10 Must-Have Financial Tools for Every Budget-Conscious Investor

Mia Anderson

Photo: 10 Must-Have Financial Tools for Every Budget-Conscious Investor

In today's fast-paced financial landscape, staying on top of your investments and making informed decisions is crucial for every budget-conscious investor. Whether you're a seasoned pro or just starting your financial journey, having the right tools can make all the difference. This article will guide you through 10 indispensable financial tools that will not only help you manage your money but also empower you to make smart investment choices. Get ready to transform your financial game!

The Power of Financial Tools

Financial tools are like having a personal finance assistant, providing you with the insights and data needed to navigate the complex world of investments. With the right tools, you can simplify budgeting, track your progress, and make strategic decisions with confidence. Let's explore some of the must-have resources that will revolutionize your investment strategy.

1. Budgeting Software: The Foundation of Financial Success

A solid budget is the cornerstone of any successful financial plan. Budgeting software is an essential tool to kickstart your investment journey. Here's why it's a game-changer:

Features:

- Expense Tracking: Keep tabs on your spending habits and identify areas where you can cut back.

- Income Management: Easily track your income sources and ensure your earnings are allocated efficiently.

- Customizable Categories: Create personalized expense categories to suit your lifestyle and goals.

- Visual Reports: Get a clear picture of your financial health through intuitive charts and graphs.

Recommended Options:

- Mint: A popular choice for its user-friendly interface and automatic transaction categorization. Mint connects to your bank accounts, making expense tracking effortless.

- YNAB (You Need a Budget): This app takes a unique approach by focusing on giving every dollar a job. It encourages mindful spending and helps build a strong financial foundation.

2. Investment Analysis Tools: Unlocking Smart Decisions

Making informed investment choices is an art, and these tools are your secret weapons. Dive into the world of investment analysis and gain a competitive edge.

Key Benefits:

- Market Research: Stay ahead of the game with real-time market data and trends.

- Portfolio Analysis: Evaluate your current investments and identify areas for improvement.

- Risk Assessment: Understand the potential risks associated with different investment options.

Top Picks:

- Morningstar: A trusted name in investment research, Morningstar offers comprehensive analysis and ratings for stocks, funds, and ETFs. Their tools provide valuable insights for both beginners and experienced investors.

- Bloomberg Terminal: Used by professionals worldwide, Bloomberg Terminal offers an extensive range of financial data, news, and analytics. It's a powerful tool for in-depth market analysis and staying updated on global financial trends.

3. Financial Trackers: Stay on Course

Consistency is key when it comes to achieving financial goals. Financial trackers help you stay focused and motivated by providing a clear overview of your progress.

How They Help:

- Goal Setting: Define your short-term and long-term financial objectives.

- Progress Monitoring: Track your savings and investments against your goals, ensuring you stay on the right path.

- Alerts and Reminders: Receive notifications for important milestones or potential issues.

Consider These:

- Personal Capital: More than just a tracker, Personal Capital offers a comprehensive financial dashboard. It aggregates your accounts and provides a holistic view of your net worth, investments, and cash flow.

- Strive: This app takes a goal-oriented approach, helping you set and achieve financial milestones. Strive provides personalized recommendations and celebrates your progress.

4. Online Banking Apps: Convenience at Your Fingertips

Modern banking apps have revolutionized how we manage our finances. These apps offer a seamless experience and a range of features to enhance your financial control.

Advantages:

- Mobile Accessibility: Access your accounts, transfer funds, and manage bills on the go.

- Security Features: Enjoy peace of mind with advanced security measures like biometric authentication.

- Budgeting Tools: Many banking apps now include budgeting features, allowing you to track expenses and set spending limits directly from your bank account.

Leading Apps:

- Chase Mobile: Chase offers a user-friendly app with a range of features, including budgeting tools, bill payment reminders, and secure mobile check deposit.

- Ally Bank: Known for its competitive rates, Ally's app provides a seamless banking experience with intuitive money management tools.

5. Robo-Advisors: Automated Investment Management

Robo-advisors are the future of investment management, offering personalized portfolio recommendations and automated investing.

What They Offer:

- Personalized Portfolios: Based on your risk tolerance and goals, robo-advisors create tailored investment plans.

- Automated Investing: These platforms automatically allocate and rebalance your investments, saving you time and effort.

- Low-Cost Fees: Typically, robo-advisors charge lower fees compared to traditional financial advisors.

Popular Robo-Advisors:

- Wealthfront: With advanced algorithms, Wealthfront offers personalized investment advice and tax-loss harvesting.

- Betterment: This platform provides a user-friendly interface and a range of investment options, making it a great choice for beginners.

6. Financial News Apps: Stay Informed, Stay Ahead

Staying up-to-date with financial news is crucial for making timely investment decisions. Financial news apps bring the latest market updates directly to your fingertips.

