of success and minimize financial risks.

Practical Tips for Successful Business Financial Planning

Monitor and Adjust Regularly

Financial planning is not a one-time activity but an ongoing process. Regularly monitoring your financial performance and making necessary adjustments ensures that your plans remain relevant and effective.

For instance, a restaurant chain may review its financial performance quarterly to assess the impact of marketing campaigns and operational changes. By making adjustments based on real-time data, they can optimize their financial performance and achieve their business goals.

Seek Professional Financial Advice

Consulting with financial experts can provide valuable insights and guidance. Expert business finance advice helps you navigate complex financial issues and develop effective strategies for managing your business finances.

For example, a startup might seek advice from a financial advisor to develop a comprehensive financial plan, secure funding, and manage cash flow. Professional guidance can enhance their financial decision-making and contribute to long-term success.

Leverage Financial Planning Tools

Utilizing financial planning tools and software can streamline your financial management processes. These tools provide valuable insights, automate calculations, and help you track your financial performance more efficiently.

A small business using financial planning software can automate budgeting, forecasting, and financial reporting tasks. This reduces manual effort, minimizes errors, and provides real-time insights into their financial health.

Conclusion

Mastering business financial planning involves implementing effective strategies, employing sound budgeting techniques, and making informed financial decisions. By focusing on business financial strategies, successful budgeting, and financial forecasting, you can enhance your business's financial health and achieve long-term success. Remember, financial planning is an ongoing process, and seeking expert advice and leveraging planning tools can further optimize your financial management efforts. Start implementing these strategies today to build a strong financial foundation for your business.

Marketing

View All

January 25, 2025

Email Marketing in the Digital AgeUnlock the power of email marketing with modern strategies tailored for the digital age. Connect with your audience like never before!

Mia Anderson

olivia.parker@outlook.com

January 23, 2025

Social Media in Digital Marketing 2024Learn how social media is revolutionizing digital marketing in 2024. Boost your brand with actionable tips for viral campaigns!

Mia Anderson

olivia.parker@outlook.com

January 19, 2025

How to Master Digital Marketing BasicsLearn the essentials of digital marketing in this beginner-friendly guide. Kickstart your journey with step-by-step strategies. Start mastering today!

Mia Anderson

olivia.parker@outlook.com

Entertainment

View AllFind out which movie streaming platforms are the best in 2024. Get insights, compare options, and choose your ideal service. Click to learn more!

Mia Anderson

olivia.parker@outlook.com

Learn how influencer marketing is used by the entertainment sector to generate buzz and increase engagement. Discover the keys to campaign success, as well as how to choose the proper influencers and produce interesting content.

Mia Anderson

olivia.parker@outlook.com

Discover the latest exclusive movie releases that everyone’s talking about. Don’t miss out click to stay ahead of the curve!

Mia Anderson

olivia.parker@outlook.com

Discover the top movies to watch in 2024. Explore our curated list of must-see films and stay updated on the year's hottest cinematic releases.

Mia Anderson

olivia.parker@outlook.com

Automotive

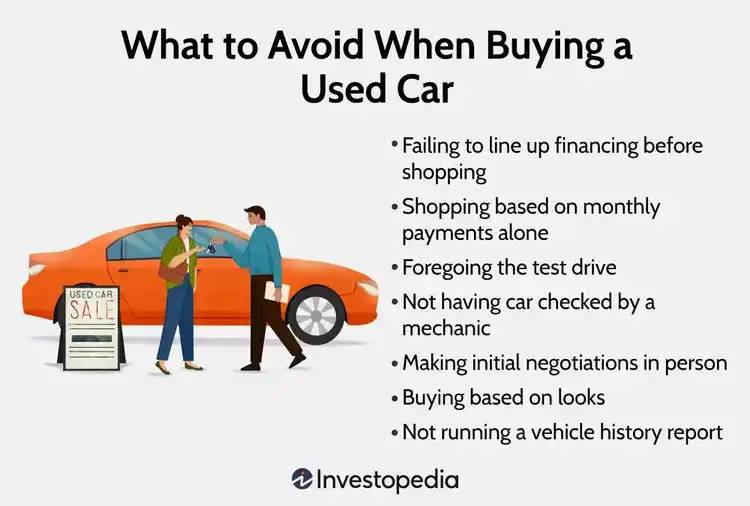

View AllAvoid these common mistakes when selling your car. Save time and secure the best deal!

Read MoreExplore how different age groups are embracing EVs. Learn what drives adoption among millennials, Gen Z, and baby boomers.

Read MoreDiscover the latest trends in fleet electrification. How are businesses adopting EVs for commercial use in 2024?

Read MorePolular🔥

View All

1

2

3

4

5

6

8

9

10

Technology

View All

December 20, 2024

Don’t Buy That Smartphone Until You Read This 2024 Comparison

Make an informed smartphone purchase! Our 2024 comparison guide helps you find the perfect match. Click to learn more.

August 26, 2024

Transform Your Business with Essential AI Software Tools You Need to Know

Discover the best Artificial Intelligence software to boost your business efficiency and innovation. Click to explore top AI tools and transform your operations.

August 9, 2024

7 Ways NLP Is Revolutionizing Business Operations

Find out how Natural Language Processing (NLP) may improve your business like a secret weap*n. The 7 main advantages of NLP for organizations are discussed in this article, which ranges from cost savings to enhanced customer experience.

Tips & Trick