Take Control of Your Finances: A Guide to Wealth Management Services

Mia Anderson

Photo: Take Control of Your Finances: A Guide to Wealth Management Services

In an ever-changing economic landscape, taking control of your financial destiny is paramount. The concept of wealth management has evolved to become a critical aspect of financial planning for individuals seeking to secure their future and that of their families. Effective wealth management services provide guidance, strategies, and tools to help individuals navigate the complex world of investments, taxes, and estate planning, ensuring financial stability and growth. This article aims to demystify the realm of wealth management services, offering insights into how they function, the benefits they provide, and the various options available to cater to diverse financial needs and goals.

Understanding Wealth Management Services: An Overview

Wealth management services encompass a range of financial services designed to help individuals manage and grow their wealth effectively. These services are typically provided by financial advisors or wealth management firms, offering customized strategies and solutions tailored to an individual's financial goals, risk tolerance, and time horizon.

Wealth management is a holistic approach to financial planning, integrating various aspects such as investment management, tax planning, retirement planning, estate planning, and insurance. By considering an individual's entire financial landscape, wealth management services provide comprehensive guidance to help make informed decisions that align with one's short-term and long-term objectives.

The Benefits of Engaging Wealth Management Services

Wealth management services offer a plethora of advantages to individuals, especially those with substantial assets or seeking to build and preserve their wealth over the long term. Here are some key benefits:

- Expert Guidance and Personalized Strategies: Wealth management professionals provide invaluable expertise and insights. They tailor their advice and strategies to your unique circumstances, goals, and risk tolerance, ensuring a personalized approach to growing and preserving your wealth.

- Holistic Financial Planning: Rather than focusing on isolated transactions or investments, wealth management adopts a comprehensive view. It considers all facets of your financial life, helping you make informed decisions that balance short-term needs with long-term goals, such as retirement or legacy planning.

- Time Efficiency: Managing finances can be time-consuming, especially for busy individuals or those with complex financial portfolios. Wealth management services alleviate this burden, allowing you to focus on other priorities while ensuring your financial matters are handled efficiently and effectively.

- Risk Management and Protection: A critical aspect of wealth management is risk mitigation. Professionals help identify and assess potential risks, such as market volatility or unforeseen life events, and devise strategies to protect your wealth, including insurance solutions and diversified investment portfolios.

- Access to Opportunities: Wealth management firms often have access to exclusive investment opportunities, alternative assets, and specialized products that may not be available to individual investors. This provides clients with a broader range of options to grow and diversify their portfolios.

Exploring Different Types of Wealth Management Services

The realm of wealth management is diverse, catering to varying needs and preferences. Here's an exploration of the two primary types:

Fee-Only Advisors

Fee-only advisors operate on a fee-for-service model, meaning they are compensated solely by the fees paid by their clients. They do not earn commissions or other forms of compensation from the sale of financial products. This structure eliminates potential conflicts of interest, ensuring that the advice provided is unbiased and aligned with the client's best interests. Fee-only advisors often charge a percentage of the assets under their management (typically 1-2%), an hourly rate, or a fixed fee for specific services.

Commission-Based Wealth Managers

In contrast, commission-based wealth managers earn a portion of the transactions they execute for their clients. They may receive commissions from the sale of financial products, such as mutual funds, stocks, or insurance policies. While this model can provide cost flexibility, potential conflicts of interest may arise. However, it's important to note that even commission-based advisors are bound by fiduciary duty, requiring them to act in their clients' best interests.

Key Considerations When Choosing a Wealth Management Service

Selecting a wealth management service is a highly personalized decision. Here are some critical factors to consider:

- Fee Structures: Understand the fee arrangements of the service. Are they fee-only or commission-based? Consider your preferences and potential conflicts of interest. Review the fee percentages, hourly rates, or fixed fees to ensure they align with the services provided and your budget.

- Expertise and Specialization: Evaluate the expertise and qualifications of the wealth management professionals. Consider their experience, certifications, and areas of specialization. Ensure they have a strong track record in managing portfolios similar to yours and possess the skills to navigate diverse financial scenarios.

- Customization and Personalized Service: Wealth management is inherently personal. Opt for services that demonstrate a commitment to understanding your unique circumstances, goals, and risk tolerance. Avoid cookie-cutter approaches, and seek advisors who tailor their strategies and advice to your specific needs.

- Transparency and Communication: Clear and transparent communication is essential. Choose wealth management services that provide concise explanations of their strategies, potential risks, and expected outcomes. Regular updates, prompt responses to queries, and easy access to your advisor are also key indicators of a reliable service.

- Technology and Innovation: Today's wealth management landscape is increasingly digital. Many firms offer online platforms and tools to enhance the client experience. Consider the availability of user-friendly interfaces, secure data management, and digital resources that provide valuable insights and real-time updates on your portfolio.