Benefits:

- Real-Time Updates: Get instant notifications on market movements and breaking financial news.

- Customized News Feeds: Tailor your news feed to focus on industries or topics relevant to your investments.

- Expert Analysis: Access in-depth articles and insights from financial experts.

Top News Apps:

- CNBC: CNBC's app provides live market updates, video content, and personalized news streams.

- Reuters: Known for its global coverage, Reuters offers a comprehensive financial news experience with real-time market data and expert analysis.

7. Tax Planning Software: Maximize Your Returns

Taxes can significantly impact your investment gains. Tax planning software ensures you make the most of your investments while staying compliant.

Features to Look For:

- Tax-Efficient Strategies: Discover ways to optimize your investments for tax benefits.

- Deduction Identification: Identify potential deductions and credits to reduce your tax liability.

- Filing Assistance: Simplify the tax filing process with step-by-step guidance.

Recommended Software:

- TurboTax: A household name in tax software, TurboTax offers a user-friendly experience and valuable tax-saving tips.

- H&R Block: This platform provides comprehensive tax planning and filing solutions, ensuring you make informed decisions.

8. Personal Finance Podcasts: Learn and Grow

Learning from experts and staying motivated is essential for long-term financial success. Personal finance podcasts offer valuable insights and inspiration.

Why Listen:

- Educational Content: Gain knowledge about various financial topics, from investing to debt management.

- Motivational Stories: Hear success stories and strategies from real-life investors and financial gurus.

- Convenience: Listen while on the go, making the most of your commute or downtime.

Popular Podcasts:

- Planet Money: Produced by NPR, Planet Money offers engaging and accessible financial stories, making complex topics easy to understand.

- The Dave Ramsey Show: Dave Ramsey's podcast provides practical advice on personal finance, debt elimination, and building wealth.

9. Online Investment Communities: Connect and Collaborate

Engaging with like-minded investors can be incredibly valuable. Online investment communities offer a platform to share knowledge and gain diverse perspectives.

Community Benefits:

- Peer Learning: Learn from the experiences and strategies of fellow investors.

- Market Insights: Stay updated on emerging trends and investment opportunities through community discussions.

- Support and Motivation: Find a supportive network to keep you motivated and accountable.

Active Communities:

- Reddit's r/investing: A vibrant community with discussions on various investment topics, from stock picks to market analysis.

- Investor Junkie Forum: This platform offers a space for investors to connect, share tips, and seek advice from experienced members.

10. Financial Calculators: Precision in Numbers

Financial calculators are simple yet powerful tools for making accurate financial projections and comparisons.

Use Cases:

- Retirement Planning: Calculate how much you need to save for retirement and estimate future growth.

- Loan Repayment: Determine the best loan options and understand the impact of interest rates.

- Investment Returns: Compare potential investment outcomes and evaluate different scenarios.

Go-To Calculators:

- Calculator.net: A comprehensive online calculator resource, offering tools for various financial calculations, from mortgage payments to investment returns.

- SmartAsset: This platform provides specialized calculators for retirement planning, budgeting, and investment analysis.

Conclusion:

Empowering yourself with the right financial tools is a game-changer for any investor. From budgeting software to investment analysis and financial trackers, these resources provide the foundation for a successful and informed financial journey. Remember, each tool serves a unique purpose, and combining them can create a powerful financial management system tailored to your needs. Stay curious, explore these tools, and take control of your financial future!

Marketing

View All

January 21, 2025

Why Digital Marketing is Vital for SMBsDiscover why small businesses must adopt digital marketing in 2024. Learn tips and tactics to compete in the digital age. Take your business online today!

Mia Anderson

January 19, 2025

How to Master Digital Marketing BasicsLearn the essentials of digital marketing in this beginner-friendly guide. Kickstart your journey with step-by-step strategies. Start mastering today!

Mia Anderson

January 25, 2025

SEO’s Role in Digital Marketing StrategyDive into the importance of SEO in crafting a digital marketing strategy that works. Rank higher and drive organic traffic today!

Mia Anderson

Entertainment

View AllDiscover the best video editing software for 2024. Our expert picks will help you choose the perfect tool for your needs. Click to find out more.

Mia Anderson

Discover how narrative design transforms video games into immersive experiences. Learn industry secrets and start creating unforgettable stories today!

Mia Anderson

Discover the top podcasting trends of 2024 and stay ahead in the industry. Learn how to leverage new insights click now to future-proof your podcast!

Mia Anderson

Unlock the secrets to creating captivating animation videos in 2024. Discover expert tips and techniques to bring your ideas to life. Start now!

