Financial Check-Up: How Often Should You Review Your Accounts?

Mia Anderson

Photo: Financial Check-Up: How Often Should You Review Your Accounts?

where money matters can feel like a complex maze, staying on top of your financial health is crucial. But how often should you pause and take a good look at your financial accounts? This question is essential for anyone aiming to achieve financial stability and reach their monetary goals. Let's embark on a journey to uncover the ideal frequency for reviewing your financial accounts and why this practice is a cornerstone of financial wellness.

The Importance of Regular Financial Check-Ins

Financial check-ups are akin to regular health screenings they provide a snapshot of your financial well-being. Just as you wouldn't neglect your physical health, your financial health deserves the same attention. Regular reviews empower you to make informed decisions, adapt to changing circumstances, and seize opportunities.

Unveiling the Ideal Review Frequency

The frequency of financial reviews should be tailored to your unique financial situation and goals. While there's no one-size-fits-all approach, here's a general guideline to consider:

Monthly Reviews: A monthly check-in is ideal for staying on top of your finances. This frequency allows you to monitor your spending, income, and savings regularly. It's an excellent time to ensure your budget is on track, bills are paid, and no unexpected expenses have thrown your finances off course. For instance, you might notice a recurring subscription you no longer use, which can be canceled, freeing up funds for savings or other priorities.

Quarterly Deep Dives: Every three months, a more comprehensive review is beneficial. This is the time to analyze your overall financial progress, assess your investment performance, and make necessary adjustments. For instance, you might discover that a particular investment is underperforming and decide to reallocate funds to more promising opportunities.

Annual Financial Overhauls: Annually, conduct a thorough financial assessment. This review should be extensive, examining your entire financial picture, including long-term goals, insurance coverage, tax planning, and estate planning. For example, you might realize that your life insurance policy needs updating to reflect significant life changes, ensuring your loved ones are adequately protected.

The Benefits of Regular Financial Reviews

Regular financial check-ups offer a plethora of advantages, ensuring your financial ship stays on course:

- Early Problem Detection: Regular reviews act as an early warning system for potential financial issues. Whether it's a spending pattern that's getting out of hand or an investment that's not performing as expected, catching these issues early allows for prompt action.

- Goal Alignment: Life is full of changes, and your financial goals may evolve over time. Regular reviews ensure your financial strategies remain aligned with your current objectives. For instance, you might decide to increase your retirement contributions after a promotion, ensuring your savings keep pace with your new income.

- Opportunity Seizing: The financial world is dynamic, with new investment opportunities and market shifts. Regular reviews keep you informed, allowing you to capitalize on favorable conditions. For example, you might identify a promising investment trend and allocate a portion of your portfolio to take advantage of it.

- Financial Education: Engaging in regular financial reviews enhances your financial literacy. You become more familiar with various financial concepts, products, and strategies, enabling you to make more informed decisions. This knowledge can lead to better financial choices and increased confidence in managing your money.

Real-Life Example: The Power of Timely Reviews

Consider the story of Sarah, a young professional who diligently reviewed her finances monthly. During one of her routine checks, she noticed a recurring charge for a gym membership she had forgotten to cancel after moving to a new city. This simple oversight was costing her $50 each month. By promptly canceling the membership, Sarah saved $600 annually, which she redirected towards her travel fund. This example illustrates how regular financial reviews can lead to significant savings and help you stay on track with your goals.

Conclusion: A Path to Financial Confidence

In the realm of personal finance, knowledge is power, and regular financial reviews are the key to unlocking this power. Whether it's monthly check-ins, quarterly assessments, or annual overhauls, each review contributes to your financial literacy and control. By embracing this practice, you can navigate the financial landscape with confidence, adapt to life's twists and turns, and make your financial dreams a reality. Remember, the frequency of your reviews should align with your circumstances and goals, ensuring your financial strategy remains dynamic and effective.

So, take charge of your financial destiny, and let regular account reviews be your compass on the journey to financial success. Your future self will thank you for the financial stability and security these simple yet powerful practices provide.

Marketing

View All

January 21, 2025

Why Digital Marketing is Vital for SMBsDiscover why small businesses must adopt digital marketing in 2024. Learn tips and tactics to compete in the digital age. Take your business online today!

Mia Anderson

January 18, 2025

Top 10 Digital Marketing Trends for 2024Discover the must-know digital marketing trends for 2024. Stay ahead of the curve and elevate your strategies with these insights! Read more now!

Mia Anderson

January 25, 2025

Email Marketing in the Digital AgeUnlock the power of email marketing with modern strategies tailored for the digital age. Connect with your audience like never before!

Mia Anderson

Entertainment

View AllExplore the essence of indie films in 2024. Learn how they stand out from mainstream cinema. Read now to dive into the world of indie filmmaking!

Mia Anderson

Discover the best video editing software for 2024. Our expert picks will help you choose the perfect tool for your needs. Click to find out more.

Mia Anderson

Explore the latest trends in virtual reality gaming for 2024. Our in-depth guide covers new technology and gameplay innovations. Discover more now!