Common Wealth Management Strategies

Wealth management services employ various strategies to grow and protect their clients' assets. Here are some common approaches:

- Investment Diversification: Diversification is a cornerstone of effective wealth management. Advisors recommend allocating assets across various investment types, sectors, and geographic regions to mitigate risk. By spreading investments, the potential impact of market fluctuations on your portfolio is reduced, enhancing long-term growth prospects.

- Tax-Efficient Strategies: Managing taxes is a critical aspect of preserving wealth. Wealth management services employ strategies such as tax-loss harvesting, tax-efficient investing, and retirement planning to minimize tax obligations, ensuring more of your wealth remains in your hands.

- Retirement Planning: Ensuring a comfortable retirement is a key focus of wealth management. Advisors help set retirement goals, recommend appropriate savings and investment strategies, and guide clients through various retirement account options, such as 401(k)s, IRAs, and pension plans.

- Estate Planning: Effective estate planning ensures your wealth is distributed according to your wishes upon your passing. Wealth management services assist in drafting wills, establishing trusts, and implementing strategies to minimize estate taxes, ensuring a seamless transfer of wealth to your beneficiaries.

When to Consider Engaging Wealth Management Services

Wealth management services are not solely for the ultra-rich or those nearing retirement. Here are some scenarios where engaging these services can be particularly beneficial:

- Significant Life Changes: Events such as marriage, divorce, the birth of a child, or receiving an inheritance can significantly impact your financial situation. Wealth management services can help you navigate these transitions effectively, ensuring your financial plans remain on track.

- Building Wealth for Specific Goals: Whether it's saving for a dream home, funding your child's education, or pursuing early retirement, wealth management services can provide tailored advice and strategies to help you achieve these milestones.

- Managing Complex Finances: As your financial portfolio grows, so does its complexity. If you find yourself overwhelmed by managing multiple investments, business interests, or tax obligations, wealth management services can provide the expertise and organization needed to optimize your financial affairs.

- Preparing for the Unexpected: Life is full of uncertainties. Wealth management services help you prepare for unforeseen events, ensuring your finances are protected through risk management strategies, insurance solutions, and emergency funds.

Common Misconceptions About Wealth Management Services

It's important to address some common misconceptions about wealth management services:

- Wealth Management is Only for the Ultra-Wealthy: While wealth management services are certainly attractive to high-net-worth individuals, they are accessible to a wide range of clients. Many firms have varying account minimums, and robo-advisors have made wealth management even more democratic, offering low-cost, algorithm-driven advice to those with smaller investment portfolios.

- Wealth Management is a One-Time Exercise: Effective wealth management is an ongoing process, not a set-and-forget exercise. It requires regular reviews and adjustments to reflect life changes, market dynamics, and evolving financial goals.

- All Wealth Management Services are Created Equal: The quality and specialization of wealth management services can vary significantly. It's essential to recognize that not all services are alike, and choosing the right one requires due diligence and a clear understanding of your unique needs and preferences.

Conclusion

Engaging wealth management services is a significant step towards securing your financial future. By providing expert guidance, holistic financial planning, and tailored strategies, these services empower individuals to make informed decisions, grow their wealth, and achieve their financial aspirations.

As you navigate the world of wealth management, remember that it is a dynamic and highly personalized journey. The right wealth management service will serve as a trusted partner, helping you turn your financial goals into tangible realities.

Marketing

View All

January 21, 2025

Why Digital Marketing is Vital for SMBsDiscover why small businesses must adopt digital marketing in 2024. Learn tips and tactics to compete in the digital age. Take your business online today!

Mia Anderson

January 23, 2025

Social Media in Digital Marketing 2024Learn how social media is revolutionizing digital marketing in 2024. Boost your brand with actionable tips for viral campaigns!

Mia Anderson

January 25, 2025

Email Marketing in the Digital AgeUnlock the power of email marketing with modern strategies tailored for the digital age. Connect with your audience like never before!

Mia Anderson

Entertainment

View AllUncover what makes a film a cult classic. From iconic characters to unique storytelling, explore the world of cult cinema. Click to discover must-watch gems!

Mia Anderson

Discover top tips on streaming your favorite films legally & safely with our guide - click now, don't miss out!

Mia Anderson

Uncover the top TV series of 2024! From thrilling dramas to binge-worthy comedies, find your next obsession. Don’t miss out click now to explore!

Mia Anderson

Discover the latest trends and strategies for creating viral videos in 2024. Learn what makes a video go viral and how you can leverage this knowledge today.