Mia Anderson

Automotive

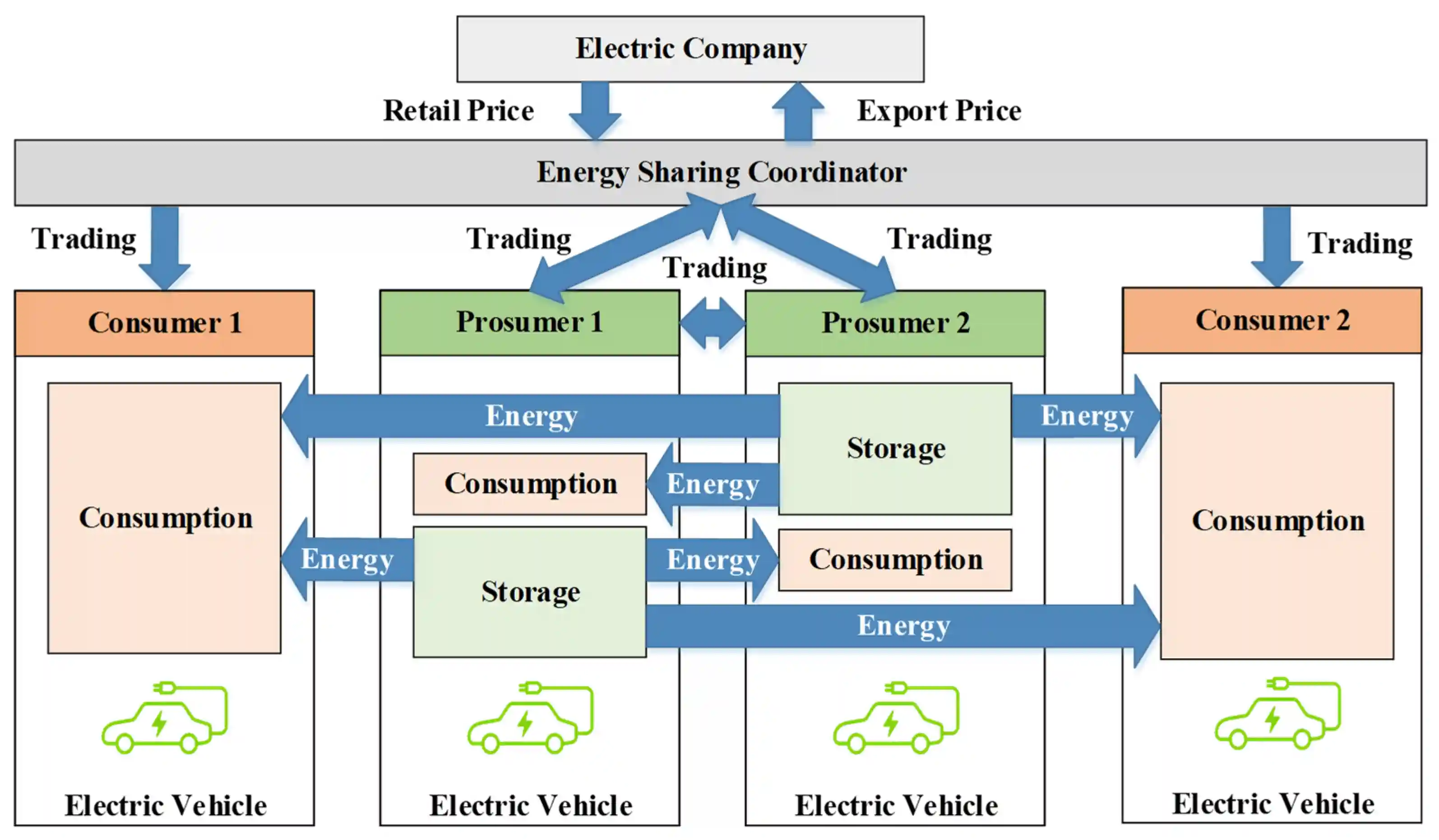

View AllLearn how smart city initiatives are seamlessly integrating EV infrastructure to enhance mobility and sustainability.

Read MoreExplore how different age groups are embracing EVs. Learn what drives adoption among millennials, Gen Z, and baby boomers.

Read MoreExplore the role of EVs in peer-to-peer energy sharing. Could EVs become key players in the decentralized energy market?

Read MorePolular🔥

View All

1

2

3

4

5

6

7

8

9

10

Technology

View All

August 27, 2024

How Expert IT Consulting Services Can Transform Your Business

Discover top IT consulting services to drive business growth. Explore expert solutions tailored to your needs and boost your tech efficiency. Click to learn more!

December 20, 2024

What’s the Best Camera for Vlogging? Top Picks for 2024

Elevate your vlogging game with the best cameras of 2024! Click to explore and find your perfect content creation companion.

September 15, 2024

Tips for Securing Your IoT Devices in 2024

Discover the latest strategies for securing IoT devices in 2024. Learn practical tips to protect your smart tech and enhance your digital safety.

Tips & Trick