Mia Anderson

Discover how the Metaverse is revolutionizing entertainment in 2024. Read about the latest trends and innovations shaping the future of digital experiences.

Mia Anderson

Automotive

View AllNeed cash fast? Discover how to sell your car for cash with quick and reliable methods!

Read MoreExplore how EV adoption differs between rural and urban areas. Understand the factors driving growth and unique challenges faced.

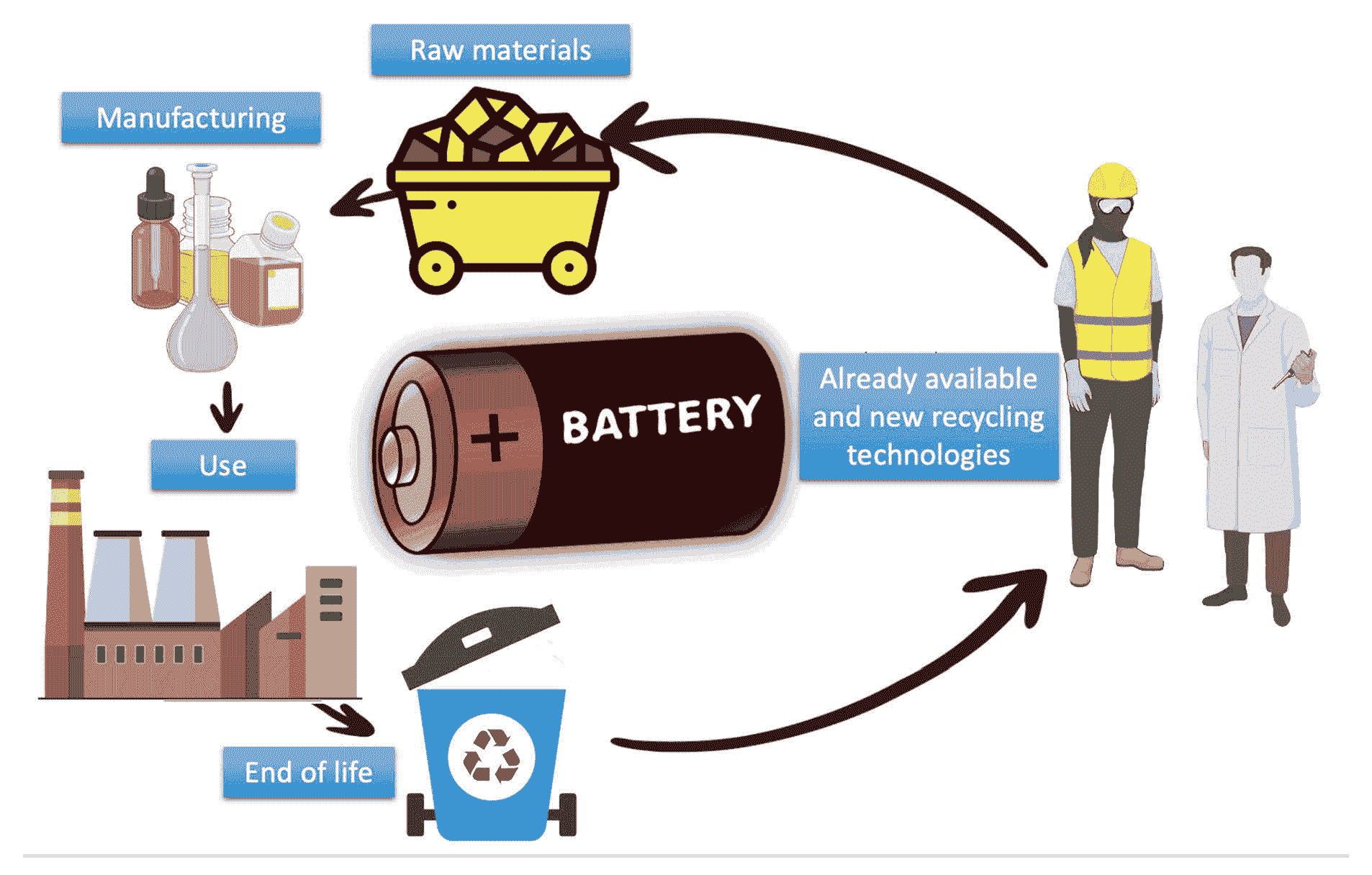

Read MoreUncover the environmental concerns surrounding EV battery recycling. What are the solutions to ensure sustainable practices?

Read MorePolular🔥

View All

1

2

3

4

5

6

7

8

9

10

Technology

View All

November 10, 2024

The Ultimate Guide to Building Your Own PC

Ready to build your own PC? Follow our ultimate guide for step-by-step instructions and tips. Build your dream machine today!

December 13, 2024

Should You Upgrade to a Smart Home? 6 Reasons to Start Today

Upgrade your home with smart tech! Learn 6 compelling reasons to embrace the future. Click to explore and transform your living space.

December 16, 2024

Is This the Smart TV You’ve Been Waiting For? Top Features Revealed!

Discover the ultimate Smart TV with must-have features! Click to learn why it's the perfect choice and upgrade your viewing experience.

Tips & Trick