Mia Anderson

Automotive

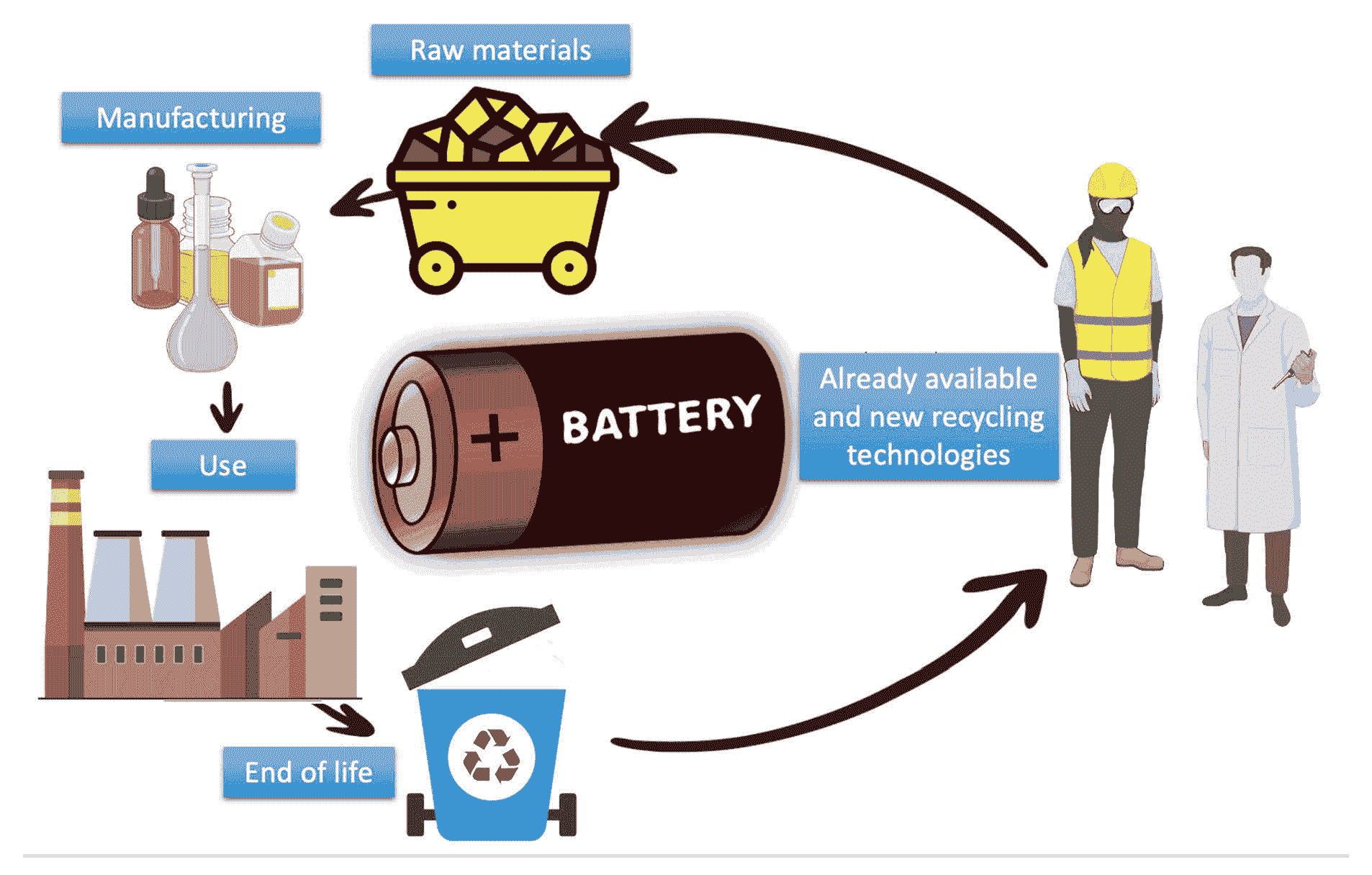

View AllUncover the environmental concerns surrounding EV battery recycling. What are the solutions to ensure sustainable practices?

Read MoreDiscover how ride-sharing services are accelerating the adoption of electric vehicles worldwide.

Read MoreLearn how rising fuel prices are making EVs a more attractive option. See why EV adoption is soaring in 2024.

Read MorePolular🔥

View All

1

2

3

4

5

6

7

8

9

10

Technology

View All

September 12, 2024

Top IoT Applications Revolutionizing Industry Today

Discover how top IoT applications are transforming industries. Explore key benefits and advancements in our in-depth analysis. Click to learn more.

December 8, 2024

Don’t Buy Another Laptop Until You Read This 2024 Comparison

Make an informed laptop purchase! Our 2024 comparison guide helps you find the perfect fit. Click to learn more and choose wisely.

August 12, 2024

The Complete Guide to Alteryx Server Cost: Unlocking the Power of Data Analytics

Discover the true cost of Alteryx Server and how it can revolutionize your data analytics. Learn how this powerful tool can drive transformative business outcomes and provide exceptional value.

Tips & Trick